Get more information on Cardiac Monitoring Devices Market - Request Sample Report

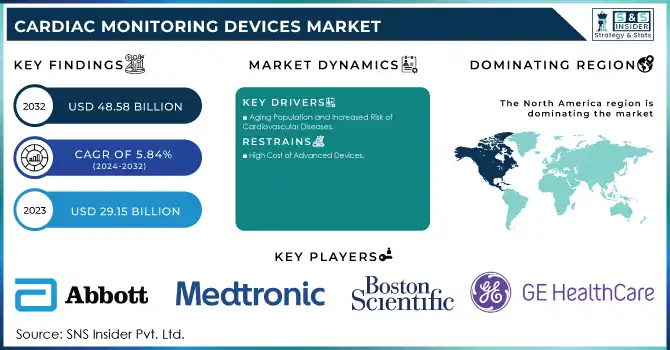

The Cardiac Monitoring Devices Market size is projected to grow from USD 29.15 billion in 2023 to USD 48.58 billion by 2032, at a Compound Annual Growth Rate (CAGR) of 5.84% during the forecast period 2024-2032.

The Cardiac Monitoring Devices Market is witnessing substantial growth, driven by the increasing prevalence of cardiovascular diseases (CVDs), technological advancements, and the growing adoption of remote patient monitoring systems. Cardiovascular diseases remain the leading cause of death globally, with the World Health Organization (WHO) estimating that 17.9 million deaths occur annually due to heart-related conditions, representing 31% of all global deaths. This rising burden of CVDs highlights the need for advanced cardiac monitoring solutions to ensure early diagnosis, timely interventions, and improved patient outcomes.

Technological innovations have revolutionized cardiac monitoring by introducing devices that offer real-time and remote tracking. Advances such as wearable electrocardiogram (ECG) monitors, wireless patches, and artificial intelligence (AI)-powered diagnostic tools have significantly improved the efficiency and accuracy of cardiac monitoring. For instance, AI-assisted ECG analysis has demonstrated a diagnostic accuracy of up to 99% in detecting arrhythmias, enabling clinicians to identify issues earlier and more reliably. Wearable technologies are particularly gaining momentum, with research indicating that continuous monitoring can enhance the early detection of conditions such as atrial fibrillation and other irregular heart rhythms.

The growing adoption of Remote Patient Monitoring (RPM) systems has further fueled market expansion. RPM allows healthcare providers to monitor patients’ cardiac health outside of clinical settings, reducing hospital readmissions and ensuring proactive care. Studies have shown that RPM significantly improves the management of chronic cardiac conditions, particularly in post-operative care and for patients with heart failure. This shift towards home-based care is also supported by increasing patient awareness and a rising preference for convenient, cost-effective healthcare solutions.

Additionally, the market is benefitting from a growing geriatric population, which is more susceptible to cardiac ailments, and improving healthcare infrastructure in emerging economies. Favorable regulatory policies and reimbursement frameworks have also played a critical role in expanding access to advanced cardiac monitoring devices globally.

Overall, the convergence of technological advancements, increasing disease prevalence, and shifting healthcare paradigms toward preventive care positions the cardiac monitoring devices market for strong and sustained growth in the coming years.

Drivers

Aging Population and Increased Risk of Cardiovascular Diseases

The global aging population is one of the primary drivers of the Cardiac Monitoring Devices Market, as older adults are more susceptible to cardiovascular diseases such as arrhythmias, heart failure, and hypertension. As individuals age, their cardiovascular system undergoes changes that increase the risk of developing heart-related conditions. According to the World Health Organization (WHO), the number of people aged 60 and older is expected to double by 2050, contributing to a significant rise in cardiovascular diseases among the elderly. This demographic shift is driving the demand for advanced cardiac monitoring devices that can detect these conditions early and effectively manage them.

Older adults often require continuous monitoring to ensure that early signs of heart complications are identified before they escalate into more severe health problems. Cardiac monitoring devices, such as wearable ECG monitors, portable heart rate monitors, and smartwatches, are becoming increasingly important in enabling elderly individuals to track their heart health in real-time. These devices offer convenience, non-invasiveness, and continuous data collection, allowing healthcare providers to intervene promptly and improve patient outcomes. With the aging population set to grow substantially, the demand for innovative and reliable cardiac monitoring solutions will continue to increase, helping to enhance the quality of life and reduce the burden of heart diseases in this vulnerable group.

Lifestyle Changes and Rising Prevalence of Heart Diseases

The rise in sedentary lifestyles, poor dietary habits, and obesity has significantly contributed to the growing prevalence of cardiovascular diseases (CVDs) worldwide. With increased screen time, reduced physical activity, and unhealthy eating habits, more individuals are developing risk factors such as hypertension, high cholesterol, and diabetes, all of which are closely linked to heart disease. As a result, there is a heightened need for early detection and continuous monitoring of heart health to prevent complications like heart attacks, strokes, and heart failure.

These lifestyle changes have spurred demand for wearable cardiac devices that provide real-time monitoring of heart rate, blood pressure, and other vital signs. Wearable technologies, such as smartwatches and portable ECG monitors, are increasingly popular due to their ability to track heart health continuously, alert users to irregularities, and enable early intervention. These devices empower individuals to take proactive control of their cardiovascular health by offering constant insights into their condition.

Advancements in Remote Monitoring and Wearable Technology

Technological advancements in remote patient monitoring (RPM) and wearable devices are revolutionizing the landscape of cardiac care. RPM solutions enable healthcare providers to monitor patients' heart health outside of traditional clinical settings, reducing the need for frequent hospital visits and ensuring continuous observation. Innovations such as portable ECG monitors, smartwatches, and heart rate trackers are at the forefront of this transformation, offering non-invasive, real-time monitoring of vital cardiovascular data. These devices provide a convenient and accessible way for patients to track their heart health from the comfort of their homes, improving adherence to treatment plans and enabling timely interventions.

The integration of wearable technologies with digital health platforms allows healthcare providers to receive continuous data from patients, which can be analyzed for irregularities such as arrhythmias or abnormal heart rates. This continuous flow of data enhances the accuracy of diagnoses and leads to more personalized, tailored treatment plans. Additionally, by allowing for remote monitoring, these devices help reduce the burden on healthcare facilities and minimize unnecessary hospital admissions, especially for chronic conditions such as heart failure or hypertension. As these technologies evolve, they will continue to enhance the quality of cardiac care, improving patient outcomes and enabling more efficient healthcare delivery.

Restraints

High Cost of Advanced Devices

The high initial cost of advanced cardiac monitoring devices, including wearable ECG monitors and portable heart rate trackers, may limit their adoption, particularly in price-sensitive regions or among patients without adequate insurance coverage. This could hinder market growth, especially in emerging economies.

Data Privacy and Security Concerns

As remote monitoring devices collect sensitive patient data, concerns around data privacy and cybersecurity remain a significant barrier. Strict regulatory requirements and the potential for data breaches could slow the adoption of these devices, especially in regions with stringent data protection laws.

By Type

In 2023, Cardiovascular Devices dominated the Cardiac Monitoring Devices Market, accounting for approximately 40% of the market share. This dominance is primarily due to their critical role in diagnosing, monitoring, and treating heart-related conditions. Devices such as ECG monitors, defibrillators, and stents are essential in hospitals, clinics, and diagnostic centers for managing heart conditions like arrhythmias, heart failure, and hypertension. The growing prevalence of cardiovascular diseases globally and the increasing healthcare investment contributed to the significant dominance of this segment.

Ambulatory Cardiac Monitoring emerged as the fastest-growing segment throughout the forecast period. This growth was driven by the rise in remote patient monitoring and the increasing demand for home-based care solutions. This segment includes wearable ECG monitors and mobile health platforms, allowing continuous tracking of heart health outside traditional clinical settings. The growth is fueled by the shift towards more flexible, patient-centric care, as ambulatory devices enable real-time data sharing with healthcare providers, making them an ideal solution for managing chronic heart conditions.

By Product Type

Multi-parameter ECG Monitors represented about 30% of the market in 2023. These monitors allow healthcare providers to track multiple vital signs—heart rate, blood pressure, oxygen levels—simultaneously, making them vital for patients with complex heart conditions. The increasing demand for real-time monitoring and the growing preference for comprehensive diagnostics contributed to the dominance of multi-parameter ECG monitors. This segment was widely used in both hospital and outpatient settings for continuous heart monitoring.

Smart Wearable Monitors, such as smartwatches and fitness trackers integrated with heart-monitoring capabilities, were among the fastest-growing product types throughout the forecast period. These devices provide users with continuous, non-invasive heart rate and rhythm tracking, along with other health metrics. As consumers increasingly prioritize personal health and fitness, the demand for smart wearable monitors has grown substantially. Their ease of use, integration with mobile applications, and ability to track heart health in real-time have made them increasingly popular, driving growth in this segment.

North America held the largest share of the Cardiac Monitoring Devices Market in 2023, driven by its advanced healthcare infrastructure, widespread adoption of innovative medical technologies, and a high prevalence of cardiovascular diseases. The U.S., in particular, plays a key role in the market, with substantial investments in research and development (R&D) of cardiac monitoring devices. The region is also witnessing a growing aging population, which further drives the demand for these devices. Additionally, remote patient monitoring is gaining traction, supported by favorable reimbursement policies and strong healthcare regulations. The combination of these factors contributes significantly to the growth of the cardiac monitoring devices market in North America.

Europe is the second-largest market for cardiac monitoring devices, with countries like Germany, the UK, and France at the forefront of demand. The growing incidence of cardiovascular diseases and improved healthcare access have led to an increased need for advanced cardiac monitoring solutions. Furthermore, the region's focus on preventive care and digital health has accelerated the adoption of wearable and ambulatory monitoring devices. As healthcare systems in Europe embrace the integration of advanced technologies, including artificial intelligence, this trend is expected to fuel further growth in the cardiac monitoring devices market.

The Asia-Pacific (APAC) region is the fastest-growing market for cardiac monitoring devices. Factors such as the large and aging population, increasing healthcare investments, and rising awareness of cardiovascular diseases are contributing to the demand for these devices. Countries like China, India, Japan, and Australia are witnessing rapid growth in the adoption of cardiac monitoring technologies. The rise in lifestyle diseases like hypertension and diabetes, along with the increasing use of wearable technologies, is accelerating market expansion. As healthcare infrastructure improves and government initiatives support healthcare access, the market for cardiac monitoring devices in APAC is expected to continue its rapid growth.

Need any customization research on Cardiac Monitoring Devices Market - Enquiry Now

1. Medtronic

Reveal LINQ

HCT (Heart Failure Monitoring)

CareLink

2. Abbott

Freestyle Libre

Confirm Rx

Tavi

3. Boston Scientific Corporation

LUX-Dx

HeartLogic

ACUITY

4. iRhythm Technologies, Inc.

Zio XT

5. GE Healthcare

CardioSoft

MAC 400

CASE System

6. Biotronik, Inc.

BioMonitor 2

Edora 8/6/4

Visions 2

7. SCHILLER Healthcare India Pvt. Ltd

CARDIOVIT AT-102 G2

CARDIOVIT FT-1

8. Koninklijke Philips N.V.

Philips HeartStart

IntelliVue Patient Monitoring

BioTel Heart

9. MicroPort Scientific Corporation

Apollo

Renata

10. Honeywell Life Care Solutions

LifeStream

AMT Cardiac Monitoring System

Care Assure

In Nov 2024, Monitra Health secured a US patent for its innovative wireless cardiac monitoring technology. The newly patented device features a wireless patch designed to enhance patient compliance and improve diagnostic accuracy in cardiac monitoring.

In July 2024, Octagos Health secured over USD 43 million in a Series B funding round, led by Morgan Stanley Expansion Capital and supported by Mucker Capital and other investors. This investment will help advance the company's AI-driven cardiac device monitoring solutions and accelerate its mission to transform cardiac care.

In May 2024, OMRON Healthcare India partnered with AliveCor to launch AI-powered home heart health monitoring devices, aiming to enhance at-home cardiac care with advanced technology for better monitoring and early detection.

In May 2024, WearLinq acquired AMI Cardiac Monitoring and secured USD 6.7 million in funding to develop its FDA-cleared 6-lead ECG device. This acquisition strengthens WearLinq's position in the cardiac monitoring market, enhancing its product offerings.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 29.15 billion |

| Market Size by 2032 | USD 48.58 Billion |

| CAGR | CAGR of 5.84% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Cardiovascular Devices, Multi-Parameter ECG Monitors, Patient Monitoring Devices, Ambulatory Cardiac Monitoring, Cardiac Monitors) • By Product Type (Portable Monitor, Smart Wearable Monitor, Standard Monitor) • By Application (Coronary Heart Diseases, Sudden Cardiac Arrest, Stroke, Arrhythmia, Congenital Heart Diseases, Heart Failure, Pulmonary Hypertension, Heart Function, Pulmonary Artery Pressure) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Abbott, Boston Scientific Corporation, iRhythm Technologies, Inc., GE Healthcare, Biotronik, Inc., SCHILLER Healthcare India Pvt. Ltd, Koninklijke Philips N.V., MicroPort Scientific Corporation, and Honeywell Life Care |

| Key Drivers | • Aging Population and Increased Risk of Cardiovascular Diseases • Lifestyle Changes and Rising Prevalence of Heart Diseases • Advancements in Remote Monitoring and Wearable Technology |

| Restraints | • High Costs and Data Privacy Concerns Restricting Adoption of Advanced Cardiac Monitoring Devices |

Ans: The estimated compound annual growth rate is 5.84% during the forecast period for the Cardiac Monitoring Devices market.

Ans: The projected market value of the Cardiac Monitoring Devices market is estimated at USD 29.15 billion in 2023 and is expected to reach USD 48.58 billion by 2032.

Ans: The global aging population is one of the primary drivers of the Cardiac Monitoring Devices Market, as older adults are more susceptible to cardiovascular diseases such as arrhythmias, heart failure, and hypertension.

Ans: The high initial cost of advanced cardiac monitoring devices, including wearable ECG monitors and portable heart rate trackers, may limit their adoption, particularly in price-sensitive regions or among patients without adequate insurance coverage.

Ans: North America is the dominant region in the Cardiac Monitoring Devices market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Cardiac Monitoring Devices Market Segmentation, by Type

7.1 Chapter Overview

7.2 Cardiovascular Devices

7.2.1 Cardiovascular Devices Market Trends Analysis (2020-2032)

7.2.2 Cardiovascular Devices Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Multi-Parameter ECG Monitors

7.3.1 Multi-Parameter ECG Monitors Market Trends Analysis (2020-2032)

7.3.2 Multi-Parameter ECG Monitors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Patient Monitoring Devices

7.4.1 Patient Monitoring Devices Market Trends Analysis (2020-2032)

7.4.2 Patient Monitoring Devices Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Ambulatory Cardiac Monitoring

7.5.1 Ambulatory Cardiac Monitoring Market Trends Analysis (2020-2032)

7.5.2 Ambulatory Cardiac Monitoring Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Cardiac Monitors

7.6.1 Cardiac Monitors Market Trends Analysis (2020-2032)

7.6.2 Cardiac Monitors Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Cardiac Monitoring Devices Market Segmentation, by Product Type

8.1 Chapter Overview

8.2 Portable Monitor

8.2.1 Portable Monitor Market Trends Analysis (2020-2032)

8.2.2 Portable Monitor Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Smart Wearable Monitor

8.3.1 Smart Wearable Monitor Market Trends Analysis (2020-2032)

8.3.2 Smart Wearable Monitor Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Standard Monitor

8.4.1 Standard Monitor Market Trends Analysis (2020-2032)

8.4.2 Standard Monitor Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Cardiac Monitoring Devices Market Segmentation, by Application

9.1 Chapter Overview

9.2 Coronary Heart Diseases

9.2.1 Coronary Heart Diseases Market Trends Analysis (2020-2032)

9.2.2 Coronary Heart Diseases Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Sudden Cardiac Arrest

9.3.1 Sudden Cardiac Arrest Market Trends Analysis (2020-2032)

9.3.2 Sudden Cardiac Arrest Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Stroke

9.4.1 Stroke Market Trends Analysis (2020-2032)

9.4.2 Stroke Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Arrhythmia

9.5.1 Arrhythmia Market Trends Analysis (2020-2032)

9.5.2 Arrhythmia Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Congenital Heart Diseases

9.6.1 Congenital Heart Diseases Market Trends Analysis (2020-2032)

9.6.2 Congenital Heart Diseases Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Heart Failure

9.7.1 Heart Failure Market Trends Analysis (2020-2032)

9.7.2 Heart Failure Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Pulmonary Hypertension

9.8.1 Pulmonary Hypertension Market Trends Analysis (2020-2032)

9.8.2 Pulmonary Hypertension Market Size Estimates and Forecasts to 2032 (USD Billion)

9.9 Heart Function

9.9.1 Heart Function Market Trends Analysis (2020-2032)

9.9.2 Heart Function Market Size Estimates and Forecasts to 2032 (USD Billion)

9.10 Pulmonary Artery Pressure

9.10.1 Pulmonary Artery Pressure Market Trends Analysis (2020-2032)

9.10.2 Pulmonary Artery Pressure Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Cardiac Monitoring Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.4 North America Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.5 North America Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.2 USA Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.6.3 USA Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.2 Canada Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.7.3 Canada Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Cardiac Monitoring Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 turkey

10.3.1.9.1 Turkey Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Cardiac Monitoring Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.2 France Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.7.3 France Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Cardiac Monitoring Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.5 Asia Pacific Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.2 China Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.6.3 China Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.2 India Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.7.3 India Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.2 Japan Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.8.3 Japan Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.2 Australia Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.12.3 Australia Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Cardiac Monitoring Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Cardiac Monitoring Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.4 Africa Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.5 Africa Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Cardiac Monitoring Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.4 Latin America Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.5 Latin America Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Cardiac Monitoring Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Cardiac Monitoring Devices Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Cardiac Monitoring Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Medtronic

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product Types/ Services Offered

11.1.4 SWOT Analysis

11.2 Abbott

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product Types/ Services Offered

11.2.4 SWOT Analysis

11.3 Boston Scientific Corporation

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product Types/ Services Offered

11.3.4 SWOT Analysis

11.4 iRhythm Technologies, Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product Types/ Services Offered

11.4.4 SWOT Analysis

11.5 GE Healthcare

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product Types/ Services Offered

11.5.4 SWOT Analysis

11.6 Biotronik, Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product Types/ Services Offered

11.6.4 SWOT Analysis

11.7 SCHILLER Healthcare India Pvt. Ltd

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product Types/ Services Offered

11.7.4 SWOT Analysis

11.8 Koninklijke Philips N.V.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product Types/ Services Offered

11.8.4 SWOT Analysis

11.9 MicroPort Scientific Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product Types/ Services Offered

11.9.4 SWOT Analysis

11.10 Honeywell Life Care Solutions

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product Types/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Cardiovascular Devices

Multi-Parameter ECG Monitors

Patient Monitoring Devices

Ambulatory Cardiac Monitoring

Cardiac Monitors

By Product Type

Portable Monitor

Smart Wearable Monitor

Standard Monitor

By Application

Coronary Heart Diseases

Sudden Cardiac Arrest

Stroke

Arrhythmia

Congenital Heart Diseases

Heart Failure

Pulmonary Hypertension

Heart Function

Pulmonary Artery Pressure

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Magnetic Resonance Imaging (MRI) Market size was valued at USD 5.92 billion in 2023 and is expected to reach USD 9.8 billion by 2032, and grow at a CAGR of 5.78%.

The Anticoagulation Market Size was valued at USD 35.25 billion in 2022, and is expected to reach USD 61.49 billion by 2030 and grow at a CAGR of 7.9% over the forecast period 2023-2030.

The Central Nervous System (CNS) Treatment Market size was valued at USD 145.04 Bn in 2023 and is expected to reach USD 273.30 Bn by 2032 and grow at a CAGR of 7.31% over the forecast period of 2024-2032.

The Mycoplasma Testing Market size was USD 941.56 million in 2023, expected to reach USD 2943.09 million by 2032, growing at a CAGR of 13.53% from 2024-2032.

The Image-guided Biopsy market size was USD 4.01 billion in 2023 and is expected to reach USD 6.98 billion by 2032 and grow at a CAGR of 6.35% over the forecast period of 2024-2032.

The Contraceptives Market size was USD 26.29 billion in 2023, projected to hit USD 44.71 billion by 2032, growing at a 6.10% CAGR.

Hi! Click one of our member below to chat on Phone