Carbon Dioxide Market Report Scope & Overview:

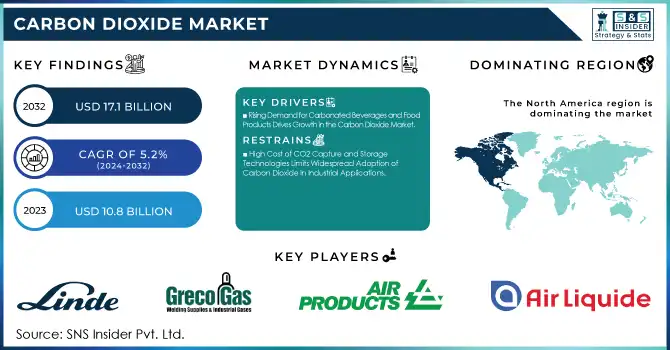

The Carbon Dioxide Market size was valued at USD 10.8 billion in 2023 and is expected to reach USD 17.1 billion by 2032, growing at a CAGR of 5.2% over the forecast period 2024-2032.

Get More Information on Carbon Dioxide Market - Request Sample Report

The carbon dioxide market is set to keep growing as carbonate consumption keeps on rising, predominantly driven by an increased preference for the use of EOR CO2 as a necessary part of several medical procedures, such as minimally invasive surgeries or medical imaging. The world population needs more basic health services, and today’s high-income countries must help provide those services. In the coming years, an augmented risk of mortality is expected to develop in many parts of the world, in parallel with an increased demand for CO2. These trends are supported by a growing food-and-beverage sector, general manufacturing activities because of industrialization, and Food & health manufacturing. In April 2023, Linde announced that it signed a long-term agreement with ExxonMobil to procure CO2 from Linde’s new green hydrogen production facility that is slated to be built at their Beaumont, Texas site. The growth potential for the carbon dioxide type market might be explained by a need to reduce environmental damage and emissions. To increase carbon dioxide output, this technique is usually used by actors in the crude petroleum industrial sector. In the foreseeable future, the mobilization of power facilities and infrastructure will see the market expand at a rate that has been predicted by the latest research. This has led to a rise in demand for carbon dioxide across the agriculture sector and could include a demand for greenhouse farming along with crop fertilization. With the advancing need for existing applications in the field like its use in medical and oil and gas, the demand for Carbon Dioxide (CO2) in varied end-use sectors with applied sciences will be on the rise. . Carbon dioxide is using different processes as plant growth Phytoplankton is a group of microscopic organisms using carbon dioxide for photosynthesis which shows a rise in demand for this raw material.

Moreover, in July 2024, according to the recent news published in the Middle East Economy, Abu Dhabi’s national oil company (ADNOC) revealed it had saved 6.2 million tonnes of CO2 mainly from its huge investment in solar and nuclear energy, creating what officials described as a race to net zero by mid-century. ADNOC’s 2023 Sustainability Report set the bar by defining comprehensive targets for a decarbonisation pathway including a slight drop in greenhouse gas emissions to 24m/t from 24.1m/t in 2022. The company planned to deliver over 900kT Co2 reductions with the balance anticipated from transport and supplemented by additional technical solutions to ensure a 5% improvement against 2025 business as usual.

Carbon Dioxide Market Dynamics

Drivers

-

Rising Demand for Carbonated Beverages and Food Products Drives Growth in the Carbon Dioxide Market

-

Expanding Industrial Applications of CO2 Promote Market Growth in Key Sectors like Oil & Gas and Chemical Manufacturing

-

Growing Focus on CO2 Capture and Utilization Technologies Enhances Market Opportunities for Carbon Dioxide

Innovations in carbon capture and utilization (CCU) technologies are transforming the CO2 market. Governments and industries alike are increasingly focusing on reducing carbon emissions, and CO2 capture technologies play a significant role in this effort. CO2 capture involves extracting carbon dioxide from industrial emissions and repurposing it in useful applications, such as producing synthetic fuels, plastics, or chemicals. As countries implement stricter environmental regulations and embrace sustainability goals, the development and scaling of CCU technologies are gaining momentum. Companies that can effectively capture, store, and convert CO2 are positioning themselves as leaders in sustainable manufacturing. The rise of green technologies that utilize CO2 for producing renewable energy or products creates vast growth opportunities in the market. This trend of sustainable CO2 use is expected to generate new business models, partnerships, and investment opportunities, further driving the demand for CO2, especially for industries involved in environmental solutions and carbon footprint reduction.

Restraints

-

High Cost of CO2 Capture and Storage Technologies Limits Widespread Adoption of Carbon Dioxide in Industrial Applications

The high cost of implementing and maintaining carbon capture and storage (CCS) technologies is a significant challenge. Capturing, compressing, and storing CO2 requires substantial investment in infrastructure and operational costs. Small and medium-sized enterprises (SMEs) and industries in developing regions face difficulties affording these systems despite government incentives. As a result, the widespread adoption of CCS technologies is limited, restricting the growth of the CO2 market, especially in industries that could benefit from carbon capture but are deterred by the high investment needed.

Opportunities

-

Advancements in Carbon Dioxide Liquefaction and Transport Technologies Open New Avenues for Market Growth

-

Increasing Use of CO2 in Sustainable Agriculture and Greenhouse Farming Creates Market Growth Opportunities

The use of CO2 in agriculture, particularly in greenhouse farming, presents new opportunities in the CO2 market. CO2 is used to enrich the atmosphere inside greenhouses to enhance plant growth, as higher levels of CO2 can promote photosynthesis, leading to improved crop yields. This is particularly beneficial in regions with limited arable land, where maximizing crop production is essential. With increasing awareness of sustainable farming practices and the need to meet food production demands in a growing global population, the adoption of CO2 in agriculture is expected to rise. As countries invest more in sustainable agricultural practices and food security, CO2 suppliers have an opportunity to tap into this emerging demand, further diversifying the applications of CO2 and opening new revenue streams.

Challenges

-

Environmental Concerns Over CO2 Emissions and Its Impact on Sustainability Efforts May Limit Market Growth

Carbon dioxide is a greenhouse gas that contributes to climate change, raising significant environmental concerns. Governments and organizations are increasingly focused on reducing CO2 emissions to meet climate targets, potentially leading to stricter regulations. This pressure on industries to lower their carbon footprint may limit long-term demand for CO2, especially if alternative technologies emerge. While the CO2 market is currently thriving, the challenge of balancing industrial needs with sustainability efforts poses risks for market expansion. Companies must adapt to evolving environmental standards or face restrictions that could limit CO2 use in various applications.

Sustainability and Circular Economy Initiatives in the Carbon Dioxide (CO2) Market

|

Initiative |

Description |

Example |

|

CO2 Recycling for Chemical Production |

CO2 is captured and converted into chemicals or synthetic fuels, reducing emissions and generating value. |

Carbon Clean Solutions' CO2 capture tech. |

|

CO2 as a Feedstock for Sustainable Agriculture |

Using CO2 to enhance plant growth in controlled environments like greenhouses, improving food production. |

Greenhouse CO2 enrichment in agricultural setups. |

|

Carbon Capture and Utilization (CCU) in Cement |

CO2 is captured from industrial processes and used in cement production, reducing the carbon footprint. |

Cement plants using CO2 for carbonation. |

|

Bio-Based CO2 Utilization for Materials |

CO2 is utilized in the production of bio-based plastics or polymers, contributing to sustainable material alternatives. |

BASF's CO2-based polymer production. |

|

CO2 Sequestration in Building Materials |

CO2 is captured and stored within building materials, such as concrete, to lock it away long-term. |

CarbonCure's CO2-based concrete technology. |

In the Carbon Dioxide (CO2) market, several initiatives are driving sustainability and advancing circular economy models. CO2 recycling for chemical production, where captured CO2 is converted into chemicals or synthetic fuels, is one such example, helping to reduce emissions while creating valuable products. Similarly, using CO2 in controlled agricultural environments, like greenhouses, enhances plant growth, supporting sustainable food production. Furthermore, in cement production, CO2 is captured and utilized, lowering the industry's carbon footprint. Another innovation is the use of CO2 in producing bio-based materials, including plastics, offering eco-friendly alternatives. Additionally, CO2 sequestration in building materials like concrete helps lock away CO2 for long periods, contributing to climate change mitigation. These initiatives not only address carbon emissions but also contribute to a more sustainable and circular economy.

Carbon Dioxide Market Segments

By Source

In 2023, the Ethylene Oxide segment dominated the Carbon Dioxide (CO2) market with a market share of 40%. Ethylene oxide is an essential chemical used in producing various products such as ethylene glycol, which is a key ingredient in antifreeze, plastics, and synthetic fibers like polyester. The production of ethylene oxide involves the oxidation of ethylene, a process that generates CO2 as a byproduct. The chemical industry, which accounts for a significant portion of global CO2 emissions, relies heavily on ethylene oxide as it is crucial in producing other chemicals such as ethanolamines, surfactants, and solvents. The growing demand for ethylene glycol in industries such as automotive, textiles, and packaging further drives the demand for CO2 from this source. Additionally, CO2 produced from ethylene oxide is used in various applications such as carbonated beverages, fire suppression systems, and industrial cooling. As a result, the dominance of ethylene oxide in the CO2 market is primarily driven by its pivotal role in chemical manufacturing and diverse applications.

By Form

In 2023, the Gas segment dominated the Carbon Dioxide (CO2) market with a market share of 70%. CO2 in its gaseous form is widely utilized across multiple industries, including food and beverages, healthcare, and industrial applications. In the food and beverage sector, CO2 is extensively used for carbonation in soft drinks, sparkling water, and beer, contributing to the high demand for CO2 gas. It is also used in the medical field for insufflation during minimally invasive surgeries and for respiratory treatments. Furthermore, CO2 gas plays a crucial role in fire suppression systems, where it is used in CO2 fire extinguishers, especially in environments like data centers and kitchens. The gas form of CO2 is preferred due to its versatility, ease of transport, and storage, making it more accessible for various applications compared to its solid or liquid counterparts. Additionally, the growing demand for CO2 in sectors like food processing, oil recovery, and medical uses supports the continuous growth of the gas segment in the CO2 market.

By Prodution Method

The Combustion segment dominated the production method for Carbon Dioxide (CO2) in 2023, with a market share of 55%. Combustion is a natural process that occurs when carbon-containing fuels such as coal, natural gas, and oil are burned to produce energy. This process generates large volumes of CO2 as a byproduct, making it a significant source of carbon emissions. The combustion of fossil fuels for power generation, transportation, and industrial processes contributes substantially to global CO2 production. In many industries, CO2 is captured from combustion exhausts and then utilized for various applications, including enhanced oil recovery, food preservation, and carbonation in beverages. The demand for CO2 from combustion processes is closely tied to industrial and power generation activities. As global energy consumption rises, so does the volume of CO2 generated through combustion. Additionally, efforts to capture and use CO2 from combustion processes, such as in carbon capture and storage (CCS) technologies, contribute to the growing market share of CO2 produced via combustion.

By Application

The Food & Beverages application segment dominated the Carbon Dioxide (CO2) in 2023, holding a market share of 45%. CO2 is extensively used in the food and beverage industry, primarily for carbonation, refrigeration, and preservation. Carbonated drinks, including soft drinks, beer, and sparkling water, are some of the largest consumers of CO2 gas. The gas is dissolved into beverages under pressure, creating bubbles that give them their characteristic fizz. In addition to carbonation, CO2 is used for food preservation in packaging, where it helps extend the shelf life of perishable products by reducing the growth of bacteria and mold. CO2 is also employed in freezing applications, where it is used in dry ice form to preserve frozen foods during transportation and storage. The increasing global demand for processed and packaged food products, combined with the rising popularity of carbonated beverages, has fueled the growth of CO2 in the food and beverage sector. As a result, this segment continues to dominate the overall CO2 market, driven by both demand and evolving consumption trends.

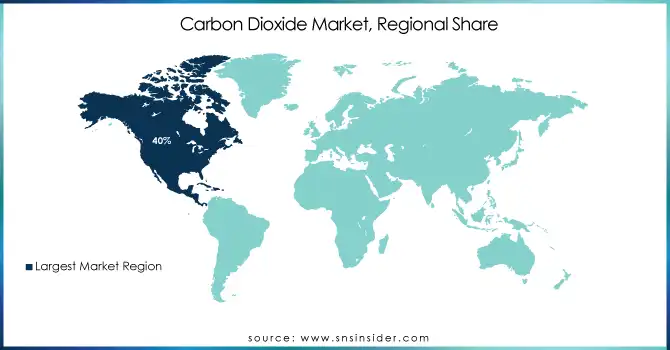

Carbon Dioxide Market Regional Analysis

In 2023, North America dominated the Carbon Dioxide (CO2) market with a market share of 40%. This dominance is largely attributed to the substantial industrial activities in the United States, including oil and gas production, chemical manufacturing, food and beverage production, and medical applications. The U.S. is one of the largest producers of CO2, largely due to its significant use in enhanced oil recovery (EOR) operations, which inject CO2 into aging oil fields to extract more crude oil. Additionally, the demand for CO2 in the food and beverage sector, particularly in carbonated beverages and food preservation, is substantial in North America. Canada and Mexico also contribute to the region’s growth, with growing investments in CO2 capture and utilization technologies. The U.S. is a leader in CO2 production from fossil fuel combustion and industrial processes. Moreover, North America has a well-established infrastructure for CO2 distribution and storage, further solidifying its position as the market leader. As the region continues to focus on carbon capture and storage (CCS) technologies to meet climate goals, the CO2 market in North America is likely to remain robust. The integration of CO2 into various sectors, including healthcare and manufacturing, ensures continued demand across industries, making North America the dominant region in the global CO2 market.

Moreover, in 2023, Asia-Pacific emerged as the fastest-growing region in the Carbon Dioxide (CO2) market, with a CAGR of 7%. This rapid growth can be attributed to the expanding industrial base in countries such as China, India, and Japan. China, as the world’s largest emitter of CO2, plays a pivotal role in the global CO2 market, with significant production from its manufacturing and energy sectors. The country’s rapid industrialization and growing demand for CO2 in industries such as food and beverages, healthcare, and oil and gas have spurred market growth. India, with its fast-developing economy, is witnessing an increased demand for CO2, particularly in the food and beverage sector, where carbonation and preservation are essential. Japan’s industrial needs, particularly in the chemical and healthcare industries, further contribute to the region’s growth. Additionally, the push for sustainability and government policies aimed at reducing carbon emissions are driving the adoption of CO2 capture and utilization technologies in Asia-Pacific. With substantial investments in CO2 infrastructure and technologies, this region is poised for continued growth in the coming years, making it the fastest-growing market globally.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Acail Gás (CO2 gas, CO2 cylinder)

-

Air Liquide (Carbon dioxide, Air separation units)

-

Air Products and Chemicals Inc. (Liquid CO2, Carbon dioxide gas)

-

Greco Gas Inc. (Carbon dioxide cylinders, CO2 gas)

-

Linde AG (CO2 liquid, CO2 gas)

-

Messer Group (Carbon dioxide, CO2 in liquid form)

-

Sicgil India Limited (Industrial CO2, Liquid carbon dioxide)

-

SOL Group (CO2 for industrial use, Carbon dioxide gas)

-

Strandmøllen A/S (Liquid carbon dioxide, Carbon dioxide cylinders)

-

Taiyo Nippon Sanso Corporation (CO2, Industrial gas solutions)

-

AGA Gas (Carbon dioxide, CO2 gas solutions)

-

Carbagas (CO2 gas, Liquid carbon dioxide)

-

Continental Carbon (CO2 recovery, Carbon dioxide gas)

-

CryoGas (Cryogenic CO2, Liquid carbon dioxide)

-

Deepwater Chemicals (CO2 injection systems, Carbon dioxide gas)

-

exaMole (CO2, Gaseous carbon dioxide)

-

Matheson Tri-Gas (Liquid carbon dioxide, CO2 gas)

-

Praxair Technology (Carbon dioxide, CO2 liquid)

-

Roborough Gas (CO2 gas, Carbon dioxide liquid)

-

Universal Industrial Gases (CO2 gas, Liquid carbon dioxide)

Recent Development:

-

February 2024: Air Liquide and Dow renewed their industrial gas supply agreement in Stade, which is one of the largest chemical production sites in Lower Saxony, Germany. According to this agreement, Air Liquide will supply industrial gases based on a long-term contract, and it will carry out nearly 40 million euros of CAPEX to upgrade its facilities, thus improving operating efficiency and reducing CO2 emissions, ultimately addressing the increasing market demand.

-

December 2023: Air Liquide announced plans to build, own, and operate a world-scale carbon capture unit in the industrial hub of Rotterdam, the Netherlands, based on its innovative Cryocap technology. The new unit will be installed behind Air Liquide’s hydrogen production plant at the Rotterdam port and will be coupled with Porthos, a large-scale carbon capture and storage infrastructure in Europe that seeks to significantly reduce CO2 emissions in the area.

-

May 2023: Air Products unveiled plans to build, own, and operate two new world-scale carbon monoxide (CO) production facilities in Texas. La Porte and Texas City will manufacture more than 70 million standard cubic feet per day (MMSCFD) of CO collectively and are connected to Air Products' extensive Gulf Coast infrastructure.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.8 Billion |

| Market Size by 2032 | US$ 17.1 Billion |

| CAGR | CAGR of 5.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Hydrogen, Ethylene Oxide, Ethyl Alcohol, Substitute Natural Gas, Others) • By Form (Solid, Liquid, Gas) • By Production Method (Combustion, Biological) • By Application (Food & Beverages, Oil & Gas, Rubber, Medical, Fire Fighting, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Air Liquide, Greco Gas Inc., Messer Group, SOL Group, Strandmøllen A/S, Acail Gás, Air Products and Chemicals Inc., Linde AG, Sicgil India Limited, Taiyo Nippon Sanso Corporation and other key players |

| Key Drivers | • Expanding Industrial Applications of CO2 Promote Market Growth in Key Sectors like Oil & Gas and Chemical Manufacturing • Growing Focus on CO2 Capture and Utilization Technologies Enhances Market Opportunities for Carbon Dioxide |

| Restraints | • High Cost of CO2 Capture and Storage Technologies Limits Widespread Adoption of Carbon Dioxide in Industrial Applications |