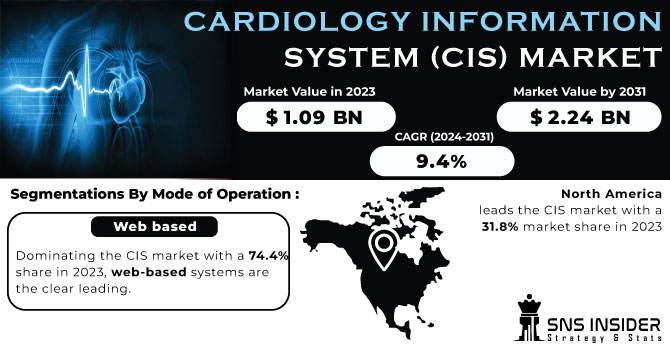

The Cardiology Information System (CIS) Market Size was valued at USD 1.09 billion in 2023 and is expected to reach USD 2.24 billion by 2031 and grow at a CAGR of 9.4% over the forecast period 2024-2031.

The cardiovascular information system market is experiencing significant growth driven by several key factors such as the global prevalence of CVD is a major concern, with heart attacks and strokes accounting for a large portion of deaths worldwide. This increasing demand for better cardiac care is fueling the need for efficient data management solutions like CVIS. Traditional methods of storing and managing cardiovascular data are becoming increasingly inefficient and error-prone.

Get more information on Cardiology Information System Market - Request Sample Report

CVIS offers a software-based solution that simplifies data collection, retrieval, and analysis, improving workflow for healthcare professionals. Moreover, the introduction of advanced CVIS features and integration with other technologies like CPACS (Cardiology Picture Archiving and Communication System) further enhances the system's capabilities and these factors are expected to continue, driving market growth. CVIS improves efficiency for cardiologists, surgeons, and hospital administrators by streamlining data management. This allows for better decision-making and potentially improves patient outcomes. Increased awareness among healthcare institutions about the benefits of CVIS is leading to higher adoption rates, further propelling market growth.

DRIVERS

Global Cardiac Disease Prevalence is Growing, and Stroke-Related Deaths Are Rising

The escalating number of cardiovascular disease (CVD) cases worldwide is a primary driver. With heart attacks and strokes being leading causes of death, healthcare systems require efficient data management tools like CVIS for improved cardiac care.

Increasing Research and Development to Create New Technologies for Cardiac Stroke Management

Systems are expensive, and regulations are strict

The high upfront costs of CVIS implementation can be a barrier for some healthcare institutions. Additionally, stringent data privacy and security regulations can add complexity and cost to the process.

As there is no established protocol, healthcare providers are reluctant to implement CIS

Application of Cloud-Based Solutions

Cloud-based CVIS offers a more cost-effective and scalable solution compared to traditional on-premise deployments. This opens doors for wider adoption, especially for smaller healthcare facilities.

Combining interoperability with integration

Integration with other healthcare technologies is beneficial, ensuring seamless interoperability between different systems remains a challenge. Data exchange needs to be smooth and secure to maximize the system's effectiveness.

The Russia Ukraine war is disrupting the Cardiology Information System (CIS) market. Web-based and cloud-based systems could face internet outages, cyberattacks, or even data center issues. On-site systems might be more stable, but could suffer from lack of spare parts or damaged infrastructure. Both CVIS and CPACS systems could experience data flow disruptions and delays in updates. Overall, CIS vendors might face higher costs and delays, while the focus on data security will increase. The severity of these impacts depends on the location of the CIS system and the vendor's operations.

The economic slowdown is likely to put the brakes on the CIS market as hospitals facing lesser budgets might delay adopting new web-based or cloud-based CIS systems, opting to maintain existing on-site ones. This could lead to increased maintenance costs and delays in upgrading on-site systems. Similarly, advanced features within CVIS and storage upgrades for CPACS might be postponed. Overall, the market growth might slow down, with healthcare providers seeking more cost-effective solutions and prioritizing a clear return on investment for any new CIS technology.

KEY MARKET SEGMENTS:

Web based

Cloud based

On site

Dominating the CIS market with a 74.4% share in 2023, web-based systems are the clear leading. This popularity attributes from their ease of use like no software installation needed, just log in from anywhere. This remote access is ideal for healthcare professionals with busy schedules. Additionally, web-based systems ensure secure data storage on servers. While cloud-based solutions are gaining traction due to their cost-effectiveness, web-based systems remain the leader due to their user-friendliness and lower initial investment.

CVIS

CPACS

CVIS is the leader of the cardiology information systems, holding the biggest market share and growing the fastest. It goes beyond images (like CPACS) and integrates all patient data, allowing for better analysis and quicker treatment decisions. This wider functionality is why CVIS is adopted more and continues to outpace its predecessor, CPACS. In simpler terms, CVIS is the all-in-one information hub for cardiologists, giving them a complete picture of their patients' heart health.

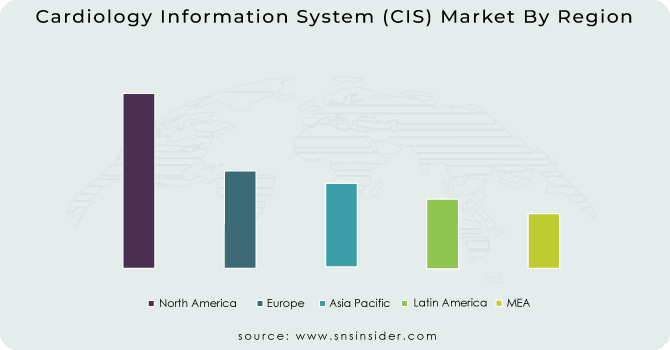

North America leads the CIS market with a 31.8% market share in 2023, driven by the high prevalence of cardiovascular diseases in the region. This is likely due to factors like shared cultural practices and economic development in the US and Canada, leading to a higher incidence of heart disease and heart failure.

Asia Pacific region is expected to experience the fastest growth at CAGR of 10.2% due to several factors such as there's a significant increase in healthcare spending, leading to more investment in research and development for cardiovascular diseases. Moreover, the presence of rapidly developing economies like India and China with improving healthcare infrastructure is boosting the market. Finally, the rising prevalence of cardiovascular diseases in this region creates a growing demand for CIS solutions to manage the increasing patient data burden.

Need any customization research on Cardiology Information System Market - Enquiry Now

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some of the major key players are as follows: GE Healthcare, Siemens Healthcare GmbH, CREALIFE Medical Technology, Honeywell Life Care Solution, Lumedx, Esasote, Cerner Corporation, Fujifilm Medical Systems, McKesson Corporation, Digisonics, Inc., Merge Healthcare Inc, Philips Healthcare, Cisco Systems and Other Players.

In September 2023, Oracle Corporation made a splash in healthcare IT with a range of new offerings. Their focus was on improving cardiac, neuro, and oncology solutions. This included a cloud-based EHR system, generative AI for data analysis, and public APIs for broader application integration. This comprehensive launch is expected to boost Oracle's healthcare sales.

In February 2023, a key development in cardiovascular care emerged. A private equity firm, Lee Equity Partners, based in New York City, joined forces with an independent cardiovascular practice in the US, the Cardiovascular Institute of the South (CIS). This collaboration resulted in the creation of Cardiovascular Logistics, a nationwide platform designed to revolutionize cardiovascular care delivery across the US.

Intelerad, a leader in enterprise imaging solutions, acquired LUMEDX Corporation in February 2021. This acquisition, following their earlier purchase of Digisonics, Inc.,

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.09 billion |

| Market Size by 2031 | US$ 2.24 billion |

| CAGR | CAGR of 9.4% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GE Healthcare, Siemens Healthcare GmbH, CREALIFE Medical Technology, Honeywell Life Care Solution, Lumedx, Esasote, Cerner Corporation, Fujifilm Medical Systems, McKesson Corporation, Digisonics, Inc., Merge Healthcare Inc, Philips Healthcare, Cisco Systems |

| DRIVERS | • Global Cardiac Disease Prevalence is Growing, and Stroke-Related Deaths Are Rising • Increasing Research and Development to Create New Technologies for Cardiac Stroke Management |

| RESTRAINTS | • Systems are expensive, and regulations are strict. • As there is no established protocol, healthcare providers are reluctant to implement CIS.es |

Ans: The Cardiology Information System (CIS) Market is to Grow is at a CAGR of 9.4% over the forecast period 2024-2031.

Ans: The Cardiology Information System (CIS) Market size was valued at US$ 1.09 billion in 2023.

Cardiology Information System (CIS)Market is divided into two segments is By Mode of Operation, and By System.

North America dominates the market for cardiology information systems.

The market share that belonged to the web-based systems is dominating.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Cardiology Information System Market Segmentation, By Mode of Operation

9.1 Introduction

9.2 Trend Analysis

9.3 Web based

9.4 Cloud based

9.5 On site

10. Cardiology Information System Market Segmentation, By System

10.1 Introduction

10.2 Trend Analysis

10.3 CVIS

10.4 CPACS

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America Cardiology Information System Market Segmentation, by Country

11.2.3 North America Cardiology Information System Market Segmentation, By Mode of Operation

11.2.4 North America Cardiology Information System Market Segmentation, By System

11.2.5 USA

11.2.5.1 USA Cardiology Information System Market Segmentation, By Mode of Operation

11.2.5.2 USA Cardiology Information System Market Segmentation, By System

11.2.6 Canada

11.2.6.1 Canada Cardiology Information System Market Segmentation, By Mode of Operation

11.2.6.2 Canada Cardiology Information System Market Segmentation, By System

11.2.7 Mexico

11.2.7.1 Mexico Cardiology Information System Market Segmentation, By Mode of Operation

11.2.7.2 Mexico Cardiology Information System Market Segmentation, By System

11.3 Europe

11.3.1 Trend Analysis

11.3.2 Eastern Europe

11.3.2.1 Eastern Europe Cardiology Information System Market Segmentation, by Country

11.3.2.2 Eastern Europe Cardiology Information System Market Segmentation, By Mode of Operation

11.3.2.3 Eastern Europe Cardiology Information System Market Segmentation, By System

11.3.2.4 Poland

11.3.2.4.1 Poland Cardiology Information System Market Segmentation, By Mode of Operation

11.3.2.4.2 Poland Cardiology Information System Market Segmentation, By System

11.3.2.5 Romania

11.3.2.5.1 Romania Cardiology Information System Market Segmentation, By Mode of Operation

11.3.2.5.2 Romania Cardiology Information System Market Segmentation, By System

11.3.2.6 Hungary

11.3.2.6.1 Hungary Cardiology Information System Market Segmentation, By Mode of Operation

11.3.2.6.2 Hungary Cardiology Information System Market Segmentation, By System

11.3.2.7 Turkey

11.3.2.7.1 Turkey Cardiology Information System Market Segmentation, By Mode of Operation

11.3.2.7.2 Turkey Cardiology Information System Market Segmentation, By System

11.3.2.8 Rest of Eastern Europe

11.3.2.8.1 Rest of Eastern Europe Cardiology Information System Market Segmentation, By Mode of Operation

11.3.2.8.2 Rest of Eastern Europe Cardiology Information System Market Segmentation, By System

11.3.3 Western Europe

11.3.3.1 Western Europe Cardiology Information System Market Segmentation, by Country

11.3.3.2 Western Europe Cardiology Information System Market Segmentation, By Mode of Operation

11.3.3.3 Western Europe Cardiology Information System Market Segmentation, By System

11.3.3.4 Germany

11.3.3.4.1 Germany Cardiology Information System Market Segmentation, By Mode of Operation

11.3.3.4.2 Germany Cardiology Information System Market Segmentation, By System

11.3.3.5 France

11.3.3.5.1 France Cardiology Information System Market Segmentation, By Mode of Operation

11.3.3.5.2 France Cardiology Information System Market Segmentation, By System

11.3.3.6 UK

11.3.3.6.1 UK Cardiology Information System Market Segmentation, By Mode of Operation

11.3.3.6.2 UK Cardiology Information System Market Segmentation, By System

11.3.3.7 Italy

11.3.3.7.1 Italy Cardiology Information System Market Segmentation, By Mode of Operation

11.3.3.7.2 Italy Cardiology Information System Market Segmentation, By System

11.3.3.8 Spain

11.3.3.8.1 Spain Cardiology Information System Market Segmentation, By Mode of Operation

11.3.3.8.2 Spain Cardiology Information System Market Segmentation, By System

11.3.3.9 Netherlands

11.3.3.9.1 Netherlands Cardiology Information System Market Segmentation, By Mode of Operation

11.3.3.9.2 Netherlands Cardiology Information System Market Segmentation, By System

11.3.3.10 Switzerland

11.3.3.10.1 Switzerland Cardiology Information System Market Segmentation, By Mode of Operation

11.3.3.10.2 Switzerland Cardiology Information System Market Segmentation, By System

11.3.3.11 Austria

11.3.3.11.1 Austria Cardiology Information System Market Segmentation, By Mode of Operation

11.3.3.11.2 Austria Cardiology Information System Market Segmentation, By System

11.3.3.12 Rest of Western Europe

11.3.3.12.1 Rest of Western Europe Cardiology Information System Market Segmentation, By Mode of Operation

11.3.2.12.2 Rest of Western Europe Cardiology Information System Market Segmentation, By System

11.4 Asia-Pacific

11.4.1 Trend Analysis

11.4.2 Asia Pacific Cardiology Information System Market Segmentation, by Country

11.4.3 Asia Pacific Cardiology Information System Market Segmentation, By Mode of Operation

11.4.4 Asia Pacific Cardiology Information System Market Segmentation, By System

11.4.5 China

11.4.5.1 China Cardiology Information System Market Segmentation, By Mode of Operation

11.4.5.2 China Cardiology Information System Market Segmentation, By System

11.4.6 India

11.4.6.1 India Cardiology Information System Market Segmentation, By Mode of Operation

11.4.6.2 India Cardiology Information System Market Segmentation, By System

11.4.7 Japan

11.4.7.1 Japan Cardiology Information System Market Segmentation, By Mode of Operation

11.4.7.2 Japan Cardiology Information System Market Segmentation, By System

11.4.8 South Korea

11.4.8.1 South Korea Cardiology Information System Market Segmentation, By Mode of Operation

11.4.8.2 South Korea Cardiology Information System Market Segmentation, By System

11.4.9 Vietnam

11.4.9.1 Vietnam Cardiology Information System Market Segmentation, By Mode of Operation

11.4.9.2 Vietnam Cardiology Information System Market Segmentation, By System

11.4.10 Singapore

11.4.10.1 Singapore Cardiology Information System Market Segmentation, By Mode of Operation

11.4.10.2 Singapore Cardiology Information System Market Segmentation, By System

11.4.11 Australia

11.4.11.1 Australia Cardiology Information System Market Segmentation, By Mode of Operation

11.4.11.2 Australia Cardiology Information System Market Segmentation, By System

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Cardiology Information System Market Segmentation, By Mode of Operation

11.4.12.2 Rest of Asia-Pacific Cardiology Information System Market Segmentation, By System

11.5 Middle East & Africa

11.5.1 Trend Analysis

11.5.2 Middle East

11.5.2.1 Middle East Cardiology Information System Market Segmentation, by Country

11.5.2.2 Middle East Cardiology Information System Market Segmentation, By Mode of Operation

11.5.2.3 Middle East Cardiology Information System Market Segmentation, By System

11.5.2.4 UAE

11.5.2.4.1 UAE Cardiology Information System Market Segmentation, By Mode of Operation

11.5.2.4.2 UAE Cardiology Information System Market Segmentation, By System

11.5.2.5 Egypt

11.5.2.5.1 Egypt Cardiology Information System Market Segmentation, By Mode of Operation

11.5.2.5.2 Egypt Cardiology Information System Market Segmentation, By System

11.5.2.6 Saudi Arabia

11.5.2.6.1 Saudi Arabia Cardiology Information System Market Segmentation, By Mode of Operation

11.5.2.6.2 Saudi Arabia Cardiology Information System Market Segmentation, By System

11.5.2.7 Qatar

11.5.2.7.1 Qatar Cardiology Information System Market Segmentation, By Mode of Operation

11.5.2.7.2 Qatar Cardiology Information System Market Segmentation, By System

11.5.2.8 Rest of Middle East

11.5.2.8.1 Rest of Middle East Cardiology Information System Market Segmentation, By Mode of Operation

11.5.2.8.2 Rest of Middle East Cardiology Information System Market Segmentation, By System

11.5.3 Africa

11.5.3.1 Africa Cardiology Information System Market Segmentation, by Country

11.5.3.2 Africa Cardiology Information System Market Segmentation, By Mode of Operation

11.5.3.3 Africa Cardiology Information System Market Segmentation, By System

11.5.3.4 Nigeria

11.5.3.4.1 Nigeria Cardiology Information System Market Segmentation, By Mode of Operation

11.5.3.4.2 Nigeria Cardiology Information System Market Segmentation, By System

11.5.3.5 South Africa

11.5.3.5.1 South Africa Cardiology Information System Market Segmentation, By Mode of Operation

11.5.3.5.2 South Africa Cardiology Information System Market Segmentation, By System

11.5.3.6 Rest of Africa

11.5.3.6.1 Rest of Africa Cardiology Information System Market Segmentation, By Mode of Operation

11.5.3.6.2 Rest of Africa Cardiology Information System Market Segmentation, By System

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America Cardiology Information System Market Segmentation, by Country

11.6.3 Latin America Cardiology Information System Market Segmentation, By Mode of Operation

11.6.4 Latin America Cardiology Information System Market Segmentation, By System

11.6.5 Brazil

11.6.5.1 Brazil Cardiology Information System Market Segmentation, By Mode of Operation

11.6.5.2 Brazil Cardiology Information System Market Segmentation, By System

11.6.6 Argentina

11.6.6.1 Argentina Cardiology Information System Market Segmentation, By Mode of Operation

11.6.6.2 Argentina Cardiology Information System Market Segmentation, By System

11.6.7 Colombia

11.6.7.1 Colombia Cardiology Information System Market Segmentation, By Mode of Operation

11.6.7.2 Colombia Cardiology Information System Market Segmentation, By System

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Cardiology Information System Market Segmentation, By Mode of Operation

11.6.8.2 Rest of Latin America Cardiology Information System Market Segmentation, By System

12. Company Profiles

12.1 GE Healthcare

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Siemens Healthcare GmbH

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 CREALIFE Medical Technology

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Honeywell Life Care Solution

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Lumedx

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Esasote

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Cerner Corporation

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 Fujifilm Medical Systems

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 McKesson Corporation

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Digisonics, Inc.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

12.11 Merge Healthcare Inc

12.11.1 Company Overview

12.11.2 Financial

12.11.3 Products/ Services Offered

12.11.4 SWOT Analysis

12.11.5 The SNS View

12.12 Philips Healthcare

12.12.1 Company Overview

12.12.2 Financial

12.12.3 Products/ Services Offered

12.12.4 SWOT Analysis

12.12.5 The SNS View

12.13 Cisco Systems

12.13.1 Company Overview

12.13.2 Financial

12.13.3 Products/ Services Offered

12.13.4 SWOT Analysis

12.13.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. USE Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Wearable Medical Devices Market size was valued at USD 40.9 Billion in 2023 and is expected to reach USD 102.5 Billion by 2032 and grow at a CAGR of 11.3% over the forecast period 2024-2032.

The Bovine Mastitis Market size was USD 0.60 Billion in 2023 and is expected to Reach USD 0.98 Billion by 2031 and grow at a CAGR of 6.4% over the forecast period of 2024-2031.

The Doppler Ultrasound Market Size was valued at USD 1.83 Billion in 2023 and is expected to reach USD 2.53 Billion by 2032 and grow at a CAGR of 3.77% Over the Forecast Period of 2024-2032.

The Cardiac Rhythm Management Devices Market was valued at USD 18.51 billion in 2023, projected to reach USD 32.35 billion by 2032, growing at a CAGR of 6.40%.

The Neuroendoscopy Devices Market was valued at USD 358.13 million in 2023 and is expected to reach USD 890.14 million by 2032, growing at a CAGR of 10.66% over the forecast period of 2024-2032.

The Pharma 4.0 Market was valued at 12.72 Bn in 2023 and is expected to reach 47.17 Bn by 2031, and grow at CAGR of 17.8% by forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone