To Get More Information on Cell Freezing Media Market - Request Sample Report

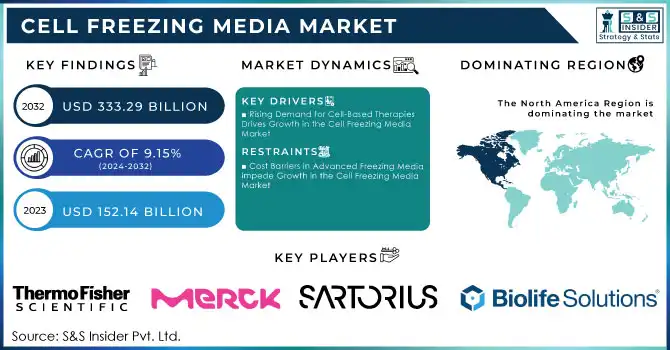

Cell Freezing Media Market was valued at USD 152.14 billion in 2023 and is expected to reach USD 333.29 billion by 2032, growing at a CAGR of 9.15% from 2024-2032.

The cell freezing media market is expected to grow at a fast pace, due to a rise in demand for solutions in the area of cryopreservation applied to cell-based therapies, regenerative medicine, and biopharmaceutical research. As these sectors progress, particularly in fields such as gene therapy, regenerative medicine, and cell banking, the demand for specialized freezing media formulations becomes increasingly evident. The increasing need is connected to advancements in cryoprotectants, as safer options than traditional agents such as DMSO are addressing issues with storing complex cell types. These developments are essential for the biotechnology and pharmaceutical industries, as they depend on accurate preservation methods to aid in drug development and personalized medicine.

As medical and biotechnology sectors rely on preserved cells, for applications such as stem cell research, cancer treatment, and vaccine development, the need for novel and effective cell freezing media increases. This growth reflects the crucial role played by cell freezing media in offering assurance for cell viability and function, making it possible to move forward in research and therapeutic solutions. For example, the 2023 AACR Cancer Progress Report highlighted tremendous progress in cancer therapy in terms of the number of new FDA-approved therapies from August 2022 through July 2023, including molecularly targeted therapy, immunotherapy, and gene therapy. These advancements highlight the growing need for reliable cell preservation solutions like freezing media to ensure continued progress in cancer research and the development of effective treatments.

Growth opportunities in the cell freezing media market are expanding with increasing uptakes in autologous cell therapies, biobanking, and clinical studies in oncology, neurology, and immunology. Spending on oncology in the United States has been growing sharply from USD 65 billion in 2019 to USD 99 billion in 2023-all of which points towards this demand for effective cryopreservation solutions. As these industries grow, the need for more advanced freezing media is increased much, creating continuous opportunities for manufacturers to develop and expand in this market. These trends show strategic use of cryopreservation in modern medicine, promoting advances in science as well as the development of therapy.

DRIVERS

Rising Demand for Cell-Based Therapies Drives Growth in the Cell Freezing Media Market

Growth in demand for cell-based treatments is the primary growth driver in the cell freezing media market. With over 100 gene, cell, and RNA therapies have been approved worldwide by June 2023, and more than 3,700 are in clinical and preclinical development. With the shift toward regenerative medicine and treatment with stem cell therapies and immunotherapies, cryopreservation technologies become quite essential. This demand is pushing the biopharmaceutical companies as well as research institutions to spend huge amounts on specialized freezing media for preserving cell viability and functionality. This promises market growth, giving room for greater innovation and competition with respect to fundamental players in this industry.

Development of Advanced Cryoprotectants and Freezing Media Formulations Drives Growth in Cell Freezing Media Market

The development in cryoprotectants and freezing media have significantly boosted the cell freezing media market, driven by innovations aimed at minimizing toxicity and improving cell survival post-thawing. Experimental results on oocytes and embryos, combined with mathematical modeling, show a potential 90% reduction in cryoprotectant toxicity in standard vitrification protocols. This progress allows for greater versatility, extended shelf life, and applicability in regenerative medicine and cell therapy. Emerging formulations are poised to support the preservation of more sensitive and complex cell types, expanding the possibilities in cryopreservation for advanced therapeutic applications.

RESTRAINTS

Cost Barriers in Advanced Freezing Media Impede Growth in the Cell Freezing Media Market

One of the key constraints in the cell freezing media market is the high development and production costs of the specialized freezing media formulation that contains advanced cryoprotectants. This would result from complex research and development, as well as the manufacturing process of developing more effective and efficient freezers. As such, products often do not reach smaller laboratories, emerging biotech companies, and those whose financial abilities are limited. These economic constraints may deter market acceptance, especially for countries whose research and development funds are limited. Thus, the potential of hindering the general market growth might be expressed through the limitation in exposure to advanced cryopreservation technologies and reduced opportunities for innovation and dispersed use.

BY END-USE

The pharmaceutical and biotechnology segment was leading the cell freezing media market in 2023, with about 45% of its revenue share. This is because the sector has proved quite strong due to constant demand for cryopreservation solutions in the drug development segment, personalized therapies, and regenerative medicine. Technological and competitive advantages in preserving cell integrity have added to the market position of this sector, encouraging further investments and innovation.

The research and academic institutes segment is expected to grow the fastest CAGR of 9.91% during 2024-2032, driven by increased research initiatives in cell biology, cancer studies, and stem cell therapies. Gene therapy and regenerative medicine mark emerging trends where academic collaborations and advanced cryopreservation techniques come into play. Growth in this segment will make for a potentially more significant shift in competitive dynamics and encourage more focused investment in this expanding segment.

BY APPLICATION

In 2023, the stem cell lines segment held the largest revenue share of about 59%, and is also expected to grow at the fastest CAGR of approximately 9.73% from 2024 to 2032. The reason for this growth is that stem cells are indispensable in most studies of regenerative medicine, research on various cancers, and clinical applications; cryopreservation methods are used to ensure long-term viability. The rising demand for stem cell therapies, coupled with increasing clinical trials and advancements in personalized medicine, makes it highly necessary to have specialized freezing media. As the research expands towards various applications of stem cell-based treatments, the demand for efficient techniques of cryopreservation will increase further and drive growth in this category.

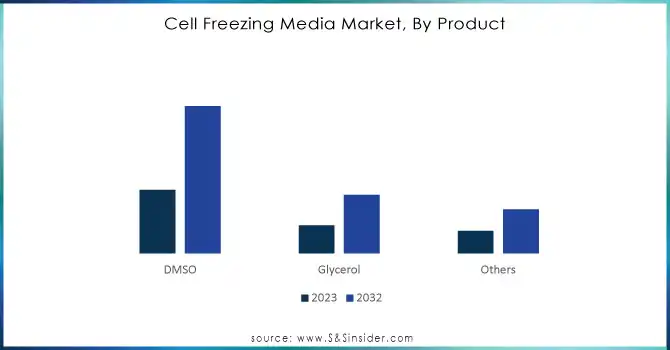

BY PRODUCT

In 2023, DMSO accounted for the largest share of the cell freezing media market at around 56% of revenue share and is also expected to grow at the fastest CAGR of 9.85% during the forecast period from 2024 to 2032. DMSO is largely used as a cryoprotectant primarily because it prevents the formation of ice crystals in frozen cells, thus preserving different types of cells such as stem cells and immune cells. Its effectiveness, low cost, and versatility in large-scale cryopreservation processes are hence preferred for both clinical and research applications. With these increased demands for cell-based therapies, regenerative medicine, and personalized medicine, DMSO's role as a key cryoprotectant is set to expand.

Do You Need any Customization Research on Cell Freezing Media Market - Enquire Now

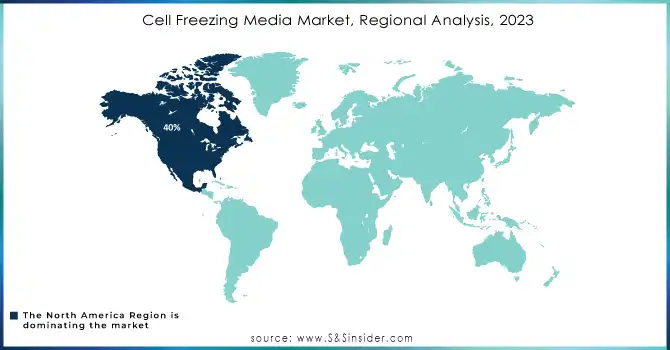

North America dominated the cell freezing media market in 2023 and held around 40% revenue share. This is due to a well-developed biotechnology sector, expansive research programs, as well as rising demand in the region for cell-based therapies. Huge pharmaceutical companies and institutions continue to rely on cryopreservation technologies as they design drugs or use regenerative medicine and this continues to fuel growth within the market in North America.

The Asia Pacific is expected to grow at the fastest CAGR of about 11.03% from 2024-2032. It is a result of the fast pace of biotechnology, the rise in expenditure by governments of different countries on health infrastructure, along a surge in clinical trials and research concerning stem cells. Highly developed focus on regenerative medicine coupled with the adoption of advanced technologies across other countries such as China, Japan, and India are some of the major contributors that account for rapid market growth.

LATEST NEWS -

In 2024, Acorn Biolabs, focused on cell-freezing media for regenerative medicine, secured USD 8 million in Series A funding to further its innovative work in cell preservation.

On February 28, 2024, Capricorn Scientific and ExcellGene formed a strategic partnership to optimize processes and develop advanced products for the biotechnology sector, with a focus on enhancing cell culture and media solutions.

KEY PLAYERS

Thermo Fisher Scientific, Inc. (Gibco CryoMax Freezing Medium, CryoStor Cryopreservation Medium)

Merck KGaA (Cell Freeze Freeze Media, Sigma-Aldrich Cell Freezing Media)

Sartorius AG (CryoMACS Freezing Media, Sartorius Stem Cell Freezing Medium)

BioLife Solutions, Inc. (CryoStor CS10, CryoStor CS5)

Bio-Techne (R&D Systems Cell Freezing Medium, R&D Systems CryoStor Media)

HiMedia Laboratories (HiFreeze Cryopreservation Medium, HiMed Freezing Medium)

PromoCell GmbH (PromoCell Cryopreservation Medium, PromoCell Cell Freezing Medium)

Capricorn Scientific (Capricorn Cryo Preservation Media, Capricorn CryoComplete)

Cell Applications, Inc. (Cell Applications Cryopreservation Medium, CryoStor Cell Freezing Media)

STEMCELL Technologies (CryoStor Freezing Medium, STEMCELL Technologies Stem Cell Freezing Medium)

AMSBIO (CryoStor Cryopreservation Medium, AMSBIO Freezing Media)

Cell Systems (CryoBio Freezing Media, Cell Systems Cryopreservation Solution)

BPS Bioscience, Inc. (BPS CryoPreservation Medium, BPS Freezing Medium)

Lonza Group (Lonza Cryopreservation Medium, CryoStor Cryopreservation Medium)

Corning Inc. (Corning Cryopreservation Medium, Corning Cell Culture Freezing Medium)

GE Healthcare (HyClone Cell Freezing Medium, HyClone Cryopreservation Medium)

Invitrogen (Gibco CryoFreeze Freezing Medium, Gibco CryoStor Cryopreservation Solution)

Wako Chemicals (Wako Cryopreservation Medium, Wako Cell Freezing Media)

VWR International (VWR Cryopreservation Medium, VWR Cell Freezing Solution)

Fisher Scientific (Gibco CryoMax Freezing Medium, Gibco CryoLife Preservation Solution)

American Type Culture Collection (ATCC) (ATCC CryoPreservation Medium, ATCC Stem Cell Freezing Medium)

Acorn Biolabs (AcornCryo, AcornBioPreserve)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 152.14 Billion |

| Market Size by 2032 | USD 333.29 Billion |

| CAGR | CAGR of 9.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (DMSO, Glycerol, Others) • By Application (Stem Cell lines, Cancer Cell Lines, Others) • By End-use (Pharmaceutical and Biotechnological Companies, Research & Academic Institutes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Inc., Merck KGaA, Sartorius AG, BioLife Solutions, Inc., Bio-Techne, HiMedia Laboratories, PromoCell GmbH, Capricorn Scientific, Cell Applications, Inc., STEMCELL Technologies, AMSBIO, Cell Systems, BPS Bioscience, Inc., Lonza Group, Corning Inc., GE Healthcare, Invitrogen, Wako Chemicals, VWR International, Fisher Scientific, American Type Culture Collection, Acorn Biolabs. |

| Key Drivers | • Rising Demand for Cell-Based Therapies Drives Growth in the Cell Freezing Media Market • Development of Advanced Cryoprotectants and Freezing Media Formulations Drives Growth in Cell Freezing Media Market |

| Restraints | • Cost Barriers in Advanced Freezing Media Impede Growth in the Cell Freezing Media Market |

Cell Freezing Media Market was valued at USD 152.14 billion in 2023 and is expected to reach USD 333.29 billion by 2032, growing at a CAGR of 9.15% from 2024-2032.

The Asia Pacific region is expected to grow at the highest CAGR of approximately 11.03% from 2024 to 2032.

DMSO (Dimethyl Sulfoxide) dominated the market with a share of about 56% in 2023.

The research and academic institutes segment is expected to grow at the highest CAGR of about 9.91% from 2024 to 2032.

The stem cell lines segment dominated the market with about 59% of the revenue share in 2023.

Table of Content:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Application Trends by Sector

5.2 Advances in Product Development

5.3 Drug Volume: Production and usage volumes of pharmaceuticals.

5.4 Challenges in Supply Chain and Distribution

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Cell Freezing Media Market Segmentation, by Product

7.1 Chapter Overview

7.2 DMSO

7.2.1 DMSO Market Trends Analysis (2020-2032)

7.2.2 DMSO Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Glycerol

7.3.1 Glycerol Market Trends Analysis (2020-2032)

7.3.2 Glycerol Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Others

7.4.1 Others Market Trends Analysis (2020-2032)

7.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Cell Freezing Media Market Segmentation, by Application

8.1 Chapter Overview

8.2 Stem Cell lines

8.2.1 Stem Cell lines Market Trends Analysis (2020-2032)

8.2.2 Stem Cell lines Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Cancer Cell Lines

8.3.1 Cancer Cell Lines Market Trends Analysis (2020-2032)

8.3.2 Cancer Cell Lines Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Cell Freezing Media Market Segmentation, by End Use

9.1 Chapter Overview

9.2 Pharmaceutical and Biotechnological Companies

9.2.1 Pharmaceutical and Biotechnological Companies Market Trends Analysis (2020-2032)

9.2.2 Pharmaceutical and Biotechnological Companies Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Research & Academic Institutes

9.3.1 Research & Academic Institutes Market Trends Analysis (2020-2032)

9.3.2 Research & Academic Institutes Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Others

9.4.1 Others Market Trends Analysis (2020-2032)

9.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Cell Freezing Media Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.4 North America Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 North America Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.6.2 USA Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6.3 USA Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.7.2 Canada Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7.3 Canada Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.8.2 Mexico Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Cell Freezing Media Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.6.2 Poland Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.7.2 Romania Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Cell Freezing Media Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.4 Western Europe Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.6.2 Germany Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.7.2 France Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7.3 France Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.8.2 UK Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.9.2 Italy Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.10.2 Spain Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.13.2 Austria Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Cell Freezing Media Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.4 Asia Pacific Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.6.2 China Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6.3 China Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.7.2 India Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7.3 India Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.8.2 Japan Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8.3 Japan Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.9.2 South Korea Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.10.2 Vietnam Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.11.2 Singapore Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.12.2 Australia Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12.3 Australia Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Cell Freezing Media Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.4 Middle East Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.6.2 UAE Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Cell Freezing Media Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.4 Africa Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 Africa Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Cell Freezing Media Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.4 Latin America Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Latin America Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.6.2 Brazil Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.7.2 Argentina Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.8.2 Colombia Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Cell Freezing Media Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Cell Freezing Media Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Cell Freezing Media Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11. Company Profiles

11.1 Thermo Fisher Scientific, Inc.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Merck KGaA

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Sartorius AG

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 BioLife Solutions, Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Bio-Techne

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 HiMedia Laboratories

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 PromoCell GmbH

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Capricorn Scientific

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Cell Applications, Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 STEMCELL Technologies

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

DMSO

Glycerol

Others

By Application

Stem Cell lines

Cancer Cell Lines

Others

By End-use

Pharmaceutical and Biotechnological Companies

Research & Academic Institutes

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Insulin Pump Market Size was valued at USD 6.70 Billion in 2023, and is expected to reach USD 13.37 Billion by 2032, and grow at a CAGR of 8.36%.

The Diabetes Drug Market Size was valued at USD 79.4 billion in 2023 and is expected to reach USD 145.0 billion by 2032, growing at a CAGR of 6.9%.

Postpartum Products Market Size was valued at USD 2.53 billion in 2023 and is expected to reach USD 4.47 billion by 2032, growing at a CAGR of 6.54% over the forecast period 2024-2032.

The Radiotherapy Market Size was valued at USD 7.01 Billion in 2023, and is expected to reach USD 11.18 Billion by 2032, and grow at a CAGR of 5.54%.

The Microbial Identification Market Size was valued at USD 3.6 Billion in 2023 and is expected to reach USD 9.77 Billion by 2032, growing at a CAGR of 11.5 % over the forecast period 2024-2032.

The Electrosurgical Devices Market Size was valued at USD 5.4 Billion in 2023, and is expected to reach USD 7.7 Billion by 2032, and grow at a CAGR of 4.1% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone