Get More Information on Ceiling Tiles Market - Request Sample Report

The Ceiling Tiles Market Size was valued at USD 8.7 billion in 2023 and is expected to reach USD 15.5 billion by 2032 and grow at a CAGR of 6.6% over the forecast period 2024-2032.

The ceiling tiles market is expanding and being supported by design and functional improvements, as well as the rising concern for sustainability. Some features that have made ceiling tiles highly sought after in commercial, healthcare, educational, and residential sectors include sound absorption, fire resistance, and thermal insulation. Companies are studying ecologically friendly materials and innovative designs that meet the growing requirements for energy-efficient and acoustically optimized spaces. In this context, for example, ROCKWOOL International A/S's subsidiary, Rockfon has introduced products like Blanka and Sonar that deliver a mixing of superior-class, sound-dampening qualities with aesthetic appeal. These ceiling tiles take care of the rising market demand for ceiling tiles that are both functional and fashionable as architecture requirements from different types.

Recent studies reveal that companies grow and expand to cater to the market's evolving needs. In April 2024, in a school in South Dakota, USA, students painted ceiling tiles within an educational arena as an art project to raise funds for creating art potentials from ceiling tiles in education. By doing this, they met the ceiling tile's flexibility but, above all, improved the aesthetical values of interiors and especially that of educational environments. Saint-Gobain India put up a new plant for manufacturing ceiling tiles at Jhagadia in January 2021. This was an important step in the expansion of its presence in the South Asian market. The new facility will now greatly help Saint-Gobain to satisfy increasing regional demand while reducing supply chain dependencies and strengthening the firm's commitment to sustainability and local production. These developments catch perfectly the dynamic nature of the ceiling tiles market, where companies invest in innovation and local expansion to stay ahead of consumer and industry demands.

Drivers:

Growing Demand for High-Performance Acoustic and Thermal Solutions Propels Ceiling Tiles Market Growth Across Commercial Spaces

The increasing need for high-performance ceiling solutions that provide acoustic and thermal insulation is driving the demand for ceiling tiles, particularly in commercial environments like offices, retail stores, and healthcare facilities. With rising concerns about noise pollution and the need for energy-efficient buildings, ceiling tiles have become a preferred choice due to their sound-absorbing and heat-insulating properties. Companies like Rockfon have introduced products that combine functional and aesthetic qualities, such as their Blanka and Sonar ceiling tiles, designed to improve indoor acoustics and provide temperature regulation. The growing adoption of open-plan offices, education centers, and public spaces, where noise control is crucial, has significantly contributed to the surge in demand for these tiles. Additionally, as energy efficiency continues to be a priority for both businesses and government regulations, ceiling tiles that help maintain indoor temperature and reduce energy consumption have become essential in commercial building projects. This has opened opportunities for manufacturers to innovate and create more specialized products tailored to specific needs.

Rapid Urbanization and Increasing Construction Activities Drive the Demand for Ceiling Tiles in Residential and Commercial Buildings

Urbanization and an increase in construction activities worldwide are key drivers for the growth of the ceiling tiles market. As cities expand and more residential, commercial, and industrial buildings are constructed, there is a growing need for materials that are both functional and cost-effective. Ceiling tiles, which offer ease of installation, lightweight properties, and various design options, are in high demand for modern building designs. In regions like Asia-Pacific and the Middle East, where rapid urbanization is at its peak, the use of ceiling tiles in both new constructions and renovations is becoming standard practice. Moreover, the rising middle class in emerging economies is pushing the demand for better living conditions, including improved building aesthetics and better soundproofing, which ceiling tiles fulfill. This trend is expected to continue as infrastructure development remains a key focus globally, supported by government policies, making ceiling tiles an integral part of modern architectural practices.

Restraint:

High Raw Material Costs and Supply Chain Constraints Pose Challenges for Ceiling Tile Manufacturers' Profitability

A significant restraint faced by the ceiling tiles market is the rising cost of raw materials such as gypsum, mineral fiber, and metal, which are essential components in tile production. With increasing demand for these materials, supply chain constraints and price fluctuations have been exacerbated, particularly in regions that rely on imports for raw materials. This can affect manufacturers’ ability to offer competitively priced products, which in turn impacts profitability. Moreover, logistical challenges such as transportation delays and geopolitical tensions can disrupt the timely supply of materials. Manufacturers are being forced to navigate these issues by either increasing product prices or absorbing the cost hikes, both of which can limit market growth. To mitigate this restraint, manufacturers are looking into alternative materials or more localized production to reduce their dependency on volatile supply chains. The ongoing challenges related to raw material costs and logistics are likely to persist, making it essential for ceiling tile producers to find cost-effective and innovative solutions to remain profitable.

Opportunity:

Increasing Focus on Sustainable and Eco-Friendly Building Solutions Presents New Opportunities for Ceiling Tiles Market Expansion

The growing global focus on sustainability and eco-friendly building practices presents a significant opportunity for the ceiling tiles market. As environmental concerns take center stage in construction and architecture, there is an increasing shift toward using sustainable materials in building projects. Ceiling tiles made from recycled materials, or those offering energy-saving properties, are becoming highly sought after. This demand is amplified by the implementation of green building standards, such as LEED (Leadership in Energy and Environmental Design), which incentivize the use of eco-friendly products in construction. Companies in the ceiling tiles market, such as Saint-Gobain and Rockfon, are already innovating by offering products that not only meet these green standards but also contribute to energy savings and improved indoor air quality. These developments open up vast opportunities for manufacturers to expand their product portfolios to cater to environmentally conscious consumers and capitalize on the growing trend of sustainable construction practices. As governments and organizations increasingly push for sustainability in building materials, the ceiling tiles market is positioned to benefit from this trend, leading to new growth avenues.

Challenge:

Fluctuations in Demand Across Seasonal Construction Cycles Pose Challenges for Ceiling Tiles Manufacturers

A significant challenge for the ceiling tiles market is the seasonal fluctuations in demand for construction materials, which impact the overall market for ceiling tiles. The demand for ceiling tiles typically rises during peak construction seasons in the spring and summer months when new projects are initiated. However, during colder months or in regions experiencing economic slowdowns, construction activities tend to slow down, leading to a drop in ceiling tile orders. This cyclical demand can create uncertainty for manufacturers, as they have to manage production volumes and inventories accordingly. Manufacturers are also faced with the challenge of maintaining a steady supply of products while managing cost efficiencies, particularly when demand dips. To overcome this challenge, manufacturers often need to diversify their market reach and adapt to regional trends, such as focusing on renovation projects during off-peak seasons or offering products that cater to different building types. Additionally, strategic planning and investment in marketing and partnerships are crucial to managing demand fluctuations in the seasonal construction cycle.

By Product Type

Acoustic ceiling tiles dominated the ceiling tiles market in 2023, with a market share of 60%. The growing emphasis on soundproofing and noise control in commercial spaces such as offices, healthcare facilities, and educational institutions has led to the dominance of acoustic tiles. These tiles are specifically designed to enhance sound absorption and are preferred in environments where noise control is crucial. For example, Rockfon’s Sonar ceiling tiles are renowned for their superior sound-damping properties, making them ideal for open-plan offices and classrooms.

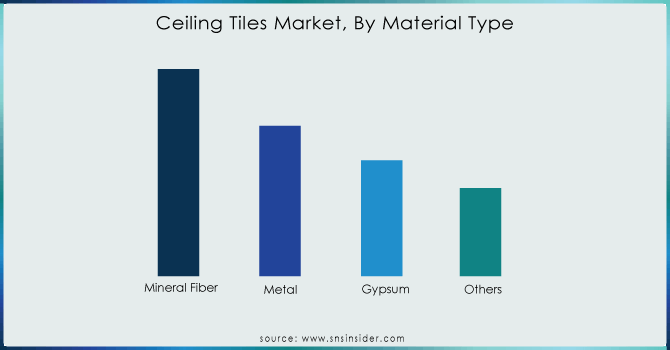

By Material Type

Mineral fiber dominated the ceiling tiles market in 2023, with a market share of 45%. Mineral fiber tiles are widely preferred due to their cost-effectiveness, versatility, and superior acoustic and fire-resistant properties. These tiles are commonly used in commercial spaces, particularly in offices, healthcare, and educational institutions, where performance and aesthetics are essential. Companies like Armstrong World Industries provide a wide range of mineral fiber tiles that cater to both aesthetic and functional demands, contributing to their dominance in the material segment.

By Installation Type

Suspended/Drop dominated the ceiling tiles market in 2023, with a market share of 70%. This installation type is commonly used in both commercial and residential sectors due to its ease of installation, accessibility for maintenance, and versatility. Suspended ceilings offer the flexibility to hide electrical wiring, air conditioning systems, and lighting, making them a popular choice for offices, retail, and healthcare spaces. The demand for suspended ceiling systems is reinforced by their aesthetic flexibility and functional advantages in large-scale construction projects.

By End-User

The commercial segment dominated the ceiling tiles market in 2023, accounting for approximately 50% of the market share. Among the subsegments, the office sector was the leading contributor, with a market share of 35%. The increasing demand for noise control, aesthetic ceiling designs, and energy-efficient building materials in office spaces has fueled the growth of this segment. Companies like Rockfon and Armstrong provide specialized ceiling tile solutions designed for open-plan office environments that improve acoustics and contribute to a healthier working environment, further solidifying the dominance of the commercial segment.

Get Customized Report as per your Business Requirement - Request For Customized Report

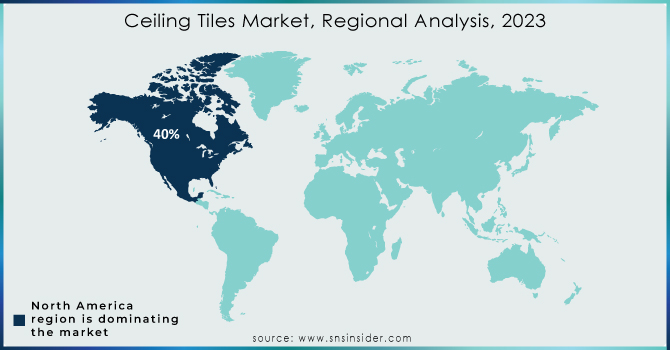

In 2023, North America dominated the ceiling tiles market with a market share of 40%. The region's leadership in the market can be attributed to the strong demand for ceiling tiles in both commercial and residential buildings, driven by ongoing infrastructure development, especially in the United States and Canada. The preference for acoustic and energy-efficient ceiling solutions in office spaces, healthcare facilities, and educational institutions has contributed to the region's market dominance. Companies like Armstrong World Industries and USG Corporation are based in North America, further fueling the region's leadership by offering innovative and high-quality ceiling solutions. Additionally, the region's focus on green building initiatives and sustainability in construction, with products that meet LEED standards, has solidified North America's dominant position in the global ceiling tiles market.

Moreover, in 2023, the Asia-Pacific region was the fastest-growing region in the ceiling tiles market, with a CAGR of 7.0%. The rapid urbanization, increasing construction activities, and growing middle-class population in countries like China, India, and Southeast Asian nations have fueled the demand for ceiling tiles in residential, commercial, and industrial projects. As infrastructure development accelerates in these emerging economies, there is a rising need for cost-effective and high-performance building materials, including ceiling tiles. The Asia-Pacific region’s focus on modernizing building infrastructure, coupled with the adoption of green and energy-efficient products, has significantly driven the demand for ceiling tiles. Companies are increasingly expanding their manufacturing and distribution networks in the APAC region to cater to this growing demand, further contributing to its rapid market growth.

AMF Ceilings Ltd. (Thermatex Acoustic, Thermatex Alpha)

Armstrong World Industries Inc. (Ultima, Dune, Cirrus)

AWI Licensing LLC (Perla, Fine Fissured)

BYUCKSAN (Sound Absorption Panels, Cleanroom Ceiling Tiles)

DAIKEN Corporation (Fine Acoustic, Wood Wool Acoustic)

Grenzebach BSH GmbH (Drywall Ceiling Solutions, Acoustic Panels)

HIL Limited (Aerocon Panels, Charminar Ceiling Tiles)

Hunter Douglas (Techstyle, HeartFelt)

Knauf Gips KG (Knauf Danoline, Heradesign)

LafargeHolcim Ltd. (Gyprex, Gypboard Ceilings)

Odenwald Faserplattenwerk GmbH (OWAtecta, OWAconsult)

Rockfon (a subsidiary of ROCKWOOL International A/S) (Blanka, Sonar)

ROCKWOOL International A/S (Rockfon Sonar, Rockfon Tropic)

Saint-Gobain Gyproc (Gyptone, Rigitone)

SAS International (SAS System 330, SAS System 600)

Siniat Ltd. (part of Etex Group) (Siniat Decogips, Siniat LaDura)

USG Boral (Echostop, Mars)

USG Corporation (Radar, Eclipse)

Zentia Group (Bioguard Acoustic, Ultima+)

Zhongshan Starleigh Building Materials Co., Ltd. (PVC Gypsum Ceiling Tiles, Acoustic Gypsum Tiles)

Suppliers and Distributors:

Building Materials Suppliers Inc.

ABC Supply Co.

Lowe’s Companies Inc.

The Home Depot, Inc.

Contractors and Installers:

Turner Construction

AECOM

Bechtel Group

Raw Material Providers:

Knauf Insulation

Owens Corning

Saint-Gobain

USG Boral

April 2024: South Dakota high school art students raised $3,070 by auctioning off painted ceiling tiles. The project, aimed at supporting school programs, showcased students' artistic talents while benefiting the local community.

May 2023: Ecophon opened a new manufacturing plant in India to directly address the growing demand in the region. This move enabled the company to offer its award-winning acoustical ceiling tiles to the expanding Indian market, strengthening its presence in the region.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.7 Billion |

| Market Size by 2032 | US$ 15.5 Billion |

| CAGR | CAGR of 6.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Acoustic, Non-Acoustic) •By Material Type (Mineral Fiber, Metal, Gypsum, Wood, Others) •By Installation Type (Suspended/Drop, Surface Mounted) •By End-User (Residential, Commercial [Retail, Hospitality, Leisure & Entertainment, Offices, Healthcare, Educational Institutions, Others], Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Odenwald Faserplattenwerk GmbH, Hunter Douglas, Armstrong World Industries Inc., AWI Licensing LLC, USG Corporation, Knauf Gips KG, ROCKWOOL International A/S, Saint-Gobain Gyproc, SAS International, BYUCKSAN, HIL Limited and other key players |

| DRIVERS | • Growing Demand for High-Performance Acoustic and Thermal Solutions Propels Ceiling Tiles Market Growth Across Commercial Spaces • Rapid Urbanization and Increasing Construction Activities Drive the Demand for Ceiling Tiles in Residential and Commercial Buildings |

| Restraints | • High Raw Material Costs and Supply Chain Constraints Pose Challenges for Ceiling Tile Manufacturers' Profitability |

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Odenwald Faserplattenwerk GmbH (Germany), Knauf (Germany), Hunter Douglas (The Netherlands), VANS Gypsum Pvt Ltd (India), Rockfon (U.S.), Saint Gobain S.A. (France), Armstrong World Industries, Inc. (U.S.), Burgess CEP (U.K.), Decorative Ceiling Tiles, Inc. (U.S.), SAS International (U.K.), Grenzebach BSH GmbH (Germany), The ReWall Company, LLC (U.S.) and USG Corporation (U.S.)

Ans: Coronavirus, a global epidemic, is affecting people all over the world. Except for the pharmaceutical industry, it has had a negative impact on all industries' operations. Almost every country has been placed on lockdown, and citizens have been compelled to remain at home. Because the borders are closed, no foreign travel is possible. Businesses are being shuttered as well. Many people have been laid off from their jobs. This has also had a negative impact on the Ceiling Tiles sector. The Global Ceiling Tiles Market Share is expected to expand dramatically following the Covid19 incident. This is due to the fact that construction projects in both developed and developing countries are on the rise.

Ans: Demand for low-maintenance building materials is growing and Increasing existing infrastructure repair and restoration activities are the opportunity for Ceiling Tiles Market.

Ans. The projected market size for the Ceiling Tiles Market is USD 15.53 Billion by 2032.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Region, 2023

5.2 Feedstock Prices, by Country, by Region, 2023

5.3 Regulatory Impact, by Country, by Region, 2023

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Region, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Ceiling Tiles Market Segmentation, by Product Type

7.1 Chapter Overview

7.2 Acoustic

7.2.1 Acoustic Market Trends Analysis (2020-2032)

7.2.2 Acoustic Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Non-Acoustic

7.3.1 Non-Acoustic Market Trends Analysis (2020-2032)

7.3.2 Non-Acoustic Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Ceiling Tiles Market Segmentation, by Material Type

8.1 Chapter Overview

8.2 Mineral Fiber

8.2.1 Mineral Fiber Market Trends Analysis (2020-2032)

8.2.2 Mineral Fiber Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Metal

8.3.1 Metal Market Trends Analysis (2020-2032)

8.3.2 Metal Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Gypsum

8.4.1 Gypsum Market Trends Analysis (2020-2032)

8.4.2 Gypsum Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Wood

8.5.1 Wood Market Trends Analysis (2020-2032)

8.5.2 Wood Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Others

8.6.1 Others Market Trends Analysis (2020-2032)

8.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Ceiling Tiles Market Segmentation, by Installation Type

9.1 Chapter Overview

9.2 Suspended/Drop

9.2.1 Suspended/Drop Market Trends Analysis (2020-2032)

9.2.2 Suspended/Drop Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Surface Mounted

9.3.1 Surface Mounted Market Trends Analysis (2020-2032)

9.3.2 Surface Mounted Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Ceiling Tiles Market Segmentation, by End-User

10.1 Chapter Overview

10.2 Residential

10.2.1 Residential Market Trends Analysis (2020-2032)

10.2.2 Residential Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Commercial

10.3.1 Commercial Market Trends Analysis (2020-2032)

10.3.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3.3 Retail

10.3.3.1 Retail Market Trends Analysis (2020-2032)

10.3.3.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3.4 Hospitality, Leisure & Entertainment

10.3.4.1 Hospitality, Leisure & Entertainment Market Trends Analysis (2020-2032)

10.3.4.2 Hospitality, Leisure & Entertainment Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3.5 Offices

10.3.5.1 Offices Market Trends Analysis (2020-2032)

10.3.5.2 Offices Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3.6 Healthcare

10.3.6.1 Healthcare Market Trends Analysis (2020-2032)

10.3.6.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3.7 Educational Institutions

10.3.7.1 Educational Institutions Market Trends Analysis (2020-2032)

10.3.7.2 Educational Institutions Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3.8 Others

10.3.8.1 Others Market Trends Analysis (2020-2032)

10.3.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Industrial

10.4.1 Industrial Market Trends Analysis (2020-2032)

10.4.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Ceiling Tiles Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.4 North America Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.2.5 North America Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.2.6 North America Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.7.2 USA Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.2.7.3 USA Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.2.7.4 USA Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.8.2 Canada Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.2.8.3 Canada Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.2.8.4 Canada Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.2.9.3 Mexico Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.2.9.4 Mexico Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Ceiling Tiles Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.1.7.3 Poland Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.1.7.4 Poland Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.1.8.3 Romania Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.1.8.4 Romania Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Ceiling Tiles Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.2.5 Western Europe Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.2.6 Western Europe Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.2.7.3 Germany Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.2.7.4 Germany Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.8.2 France Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.2.8.3 France Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.2.8.4 France Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.2.9.3 UK Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.2.9.4 UK Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.2.10.3 Italy Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.2.10.4 Italy Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.2.11.3 Spain Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.2.11.4 Spain Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.2.14.3 Austria Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.2.14.4 Austria Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Ceiling Tiles Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.4.5 Asia Pacific Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.4.6 Asia Pacific Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.7.2 China Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.4.7.3 China Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.4.7.4 China Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.8.2 India Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.4.8.3 India Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.4.8.4 India Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.9.2 Japan Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.4.9.3 Japan Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.4.9.4 Japan Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.4.10.3 South Korea Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.4.10.4 South Korea Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.4.11.3 Vietnam Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.4.11.4 Vietnam Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.4.12.3 Singapore Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.4.12.4 Singapore Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.13.2 Australia Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.4.13.3 Australia Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.4.13.4 Australia Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Ceiling Tiles Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.5.1.5 Middle East Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.5.1.6 Middle East Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.5.1.7.3 UAE Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.5.1.7.4 UAE Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Ceiling Tiles Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.4 Africa Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.5.2.5 Africa Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.5.2.6 Africa Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Ceiling Tiles Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.4 Latin America Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.6.5 Latin America Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.6.6 Latin America Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.6.7.3 Brazil Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.6.7.4 Brazil Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.6.8.3 Argentina Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.6.8.4 Argentina Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.6.9.3 Colombia Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.6.9.4 Colombia Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Ceiling Tiles Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Ceiling Tiles Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Ceiling Tiles Market Estimates and Forecasts, by Installation Type (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Ceiling Tiles Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

12. Company Profiles

12.1 Odenwald Faserplattenwerk GmbH

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Hunter Douglas

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Armstrong World Industries Inc.

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 AWI Licensing LLC

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 USG Corporation

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Knauf Gips KG

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 ROCKWOOL International A/S

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Saint-Gobain Gyproc

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 SAS International

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 BYUCKSAN

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product Type

Acoustic

Non-Acoustic

By Material Type

Mineral Fiber

Metal

Gypsum

Wood

Others

By Installation Type

Suspended/Drop

Surface Mounted

By End-User

Residential

Commercial

Retail

Hospitality, Leisure & Entertainment

Offices

Healthcare

Educational Institutions

Others

Industrial

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Synthetic Dyes Market Size was valued at USD 6.63 Billion in 2023 and is expected to reach USD 11.41 Billion by 2032, growing at a CAGR of 6.23% over the forecast period of 2024-2032.

Electronic Chemicals CDMO & CRO Market was valued at USD 0.45 Bn in 2023 and is expected to reach USD 0.81 Bn by 2032, at a CAGR of 6.80% from 2024 to 2032.

Insoluble Sulfur Market was valued at USD 1.13 Billion in 2023 and is expected to reach USD 1.91 Billion by 2032, growing at a CAGR of 6.00% from 2024-2032.

The Palm Oil Market Size was valued at USD 70.4 billion in 2023 and is expected to reach USD 106.5 billion by 2032, at a CAGR of 4.7% from 2024-2032.

The Ethanolamine Market Size was valued at USD 3.76 billion in 2023 and is expected to reach USD 5.82 billion by 2032 and grow at a CAGR of 5.70% over the forecast period 2024-2032.

The Plastic Films & Sheets market size was valued at USD 135 billion in 2023 and is expected to reach USD 212.3 billion by 2032 and grow at a CAGR of 5.20% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone