Get More Information on Cassava Bags Market - Request Sample Report

The Cassava Bags Market Size was valued at USD 67 million in 2023 and is projected to reach USD 130.62 million by 2032 and grow at a CAGR of 7.7% over the forecast periods 2024 -2032.

The cassava bag market is projected for significant growth driven by several factors. Rising environmental awareness, particularly concerning plastic pollution in the food and beverage industry due to online delivery, is fueling demand for biodegradable alternatives.

Cassava bags' biodegradability, safety for marine life, and lower carbon footprint compared to traditional plastics are key selling points. Additionally, government regulations aimed at reducing plastic use are creating opportunities.

The food and beverage industry is a key area for cassava bags, driven by the surge in online food delivery and the resulting mountain of plastic takeout containers and bags. A Zomato report highlights this trend, projecting Indian food delivery platforms to reach a staggering 80 million monthly active users , with ambitions to double that number in the coming years. This explosive growth in online food delivery is expected to significantly benefit the cassava bag market. However, the market faces challenges such as complex manufacturing processes requiring expensive equipment, potential methane production in landfills, and the need for specific weather conditions for proper decomposition. L'Oreal's partnership with EcoNest PH for sustainable packaging highlights the potential of cassava bags in the cosmetics industry as well. Overall, the market presents promising opportunities for growth due to its eco-friendly nature and increasing consumer preference for sustainable solutions.

MARKET DYNAMICS

KEY DRIVERS:

Increased public concern about the environment is leading to a shift towards more sustainable practices.

Fueled by growing concerns about plastic pollution's harm to our environment and health, consumers are increasingly seeking eco-friendly alternatives like cassava bags. This shift towards sustainability reflects a rising public consciousness about the impact of packaging choices.

Consumers, driven by a growing desire for a healthier planet, are increasingly making conscious choices

RESTRAINTS:

Public awareness about cassava bags remains low.

Switching to cassava bags is initially costlier due to R&D and supply chain adjustments.

Several factors contribute to the higher initial cost of switching to cassava bags. These include ongoing research and development (R&D) to optimize production processes and material science. Additionally, establishing a new supply chain for cassava-based materials requires infrastructure investment and navigating new logistics compared to established plastic production.

OPPORTUNITY:

Cassava bags are improving in affordability, versatility, and availability thanks to ongoing R&D in materials, processing, and design.

E-commerce, consumer trends, and sustainability are reshaping retail.

The retail industry's growing focus on sustainability is driving a shift towards eco-friendly packaging like cassava bags. This trend pushes manufacturers and suppliers to adapt and offer greener options to meet retailers' evolving needs.

CHALLENGES:

Cassava bag production faces challenges due to limited cassava crop availability and a lack of processing infrastructure.

Cassava bag production involves a more intricate process compared to the simpler methods used for regular plastics.

Regular plastic manufacturing typically relies on a well-established, high-volume production line, whereas cassava bags often involve additional steps such as sourcing the cassava starch, purifying it, and combining it with other bio-based materials. This can make cassava bag production less scalable at present.

IMPACT OF RUSSIA UKRAINE WAR

The war has caused significant increases in energy and fertilizer prices. Cassava cultivation likely wouldn't be exempt from these cost hikes. This could lead to increased cassava bag production costs, making them potentially less competitive compared to other packaging options. With concerns about global food security and potentially higher import costs, some countries, particularly those dependent on wheat imports like Nigeria, might prioritize boosting domestic production of alternative food sources like cassava. This could lead to increased demand for cassava, potentially benefiting the cassava bag market as a byproduct.

IMPACT OF ECONOMIC SLOWDOWN

During an economic slowdown or recession, rising food prices can disproportionately affect the cassava bag market, particularly in developing economies like those in Africa. As food becomes more expensive, especially staples like cassava, people in poverty may prioritize buying the food itself over pricier packaging options like cassava bags. This could lead to a decrease in demand for these bags, particularly for non-essential uses like shopping bags for discretionary purchases. The price competitiveness of cassava bags compared to traditional plastics will be a significant factor influencing consumer behavior. However, in the long term, the focus on food security could lead to increased cassava production, potentially benefiting the cassava bag market as a byproduct. Additionally, if cassava remains a staple food source during a recession, the market could see a rebound in demand once economic conditions improve.

KEY MARKET SEGMENTS

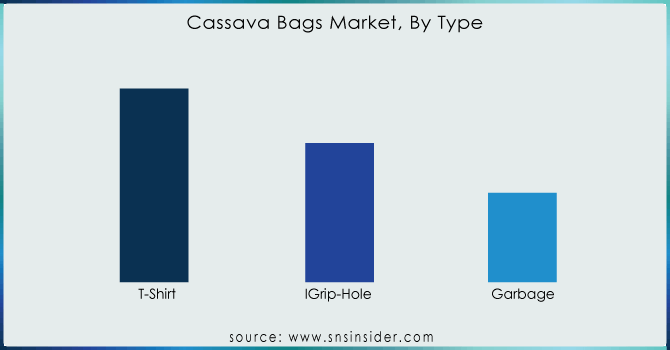

By Type

Grip-Hole

T-Shirt

Garbage

T-shirt bags dominates in the cassava bag market, capturing a around 57% of market revenue. This dominance reflects the preference of eco-conscious consumers and companies seeking to promote sustainability. For these companies, choosing cassava-based materials for T-shirt bags, boosting their brand image while aligning with evolving consumer preferences.

Need any customization research on Cassava Bags Market - Enquiry Now

By Category

Organic

Conventional

The organic segment leads the cassava bag market at 60% share, appealing to both eco-conscious brands and health-focused consumers. Brands promoting sustainability can leverage this segment's focus on responsible sourcing and minimal chemical use, potentially driving further growth across various markets.

By End User

Food & Beverages

Animal Feed

Food and beverages dominating with 61% market share in cassava bag usage. These bags are popular for packaging fresh produce, snacks, and ready-to-eat meals due to their excellent moisture resistance, which helps maintain food freshness and quality.

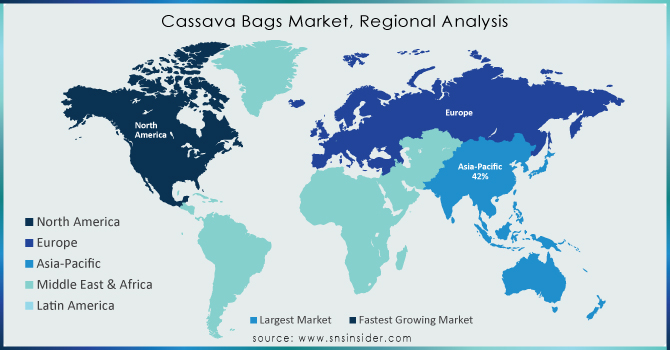

REGIONAL ANALYSIS

The Asia Pacific region dominates the cassava bag market with share of 42% due to a confluence of factors such as a large population with rising disposable income, growing environmental awareness about plastic pollution, and increasing consumption of processed foods. This booming market benefits from being located in major cassava-producing countries like Thailand, Indonesia, China, and Vietnam. These countries not only manufacture cassava bags but have also developed lightweight varieties for export. Additionally, China's use of cassava extract for biofuel production further promotes sustainability in the region by reducing greenhouse gas emissions and reliance on imported fuels. Moreover, the textile industry's adoption of cassava to enhance thread quality contributes to the overall improvement of cassava bags in the Asia Pacific.

North America is projected for solid cassava bag growth due to rising environmental awareness and high packaged food consumption. Additionally, Brazil's production capacity and growing beauty and hospitality industries in the Americas will contribute to market expansion. South Africa aims to cultivate cassava with NGO support (SHA) since 2016. In Nigeria, Bakeries are adopting cassava flour for bread production due to lower costs and simpler ingredients.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Key players

Some the major players in Cassava Bags Market are Avani Eco Affinity Supply Co, Biopac India Co. Ltd., Envigreen Biotech India Pvt. Ltd, Affinity Supply Co., Biogreen Bags Co. Ltd, SainBag No Plastic International Pty Ltd, SandBag, IMillionotplasticbag, Baolai Packaging Co., Ltd., Urban Plastik Indonesia, Baolai Packaging Co., Ltd., Tipa, Henan Baolai Packaging Co., Ltd. And Others Players.

RECENT DEVELOPMENT

Cassava Bags Australia won a global sustainability competition in May 2023, beating out hundreds of other eco-friendly startups. This win highlights their dedication to environmentally friendly practices.

DRDO, along with Acharya Nagarjuna University and Ecolastic, developed and launched plant-based, food-safe biodegradable packaging solutions in July 2021.

ALPLA Group partnered with Slovak bioplastics leader Panara in July 2021, acquiring a minority stake to advance biodegradable packaging solutions, including bags.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 67 Mn |

| Market Size by 2032 | US$ 130.62 Mn |

| CAGR | CAGR of 7.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Grip-Hole, T-Shirt, Garbage), By Category (Organic, Conventional) • By End User (Food & Beverages, Animal Feed) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Avani Eco Affinity Supply Co, Biopac India Co. Ltd., Envigreen Biotech India Pvt. Ltd, Affinity Supply Co., Biogreen Bags Co. Ltd, SainBag No Plastic International Pty Ltd, SandBag, IMillionotplasticbag, Baolai Packaging Co., Ltd., Urban Plastik Indonesia, Baolai Packaging Co., Ltd., Tipa, Henan Baolai Packaging Co., Ltd. |

| Key Drivers | • Increased public concern about the environment is leading to a shift towards more sustainable practices. • Consumers, driven by a growing desire for a healthier planet, are increasingly making conscious choices |

| Key Restraints | • Public awareness about cassava bags remains low. • Switching to cassava bags is initially costlier due to R&D and supply chain adjustments. |

Ans: The Cassava Bags Market is expected to grow at a CAGR of 7.7%.

Ans: Cassava Bags Market size was USD 67 million in 2023 and is expected to Reach USD 130.62 million by 2032.

Ans: Increased public concern about the environment is leading to a shift towards more sustainable practices.

Ans: Switching to cassava bags is initially costlier due to R&D and supply chain adjustments.

Ans: Asia-Pacific holds the dominant position with the market share of 42%.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Cassava Bags Market Segmentation, By Type

9.1 Introduction

9.2 Trend Analysis

9.3 Grip-Hole

9.4 T-Shirt

9.5 Garbage

10. Cassava Bags Market Segmentation, By Category

10.1 Introduction

10.2 Trend Analysis

10.3 Organic

10.4 Conventional

11. Cassava Bags Market Segmentation, By End User

11.1 Introduction

11.2 Trend Analysis

11.3 Food & Beverages

11.4 Animal Feed

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Cassava Bags Market by Country

12.2.3 North America Cassava Bags Market By Type

12.2.4 North America Cassava Bags Market By Category

12.2.5 North America Cassava Bags Market By End User

12.2.6 USA

12.2.6.1 USA Cassava Bags Market By Type

12.2.6.2 USA Cassava Bags Market By Category

12.2.6.3 USA Cassava Bags Market By End User

12.2.7 Canada

12.2.7.1 Canada Cassava Bags Market By Type

12.2.7.2 Canada Cassava Bags Market By Category

12.2.7.3 Canada Cassava Bags Market By End User

12.2.8 Mexico

12.2.8.1 Mexico Cassava Bags Market By Type

12.2.8.2 Mexico Cassava Bags Market By Category

12.2.8.3 Mexico Cassava Bags Market By End User

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Cassava Bags Market by Country

12.3.2.2 Eastern Europe Cassava Bags Market By Type

12.3.2.3 Eastern Europe Cassava Bags Market By Category

12.3.2.4 Eastern Europe Cassava Bags Market By End User

12.3.2.5 Poland

12.3.2.5.1 Poland Cassava Bags Market By Type

12.3.2.5.2 Poland Cassava Bags Market By Category

12.3.2.5.3 Poland Cassava Bags Market By End User

12.3.2.6 Romania

12.3.2.6.1 Romania Cassava Bags Market By Type

12.3.2.6.2 Romania Cassava Bags Market By Category

12.3.2.6.4 Romania Cassava Bags Market By End User

12.3.2.7 Hungary

12.3.2.7.1 Hungary Cassava Bags Market By Type

12.3.2.7.2 Hungary Cassava Bags Market By Category

12.3.2.7.3 Hungary Cassava Bags Market By End User

12.3.2.8 Turkey

12.3.2.8.1 Turkey Cassava Bags Market By Type

12.3.2.8.2 Turkey Cassava Bags Market By Category

12.3.2.8.3 Turkey Cassava Bags Market By End User

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Cassava Bags Market By Type

12.3.2.9.2 Rest of Eastern Europe Cassava Bags Market By Category

12.3.2.9.3 Rest of Eastern Europe Cassava Bags Market By End User

12.3.3 Western Europe

12.3.3.1 Western Europe Cassava Bags Market by Country

12.3.3.2 Western Europe Cassava Bags Market By Type

12.3.3.3 Western Europe Cassava Bags Market By Category

12.3.3.4 Western Europe Cassava Bags Market By End User

12.3.3.5 Germany

12.3.3.5.1 Germany Cassava Bags Market By Type

12.3.3.5.2 Germany Cassava Bags Market By Category

12.3.3.5.3 Germany Cassava Bags Market By End User

12.3.3.6 France

12.3.3.6.1 France Cassava Bags Market By Type

12.3.3.6.2 France Cassava Bags Market By Category

12.3.3.6.3 France Cassava Bags Market By End User

12.3.3.7 UK

12.3.3.7.1 UK Cassava Bags Market By Type

12.3.3.7.2 UK Cassava Bags Market By Category

12.3.3.7.3 UK Cassava Bags Market By End User

12.3.3.8 Italy

12.3.3.8.1 Italy Cassava Bags Market By Type

12.3.3.8.2 Italy Cassava Bags Market By Category

12.3.3.8.3 Italy Cassava Bags Market By End User

12.3.3.9 Spain

12.3.3.9.1 Spain Cassava Bags Market By Type

12.3.3.9.2 Spain Cassava Bags Market By Category

12.3.3.9.3 Spain Cassava Bags Market By End User

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Cassava Bags Market By Type

12.3.3.10.2 Netherlands Cassava Bags Market By Category

12.3.3.10.3 Netherlands Cassava Bags Market By End User

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Cassava Bags Market By Type

12.3.3.11.2 Switzerland Cassava Bags Market By Category

12.3.3.11.3 Switzerland Cassava Bags Market By End User

12.3.3.1.12 Austria

12.3.3.12.1 Austria Cassava Bags Market By Type

12.3.3.12.2 Austria Cassava Bags Market By Category

12.3.3.12.3 Austria Cassava Bags Market By End User

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Cassava Bags Market By Type

12.3.3.13.2 Rest of Western Europe Cassava Bags Market By Category

12.3.3.13.3 Rest of Western Europe Cassava Bags Market By End User

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Cassava Bags Market by Country

12.4.3 Asia-Pacific Cassava Bags Market By Type

12.4.4 Asia-Pacific Cassava Bags Market By Category

12.4.5 Asia-Pacific Cassava Bags Market By End User

12.4.6 China

12.4.6.1 China Cassava Bags Market By Type

12.4.6.2 China Cassava Bags Market By Category

12.4.6.3 China Cassava Bags Market By End User

12.4.7 India

12.4.7.1 India Cassava Bags Market By Type

12.4.7.2 India Cassava Bags Market By Category

12.4.7.3 India Cassava Bags Market By End User

12.4.8 Japan

12.4.8.1 Japan Cassava Bags Market By Type

12.4.8.2 Japan Cassava Bags Market By Category

12.4.8.3 Japan Cassava Bags Market By End User

12.4.9 South Korea

12.4.9.1 South Korea Cassava Bags Market By Type

12.4.9.2 South Korea Cassava Bags Market By Category

12.4.9.3 South Korea Cassava Bags Market By End User

12.4.10 Vietnam

12.4.10.1 Vietnam Cassava Bags Market By Type

12.4.10.2 Vietnam Cassava Bags Market By Category

12.4.10.3 Vietnam Cassava Bags Market By End User

12.4.11 Singapore

12.4.11.1 Singapore Cassava Bags Market By Type

12.4.11.2 Singapore Cassava Bags Market By Category

12.4.11.3 Singapore Cassava Bags Market By End User

12.4.12 Australia

12.4.12.1 Australia Cassava Bags Market By Type

12.4.12.2 Australia Cassava Bags Market By Category

12.4.12.3 Australia Cassava Bags Market By End User

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Cassava Bags Market By Type

12.4.13.2 Rest of Asia-Pacific Cassava Bags Market By Category

12.4.13.3 Rest of Asia-Pacific Cassava Bags Market By End User

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Cassava Bags Market by Country

12.5.2.2 Middle East Cassava Bags Market By Type

12.5.2.3 Middle East Cassava Bags Market By Category

12.5.2.4 Middle East Cassava Bags Market By End User

12.5.2.5 UAE

12.5.2.5.1 UAE Cassava Bags Market By Type

12.5.2.5.2 UAE Cassava Bags Market By Category

12.5.2.5.3 UAE Cassava Bags Market By End User

12.5.2.6 Egypt

12.5.2.6.1 Egypt Cassava Bags Market By Type

12.5.2.6.2 Egypt Cassava Bags Market By Category

12.5.2.6.3 Egypt Cassava Bags Market By End User

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Cassava Bags Market By Type

12.5.2.7.2 Saudi Arabia Cassava Bags Market By Category

12.5.2.7.3 Saudi Arabia Cassava Bags Market By End User

12.5.2.8 Qatar

12.5.2.8.1 Qatar Cassava Bags Market By Type

12.5.2.8.2 Qatar Cassava Bags Market By Category

12.5.2.8.3 Qatar Cassava Bags Market By End User

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Cassava Bags Market By Type

12.5.2.9.2 Rest of Middle East Cassava Bags Market By Category

12.5.2.9.3 Rest of Middle East Cassava Bags Market By End User

12.5.3 Africa

12.5.3.1 Africa Cassava Bags Market by Country

12.5.3.2 Africa Cassava Bags Market By Type

12.5.3.3 Africa Cassava Bags Market By Category

12.5.3.4 Africa Cassava Bags Market By End User

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Cassava Bags Market By Type

12.5.3.5.2 Nigeria Cassava Bags Market By Category

12.5.3.5.3 Nigeria Cassava Bags Market By End User

12.5.3.6 South Africa

12.5.3.6.1 South Africa Cassava Bags Market By Type

12.5.3.6.2 South Africa Cassava Bags Market By Category

12.5.3.6.3 South Africa Cassava Bags Market By End User

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Cassava Bags Market By Type

12.5.3.7.2 Rest of Africa Cassava Bags Market By Category

12.5.3.7.3 Rest of Africa Cassava Bags Market By End User

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Cassava Bags Market by country

12.6.3 Latin America Cassava Bags Market By Type

12.6.4 Latin America Cassava Bags Market By Category

12.6.5 Latin America Cassava Bags Market By End User

12.6.6 Brazil

12.6.6.1 Brazil Cassava Bags Market By Type

12.6.6.2 Brazil Cassava Bags Market By Category

12.6.6.3 Brazil Cassava Bags Market By End User

12.6.7 Argentina

12.6.7.1 Argentina Cassava Bags Market By Type

12.6.7.2 Argentina Cassava Bags Market By Category

12.6.7.3 Argentina Cassava Bags Market By End User

12.6.8 Colombia

12.6.8.1 Colombia Cassava Bags Market By Type

12.6.8.2 Colombia Cassava Bags Market By Category

12.6.8.3 Colombia Cassava Bags Market By End User

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Cassava Bags Market By Type

12.6.9.2 Rest of Latin America Cassava Bags Market By Category

12.6.9.3 Rest of Latin America Cassava Bags Market By End User

13. Company Profiles

13.1 Avani Eco Affinity Supply Co

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Biopac India Co. Ltd.

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Envigreen Biotech India Pvt. Ltd

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Affinity Supply Co.

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Biogreen Bags Co. Ltd

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 SainBag No Plastic International Pty Ltd

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 SandBag

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 IMillionotplasticbag

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Baolai Packaging Co., Ltd.

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Urban Plastik Indonesia

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

13.11 Baolai Packaging Co., Ltd.

13.11.1 Company Overview

13.11.2 Financial

13.11.3 Products/ Services Offered

13.11.4 SWOT Analysis

13.11.5 The SNS View

13.12 Tipa

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

13.12.5 The SNS View

13.13 Henan Baolai Packaging Co., Ltd.

13.13.1 Company Overview

13.13.2 Financial

13.13.3 Products/ Services Offered

13.13.4 SWOT Analysis

13.13.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Box And Carton Overwrap Film Market size was USD 12.18 billion in 2023 and is expected to Reach USD 16.42 billion by 2031 and grow at a CAGR of 3.8% over the forecast period of 2024-2031.

The Bioplastic Packaging Market was valued at USD 17.27 billion in 2023 and will reach USD 67.48 billion by 2032, expanding at a CAGR of 16.17% by 2032.

The Rigid Packaging Market size was USD 455.94 billion in 2023 and is expected to reach USD 792.23 billion by 2032 and grow at a CAGR of 6.33% over the forecast period of 2024-2032.

The Bag Clips Market size was USD 4.95 billion in 2023 and is expected to Reach USD 7.77 billion by 2031 and grow at a CAGR of 5.8% over the forecast period of 2024-2031.

The Folding Carton Packaging Market size was valued at USD 167.01 billion in 2023 and is expected to increase to USD 239.33 billion in 2031, growing at a compound annual growth rate of 4.6% Over the Forecast Period of 2024-2031.

The Cladding Systems Market size was USD 268.28 billion in 2023 and is expected to Reach USD 411.73 billion by 2031 and grow at a CAGR of 5.5% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone