Cash Flow Management Market Report Scope & Overview:

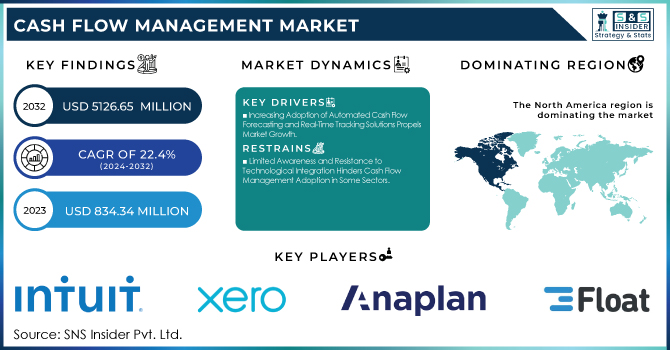

The Cash Flow Management Market Size was valued at USD 834.34 Million in 2023 and is expected to reach USD 5126.65 Million by 2032 and grow at a CAGR of 22.4% over the forecast period 2024-2032. The Market is evolving with increasing adoption of automated solutions across industries. 82% of small businesses fail due to poor cash flow management, highlighting the demand for efficient tools. Delayed payments impact over 60% of SMEs globally, making Days Sales Outstanding (DSO) a crucial metric. 40% of financial firms use AI-driven cash flow analytics, improving liquidity management by 20-30%. Cloud-based solutions are growing, alongside a 25% annual increase in API-based integrations. These trends reflect the market’s digital transformation, emphasizing the need for advanced financial planning and forecasting solutions.

To Get More Information on Cash Flow Management Market - Request Sample Report

Cash Flow Management Market Dynamics

Key Driver:

-

Increasing Adoption of Automated Cash Flow Forecasting and Real-Time Tracking Solutions Propels Market Growth

The growing demand for automated cash flow forecasting and real-time tracking solutions is a key driver for the Cash Flow Management Market. Businesses are increasingly recognizing the importance of accurate, timely cash flow insights to ensure liquidity and business continuity. By leveraging advanced technologies such as cloud-based solutions and AI-powered forecasting tools, organizations can improve cash flow management, reduce operational inefficiencies, and make more informed financial decisions. Small and medium-sized enterprises (SMEs), along with large enterprises, are adopting these tools to gain greater visibility into their cash flow, reduce human errors, and enhance financial planning. The global push for digitization across industries, coupled with the increasing reliance on data-driven decision-making, is boosting the demand for automated solutions. As these technologies become more accessible and affordable, the adoption rate continues to grow, further accelerating market growth.

Restraint:

-

Limited Awareness and Resistance to Technological Integration Hinders Cash Flow Management Adoption in Some Sectors

A significant restraint in the Cash Flow Management Market is the limited awareness and resistance to adopting new technologies in certain sectors. Small businesses and traditional industries often face challenges when transitioning to automated cash flow management solutions, primarily due to a lack of knowledge about available tools and the perceived complexity of integration. Many businesses, especially in developing regions, continue to rely on manual methods or outdated software for financial management, hindering their ability to fully capitalize on advanced cash flow management solutions. Additionally, the reluctance to shift from legacy systems to cloud-based solutions or embrace AI and machine learning technologies further slows down adoption. As businesses fear the upfront costs and technical challenges of transitioning, this resistance remains a significant barrier to the broader market's growth.

Opportunity:

-

Growing Integration of Artificial Intelligence and Machine Learning Presents New Opportunities for Cash Flow Optimization

The integration of artificial intelligence (AI) and machine learning (ML) presents a significant opportunity for the Cash Flow Management Market. AI and ML algorithms can process vast amounts of financial data and generate accurate cash flow forecasts, making them essential tools for businesses aiming to optimize liquidity management. These technologies can help businesses predict cash flow patterns more accurately, detect anomalies, and provide insights for better financial decision-making. Additionally, AI can be used to automate routine tasks, reducing human error and enhancing overall efficiency. As AI and ML technologies continue to evolve, they provide substantial opportunities for financial firms and businesses to enhance forecasting, liquidity planning, and risk management. By embracing these technologies, companies can gain a competitive edge and achieve more precise control over their financial operations, ultimately driving market growth.

Challenge:

-

Data Security and Privacy Concerns in Cloud-Based Solutions Pose Challenges for Widespread Cash Flow Management Adoption

Data security and privacy concerns in cloud-based solutions are a major challenge for the Cash Flow Management Market. As businesses increasingly adopt cloud platforms for managing sensitive financial data, concerns about the security of financial information and the risk of data breaches are growing. Companies worry about the potential exposure of proprietary data and financial records to cyberattacks. Despite advancements in encryption and security protocols, businesses remain cautious about moving their financial operations to the cloud, especially in sectors dealing with highly sensitive information such as healthcare and BFSI (Banking, Financial Services, and Insurance). As regulatory requirements for data protection become stricter, businesses must ensure compliance with global standards like GDPR and others. This challenge could slow the adoption of cloud-based cash flow management solutions unless providers can offer robust security measures and assurances regarding data protection.

Cash Flow Management Market Segments Analysis

By Component

In 2023, the Solution segment dominated the Cash Flow Management Market with a substantial revenue share of 62%. This growth can be attributed to the increasing demand for automated tools and software that offer advanced cash flow forecasting, liquidity management, and financial planning capabilities. These solutions help businesses streamline financial operations, offering real-time tracking and AI-powered forecasting, which significantly improves decision-making. The focus is shifting towards cloud-based solutions due to their scalability, accessibility, and ease of integration into existing systems.

The Services segment in the Cash Flow Management Market is experiencing the largest growth, with a remarkable CAGR of 23.3% during the forecast period. This growth is driven by the increasing demand for consulting, implementation, and support services related to cash flow management tools. Companies such as Float, which offers real-time cash flow forecasting combined with expert financial advisory services, have helped businesses maximize their liquidity management.

Similarly, Finagraph provides cloud-based financial analysis services to help businesses optimize their cash flow strategy. The need for comprehensive services is rising as organizations increasingly adopt complex financial management tools and require professional guidance for seamless integration.

By Deployment Mode

In 2023, the On-Premise segment accounted for the largest revenue share in the Cash Flow Management Market. This dominance can be attributed to organizations' preference for secure, customized solutions where data privacy and control are paramount. Large enterprises, especially those in industries like banking, healthcare, and government, favor on-premise deployments due to strict regulatory requirements and the need for direct control over sensitive financial data. Companies such as Sage with its Sage Intacct Cash Management solution and Anaplan with its Anaplan Cash Flow Planning have been key players in this segment, providing on-premise solutions tailored to large enterprises with complex financial structures.

The Cloud-Based segment is projected to grow at the highest CAGR during the forecast period in the Cash Flow Management Market, driven by businesses' increasing shift towards digital solutions. Cloud-based cash flow management solutions provide scalability, accessibility, and integration capabilities that on-premise solutions cannot match. The demand for these solutions is further propelled by their ability to provide real-time cash flow forecasting, automated reporting, and AI-driven insights.

By End-User

In 2023, the SME segment held the largest revenue share in the Cash Flow Management Market, driven by the increasing need for efficient, scalable, and affordable financial management tools. SMEs are often more vulnerable to cash flow disruptions due to their limited financial resources, which makes effective cash flow management crucial for business survival and growth.

Additionally, Float has introduced cash flow forecasting tools aimed at helping small businesses with real-time insights, enabling them to make informed financial decisions. The Sage 50cloud Cash Flow Manager and Agicap have also emerged as strong players, offering comprehensive solutions that integrate with accounting software and provide automated forecasting and budgeting tools. As the adoption of digital tools continues to rise among SMEs, especially those in the tech, retail, and service industries, the SME segment is expected to remain dominant in the market.

By Vertical

In 2023, the BFSI segment held the largest revenue share of 24% in the Cash Flow Management Market, driven by the sector’s inherent need for precise liquidity management and financial forecasting. Financial institutions are increasingly adopting cash flow management solutions to enhance risk management, optimize capital allocation, and ensure regulatory compliance. Companies like Sage Intacct and Anaplan offer advanced cash flow forecasting and financial reporting solutions tailored to the needs of the BFSI sector, allowing banks and financial institutions to track cash inflows and outflows accurately.

The Retail segment is projected to grow at the highest CAGR of 24.92% during the forecasted period in the Cash Flow Management Market, driven by the growing need for efficient cash flow tools in a dynamic and highly competitive industry. Retailers face significant challenges in managing cash flow due to fluctuations in sales, seasonal variations, and inventory management. To address these challenges, companies like Float and Agicap have developed advanced cloud-based cash flow forecasting solutions that enable retailers to track cash flow in real-time, manage liquidity, and forecast revenue based on sales patterns.

Regional Analysis

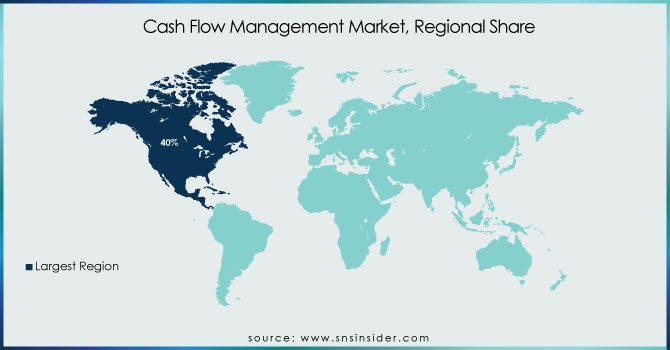

In 2023, North America dominated the Cash Flow Management Market, holding a significant market share of approximately 40%. This dominance is driven by the region's mature financial ecosystem, widespread adoption of advanced financial technologies, and a strong presence of key market players like Intuit, Sage, and Xero. North American businesses, particularly in sectors like BFSI, healthcare, and IT, are early adopters of cloud-based cash flow management solutions, which provide real-time insights, forecasting, and automation to enhance financial operations. The increasing focus on improving operational efficiency, regulatory compliance, and managing liquidity has led to a robust demand for AI-driven forecasting and automated cash flow tracking tools.

The Asia Pacific region is the fastest-growing in the Cash Flow Management Market in 2023, with an estimated CAGR of 25% during the forecast period. This rapid growth can be attributed to the increasing number of small and medium-sized enterprises (SMEs) in countries like China, India, and Japan, which are embracing digital financial tools to manage cash flow more effectively. The region’s rising digital transformation, the surge in e-commerce, and the growing emphasis on financial inclusion have created significant opportunities for cash flow management solution providers. With governments in the region promoting digital financial services and SMEs increasingly seeking more efficient financial management systems, the APAC region is poised for continued growth in the coming years.

Do You Need any Customization Research on Cash Flow Management Market - Enquire Now

Key Players

Some of the major players in the Cash Flow Management Market are:

-

Intuit (QuickBooks Cash Flow, QuickBooks Online)

-

Xero (Xero Cash Flow, Xero Business Finance)

-

Anaplan (Anaplan for Finance, Anaplan Cash Flow Planning)

-

Sage (Sage Intacct Cash Management, Sage 50cloud Cash Flow Manager)

-

Float (Float Cash Flow Forecasting, Float Budgeting & Scenario Planning)

-

Panguru (Planguru Budgeting, Planguru Forecasting)

-

Dryrun (Dryrun Cash Flow Forecasting, Dryrun Scenario Planning)

-

Caflou (Caflou Business Management, Caflou Cash Flow Management)

-

Pulse (Pulse Cash Flow Software, Pulse Forecasting Tool)

-

Cash Analytics (CashAnalytics Cash Flow Forecasting, CashAnalytics Liquidity Planning)

-

Fluidly (Fluidly Intelligent Cash Flow, Fluidly Credit Control)

-

Finagraph (Finagraph CashFlowTool, Finagraph Financial Analysis)

-

Cashflowmapper (Cashflowmapper Forecasting, Cashflowmapper Planning Tool)

-

Finsync (Finsync Cash Flow Management, Finsync Accounting)

-

Cashflow Manager (Cashflow Manager Gold, Cashflow Manager Accounting Software)

-

Agicap (Agicap Cash Flow Management, Agicap Liquidity Planning)

-

Calqulate (Calqulate Cash Flow Forecasting, Calqulate SaaS Financial Planning)

-

Cashbook (Cashbook Cash Flow Automation, Cashbook Treasury Management)

-

Cash Flow Mojo (Cash Flow Mojo Business Planning, Cash Flow Mojo Budgeting)

-

Cashforce (Cashforce Smart Cash Flow, Cashforce Liquidity Forecasting)

Recent Trends

-

September 2024 – Intuit launched the Intuit Enterprise Suite to help businesses streamline operations, manage cash flow, and scale efficiently. The suite integrated AI-driven financial tools to enhance forecasting and liquidity management.

-

February 2025 – Xero partnered with Bluevine to provide small businesses with enhanced banking solutions. The collaboration aimed to improve cash flow management by offering integrated banking, lending, and payment services within the Xero platform.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 834.34 Million |

| Market Size by 2032 | USD 5126.65 Million |

| CAGR | CAGR of 22.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Deployment Mode (Cloud-Based, On-Premise) • By End-User (SMEs, Professionals) • By Vertical (BFSI, IT & Telecom, Media, Entertainment, Healthcare, Retail, Manufacturing, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Intuit, Xero, Anaplan, Sage, Float, Planguru, Dryrun, Caflou, Pulse, Cash Analytics, Fluidly, Finagraph, Cashflowmapper, Finsync, Cashflow Manager, Agicap, Calqulate, Cashbook, Cash Flow Mojo, Cashforce. |