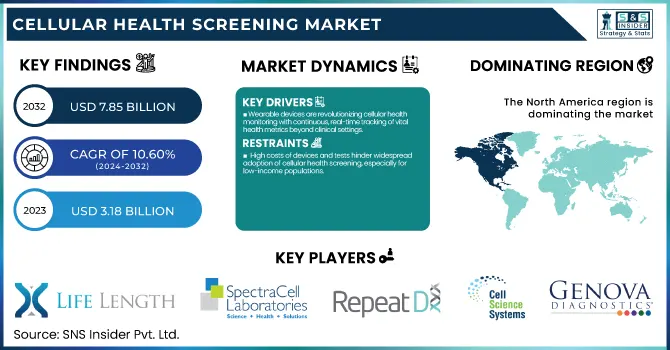

The Cellular Health Screening Market, valued at USD 3.18 billion in 2023, is projected to reach USD 7.85 billion by 2032, growing at a CAGR of 10.60% from 2024 to 2032. Key market drivers include the increasing adoption of personalized diagnostics, with consumers demanding tailored health solutions. Additionally, the rising demand for point-of-care devices from 2020 to 2032 is significantly contributing to market growth, as these devices provide quick and accurate results, improving patient care. Moreover, healthcare spending on preventive diagnostics in the U.S. is steadily increasing, projected to rise from USD 1.13 billion in 2023 to USD 2.78 billion by 2032, growing at a CAGR of 10.50%. This rise in spending reflects the growing focus on early disease detection and prevention, further bolstering the market for cellular health screening solutions. As awareness about preventive healthcare grows, demand for these services is expected to continue increasing.

To Get more information on Cellular Health Screening Market - Request Free Sample Report

Drivers:

Wearable devices are revolutionizing cellular health monitoring with continuous, real-time tracking of vital health metrics beyond clinical settings.

The integration of wearable devices with cellular health screening is transforming the healthcare landscape by enabling continuous, real-time monitoring of health metrics Recent advancements occurring in the mobile computing and the wearable technologies enable ones to monitor the cellular health and track the critical health parameters (e.g. ECG, cognitive function, heart rate variability) outside the traditional clinical settings. Research noted a high acceptance rate of such devices among expecting mothers, and patients with cognitive impairments. For instance, an online survey showed that 91% of women are willing to use wearable ECG technology during pregnancy, and 42% said they are willing to spend up to USD 200 on ECG technology during pregnancy. In addition, as we bring more data sources on line, a 20% improvement in understanding the state of our health emerges from fusing data from various devices. The growing adoption of these technologies in both consumer and clinical markets plays a crucial role in the expansion of the cellular health screening market.

Restraints:

High costs of devices and tests hinder widespread adoption of cellular health screening, especially for low-income populations.

The high costs associated with advanced wearable devices and diagnostic tests present a significant challenge to the widespread adoption of cellular health screening, particularly for low-income populations. While wearable devices offer significant benefits, such as continuous monitoring and real-time health data, their high initial cost, along with the recurring expenses for diagnostic tests and remote monitoring programs, can be a financial burden for many individuals. This makes it difficult for a large segment of the population to access these technologies, particularly in regions with limited healthcare resources. As a result, the potential for market expansion is limited, and broader healthcare accessibility remains a challenge. For low-income groups, these financial barriers could prevent them from benefiting from the advanced health tracking capabilities that wearable devices offer, ultimately restricting market growth.

Opportunities:

Cost-effectiveness and growth opportunities are driving the expansion of the cellular health screening market.

The growing demand for wearable health devices and remote monitoring solutions presents significant opportunities in the cellular health screening market. PPG and ECG offer 20 to 23 fewer strokes per 100,000 person-years per 1% detection per annum, making it more likely for cost-effective use to be expanded and accepted widely. As production costs decrease, this cost-effectiveness ratio of USD 57,894 per QALY for screening for AF via a wearable telephonic cardiogram provides important question as to access to such technology across demographics. Moreover, more affordable alternatives such as pulse palpation and 12-lead ECG, offering 93 QALYs per 100,000 individuals, can extend coverage in low-resource environments. Teenagers and young adults can access telemedicine Collection Site s through their smartphone for remotely solving their acute and chronic conditions, while continuous health monitoring systems integrated with telehealth platform open up a pathway for more proactive approach to healthcare for chronic conditions, thus improving patient outcome.

Challenges:

Ensuring accurate and reliable readings from wearable devices is crucial for the effectiveness of cellular health screening, especially for early disease detection.

Accuracy and reliability are crucial challenges for wearable devices used in cellular health screening. For these devices to be effective, they must consistently provide precise and dependable readings of vital health parameters such as heart rate, blood pressure, ECG patterns, and blood oxygen levels. Inaccurate readings could lead to false positives or missed diagnoses, undermining early disease detection and potentially putting patients at risk. Achieving the necessary accuracy requires high-quality sensors that can handle a wide range of environmental and physiological variables. Additionally, robust data processing algorithms are essential to interpret the readings effectively, ensuring that the information gathered is reliable and actionable. The devices must also adapt to different user profiles, including age, health condition, and activity levels. Without these capabilities, wearable devices may fail to offer the required level of accuracy for preventive healthcare, limiting their potential for broader adoption.

By Sample Type

The blood segment dominated the Cellular Health Screening Market with the largest share of revenue, approximately 48%, in 2023. This dominance is attributed to the widespread use of blood tests for early detection, disease monitoring, and overall health assessment. Blood-based screening methods are widely accepted in both clinical and at-home settings due to their accuracy, ease of administration, and ability to provide comprehensive insights into various health parameters, including cholesterol levels, glucose, liver function, and biomarkers for diseases like cancer, heart disease, and diabetes. Additionally, advancements in lab technology have improved the precision and speed of blood-based tests, making them more cost-effective and accessible. The integration of blood tests with wearable devices and at-home health screening kits further drives the growth of this segment. As a result, blood screening remains a key component of cellular health screening, enabling early intervention and proactive management of health conditions.

The urine segment is expected to be the fastest-growing in the cellular health screening market from 2024 to 2032, to the increasing demand for non-invasive, affordable diagnostic approaches. Urine tests, on the other hand, can be done more easily, are less invasive, and give powerful information for evaluating a number of health problems together with kidney disease, diabetes, urinary tract infections and metabolic problems. As technology has improved, urine-based screenings have become increasingly accurate and reliable, making such tests appealing for early disease detection and preventive medicine. Furthermore, the increasing emphasis on personalized health management and home-based testing solutions are facilitating the adoption of urine-based diagnostics, thus supporting the market growth during this period. The convenience and affordability of urine testing are likely to contribute significantly to its market expansion in the coming years.

By Test Type

The Single Test Panels segment dominated the largest share of the revenue in the Cellular Health Screening Market, accounting for around 81% in 2023, and is expected to maintain its dominance through the forecast period from 2024 to 2032. This tends to go hand in hand with the growing demand for streamlined and concentrated diagnostic tools that provide fast results with less complexity. In single test panels, only one health parameter, such as cholesterol levels, blood glucose, or specific biomarkers, will be tested due to testing convenience in healthcare settings. These tests are more economical and semi-automated and are generally performed as part of a routine profile or targeted screening. With advancements in technology, single test panels have become more accurate and accessible, contributing to their widespread adoption in both clinical settings and at-home health monitoring.

The Multi-Test Panels segment is the fastest growing in the Cellular Health Screening Market from 2024 to 2032. These panels enable the simultaneous screening of multiple health markers from a single sample, offering a cost-effective and efficient approach to diagnostics. They provide comprehensive insights into a patient’s health, reducing the need for multiple tests or appointments. The increasing demand for preventive healthcare, coupled with advancements in diagnostic technologies, is driving the adoption of multi-test panels. Their growing use in hospitals, clinics, and home testing kits highlights their potential to transform routine health monitoring and enhance early disease detection.

By Collection Site

The hospital segment dominated the largest revenue share in the cellular health screening market in 2023. Hospitals are critical healthcare system providers with sophisticated diagnostic equipment and screening capabilities. The clinics are critical facilities through which cellular health screening, using a spectrum of diagnostic tests to enable early disease detection, prevention, and personalised treatment that is tailored to the individual, can take place. This segment has been positively influenced by an increase in the demand for diagnostic Collection Sites due to a rise in the number of chronic diseases and communication regarding health. Innovative testing solutions like wearables and lab-based screenings that deliver accurate and timely results help hospitals gain share. The hospital segment in the global mobility aids market holds a relatively larger share owing to the high patient number and the advanced healthcare infrastructure integrated in such hospitals.

The home segment is the fastest growing in the cellular health screening market over the forecast period from 2024 to 2032. This growth is being driven by a rising consumer demand for convenient, at-home diagnostic solutions. Over the years, with the evolution of technology, cellular health screenings can be conducted by users through easy to use, at-home kits that typically require a blood, urine, or saliva sample. The growing popularity and accessibility of digital health, aided by the availability of remote monitoring devices and the increasing use of telemedicine, has continued this trend which has made it easier for individuals to manage their health routinely without visiting healthcare facilities. Additionally, the affordability and accessibility of home-based testing options make it an attractive alternative for many, especially in areas with limited healthcare access, contributing to its rapid market expansion.

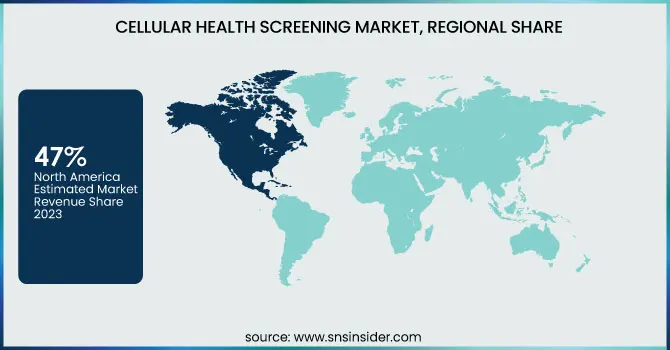

North America dominated the cellular health screening market in 2023, accounting for around 47% of the revenue share. The region's dominance can be attributed to the high adoption of advanced healthcare technologies, increasing consumer awareness, and a robust healthcare infrastructure. The presence of leading diagnostic companies, coupled with government initiatives promoting preventive healthcare, has fostered market growth. Additionally, the growing demand for personalized health screening and continuous monitoring solutions in North America is driving the adoption of cellular health screening technologies. The increasing prevalence of chronic diseases and an aging population are further contributing to the demand for early and efficient health screenings, making North America a key player in the market.

The Asia Pacific region is the fastest-growing market for cellular health screening, projected to experience significant growth over the forecast period from 2024 to 2032. This growth has been fueled by rapid developments in healthcare technology, growing awareness regarding preventive care and increasing prevalence of chronic diseases. Furthermore, the growing middle class, coupled with advancements in healthcare infrastructure and government programs that promote health awareness, are facilitating the uptake of cellular health screening solutions. The rising need for economical, accessible, and personalized health diagnostics, especially in regions such as China, India, and Japan, is projected to propel market growth in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the Major Players in Cellular Health Screening Market along with their Product:

Life Length (Spain): Telomere testing, aging diagnostics.

SpectraCell Laboratories, Inc. (U.S.): Micronutrient testing, telomere testing.

RepeatDx (U.S.): DNA testing, telomere length analysis.

Cell Science Systems (U.S.): Cell-based diagnostics, telomere testing kits.

Quest Diagnostics Incorporated (U.S.): Diagnostic testing, telomere testing, genetic testing.

Laboratory Corporation of America Holdings (U.S.): Diagnostic Collection Site s, genetic and telomere testing.

OPKO Health, Inc. (U.S.): Diagnostic testing, health and wellness diagnostics.

Genova Diagnostics (GDX) (U.S.): Functional medicine testing, telomere analysis.

Immundiagnostik AG (Germany): Telomere testing, immunodiagnostic products.

DNA Labs India (India): Genetic testing, telomere testing Collection Site s.

BioReference Health, LLC (U.S.): Diagnostic Collection Site s, genetic and telomere testing.

Innovatics Laboratories, Inc. (U.S.): Genetic and telomere testing solutions.

List of suppliers that provide raw materials and components for the Cellular Health Screening Market:

Thermo Fisher Scientific (United States)

Merck KGaA (Germany)

Sigma-Aldrich (United States)

Bio-Rad Laboratories (United States)

Agilent Technologies (United States)

PerkinElmer, Inc. (United States)

Illumina, Inc. (United States)

Danaher Corporation (United States)

Qiagen (Germany)

Becton, Dickinson and Company (BD) (United States)

Lonza Group (Switzerland)

GE Healthcare Life Sciences (United Kingdom)

Sartorius AG (Germany)

Abbott Laboratories (United States)

F. Hoffmann-La Roche AG (Switzerland)

July 23, 2024 Genova Diagnostics Launches At-Home Fatty15 Test to Assess Pentadecanoic Acid (C15:0) for Cellular Health.The test, in collaboration with Seraphina Therapeutics, offers an easy, at-home solution for monitoring C15:0 levels, supporting overall health and combating Cellular Fragility Syndrome.

March 28, 2024 – Labcorp announces the acquisition of select assets from BioReference Health's diagnostics business, enhancing its laboratory Collection Site s network and expanding access to clinical diagnostics and women's health Collection Site s across the U.S. (excluding New York and New Jersey)

| Report Attributes | Details |

| Market Size in 2023 | USD 3.2 Billion |

| Market Size by 2032 | USD 7.8 Billion |

| CAGR | CAGR of 10.60 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Test Type (Single Test Panels, Multi-test Panels) • By Sample Type (Blood, Saliva, Serum, Urine) • By Collection Site (Home, Office, Hospital, Diagnostic Labs) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Life Length, SpectraCell Laboratories, Inc., RepeatDx, Cell Science Systems, Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings, OPKO Health, Inc., Genova Diagnostics (GDX), Immundiagnostik AG, DNA Labs India, BioReference Health, LLC, , Innovatics Laboratories, Inc. |

Ans: The Cellular Health Screening Market is expected to grow at a CAGR of 10.60% during 2024-2032.

Ans: The Cellular Health Screening Market was USD 3.18 Billion in 2023 and is expected to Reach USD 7.85 Billion by 2032.

Ans: Key drivers of the Cellular Health Screening Market include increasing demand for personalized healthcare, advancements in wearable devices, rising health consciousness, and the growing focus on early disease detection and prevention.

Ans: The “Blood” segment dominated the Cellular Health Screening Market.

Ans: North America dominated the Cellular Health Screening Market in 2023

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Increased Adoption of Personalized Diagnostics

5.2 Rising Demand for Point-of-Care Devices (2020-2032)

5.3 Healthcare Spending on Preventive Diagnostics (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Cellular Health Screening Market Segmentation, By Test Type

7.1 Chapter Overview

7.2 Single Test Panels

7.2.1 Single Test Panels Market Trends Analysis (2020-2032)

7.2.2 Single Test Panels Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Telomere Tests

7.2.3.1 Telomere Tests Market Trends Analysis (2020-2032)

7.2.3.2 Telomere Tests Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Oxidative Stress Tests

7.2.4.1 Oxidative Stress Tests Market Trends Analysis (2020-2032)

7.2.4.2 Oxidative Stress Tests Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Inflammation Tests

7.2.5.1 Inflammation Tests Market Trends Analysis (2020-2032)

7.2.5.2 Inflammation Tests Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 Heavy Metals Tests

7.2.6.1 Heavy Metals Tests Market Trends Analysis (2020-2032)

7.2.6.2 Heavy Metals Tests Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Multi-test Panels

7.3.1 Multi-test Panels Market Trends Analysis (2020-2032)

7.3.2 Multi-test Panels Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Cellular Health Screening Market Segmentation, by Sample Type

8.1 Chapter Overview

8.2 Blood

8.2.1 Blood Market Trends Analysis (2020-2032)

8.2.2 Blood Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Saliva

8.3.1 Saliva Market Trends Analysis (2020-2032)

8.3.2 Saliva Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Serum

8.4.1 Serum Market Trends Analysis (2020-2032)

8.4.2 Serum Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Urine

8.5.1 Urine Market Trends Analysis (2020-2032)

8.5.2 Urine Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Cellular Health Screening Market Segmentation, by Collection Site

9.1 Chapter Overview

9.2 Home

9.2.1 Home Market Trends Analysis (2020-2032)

9.2.2 Home Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Office

9.3.1 Office Market Trends Analysis (2020-2032)

9.3.2 Office Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Hospital

9.4.1Hospital Market Trends Analysis (2020-2032)

9.4.2Hospital Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Diagnostic Labs

9.5.1Diagnostic Labs Market Trends Analysis (2020-2032)

9.5.2Diagnostic Labs Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Cellular Health Screening Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.2.4 North America Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.2.5 North America Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.2.6.2 USA Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.2.6.3 USA Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.2.7.2 Canada Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.2.7.3 Canada Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Cellular Health Screening Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Cellular Health Screening Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.2.7.2 France Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.2.7.3 France Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Cellular Health Screening Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.4.6.2 China Cellular Health Screening Market Estimates and Forecasts, by Display (2020-2032) (USD Billion)

10.4.6.3 China Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.4.7.2 India Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.4.7.3 India Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.4.8.2 Japan Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.4.8.3 Japan Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.4.12.2 Australia Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.4.12.3 Australia Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Cellular Health Screening Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Cellular Health Screening Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.5.2.4 Africa Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.5.2.5 Africa Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Cellular Health Screening Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.6.4 Latin America Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.6.5 Latin America Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Cellular Health Screening Market Estimates and Forecasts, By Test Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Cellular Health Screening Market Estimates and Forecasts, by Sample Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Cellular Health Screening Market Estimates and Forecasts, by Collection Site (2020-2032) (USD Billion)

11. Company Profiles

11.1 Life Length

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Collection Site s Offered

11.1.4 SWOT Analysis

11.2 SpectraCell Laboratories

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Collection Site s Offered

11.2.4 SWOT Analysis

11.3 RepeatDx

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Collection Site s Offered

11.3.4 SWOT Analysis

11.4 Cell Science Systems

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Collection Site s Offered

11.4.4 SWOT Analysis

11.5 Quest Diagnostics Incorporated

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Collection Site s Offered

11.5.4 SWOT Analysis

11.6 Laboratory Corporation of America Holdings

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Collection Site s Offered

11.6.4 SWOT Analysis

11.7 OPKO Health

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Collection Site s Offered

11.7.4 SWOT Analysis

11.8 Genova Diagnostics

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Collection Site s Offered

11.8.4 SWOT Analysis

11.9 Immundiagnostik AG

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Collection Site s Offered

11.9.4 SWOT Analysis

11.10 DNA Labs India

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Collection Site s Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Test Type

Single Test Panels

Telomere Tests

Oxidative Stress Tests

Inflammation Tests

Heavy Metals Tests

Multi-test Panels

By Sample Type

Blood

Saliva

Serum

Urine

By Collection Site

Home

Office

Hospital

Diagnostic Labs

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Scoliosis Management Market size was USD 3060.51 Million in 2023 and is expected to Reach USD 4356.06 Million by 2032 and grow at a CAGR of 4% over the forecast period of 2024-2032.

The Knee Replacement Market size was valued at USD 10.61 billion in 2023 and is projected grow to at a CAGR of 4.98% to reach USD 16.41 billion by 2032

The Mammography Workstations Market Size was valued at USD 152.75 million in 2023, and is expected to reach USD 264.42 million by 2031, and grow at a CAGR of 7.1% over the forecast period 2024-2031.

The Compounding Pharmacies Market Size was valued at USD 12.6 Billion in 2023 and will hit USD 19.9 Billion by 2032 with an emerging CAGR of 5.2% Over the Forecast Period of 2024-2032.

The Scleral Lens Market size was valued at USD 319.78 Million in 2023 and is expected to reach USD 1197.36 Million By 2031 and grow at a CAGR of 15.8% over the forecast period of 2024-2031.

The Automated Liquid Handling Technologies Market Size was valued at USD 2.11 Billion in 2023 and is expected to reach USD 5.24 Billion by 2032 and grow at a CAGR of 11.18% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone