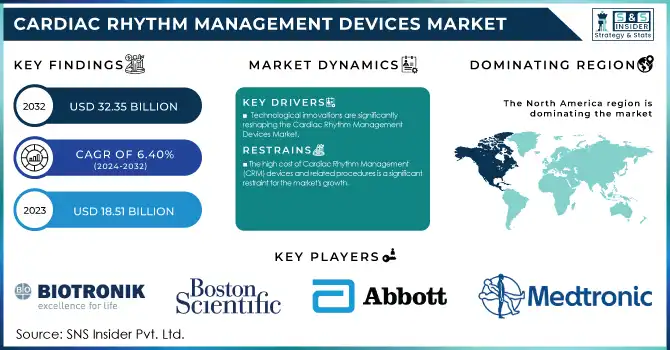

Cardiac Rhythm Management Devices Market Size:

The Cardiac Rhythm Management Devices Market was valued at USD 18.51 billion in 2023 and is projected to reach USD 32.35 billion by 2032, growing at a CAGR of 6.40% from 2024-2032.

To get more information on Cardiac Rhythm Management Devices Market - Request Free Sample Report

The Cardiac Rhythm Management (CRM) Devices Market is growing primarily due to the ever-growing incidence of cardiovascular diseases, technological advancements, and the rising aging population across the globe. Diseases like arrhythmias and atrial fibrillation are on the rise. The Centers for Disease Control and Prevention (CDC) estimates that by 2030, 12.1 million Americans will be affected by atrial fibrillation. The increasing incidence of cardiac diseases is leading to a rise in the demand for CRM devices globally.

Technological innovations are also among the key drivers for the market growth. Emerging solutions including leadless pacemakers, artificial intelligence-based diagnostic algorithms, and wearable cardioverter defibrillators are enhancing patient outcomes and broadening the landscape for CRM device indications. Your technologies are improving the accuracy and efficiency of treatment, thus increasing the attractiveness of CRM devices for both healthcare practitioners and patients.

Another major force fueling the CRM devices market is the graying population. Cardiovascular diseases impose an escalating worldwide burden in terms of morbidity and mortality, as the global population ages and the incidence of cardiac conditions — particularly among older adults — increases. The elderly population is also more vulnerable to heart diseases which eventually lead to the need for implantable cardiac devices like pacemakers and defibrillators.

Moreover, recent industry moves reflect the positive connotation surrounding the growth of the market. Examples include the launch by Boston Scientific of the LUX-Dx II+ Insertable Cardiac Monitor (ICM) system in October 2023, which aims to offer long-term monitoring for arrhythmias associated with conditions such as atrial fibrillation, cryptogenic stroke, and syncope. Likewise, in the same month, MicroPort CRM introduced the ULYS Implantable Cardioverter Defibrillator (ICD) and INVICTA defibrillation leading to the Japanese market. Moreover, in February 2024, BIOTRONIK also employed the strategy of only providing its proprietary DX models for new single-chamber ICD implants after it published positive clinical data demonstrating more efficient diagnostics with fewer complications than conventional high-voltage systems.

Cardiac Rhythm Management Devices Market Dynamics:

Drivers

-

The increasing prevalence of cardiovascular diseases, especially arrhythmias like atrial fibrillation propels the growth of the Cardiac Rhythm Management (CRM) Devices Market.

Atrial fibrillation in isolation affects millions of people around the world and in the United States. In addition, the world is aging, and elderly people are more likely to be suffering from heart disease. This demographic change is a major contributing factor to the increasing requirements for RCM devices. Globally, cardiovascular diseases are the biggest cause of death, WHO reported that Cardiovascular diseases are the leading cause of disability and premature mortality in the European Region, accounting for more than 42.5% of all deaths each year. This translates to approximately 10,000 deaths every day. The rising global burden of heart disease is driving the demand for CRM devices, which play a crucial role in the treatment of heart rhythm disorders and are preventative for often fatal conditions, including stroke and precipitous cardiac arrest.

-

Technological innovations are significantly reshaping the Cardiac Rhythm Management Devices Market.

Technological advances are extensively changing the Cardiac Rhythm Management Devices Market. These are replaced with leadless pacemakers, wearable cardioverter defibrillators, and AI-integrated diagnostic systems which of course are not readily available but as experience with these technologies advances and uptake expands, the accuracy and efficacy of treatments improves. One such example is the Micra Transcatheter Pacing System MediGo the world’s smallest pacemaker, delivered by Medtronic, the new leads-free pacemaker has already revolutionized the management of bradycardia. Moreover, the LUX-Dx II+ Insertable Cardiac Monitor was released by Boston Scientific in October 2023, which is designed for histological monitoring of complications of arrhythmias in conditions such as atrial fibrillation, cryptogenic stroke, and also in patients with syncope translating into better management of patients as well as early detection of cardiac events. This transition not only improves the quality of care to the patient but also opens the market for the use of CRM devices. The increasingly established presence of minimally invasive, remote monitoring and AI-powered devices is anticipated to provide a major boost to the market, as the need for a more targeted and personalized approach to symptoms and treatment of patients with arrhythmias is becoming evident.

Restraint

-

The high cost of Cardiac Rhythm Management (CRM) devices and related procedures is a significant restraint for the market's growth.

The cost of CRM devices such as pacemakers, defibrillators, and cardiac resynchronization therapy (CRT) devices can single-handedly run into thousands to tens of thousands of dollars. Besides the upfront cost of the device itself, there are recurring costs associated with surgical implantation, follow-up care, and the need for periodic replacements of the device. Pacemakers and defibrillators, for example, must be monitored and their batteries replaced every few years. The high cost of CRM devices may restrict access, especially in poorer areas and among uninsured or underinsured patients. Although this burden is lessened in developed countries due to insurance coverage, differences in the reimbursement of technologies throughout markets can affect growth, limiting the penetration of these devices and the ability of CRMs to reduce consequential complications related to cardiovascular disease.

Cardiac Rhythm Management Devices Market Segmentation Insights:

By Product

The defibrillators segment dominated the market with a 43% market share in 2023. The worldwide rise in Subcutaneous (S-ICD), and Transvenous (T-ICD) Implantable Cardioverter Defibrillators adoption within the U.S., and European, Chinese, and Indian regions are the major contributing factors of the market-leading share. These devices fall into two general categories: implantable cardioverter defibrillators (ICD) and external defibrillators. By Product type, the external defibrillator segment is expected to have the highest growth in the forecast period owing to the rising adoption of these devices in publicly accessible locations.

The cardiac resynchronization therapy (CRT) segment is expected to experience at the fastest rate throughout the forecast period. Due to Low rates of blood transfusion, lower risk of infection, and shorter hospital rate. Although implantation methods are primarily dependent on the doctor's expertise, physicians are increasingly favoring minimally invasive procedures for CRT pacemaker implantation to treat bradycardia and cardiac arrest, which is anticipated to drive sales in the forecast period.

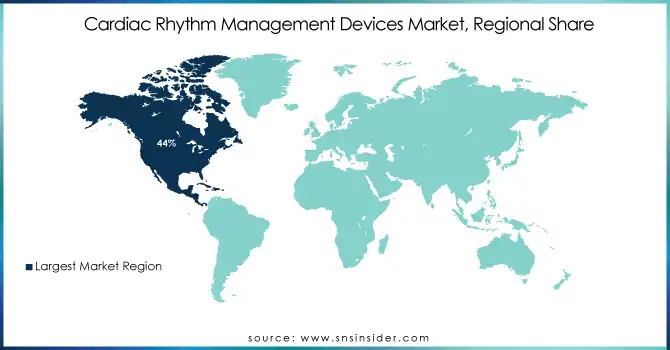

Cardiac Rhythm Management Devices Market Regional Overview:

North America dominated the cardiac rhythm management devices market in 2023, accounting for 44% market share. North America accounts for the largest share due to the better-developed healthcare systems in these regions, an increasing geriatric population, and the extensive adoption of technologically advanced products, such as extended battery life, biocompatibility, miniaturization, and leadless. Another significant factor has been the rising number of regulatory approvals. Various organizations are emphasizing on the development of new devices on the foundation of the existing pacemaker and the Implantable Cardioverter Defibrillator (ICD) technology.

The Asia Pacific cardiac rhythm management devices market is expected to register the fastest growth over the forecast period. This growth is propelled by rising investment in research and development from international organizations such as the China Cardiovascular Association and the American College of Cardiology that are working together to develop cardiac care technologies. Although consumption of tobacco, one of the leading causes of cardiovascular diseases in developed Asian economies, remains at a moderate level when compared to OECD countries.

Get Customized Report as per Your Business Requirement - Enquiry Now

Cardiac Rhythm Management Devices Market Companies:

-

Medtronic (Micra Transcatheter Pacing System, Evera MRI SureScan ICD)

-

Abbott (Assurity MRI Pacemaker, Gallant ICD and CRT-D)

-

Boston Scientific (ACUITY X4 Quadripolar LV Lead, EMBLEM S-ICD System)

-

Biotronik (Eluna 8 SR-T, Iperia ProMRI CRT-D)

-

ZOLL Medical Corporation (LifeVest Wearable Defibrillator, RescueNet AED Program Manager)

-

LivaNova (KORA 250 Pacemaker, PLATINIUM ICD)

-

MicroPort CRM (Alizea Pacemaker, Defender CRT-D System)

-

EBR Systems (WiSE CRT System, Cardiac Implantable Leadless Stimulator)

-

Shree Pacetronix Ltd. (Single Chamber Pacemaker, Dual Chamber Pacemaker)

-

Pacetronix (Tempo Pacemakers, Defib-X ICD Devices)

-

Lepu Medical Technology (AI-Rhythm Pacemaker, Pioneer ICD System)

-

Osypka Medical (Pace 101 H Temporary Pacemaker, 5-H-ICD System)

-

Oscor Inc. (Osprey Pacemaker, Yukon ICD System)

-

BioSig Technologies (PURE EP System, Signal Processing Technologies)

-

CardioComm Solutions (HeartCheck CardiBeat ECG Monitor, GEMS ECG Software)

-

AliveCor (KardiaMobile ECG Monitor, KardiaMobile 6L)

-

Medico S.p.A. (Brio Pacemakers, Mirco Implantable Defibrillators)

-

Rhythm Management Group (PulseCheck Remote Monitoring, Advanced Cardiac Monitoring Platform)

-

Cameron Health (S-ICD System, Pulse Generator Devices)

-

BIOTRONIK (Setrox S 53, Acticor Devices)

Key suppliers

key suppliers that provide components, materials, or services to the companies manufacturing Cardiac Rhythm Management (CRM) devices

-

TDK Corporation

-

Texas Instruments

-

Medicoil (MW Industries)

-

TE Connectivity

-

Heraeus Medical Components

-

Schott AG

-

Elkem Silicones

-

Solvay

-

BASF SE

-

CoorsTek Medical

Recent Developments in Cardiac Rhythm Management Devices Market

-

February 2024, BIOTRONIK, a global leader in implantable medical device technology, has announced that it will exclusively offer its proprietary DX models for new single-chamber ICD implants moving forward. This decision follows the release of compelling clinical data that highlights the superior diagnostic capabilities and reduced complication risks of the DX models compared to traditional high-voltage systems.

-

October 2023, MicroPort CRM introduced its new ULYS Implantable Cardioverter Defibrillator (ICD) and the INVICTA defibrillation lead in the Japanese market. This move is part of the company’s strategy to expand and strengthen its product portfolio globally.

-

October 2023, Boston Scientific launched the LUX-Dx II+ Insertable Cardiac Monitor (ICM) system, designed to provide enhanced monitoring of arrhythmias associated with conditions such as atrial fibrillation (AFib), cryptogenic stroke, and syncope. This innovative system offers extended monitoring capabilities for more accurate diagnosis and management.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 18.51 Billion |

| Market Size by 2032 | US$ 32.35 Billion |

| CAGR | CAGR of 6.40% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Pacemakers, Defibrillators, Cardiac Resynchronization Therapy (CRT)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Abbott, Boston Scientific, Biotronik, ZOLL Medical Corporation, LivaNova, MicroPort CRM, EBR Systems, Shree Pacetronix Ltd., Pacetronix, Lepu Medical Technology, Osypka Medical, Oscor Inc., BioSig Technologies, CardioComm Solutions, AliveCor, Medico S.p.A., Rhythm Management Group, Cameron Health, BIOTRONIK, and other players. |

| Key Drivers | •The increasing prevalence of cardiovascular diseases, especially arrhythmias like atrial fibrillation propels the growth of the Cardiac Rhythm Management (CRM) Devices Market. •Technological innovations are significantly reshaping the Cardiac Rhythm Management Devices Market. |

| Restraints | •The high cost of Cardiac Rhythm Management (CRM) devices and related procedures is a significant restraint for the market's growth. |