Cast Elastomer Market Report Scope & Overview:

The Cast Elastomer Market Size was valued at USD 1.3 billion in 2023 and is expected to reach USD 2.0 billion by 2032 and grow at a CAGR of 6.0% over the forecast period 2024-2032.

Get More Information on Cast Elastomer Market - Request Sample Report

Large-scale demand in other end-user industries, such as automotive, industrial, and mining, is responsible for the cast elastomer market to grow at a significant rate. These elastomers are increasingly being used in applications where high-performance materials are required because of their high durability, flexibility, and abrasion resistance. One of the key growth drivers for this market is rapid growth in the automotive sector where cast elastomers are utilized for the preparation of various related components such as seals, gaskets, and suspension parts. Automotive manufacturers are bound to choose cast elastomers due to their superior load-bearing capability and resistance to harsh environmental conditions, thus facilitating better vehicle performance and longer duration. Other significant customers for these materials are the mining industry, where they are used in conveyor belts and screens; abrasion resistance is critical for operational efficiency and minimized downtime.

Cast elastomer production technology advances play a significant role in determining market dynamics. Significant attention has been paid to high-performance polyurethane elastomers having superior mechanical properties in recent years. For instance, Huntsman's Adiprene and Vibrathane lines have been developed providing superior temperature and chemical resistance to extend the application range in more industries. Dow Chemical also introduced new formulations for its Hyperlast and Diprane systems aiming at providing better processing efficiency and product consistency. These innovations are not only enhancing the quality of the product but also reducing the production cost; thus, they offer more opportunities for use in cast elastomers in numerous markets.

Sustainability is also another very important factor that defines the scenario of the current market, and companies now pay more attention to creating ecologically friendly and recyclable cast elastomers. One such example that stands out can be seen in BASF, as it has developed its Elastollan N series, which contains renewable raw materials without sacrificing performance characteristics. All this forms part of a trend toward more sustainable materials in manufacturing as regulators and consumers increasingly demand environmentally friendly products. As industries take on efforts to reduce their environmental footprint, all these are going to offer considerable scope for market growth in the area of cast elastomers.

Strategic collaborations and acquisitions are also to be seen over time in the market as companies look at strengthening their product portfolios and thus building their market presence. In 2023, Covestro acquired DSM's Resins & Functional Materials business-that further enhances the product portfolio of Covestro in the polyurethane segment, cast elastomers range, and so on. LANXESS also completed its acquisition of specialty chemicals manufacturer Emerald Kalama Chemical in 2021-improving its position in high-performance elastomers. These have opened their gates to the market players to capitalise on synergy, enhance their production capability, and offer a holistic set of solutions to their customers.

Recent developments give a proactive sense, enlarging the production capacity and supply chain networks to meet the increasing demand. The subsidiary, Wanhua Chemical USA LLC, announced in 2022 its plan to build a new polyurethane facility in Louisiana, USA, to grow the supply of cast elastomers for North America. This expansion besides better market share also promises a more secure source of high-quality elastomers from the company to its customers. In addition, Tosoh Corporation upgraded its production facility at its headquarters in Japan to improve the quality and consistency of the polyurethane elastomers. This indicates a larger macro trend on a general industry level where operational efficiency and product performance are enhanced. Overall, these trends represent a dynamic and evolving market with immense growth opportunities, and innovation activities continue to alter it.

Cast Elastomer Market Dynamics:

Drivers:

-

The increasing adoption of cast elastomers in the automotive sector, driven by their durability and ability to enhance vehicle performance, is a significant market driver.

The current growth in the automobile industry, particularly in emerging economies, is primarily responsible for the rise of the cast elastomer market. Automotive bushes, seals, gaskets, and suspension components, to name a few, now often see cast elastomers used in their manufacturing because of their superior properties, including resistance to wear, tear, and rough environmental conditions. Automakers seek parts that help in vehicle durability and functionality with low maintenance costs. Elastomers possess high load-bearing strength, elasticity, oil/grease/chemical resistance, and hence are a suitable choice for application in the automobile sector when the requirement is for durability. The market for cast elastomer also increases due to the demand for electric vehicles since several types of elastomers have application in various parts of an electric vehicle. Moreover, with strict fuel efficiency and emission standards implemented globally by governments and in a move to reduce vehicle weights, along with increasing efficiency, automakers are being forced to include better efficiency, and their edge in making growth for this market further is developed by the creation of cast elastomers as advanced materials.

-

Innovations in polyurethane chemistry have led to the development of cast elastomers with enhanced mechanical properties, expanding their applicability in industrial sectors.

Technological development has surfaced during the production of polyurethane elastomers, and it has revolutionized the face of the cast elastomer market. The new applications of various kinds within industries are results of high-performance cast elastomers developed due to improved property levels, like abrasion resistance, temperature stability, and chemical resistance. Advances in polyurethane chemistry have allowed elastomers that can be formulated specifically according to the needs and requirements of the desired application. In fact, the good ability of cast elastomers to work in extreme conditions makes adoption more worthwhile for mining, oil & gas, and construction industries. On similar grounds, the ease of processing and molding makes polyurethane elastomers cheaper for the manufacturers. Further research will lead to the entry of more enhanced mechanical and thermal properties of elastomers in the market, which will prove yet again the driving demand across various industrial sectors.

Restraint:

-

The high production and processing costs associated with cast elastomers, particularly in terms of raw materials and energy consumption, can restrain market growth.

High cost of production is one of the major bottlenecks in the cast elastomer industry, making it very expensive to penetrate price-sensitive sectors. Raw materials put into cast elastomers, especially high-performance polyurethanes, are quite expensive. Additionally, considerable amounts of energy are used processing in molding and curing techniques to manufacture these elastomers. Cast elastomers can be costlier, creating more significant price barriers against industrial applications where cost is a major factor. Automotive and industrial machinery industry could consider its applicability only because of its available alternatives like rubber or thermoplastics, which might offer the similar end requirements at a much lower price. This cost factor not only affects manufacturers but pushes them to look for more affordable substitutes, especially in applications wherein extreme durability and chemical resistance may not be an essential feature. The financial burden over the adoption of cast elastomers is rather high to smaller manufacturers and companies with tight margins, thus a limitation to wider market penetration, especially in developing regions where cost becomes a critical determinant in any decision.

Opportunity:

-

The growing demand for sustainable and eco-friendly materials opens opportunities for manufacturers to develop biodegradable or recyclable cast elastomers, catering to environmental regulations and consumer preferences.

An increasing global focus on sustainability and environmental accountability opens up a large door for the cast elastomer market to enter in that governments and regulatory mechanisms begin to raise the enforcement of environmental rules and regulations that get industries towards sustainable production methods and materials. This trend creates a demand for green elastomers derived from raw materials either bio-based or recyclable. Examples of innovation include biodegradable elastomers or those derived from renewable feedstocks such as plant-based polyols. For instance, BASF introduced bio-based feedstocks for the production of elastomers, equating performance with sustainability goals. Companies that can provide these greener technologies for industries such as automotive, mining, and construction will enjoy a competitive edge. Consumers too are becoming more environmentally conscious, preferring product lines that adversely affect the environment the least. This shift in consumer preference, therefore, is prodding industries to seek suppliers who could provide them with environmentally friendly elastomers, and this brings about immense growth opportunities for companies that have sustainability in their DNA.

Challenge:

-

The raw materials are also quite volatile, in this case mainly the petroleum-based chemicals used in the polyurethane manufacturing process. The fixing of prices on the product is also difficult for the producers of cast elastomer because of the volatility of the raw materials.

Primarily, one of the biggest challenges facing the cast elastomer market is raw material price volatility, mainly from petroleum products. Polyurethane forms one of the primary materials that make up any product made from cast elastomer and, conversely, synthesized from chemicals such as isocyanates, while polyols tend to directly relate to the price of crude oil. Fluctuations in global oil prices cause uncertainty in the cost of raw materials and hence affect the unpredictability of production costs. This may squeeze the profit margins of manufacturers or even compel them to raise prices to customers, thereby reducing demand eventually. Secondly, whatever crisis is targeting the supply chain - geopolitical actions, a devastating natural disaster, or changes in crude oil supply - grates matters for manufacturers. Manufacturers of smaller sizes cannot absorb such voluminous cost fluctuations, where they are susceptible to market dynamics. Secondly, increased raw material costs may lead industry firms to look for alternative materials, so cast elastomer competition becomes even fiercer. This raises the point that companies should develop alternative sources of raw materials or should invest in bio-based or synthetic alternatives to make them less volatile and dependent on petroleum-based inputs.

Cast Elastomer Market Segments

By Type

In 2023, the hot cast elastomer segment dominated and accounted for a Cast Elastomer Market share of approximately 65%. Hot cast elastomers have an important application advantage in many applications over cold cast elastomers because of their higher mechanical properties, faster curing, and easier processing. For example, they are highly used in automotive parts, industrial machines, and mining industries where performance and durability are crucial aspects. Examples include Huntsman and BASF, which market advanced hot cast elastomer formulations that boast superior abrasion and thermal stability, ideal for the most challenging environments. The efficiency and quality of hot cast elastomers have placed them so comfortably on the favored side of industries in search of dependability and high-performance materials that their dominant hold on market leadership is further ensured.

By Raw Material

TDI-based cast elastomers lead the Cast Elastomer Market in 2023, thereby accounting for more or less 50% market share. TDI-based cast elastomers are highly prized for their superior flexibility, high tensile strength, and resilience, making this product group ideal for application in automotive, footwear, and industrial parts. For instance, TDI-based elastomers are widely used in seal, gasket, and bushing parts for durability and wear-resistance performance. BASF and Covestro are leaders in developing and formulating sophisticated compositions of advanced TDI-based composites, ensuring they perform while maintaining parameters that guarantee quality is not compromised. Their versatility and reliability have been some of the big drivers of extensive industrial acceptance, further consolidating their leading market position.

By Application

Separating screens dominated and accounted for a market share of around 35% in 2023 and dominated the cast elastomer market. Separating screens are widely used in mining and mineral processing sectors due to their outstanding wear resistance and excellent properties concerning the handling of abrasive materials. For example, cast elastomers are utilized in vibrating screens that separate various particle sizes in the mining process with efficient material handling and relatively minimal downtime. Such industry leaders, including Schenck Process and Weir Minerals, have gradually adopted advanced cast elastomer technologies in the designs of these screens that positively enhance performance and durability under harsh operating conditions. The huge demand for efficient separation processes in the field of mining and mineral applications has ensured the position of separating screens as the leading application segment of cast elastomer.

By End-use Industry

In 2023, the automotive and transportation segment dominated the cast elastomer market accounting for a revenue share of around 40%. The growth in the usage of these cast elastomers would happen in the broad range of automotive components because of their excellent mechanical properties, durability, and capability to withstand harmful environmental conditions. For instance, cast elastomers have become the key raw materials in the manufacturing of bushings, seals, and gaskets that have to operate with high reliability efficiency. Apart from producing specific formulated cast elastomers that ensure the optimization of an automobile part's life cycle and performance, other organizations such as DuPont and Huntsman have specialized formulations formulated to elongate the life cycle or enhance the overall performance of an automobile part. Similarly, the boom in electric vehicles has increased demand as manufacturers look for materials that have minimal weaknesses in their use for EV components. Innovation coupled with a strong automotive market has made the automotive and transportation end-use industry the top end-user for cast elastomers.

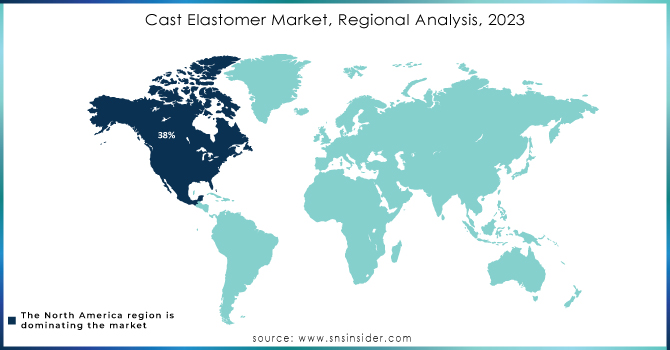

Cast Elastomer Market Regional Analysis

North America dominated the Cast Elastomer Market in 2023, with a market share of about 38%. Regional dominance can be attributed to its mature automotive and industrial sector drivers commanding large volumes of high-performance materials. The prime position is taken by the United States, with substantial manufacturing by BASF and Huntsman on new cast elastomer technologies capable of optimizing product performance for diverse applications. For example, the automobile and automobile ancillaries industries have emphasized electric vehicles, which has created a demand for stronger and more efficient material used in the production of cast elastomers, hence an increase in adoption in various parts of automotive components such as seals and bushings. More so, the region prioritizes research and development and boasts a solidly manufactured infrastructure to aid in its continuous growth in this market. The cumulative effect places North America at the front end of this market.

Moreover, the Asia-Pacific region is the fastest-growing area in the Cast Elastomer Market, which is slated to grow at a CAGR of approximately 7.5% through the forecast period in 2023. This is because of its rapidly developing industrial base and increasing demand for automotive components in the countries of China and India. Cast elastomers are employed by various manufacturers in this Asia-Pacific automotive industry for multiple applications due to their superior durability and performance characteristics. For instance, producers at the forefront of leading automotive companies in China increasingly input advanced technologies in cast elastomer production into production to better make vehicles longer-lasting and more efficient. Also, in this region, mining and oil and gas industries have experienced growth, which further gained pace for the demands; cast elastomers are mainly used for highly stressed and abrasive-strength components. Along with this industrial growth and progressive knowledge regarding advanced technologies and sustainable materials, Asia-Pacific is expected to see dramatic growth in the cast elastomer market in the next few years.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Accella Corporation (Accella Polyurethane Systems, Accella Thermoplastic Elastomers)

-

BASF SE (Elastollan, Elastoflex)

-

Chemline (Chemline Polyurethane Cast Elastomers, Chemline Urethane Systems)

-

Covestro AG (Desmopan, Bayflex)

-

The Dow Chemical Company (VORASURF, DOWSIL Silicones)

-

ERA Polymer (ERA Cast Urethanes, ERA Elastomers)

-

Huntsman Corporation (Irogran, Rigid Polyurethane Systems)

-

LANXES, AG (Desmopan, Baytec)

-

Mitsui Chemicals (APRONEX, MDI-based Polyurethane Systems)

-

PolyOne Corporation (Versaflex, OnColor TPE)

-

Wanhua Chemicals (Wanhua Polyurethane, WPU Elastomers)

-

Momentive Performance Materials (RTV Silicone Elastomers, Silopren)

-

Kraton Corporation (Kraton G, Kraton D)

-

Evonik Industries (VESTOSINT, VESTAMID)

-

TOHO TENAX Co., Ltd. (TENAX Polyamide, TENAX Thermoplastic Composites)

-

Shin-Etsu Chemical Co., Ltd. (KE-TPU, KE-EPDM)

-

Trelleborg AB (Trelleborg Sealing Solutions, Trelleborg Coated Fabrics)

-

DSM Engineering Plastics (Stanyl, Arnitel)

-

Benvic Europe (Benvic Elastomers, Benvic Thermoplastic Polyurethanes)

Recent Developments

September 2023: Argonics released Ceramic Tile Magnetic Panels with extreme wear protection of nearly uninterrupted 4" x 6" ceramic tile surface. The strong rare earth magnets ensure an easy, secure fit for 6" x 12" or 12" x 12" sizes. Ceramic tiles show exceptional durability towards wear and tear in industrial applications. This performance-proven solution provided by Argonics serves to safeguard the longevity of equipment.

September 2023: COIM Group invested in a controlling stake in the Spanish company Neoflex SL which represents the latest strategic acquired strategy for COIM, and prepares COIM to expand on the polyurethane adhesives market incorporating Neoflex solutions that use raw materials existing in COIM with low environmental impact.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.3 Billion |

| Market Size by 2032 | US$ 2.0 Billion |

| CAGR | CAGR of 6.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hot cast elastomer, Cold cast elastomer) • By End-use Industry (Industrial, Automotive & Transportation, Oil & gas, Mining, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | The Dow Chemical Company (US), Covestro AG (Germany), Chemline (US), LANXES, AG (Germany), Wanhua Chemicals (China), ERA polymer (Australia), Accella Corporation (US), Mitsui Chemicals, BASF SE, LANXESS AG, ERA polymer |

| DRIVERS | • Growing demand over Cast Elastomers in High-Value Industries • significant demand for manufacturing in emerging economies |

| Restraints | • Environmental and Health Concerns in the cast elastomers market • Fluctuations in the prices of raw materials affect the market |