Get more information on Cardiovascular devices Market - Request Sample Report

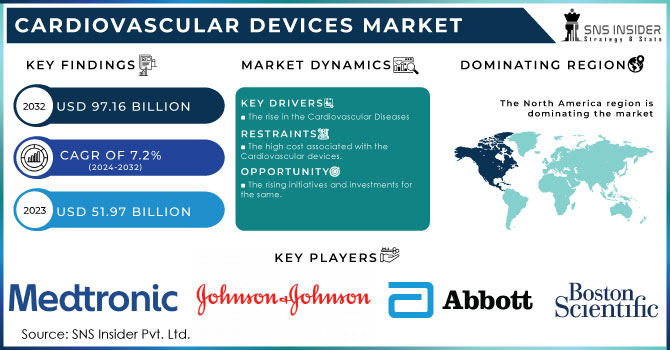

The Cardiovascular Devices Market size was estimated at USD 51.97 billion in 2023 and is expected to reach USD 97.16 billion by 2032 at a CAGR of 7.2% during the forecast period of 2024-2032.

Cardiovascular diseases (CVD) are considered the most common cause of death all around the globe. According to the National Institute of Health (NIH) people suffering from heart disease in rural and urban areas are increasing rapidly. For instance, in the UK approx. 24500 deaths are been recorded because of CVD. There are several factors which are contributing to this scenario. The major factors are an unhealthy lifestyle of the people, consumption of excess alcohol and so forth. The U.S. organizations and hospitals are taking a lot of initiatives to promote awareness regarding how heart disease can be prevented. Mayo Clinic has started promotions related to how physical activities can help people to prevent heart disease.

There are many types of cardiac devices some of the common ones include pacemakers, Implantable cardioverter-defibrillator (ICD), cardiac loop recorders, and biventricular pacemakers. Every device is been recommended by the healthcare professional according to the patient's condition. The basic objective of the devices is to monitor and control the irregular heartbeats and the functioning of the heart. The healthcare sector is constantly trying to improve devices by adding new features and technology. The innovation’s objective is to provide good services and improve the quality of patient’s life. The healthcare professional states that rising technological advancement is shaping the future of the healthcare sector. Indeed, it is, when we particularly focus on the CDV not only the cardiac devices but the smart wearable devices are also adding value to the patient's and normal human being’s quality of life. Another beneficial factor of the cardiac devices is they can store the data of the patients which can be further used for the analysis and performance tracking purposes.

The market is divided into three segments which have the type of devices which is been used, and the other segments are basically the end users and applications. The type segment will give the exact overview of which device is holding the largest share.

The high cost is the barrier for the Cardiovascular Devices market which puts several limitations on the regions which are facing economic constraints because of the high inflation rates, unemployment rates, and all sorts of factors that affect the market to follow a negative zone. Though the demand for the cardiac devices is high as the adoption rate is pushing the market to attract opportunities.

Driver

The rise in the Cardiovascular Diseases

As we mentioned earlier the rise in CVD all around the globe is a driving factor. According to the Centers for Disease Control and Prevention (CDC), 69,500 people in the U.S. died from heart disease, the data is for the year 2021. Our objective behind mentioning the stats is to glorify how important it is to increase the access to diagnosis and facilities for the people suffering from heart diseases.

The key players in this market have experienced good growth in the sales of the cardiac devices which states the rising demand for the same. For instance, despite the global disruptions and economic constraints, Medtronic Plc recorded an increase of 6% growth in the sales for the year 2022. Another important aspect of why the demand for cardiac devices is so high is because of the rising obesity and rising prevalence of diabetes. Healthcare experts have clarified how the rising obesity among the younger men and women can increase the risk of the heart disease.

According to a survey which was conducted by Harvard University which stated if the current situation is carried on then by 2030 half of the men and women in the U.S. will suffer from obesity condition. All these facts contribute to why the demand for the cardiac devices will be high and which is driving the market.

Restrain

The high cost associated with the Cardiovascular devices.

Opportunity

The rising initiatives and investments for the same.

The key players and the merging players have assured how the rising trends in the healthcare sector are allowing them to attract opportunities to gain growth. Cardiac devices are one of them, the company is increasing its R&D activities which will help them to innovate new products and devices. Also, the approval from the FDA for the devices creates a positive outlook for investors and organizations. The implementation of AI and ML by the key players in emerging countries will help them to improve their services, which is also a great opportunity for the market. The use of AI and ML will help producers to innovate devices that will improve the functionality of the devices.

Challenge

The laws and regulations which are imposed by the government regarding the data privacy and product innovation.

Impact of Recession

Due to cost-cutting initiatives, businesses may decrease their investment in research and development (R&D) during a recession. This might have an adverse effect on the long-term development and growth of the sector by slowing down innovation and the creation of new cardiovascular devices.

Price sensitivity tends to rise during economic downturns. Healthcare providers might become more frugal and look for less expensive options or bargain better prices with equipment manufacturers. The market for cardiovascular devices may become more competitive as a result, which could have an impact on manufacturers' profit margins.

The worldwide supply chain for cardiovascular devices, which includes Russia and Ukraine, could be affected by the crisis. In the manufacturing and distribution of various pieces of medical gear and equipment, both nations have vital roles. It is possible for delays or shortages in the supply of cardiovascular devices to disrupt both home and foreign markets due to problems with transportation, trade routes, or production facilities.

Instability in the global market may result from the geopolitical tension and ambiguity surrounding the conflict. The market for cardiovascular equipment could be impacted if investors start to grow more cautious and economic indicators change. Investments in healthcare infrastructure can be curtailed, purchases can be postponed or cancelled, and market volatility can increase.

By Device Type

Diagnostic and Monitoring devices

Therapeutic and Surgical Devices

By Application

Coronary Artery Disease (CAD)

Cardiac Arrhythmia

Heart Failure

Others

By End-User

Hospitals

Specialty Clinics

Others

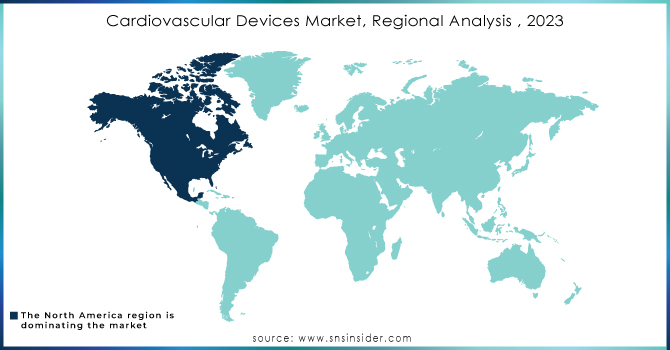

North America region will be the dominating region for this market. As we mentioned earlier the rising cases of CVD in the developed countries of this region is attracting significant growth. Also, the major key players of this market are noticing good growth in terms of revenues generated from the cardiac devices business segments. The rising clinical trials and approvals from government healthcare agencies are contributing to the growth of the CDV market.

Europe is the region which will have the second largest share. According to the stats provided by the European Union (EU) in 2019, 17,07,338 are the number of deaths caused by CVD. Germany is the country which has the highest number of share in this count. This proves our statement which we had mentioned earlier “the deaths are observed more in the developed countries”. The rising cases of CVD are the major driving factor for this region to attract growth during the forecasted period.

APAC is the region which has the highest CAGR growth rate because of rising clinical trials and the market expansion strategies of the key players. Countries like China and Japan are considered the targeted market to attract a lot of potential growth. The reasons are obvious the rising infrastructure development and the adoption of the latest technologies.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major players are Medtronic, Abbott, Boston Scientific Corporation, Johnson & Johnson, Siemens Healthcare, B. Braun Melsungen, Edward Lifesciences Corporation, LivaNova Plc, and other players

Abbott: Abbott company has officially announced that they will be acquiring Cardiovascular Systems, Inc.

LivaNova: The company has got FDA 510(k) a clearance for Essenz Heart-Lung machine for Cardiopulmonary Bypass Procedures.

| Report Attributes | Details |

| Market Size in 2023 | US$ 51.97 Bn |

| Market Size by 2032 | US$ 97.16 Bn |

| CAGR | CAGR of 7.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Diagnostic and Monitoring devices, Therapeutic and Surgical Devices) • By Application (Coronary Artery Disease (CAD), Cardiac Arrhythmia, Heart Failure, Others) • By End-User (Hospitals, Speciality Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Medtronic, Abbott, Boston Scientific Corporation, Johnson & Johnson, Siemens Healthcare, B. Braun Melsungen, Edward Lifesciences Corporation, LivaNova Plc |

| Key Drivers | • The rise in the Cardiovascular Diseases |

| Market Restraints | • The high cost associated with the Cardiovascular devices. |

Ans: The Cardiovascular Devices Market is expected to grow at a CAGR of 7.2%.

Ans: The Cardiovascular devices market size was valued at USD 51.97 Bn in 2023 and is expected to reach USD 97.16 Bn by 2032 and grow at a CAGR of 7.2% over the forecast period of 2024-2032.

Ans: Increasing consumer demand for Cardiovascular Devices is major driver for the market.

Ans: The laws and regulations which are imposed by the government regarding the data privacy and product innovation.

Ans: North America region will be dominating region for this market. As we mentioned earlier the rising cases of CVD in the developed countries of this region is attracting significant growth.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine war

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

4.3 Supply Demand Gap Analysis

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Cardiovascular Devices Market Segmentation, By Device Type

8.1 Diagnostic and Monitoring Devices

8.2 Therapeutic and Surgical Devices

9. Cardiovascular Devices Market Segmentation, By Application

9.1 Coronary Artery Disease (CAD)

9.2 Cardiac Arrhythmia

9.3 Heart Failure

9.4 Others

10. Cardiovascular Devices Market Segmentation, By End User

10.1 Hospitals

10.2 Speciality Clinics

10.3 Others

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Cardiovascular Devices Market by Country

11.2.2North America Cardiovascular Devices Market by Device Type

11.2.3 North America Cardiovascular Devices Market by Application

11.2.4 North America Cardiovascular Devices Market by End User

11.2.5 USA

11.2.5.1 USA Cardiovascular Devices Market by Device Type

11.2.5.2 USA Cardiovascular Devices Market by Application

11.2.5.3 USA Cardiovascular Devices Market by End User

11.2.6 Canada

11.2.6.1 Canada Cardiovascular Devices Market by Device Type

11.2.6.2 Canada Cardiovascular Devices Market by Application

11.2.6.3 Canada Cardiovascular Devices Market by End User

11.2.7 Mexico

11.2.7.1 Mexico Cardiovascular Devices Market by Device Type

11.2.7.2 Mexico Cardiovascular Devices Market by Application

11.2.7.3 Mexico Cardiovascular Devices Market by End User

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Cardiovascular Devices Market by Country

11.3.1.2 Eastern Europe Cardiovascular Devices Market by Device Type

11.3.1.3 Eastern Europe Cardiovascular Devices Market by Application

11.3.1.4 Eastern Europe Cardiovascular Devices Market by End User

11.3.1.5 Poland

11.3.1.5.1 Poland Cardiovascular Devices Market by Device Type

11.3.1.5.2 Poland Cardiovascular Devices Market by Application

11.3.1.5.3 Poland Cardiovascular Devices Market by End User

11.3.1.6 Romania

11.3.1.6.1 Romania Cardiovascular Devices Market by Device Type

11.3.1.6.2 Romania Cardiovascular Devices Market by Application

11.3.1.6.4 Romania Cardiovascular Devices Market by End User

11.3.1.7 Turkey

11.3.1.7.1 Turkey Cardiovascular Devices Market by Device Type

11.3.1.7.2 Turkey Cardiovascular Devices Market by Application

11.3.1.7.3 Turkey Cardiovascular Devices Market by End User

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Cardiovascular Devices Market by Device Type

11.3.1.8.2 Rest of Eastern Europe Cardiovascular Devices Market by Application

11.3.1.8.3 Rest of Eastern Europe Cardiovascular Devices Market by End User

11.3.2 Western Europe

11.3.2.1 Western Europe Cardiovascular Devices Market by Country

11.3.2.2 Western Europe Cardiovascular Devices Market by Device Type

11.3.2.3 Western Europe Cardiovascular Devices Market by Application

11.3.2.4 Western Europe Cardiovascular Devices Market by End User

11.3.2.5 Germany

11.3.2.5.1 Germany Cardiovascular Devices Market by Device Type

11.3.2.5.2 Germany Cardiovascular Devices Market by Application

11.3.2.5.3 Germany Cardiovascular Devices Market by End User

11.3.2.6 France

11.3.2.6.1 France Cardiovascular Devices Market by Device Type

11.3.2.6.2 France Cardiovascular Devices Market by Application

11.3.2.6.3 France Cardiovascular Devices Market by End User

11.3.2.7 UK

11.3.2.7.1 UK Cardiovascular Devices Market by Device Type

11.3.2.7.2 UK Cardiovascular Devices Market by Application

11.3.2.7.3 UK Cardiovascular Devices Market by End User

11.3.2.8 Italy

11.3.2.8.1 Italy Cardiovascular Devices Market by Device Type

11.3.2.8.2 Italy Cardiovascular Devices Market by Application

11.3.2.8.3 Italy Cardiovascular Devices Market by End User

11.3.2.9 Spain

11.3.2.9.1 Spain Cardiovascular Devices Market by Device Type

11.3.2.9.2 Spain Cardiovascular Devices Market by Application

11.3.2.9.3 Spain Cardiovascular Devices Market by End User

11.3.2.10 Netherlands

11.3.2.10.1 Netherlands Cardiovascular Devices Market by Device Type

11.3.2.10.2 Netherlands Cardiovascular Devices Market by Application

11.3.2.10.3 Netherlands Cardiovascular Devices Market by Test Type

11.3.2.11 Switzerland

11.3.2.11.1 Switzerland Cardiovascular Devices Market by Device Type

11.3.2.11.2 Switzerland Cardiovascular Devices Market by Application

11.3.2.11.3 Switzerland Cardiovascular Devices Market by End User

11.3.2.1.12 Austria

11.3.2.12.1 Austria Cardiovascular Devices Market by Device Type

11.3.2.12.2 Austria Cardiovascular Devices Market by Application

11.3.2.12.3 Austria Cardiovascular Devices Market by End User

11.3.2.13 Rest of Western Europe

11.3.2.13.1 Rest of Western Europe Cardiovascular Devices Market by Device Type

11.3.2.13.2 Rest of Western Europe Cardiovascular Devices Market by Application

11.3.2.13.3 Rest of Western Europe Cardiovascular Devices Market by End User

11.4 Asia-Pacific

11.4.1 Asia-Pacific Cardiovascular Devices Market by country

11.4.2 Asia-Pacific Cardiovascular Devices Market by Device Type

11.4.3 Asia-Pacific Cardiovascular Devices Market by Application

11.4.4 Asia-Pacific Cardiovascular Devices Market by End User

11.4.5 China

11.4.5.1 China Cardiovascular Devices Market by Device Type

11.4.5.2 China Cardiovascular Devices Market by End User

11.4.5.3 China Cardiovascular Devices Market by Application

11.4.6 India

11.4.6.1 India Cardiovascular Devices Market by Device Type

11.4.6.2 India Cardiovascular Devices Market by Application

11.4.6.3 India Cardiovascular Devices Market by End User

11.4.7 Japan

11.4.7.1 Japan Cardiovascular Devices Market by Device Type

11.4.7.2 Japan Cardiovascular Devices Market by Application

11.4.7.3 Japan Cardiovascular Devices Market by End User

11.4.8 South Korea

11.4.8.1 South Korea Cardiovascular Devices Market by Device Type

11.4.8.2 South Korea Cardiovascular Devices Market by Application

11.4.8.3 South Korea Cardiovascular Devices Market by End User

11.4.9 Vietnam

11.4.9.1 Vietnam Cardiovascular Devices Market by Device Type

11.4.9.2 Vietnam Cardiovascular Devices Market by Application

11.4.9.3 Vietnam Cardiovascular Devices Market by End User

11.4.10 Singapore

11.4.10.1 Singapore Cardiovascular Devices Market by Device Type

11.4.10.2 Singapore Cardiovascular Devices Market by Application

11.4.10.3 Singapore Cardiovascular Devices Market by End User

11.4.11 Australia

11.4.11.1 Australia Cardiovascular Devices Market by Device Type

11.4.11.2 Australia Cardiovascular Devices Market by Application

11.4.11.3 Australia Cardiovascular Devices Market by End User

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Cardiovascular Devices Market by Device Type

11.4.12.2 Rest of Asia-Pacific Cardiovascular Devices Market by Application

11.4.12.3 Rest of Asia-Pacific Cardiovascular Devices Market by Test Type

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Cardiovascular Devices Market by Country

11.5.1.2 Middle East Cardiovascular Devices Market by Device Type

11.5.1.3 Middle East Cardiovascular Devices Market by Application

11.5.1.4 Middle East Cardiovascular Devices Market by End User

11.5.1.5 UAE

11.5.1.5.1 UAE Cardiovascular Devices Market by Device Type

11.5.1.5.2 UAE Cardiovascular Devices Market by Application

11.5.1.5.3 UAE Cardiovascular Devices Market by End User

11.5.1.6 Egypt

11.5.1.6.1 Egypt Cardiovascular Devices Market by Device Type

11.5.1.6.2 Egypt Cardiovascular Devices Market by Application

11.5.1.6.3 Egypt Cardiovascular Devices Market by End User

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Cardiovascular Devices Market by Device Type

11.5.1.7.2 Saudi Arabia Cardiovascular Devices Market by Application

11.5.1.7.3 Saudi Arabia Cardiovascular Devices Market by End User

11.5.1.8 Qatar

11.5.1.8.1 Qatar Cardiovascular Devices Market by Device Type

11.5.1.8.2 Qatar Cardiovascular Devices Market by Application

11.5.1.8.3 Qatar Cardiovascular Devices Market by End User

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Cardiovascular Devices Market by Device Type

11.5.1.9.2 Rest of Middle East Cardiovascular Devices Market by Application

11.5.1.9.3 Rest of Middle East Cardiovascular Devices Market by End User

11.5.2 Africa

11.5.2.1 Africa Transfusion Diagnostics Market by country

11.5.2.2 Africa Cardiovascular Devices Market by Device Type

11.5.2.3 Africa Cardiovascular Devices Market by Application

11.5.2.4 Africa Cardiovascular Devices Market by End User

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Cardiovascular Devices Market by Device Type

11.5.2.5.2 Nigeria Cardiovascular Devices Market by Application

11.5.2.5.3 Nigeria Cardiovascular Devices Market by End User

11.5.2.6 South Africa

11.5.2.6.1 South Africa Cardiovascular Devices Market by Device Type

11.5.2.6.2 South Africa Cardiovascular Devices Market by Application

11.5.2.6.3 South Africa Cardiovascular Devices Market by End User

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Cardiovascular Devices Market by Device Type

11.5.2.7.2 Rest of Africa Cardiovascular Devices Market by Application

11.5.2.7.3 Rest of Africa Cardiovascular Devices Market by Test type

11.6 Latin America

11.6.1 Latin America Cardiovascular Devices Market by country

11.6.2 Latin America Cardiovascular Devices Market by Device Type

11.6.3 Latin America Cardiovascular Devices Market by Application

11.6.4 Latin America Cardiovascular Devices Market by End User

11.6.5 Brazil

11.6.5.1 Brazil America Cardiovascular Devices by Device Type

11.6.5.2 Brazil America Cardiovascular Devices by Application

11.6.5.3 Brazil America Cardiovascular Devices by End User

11.6.6 Argentina

11.6.6.1 Argentina America Cardiovascular Devices by Device Type

11.6.6.2 Argentina America Cardiovascular Devices by Application

11.6.6.3 Argentina America Cardiovascular Devices by End User

11.6.7 Colombia

11.6.7.1 Colombia America Cardiovascular Devices by Device Type

11.6.7.2 Colombia America Cardiovascular Devices by Application

11.6.7.3 Colombia America Cardiovascular Devices by End User

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Cardiovascular Devices by Device Type

11.6.8.2 Rest of Latin America Cardiovascular Devices by Application

11.6.8.3 Rest of Latin America Cardiovascular Devices by End User

12 Company profile

12.1 Medtronic

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Abbott

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Boston Scientific Corporation

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Johnson & Johnson

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Siemens Healthcare

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 B. Braun Melsungen

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Edward Lifesciences Corporation

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 LivaNova Plc

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Product/Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 Others

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Capillary Electrophoresis Market size was USD 354.7 Million in 2023, expected to reach USD 567.7 Million by 2032, growing at a CAGR of 5.38% from 2024-2032.

The Veterinary Digital Pathology Market size was valued at USD 300 Million in 2023 and is projected to reach USD 1140 Million by 2032, growing at a CAGR of 15.98%.

The Immunology Market Size was valued at USD 97.58 Billion in 2023, and is expected to reach USD 254.23 Billion by 2032, and grow at a CAGR of 11.8%.

The Hirsutism Market was valued at USD 3.21 billion in 2023 and is expected to reach USD 6.02 billion by 2032, growing at a CAGR of 7.25% over the forecast period of 2024-2032.

The Sleep Disorder Treatment Market was valued at $20.3 billion in 2023 and is expected to reach $40.0 billion by 2032 at a CAGR of 7.84% from 2024 to 2032.

The Clinical Trial Imaging Market is expected to reach USD 2.45 billion by 2032 from USD 1.24 billion in 2023 growing at a CAGR of 7.86% by 2024-2032.

Hi! Click one of our member below to chat on Phone