Get more information on Cellulose Acetate Market - Request Sample Report

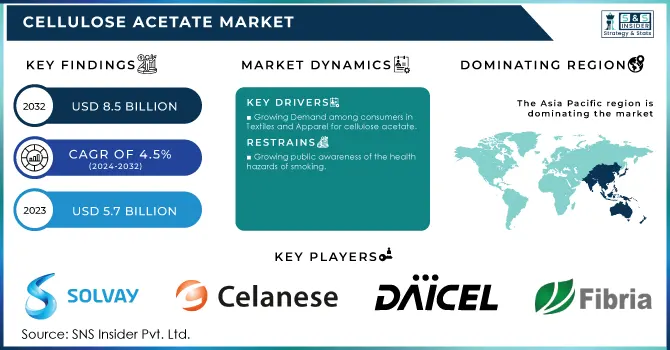

The Cellulose Acetate Market Size was valued at USD 5.7 Billion in 2023. It is expected to grow to USD 8.5 Billion by 2032 and grow at a CAGR of 4.5% over the forecast period of 2024-2032.

Cellulose acetate is one of the primary components present in the products made by the tobacco industry, and, significantly, its use is still substantial at the moment of tobacco’s declining popularity. A fact explaining this phenomenon is that the production of super-efficient filters for cigarettes is currently on the rise and is likely to continue on the same course. Various countries are also stepping up their cigarette health and environmental requirements, and the making of highly effective cigarette filters capable of trapping any number of toxic particles and significantly decreasing the number of toxins inhaled by the smoker can soon become standard as far as cigarette production is concerned. A change in the market’s ecological orientation also plays a role in the account of the fact that tobacco producers will also follow the growing trend of being environment-friendly and producing biodegradable filters for their cigarettes. Thus, although, indeed, tobacco consumption is now in decline, the amount of cellulose acetate consumed is continuously increasing in any market related to this product.

In the European Union, Directive 2014/40/EU mandates that cigarette filters must meet specific performance criteria to reduce harmful emissions such as tar, nicotine, and carbon monoxide. This regulation has prompted tobacco companies to develop advanced cellulose acetate filters that can better trap toxic particles and comply with health standards.

Cellulose acetate material having a significant impact on the medical and pharmaceutical sectors is cellulose acetate. Owing to its biocompatible and versatile properties, as well as its safety, it is being applied increasingly in the analyses. For instance, cellulose acetate fabricates drug delivery systems. Such controlled-release products are designed to enhance the treatment’s effectiveness, ensure exact delivery, minimize the dose administered to patients, and maintain a constant level of the drug in the bloodstream. Meanwhile, products based on cellulose acetate such as wound dressings are in growing demand. They can absorb moisture well, create a favorable wound-healing medium, and cause no inconvenience to the patients.

Furthermore, the novel cellulose acetate fabricates dialysis membranes. They are very permeable and selective, which makes it possible to purify the blood as efficiently as possible. Due to the growing needs of the population in terms of health conditions, this attribute contributes to its appropriation in the medical sphere. According to the U.S. Centers for Medicare & Medicaid Services (CMS), dialysis treatments alone accounted for over USD 114 billion in healthcare spending in 2021, reflecting the growing demand for high-performance medical materials like cellulose acetate.

Drivers

Cellulose acetate is becoming more and more common in the textile and apparel industry, due to its unique combination of style, sustainability, and affordability. It is as exotic in appearance as high-quality fashion clothes should be. It facilitates environmentally compatible and nature-friendly living. It enables looking into the future with confidence, to survive without destroying nature. This peculiar material has abundant benefits rather than mere favor. It has a rich sheen and cottony-soft feel fashionable for high-quality dresses, blouses, and linings. Durable in wet conditions, resistant to creasing, and washable, cellulose acetate offers the fashionable look of luxurious fabrics. It contains the natural cellulose used as the only raw material. Nowadays, society is experiencing an increasing demand for nature-friendly products. To rise in this trend, this material is in broad demand, as it is renewable, as compared with other materials. As a further advantage, cellulose acetate offers the wear comfort and styling ease.

According to the European Union’s Circular Economy Action Plan, textile waste accounts for nearly 5.8 million tons of waste in the EU annually, and the shift towards biodegradable and renewable materials like cellulose acetate is seen as a key step in reducing environmental impacts.

Restraint

The decline of photographic film has had a cascading effect on various industries, and the cellulose acetate market is no exception. Cellulose acetate was once a prominent material used in film bases, but the shift toward digital photography has significantly reduced this application. With the reduction in film cameras being manufactured and used, the demand for film base, including cellulose acetate, plummeted. This significantly reduced the market share of cellulose acetate in this application. Major film producers reduced or ceased production, contributing to a significant contraction in this segment of the cellulose acetate market. Once a dominant application for the material, its market share has diminished as the photographic industry has transitioned to digital technologies, leaving the cellulose acetate market to pivot toward other growing applications, such as textiles, cigarette filters, and biodegradable plastics.

Opportunity

The future of cellulose acetate is bright, brimming with possibilities beyond its current uses, cellulose acetate become a game-changer in 3D printing. Ongoing studies are investigating its potential in this rapidly evolving field. Cellulose acetate can be processed into filaments suitable for 3D printing. These filaments offer a significant advantage – they are biodegradable! This translates to printed products that decompose naturally at the end of their lifespan, reducing environmental impact compared to traditional non-biodegradable materials commonly used in 3D printing, like ABS plastic.

By Type

The fiber segment held the largest market share around 64% in 2023. This dominance can be attributed to the surging demand for fiber-based cellulose acetate in the textile industry. This material is widely used in a variety of consumer goods, including apparel, carpets, linings, umbrellas, furniture, felts, and even cigarette filters. Cellulose acetate fiber stands out as a prominent synthetic fiber prized for its beautiful drape and affordability. Furthermore, staple acetate fibers, with their wool-like qualities, serve as a cost-effective substitute for wool in various knitwear and luxury fabrics. This widespread adoption in textiles is expected to propel the fiber segment's growth in the coming years.

By Application

The Cigarette filters held the largest market share around 38% in 2023. This dominance is projected from cellulose acetate's exceptional filtering properties and its eco-friendly nature as a biodegradable material in the Cellulose Acetate Market. The increasing number of smokers in developing countries like India and China presents a potential growth opportunity for the cigarette filter segment. The increasing number of smokers in developing countries like India and China presents a potential growth opportunity for the cigarette filter segment.

The Asia Pacific region held the largest market share around 44% in 2023. This dominance is driven by several factors increasing the use of cellulose acetate in various applications, including cigarette filters, textiles & apparel, photographic films, and tapes & labels, fuels market expansion. Strong government initiatives and ongoing infrastructure projects provide a tailwind for the APAC market. The major markets in the Asia-Pacific region are China and India as there is a rapid industrialization and urbanization process which resulted in an increased demand for textiles, packaging, and consumer goods. The Indian Ministry of Textiles reported that the Indian textiles and apparel industry would reach USD223 billion by 2021, positively impacting the demand for cellulose acetate. By focusing on environmental safety, the industry focused on developing biodegradable traits to replace synthetic plastics

Europe secures the second-largest market share, primarily driven by the robust demand from its thriving textile industry. Germany currently holds the top spot within Europe for cellulose acetate consumption, while the UK exhibits the fastest growth rate, suggesting promising potential for the future.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Key Manufacturers

Solvay (Acetate Filaments)

Celanese Corporation (Celanex)

Daicel Corporation (Celulose Acetato)

Accords Cellulosic Fibers Inc. (Accord Fiber)

China National Tobacco Corporation (Cigarette Filters)

SK Chemicals (Eco-Friendly Cellulose Acetate)

Sappi (Fibrilated Cellulose Acetate)

Rayonier Advanced Materials (Acetate Tow)

Sichuan Push Acetate Co. Ltd. (Push Acetate)

Borregaard (Lignin-Based Cellulose Acetate)

Eastman Chemical Company (Eastman Acetate)

Mitsubishi Chemical Holdings (Mitsubishi Acetate)

Acordis (Acordis Acetate)

Fibria (Fibria Acetate)

Kaneka Corporation (Kaneka Acetate)

Georgia-Pacific (GP Acetate)

PUC-Rio (PUC Acetate)

Juken Technology (Juken Acetate)

Jushi Group (Jushi Acetate)

Braskem (Braskem Acetate)

Key Users in End -Use Industry

H&M

Zara (Inditex)

Philip Morris International

British American Tobacco

Japan Tobacco International

Johnson & Johnson

Pfizer

Baxter International

In August 2023, Eastman Chemical Company, a key player in cellulose acetate production, revealed plans to develop a new, specialized grade of this material. This innovation is expected to hit the market in 2024, offering a material specifically formulated for 3D printing applications.

In November 2022, Celanese Corporation, a U.S. materials leader, acquired DuPont de Nemours Inc.'s Mobility & Materials division for USD11 billion. This acquisition allows Celanese to streamline its offerings and focus resources on high-growth sectors. While DuPont, another U.S. chemical company, remains a prominent player in cellulose acetate production, this divestiture reflects their evolving focus.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.7 Billion |

| Market Size by 2032 | US$ 8.5 Billion |

| CAGR | CAGR of 4.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Plastics, Fiber) • By Application (Cigarette Filters, Tapes & Labels, Textiles & Apparel, Photographic Films, Others) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Cerdia International GmbH, Sichuan Push Acetati Co Ltd, Rayonier Advanced Materials, Inc, Eastman Chemical Company, Celanese Corporation, Mitsubishi Chemical Holdings Corporation, China National Tobacco Corporation, Sappi Ltd, Rotuba Extruders, Inc, Daicel Corporation |

| DRIVERS | • Growing Textile and Apparel Industry Demand • Application of Technological Advancements • Growing Uses of Biodegradable Plastic in a Range of Industries |

| Restraints | • Declining Demand for Products in Markets Like Photographic Films and Cigarette Filters |

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Due to the COVID-19 pandemic, the market for cellulose acetate is anticipated to experience a drop in 2020. The entire world has suffered because of this terrible illness, but mainly the APAC and European regions. Companies shut down their operations and production facilities, and the government stopped construction activity to stop the virus from spreading further. This has caused a decrease in the use of cellulose acetate across all applications.

Ans: Rise in Emerging Market Demand are the opportunity for Cellulose Acetate Market.

Ans: Growing Textile and Apparel Industry Demand, Application of Technological Advancements and Growing Uses of Biodegradable Plastic in a Range of Industries are the drivers for Cellulose Acetate Market.

Ans. The projected market size for the Cellulose Acetate Market is USD 9.2 Billion by 2032.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by l Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Cellulose Acetate Market Segmentation, by Type

7.1 Chapter Overview

7.2 Plastics

7.2.1 Plastics Market Trends Analysis (2020-2032)

7.2.2 Plastics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Fiber

7.3.1 Fiber Market Trends Analysis (2020-2032)

7.3.2 Fiber Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Cellulose Acetate Market Segmentation, by Application

8.1 Chapter Overview

8.2 Cigarette Filters

8.2.1 Cigarette Filters Market Trends Analysis (2020-2032)

8.2.2 Cigarette Filters Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Tapes & Labels

8.3.1 Tapes & Labels Market Trends Analysis (2020-2032)

8.3.2 Tapes & Labels Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Textiles & Apparel

8.4.1 Textiles & Apparel Market Trends Analysis (2020-2032)

8.4.2 Textiles & Apparel Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Photographic Films

8.5.1 Photographic Films Market Trends Analysis (2020-2032)

8.5.2 Photographic Films Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Others

8.6.1 Others Market Trends Analysis (2020-2032)

8.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Cellulose Acetate Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Cellulose Acetate Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Cellulose Acetate Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Cellulose Acetate Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Cellulose Acetate Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Cellulose Acetate Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Cellulose Acetate Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Cellulose Acetate Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Cellulose Acetate Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Solvay

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Product / Services Offered

10.1.4 SWOT Analysis

10.2 Celanese Corporation

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Product / Services Offered

10.2.4 SWOT Analysis

10.3 Daicel Corporation

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Product / Services Offered

10.3.4 SWOT Analysis

10.4 Accords Cellulosic Fibers Inc.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Product / Services Offered

10.4.4 SWOT Analysis

10.5 China National Tobacco Corporation

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Product / Services Offered

10.5.4 SWOT Analysis

10.6 SK Chemicals

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Product / Services Offered

10.6.4 SWOT Analysis

10.7 Sappi

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Product / Services Offered

10.7.4 SWOT Analysis

10.8 Rayonier Advanced Materials

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Product / Services Offered

10.8.4 SWOT Analysis

10.9 Sichuan Push Acetate Co. Ltd.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Product / Services Offered

10.9.4 SWOT Analysis

10.10 Borregaard

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Product / Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Plastics

Fiber

By Application

Cigarette Filters

Tapes & Labels

Textiles & Apparel

Photographic Films

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Nitric Acid Market size was USD 27.36 billion in 2023 and is expected to reach USD 37.05 billion by 2032 and grow at a CAGR of 3.43% from 2024 to 2032.

The Amaranth Oil market size was USD 769.43 Million in 2023 and is expected to reach USD 2002.11 Million by 2032, growing at a CAGR of 11.21 % from 2024-2032.

The Drilling Fluids Market was valued at $ 10.06 Billion in 2023 and is expected to reach $ 14.75 Billion by 2032, growing at a CAGR of 4.72% from 2024-2032.

The Isoamyl Acetate Market size was valued at USD 366.8 Million in 2023. It is expected to grow to USD 605.05 Million by 2032 and grow at a CAGR of 5.7% over the forecast period of 2024-2032.

The M-Toluic Acid Market Size was valued at USD 1.7 billion in 2023, and is expected to reach USD 4.2 billion by 2032, and grow at a CAGR of 10.8% over the forecast period 2024-2032.

The Industrial Wastewater Treatment Chemicals Market Size was valued at USD 15.28 billion in 2023, and is expected to reach USD 23.58 billion by 2032, and grow at a CAGR of 5.66% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone