Carbon Black Feedstock Market Report Scope & Overview

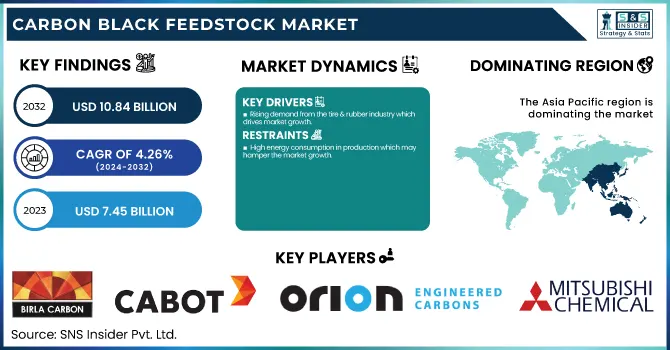

The Carbon Black Feedstock Market size was USD 7.45 Billion in 2023 and is expected to reach USD 10.84 Billion by 2032 and grow at a CAGR of 4.26% over the forecast period of 2024-2032.

To Get more information on Carbon Black Feedstock Market - Request Free Sample Report

The report provides an in-depth analysis of production capacity and utilization across key regions, highlighting supply-demand dynamics in 2023. It examines feedstock price trends by type and region, offering insights into cost fluctuations and market volatility. The report assesses regulatory impacts, emission standards, and sustainability initiatives, focusing on compliance with environmental policies. Additionally, it explores supply chain disruptions, raw material availability, and geopolitical influences affecting feedstock sourcing. Advancements in refining technologies and process innovations are analyzed, showcasing efficiency improvements. The study also covers sustainability efforts, including circular economy developments and waste management practices. Overall, the report delivers a data-driven perspective on market trends, industry challenges, and future growth opportunities.

Market Dynamics

Drivers

-

Rising demand from the tire & rubber industry which drives market growth.

Carbon black is primarily used as a reinforcing agent in tire manufacturing and the increasing demand for tires from the automotive industry is expected to be a significant factor driving growth in the carbon black feedstock market. As the global automotive industry grows, car and commercial vehicle tire production rises and consequently drives the carbon black feedstock market. Furthermore, the growing vehicle ownership and road safety regulations, as well as rising consumer inclination for performance tires are some of the factors augmenting the replacement tire market. Tire-makers use carbon black feedstock in tires to increase durability and wear and to protect them from UV rays. In addition, the increasing need for synthetic and high-performance rubber components for use in industrial applications such as conveyor belts, hoses, and gaskets is also boosting the market growth. Alongside this, the trend towards more sustainable products is leading to the development of green carbon black feedstock from recycled materials and bio-based sources, which will also influence the market in the years to come.

Restraint

-

High energy consumption in production which may hamper the market growth.

Carbon black feedstock production is energy-intensive, which is one of the major factors impeding the growth of the market. The production process, especially using thermal decomposition or incomplete combustion of hydrocarbons, consumes a considerable amount of electricity and fuel. Increasing global energy costs and wind restrictions on emissions translate into higher costs of production for producers, making production less economical. Besides, the production of carbon black is characterized by greenhouse gas emissions, which put pressure on regulatory acts for a cleaner and more energy-efficient process. The focus on sustainable alternatives, such as recovered carbon black (rCB), in many industries is likely to exacerbate the challenge to demand for conventional feedstocks. Consequently, high energy consumption raises costs as well as hinders market growth based on environmental and economic factors.

Opportunity

-

Increasing investments in specialty carbon black create an opportunity in the market.

Specialty carbon black is increasingly in demand in various sectors such as coatings, plastics, electronics, and batteries, and thus capital investments in specialty carbon black manufacturing are on the rise. Specialty grades of carbon black have better conductivity, U.V. stability, and good dispersion properties than conventional carbon black, and therefore have better value and a well-suited for next-gen applications. Growing consumption of high-performance materials in applications such as automotive, aerospace & packaging is disproportionately driving the demand for specialized carbon black formulations. At the same time, increasing R&D investments to manufacture tailor-made, low-emission, and high-purity carbon black for various applications, are also creating substantial market opportunities. Within this growing segment, product innovation, sustainability, and expanded production capacity will provide formidable competitive moats. Moreover, the rise of low-VOC and green specialty carbon black in response to government-imposed statutory compliance is developing market growth.

Challenges

-

Lack of advanced recycling infrastructure may challenge the market growth.

The poor recycling infrastructure presents a challenge for the carbon black feedstock market growth as inefficient recycling technologies render slightly used rCBs unavailable for use as feedstock. Generally, coal tar, ethylene cracker tar, and FCC tar have been used as feedstock which resulted in high carbon emissions during the carbon black production process due to the fossil feeds-based nature of these processes. Although recycling out-of-service tires and carbon wastes from industrial processes may offer an environmentally friendly feedstock alternative, the lack of efficient collection systems, sophisticated pyrolysis technologies, and large-centralized processing plants hamper the large-scale utilization of rCB. Further, manufacturers are also deterred by regulatory uncertainties and the high initial capital investment required to establish advanced recycling plants to shift to sustainable feedstock sources. Without the required recycling infrastructure, the market’s capacity to achieve future sustainability targets may be hampered as businesses are being urged to decrease their carbon footprints and transition into a circular economy.

Segmentation Analysis

By Product

General Type held the largest market share around 38% in 2023. It is widely adopted in the manufacture of tires, rubber, plastics, coatings, and inks. By providing a relatively balanced combination of strength, conductivity, and reinforcing properties, this type of carbon black feedstock is then well adapted to different applications. For instance, the automotive industry will be one of the main drivers of demand for general carbon black for the manufacturing of tires, as it can further augment tire strength, longevity, and wear resistance. Moreover, the general-type feedstock is more readily available and more economical than specialty grades, which also plays a significant role in dictating the position of the market. One of the major factors that has helped general-type carbon black feedstock maintain its leadership role in the market is the increasing demand for it due to boosting industrialization, infrastructural developments, and growth of consumer goods industries across the globe.

By Source

Clarified Slurry Oil held the largest market share around 42% in 2023. It is owing to the high demand for cereals & grains across the globe and their large-scale production. Nitrogen inputs are important for the growth, yield, and soil fertility of staple crops such as wheat, rice, corn, and barley. Carbon Black Feedstocks are placed before other fertilizers is an essential step given the global population and concerns about food security. Moreover, the demand for nitrogen-based fertilizers is further created in this segment due to intensive farming practices and the growing areas under high-yield hybrid varieties. Increased fertilizer application is also a consequence of the rapidly expanding biofuel sector, especially in corn ethanol production. This means that we can expect cereals and grains, on which the majority of the global food supply chains stand, to remain on the market in a strong place, because they depend on nitrogen fertilizers.

Regional Analysis

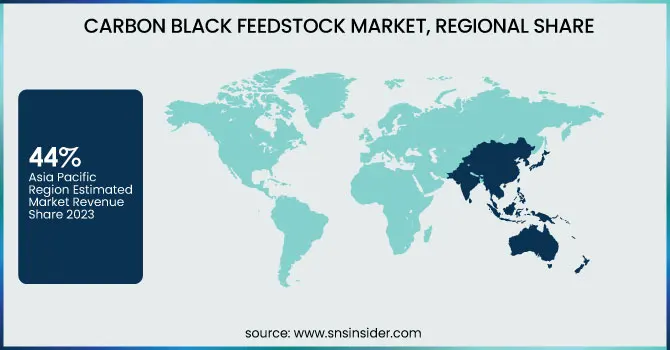

Asia Pacific held the largest market share around 44% in 2023. This is owing to the large industrial base, large end-use sector-driven demand, and presence of major carbon black manufacturing companies. High-volume consumption of carbon black is expected owing to a strong presence of major players operating in tire manufacturing, automotive, rubber processing, and industrial coatings in this region. In states like China, India, and Japan solid and liquid feedstocks such as clarified slurry oil (CSO), coal tar, and ethylene cracker tar are easily provided due to the well prevailed exploring and refining industries. Moreover, rising demand is supported by the increasing rate of urbanization along with infrastructure development and construction activities among developing economies. Asia Pacific continues to dominate the market with cheap availability of natural resources, government policies supportive to manufacturing sectors, and increasing foreign investments in the region. The region will continue to lead as industries scale up and embrace sustainable production methods.

North America held a significant market share in 2023. This is due to the presence of a well-established refining industry, high demand from the automotive and industrial sectors, and advanced technological capabilities. It is a large producer of Clarified Slurry Oil (CSO), Ethylene Cracker Tar, and FCC Tar, providing a stable feedstock supply for carbon black production. High consumption of carbon black in tire and rubber production in the U.S. & Canada due to the strong automotive industry. In addition, stringent environmental regulations have compelled manufacturers to adopt sustainable production processes and recycling schemes, augmenting the market growth. North America retains a strong position in the carbon black market owing to the presence of major carbon black producers, established infrastructure, and continuous investments in research & development activities on advanced feedstock processing technologies. Apart from this, growth in construction activities and high demand for coatings and polymers further induce growth of the market in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Birla Carbon (Continua 8000, Raven 5000 Ultra)

-

Cabot Corporation (BLACK PEARLS160, VULCAN XC-72)

-

Orion Engineered Carbons (Printex 30, NEROX 605)

-

Phillips Carbon Black Limited (PCBL) (Swanlac 120, Carbon Black N330)

-

Himadri Specialty Chemical Ltd. (Himablack 45, Hitech Carbon Black)

-

Continental Carbon (Continex N220, Continex N330)

-

Tokai Carbon Co., Ltd. (50 Carbon Black, 70 Carbon Black)

-

OMSK Carbon Group (Carbon Black P 803, Carbon Black P 705)

-

China Synthetic Rubber Corporation (CSRC) (N220 Carbon Black, N330 Carbon Black)

-

Mitsubishi Chemical Holdings Corporation (MA-100, MA-600)

-

Asahi Carbon Co., Ltd. (Asahi 60, Asahi 80)

-

Lion Specialty Chemicals Co., Ltd. (LSC-100, LSC-200)

-

Denka Company Limited (DENKA BLACK, DENKA BLACK HS)

-

Geotech International B.V. (GeoBlack N220, GeoBlack N330)

-

Klean Industries Inc. (KleanCarbon N550, KleanCarbon N660)

-

Black Bear Carbon B.V. (BBC 100, BBC 200)

-

Beilum Carbon Chemical Limited (Beilum N220, Beilum N330)

-

Jiangxi Black Cat Carbon Black Inc. (Black Cat N220, Black Cat N330)

-

Longxing Chemical (LX-50, LX-70)

-

Atlas Organic Pvt. Ltd. (Atlas N220, Atlas N330)

Recent Development:

-

In April 2023, Orion introduced cogeneration technology at its Ivanhoe plant in Louisiana, incorporating a steam turbine generator that harnesses waste steam from carbon black production to generate renewable electricity.

-

In March 2023, Tokai Carbon collaborated with Sekisui Chemical Co., Ltd. to enhance the practical use of Carbon Capture and Utilization (CCU) technology. This partnership aims to develop carbon-based products and materials designed for capturing and storing carbon dioxide (CO₂) in solid form.

| Report Attributes | Details |

| Market Size in 2023 | USD7.45 Billion |

| Market Size by 2032 | USD 10.84 Billion |

| CAGR | CAGR of 4.26 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Urea, Methylene Urea, Ammonium Nitrate, Ammonium Sulfate, Ammonia, Calcium Ammonium Nitrate, Others) • By Application (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Birla Carbon, Cabot Corporation, Orion Engineered Carbons, Phillips Carbon Black Limited (PCBL), Himadri Specialty Chemical Ltd., Continental Carbon, Tokai Carbon Co., Ltd., OMSK Carbon Group, China Synthetic Rubber Corporation (CSRC), Mitsubishi Chemical Holdings Corporation, Asahi Carbon Co., Ltd., Lion Specialty Chemicals Co., Ltd., Denka Company Limited, Geotech International B.V., Klean Industries Inc., Black Bear Carbon B.V., Beilum Carbon Chemical Limited, Jiangxi Black Cat Carbon Black Inc., Longxing Chemical, Atlas Organic Pvt. Ltd. |