The Car Rental Market Size was valued at USD 130.45 billion in 2023 and is expected to reach USD 311.63 billion by 2031 and grow at a CAGR of 11.5% over the forecast period 2024-2031.

The car rental industry is experiencing a rise due to the several factors. More people are traveling for business and leisure, creating a surge in demand. Child safety seats, navigation systems, mobile phones, entertainment systems, and portable Wi-Fi are some of the additional services and items that can be rented from the car rental facility in addition to the vehicle itself.

Get more information on Car Rental Market - Request Sample Report

The rise of the internet, particularly in developing countries, allows companies to reach a wider audience through convenient mobile apps. Technology is a key driver, with improved customer management systems and online booking streamlining the rental process. The global travel surge has also spurred car rental companies to expand their reach internationally, creating integrated systems to manage their geographically dispersed operations. Another trend impacting the industry is "bleisure travel," the merging of business trips with leisure activities. Companies are increasingly allowing employees to bring their families on business trips, particularly for international destinations, to boost employee retention and reduce stress. This "bleisure" concept caters to younger business travellers who value the opportunity to explore new locations while on work trips.

MARKET DYNAMICS:

KEY DRIVERS:

The car rental market is flourishing due to a surge in global travel for both business and leisure. A growing number of business trips, fueled by expanding industries, translates to more car rentals for work commutes. Increased disposable income also plays a role, as people have more resources to dedicate to personal travel and exploring new destinations. This rise in travel needs, coupled with growing spending power is propelling the car rental market forward.

RESTRAINTS:

The car rental industry can be susceptible to economic fluctuations. When economic downturns or recessions occur, consumer spending tends to become more cautious. Travel, which is often considered discretionary spending, can be one of the first areas where people cut back. This decrease in travel translates to a lower demand for car rentals. Companies on limited budgets may reduce business trips, and individuals might opt for staycations or more economical travel options that don't require car rentals. Thus, the car rental industry can experience a slowdown during economic hardships.

OPPORTUNITIES:

CHALLENGES:

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has significantly disrupted the car rental market globally. Reduced tourism is a major cause with 70% of drop in Eastern European tourism, leading to rapid decline in car rental demand and impacting regional companies' revenue. The war has exacerbated existing supply chain issues in the auto industry. Sanctions and logistical hurdles have limited car production and deliveries, making it harder for rental companies to acquire new vehicles. This shortage could inflate rental prices by up to 15% in some areas due to limited car availability. The conflict has also driven up insurance costs for car rentals in nearby countries due to heightened regional instability. This could deter travellers from renting cars, further decreasing demand. The war's impact on global oil prices has caused fuel cost volatility for car rentals. Companies may raise rental rates or implement fuel surcharges to offset these increased expenses.

IMPACT OF ECONOMIC SLOWDOWN

The Economic downturns can significantly disrupt the car rental market. Tightened consumer spending puts a damper on car rentals, often seen as less economical than using personal vehicles. This is especially true in regions with limited government incentives for rentals. There is a potential 5-10% of revenue decline during downturns. Businesses, a major source of demand, often cut back on discretionary spending like travel, leading to a potential reduction in business travel spending. Consumers, with limited budgets, may opt for staycations or cheaper travel options, further reducing car rental needs. Thus, economic sensitivity can make it difficult for rental companies to raise prices despite rising operational costs, potentially squeezing profit margins.

KEY MARKET SEGMENTS:

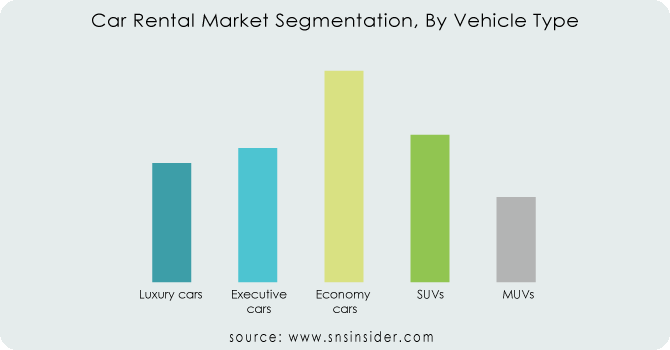

By Vehicle Type

Economy Cars is the dominating sub-segment in the Car Rental Market by vehicle type holding around 30-35% of market share due to their affordability. They are the favourite choice for budget-conscious travellers and for short-term rentals. This segment caters to a wider audience, making it the most in-demand category.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

Airport Transport is the dominating sub-segment in the Car Rental Market by application. Airport transport caters to arriving passengers seeking convenient onward journeys. Outstation rentals are popular for exploring destinations beyond the arrival city, often for leisure purposes. The dominance can vary depending on location and tourist activity.

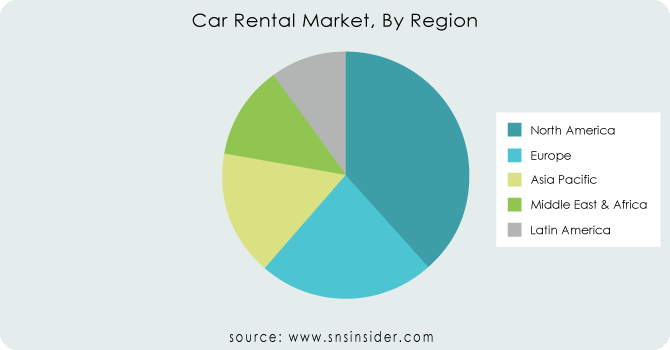

The North America is the dominating region in the car rental market, holding roughly 35% share. This dominance stems from a thriving tourism industry attracting millions of visitors annually. Strong economies in the US and Canada translate to higher disposable income, fueling leisure travel and car rental needs.

Europe is the second highest region in this market driven by its rich cultural heritage and diverse landscapes. These factors create a high demand for car rentals as tourists explore the continent. Major European cities like London and Paris act as global business hubs, attracting business travellers who frequently rely on car rentals.

The Asia Pacific is the fastest growing region in this market. This rapid growth is fueled by growing economies in countries like China and India, leading to a rise in disposable income and increased travel spending, with car rentals included.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

KEY PLAYERS

The major key players are Enterprise Holdings Inc, Uber Technologies, Inc., Avis Budget Group Inc, Hertz Global Holdings Inc, ANI Technologies Pvt. Ltd., Europcar, Carzonrent India Pvt Ltd, SIXT, Eco Rent a Car, Localiza and other key players.

In May 2023: Car Karlo, a new self-drive car rental service, launched in Pune, India. They aim to capture a share of the booming Indian market by offering an easy-to-use website and mobile app for booking rentals.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 130.45 Billion |

| Market Size by 2031 | US$ 311.63 Billion |

| CAGR | CAGR of 11.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Application (Local Usage, Airport Transport, Outstation, Others) • by Rental Duration (Short-term, Long-term) • by Vehicle Type (Luxury car, Executive car, Economical car, Sports utility vehicle (SUV), Multi-utility vehicle (MUV)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Enterprise Holdings Inc, Uber Technologies, Inc., Avis Budget Group Inc, Hertz Global Holdings Inc, ANI Technologies Pvt. Ltd., Europcar, Carzonrent India Pvt Ltd, SIXT, Eco Rent a Car, and Localiza |

| Key Drivers | • Consumers' increasing ability to spend their money and economies that are expanding steadily. • Renting a car is becoming more popular as millennials are less likely to possess a car than previous generations. |

| RESTRAINTS | • Rising gasoline and diesel prices in developing countries are expected to slow market growth. • The lack of awareness regarding car rental in these locations is the main setback in the business. |

Base Year: 2023

Forecast Period: 2024-2031

Historical Data: 2020-2022

Car Rental Market is growing at a CAGR of 11.5% From 2024 to 2031

Yes, As we are Publisher of this report, We can provide customized version of this report as per client's business requirement.

This report covers various segments like by Vehicle Type, by Rental Duration, by Application

Manufacturers, Consultants, Association, Research Institutes, private and university libraries, suppliers, and distributors of the product

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Car Rental Market Segmentation, By Vehicle Type

9.1 Introduction

9.2 Trend Analysis

9.3 Luxury cars

9.4 Executive cars

9.5 Economy cars

9.6 SUVs

9.7 MUVs

10. Car Rental Market Segmentation, By Application

10.1 Introduction

10.2 Trend Analysis

10.3 Local usage

10.4 Airport transport

10.5 Outstation

10.6 Others

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America Car Rental Market Segmentation, By Country

11.2.3 North America Car Rental Market Segmentation, By Vehicle Type

11.2.4 North America Car Rental Market Segmentation, By Application

11.2.5 USA

11.2.5.1 USA Car Rental Market Segmentation, By Vehicle Type

11.2.5.2 USA Car Rental Market Segmentation, By Application

11.2.6 Canada

11.2.6.1 Canada Car Rental Market Segmentation, By Vehicle Type

11.2.6.2 Canada Car Rental Market Segmentation, By Application

11.2.7 Mexico

11.2.7.1 Mexico Car Rental Market Segmentation, By Vehicle Type

11.2.7.2 Mexico Car Rental Market Segmentation, By Application

11.3 Europe

11.3.1 Trend Analysis

11.3.2 Eastern Europe

11.3.2.1 Eastern Europe Car Rental Market Segmentation, By Country

11.3.2.2 Eastern Europe Car Rental Market Segmentation, By Vehicle Type

11.3.2.3 Eastern Europe Car Rental Market Segmentation, By Application

11.3.2.4 Poland

11.3.2.4.1 Poland Car Rental Market Segmentation, By Vehicle Type

11.3.2.4.2 Poland Car Rental Market Segmentation, By Application

11.3.2.5 Romania

11.3.2.5.1 Romania Car Rental Market Segmentation, By Vehicle Type

11.3.2.5.2 Romania Car Rental Market Segmentation, By Application

11.3.2.6 Hungary

11.3.2.6.1 Hungary Car Rental Market Segmentation, By Vehicle Type

11.3.2.6.2 Hungary Car Rental Market Segmentation, By Application

11.3.2.7 Turkey

11.3.2.7.1 Turkey Car Rental Market Segmentation, By Vehicle Type

11.3.2.7.2 Turkey Car Rental Market Segmentation, By Application

11.3.2.8 Rest of Eastern Europe

11.3.2.8.1 Rest of Eastern Europe Car Rental Market Segmentation, By Vehicle Type

11.3.2.8.2 Rest of Eastern Europe Car Rental Market Segmentation, By Application

11.3.3 Western Europe

11.3.3.1 Western Europe Car Rental Market Segmentation, By Country

11.3.3.2 Western Europe Car Rental Market Segmentation, By Vehicle Type

11.3.3.3 Western Europe Car Rental Market Segmentation, By Application

11.3.3.4 Germany

11.3.3.4.1 Germany Car Rental Market Segmentation, By Vehicle Type

11.3.3.4.2 Germany Car Rental Market Segmentation, By Application

11.3.3.5 France

11.3.3.5.1 France Car Rental Market Segmentation, By Vehicle Type

11.3.3.5.2 France Car Rental Market Segmentation, By Application

11.3.3.6 UK

11.3.3.6.1 UK Car Rental Market Segmentation, By Vehicle Type

11.3.3.6.2 UK Car Rental Market Segmentation, By Application

11.3.3.7 Italy

11.3.3.7.1 Italy Car Rental Market Segmentation, By Vehicle Type

11.3.3.7.2 Italy Car Rental Market Segmentation, By Application

11.3.3.8 Spain

11.3.3.8.1 Spain Car Rental Market Segmentation, By Vehicle Type

11.3.3.8.2 Spain Car Rental Market Segmentation, By Application

11.3.3.9 Netherlands

11.3.3.9.1 Netherlands Car Rental Market Segmentation, By Vehicle Type

11.3.3.9.2 Netherlands Car Rental Market Segmentation, By Application

11.3.3.10 Switzerland

11.3.3.10.1 Switzerland Car Rental Market Segmentation, By Vehicle Type

11.3.3.10.2 Switzerland Car Rental Market Segmentation, By Application

11.3.3.11 Austria

11.3.3.11.1 Austria Car Rental Market Segmentation, By Vehicle Type

11.3.3.11.2 Austria Car Rental Market Segmentation, By Application

11.3.3.12 Rest of Western Europe

11.3.3.12.1 Rest of Western Europe Car Rental Market Segmentation, By Vehicle Type

11.3.2.12.2 Rest of Western Europe Car Rental Market Segmentation, By Application

11.4 Asia-Pacific

11.4.1 Trend Analysis

11.4.2 Asia Pacific Car Rental Market Segmentation, By Country

11.4.3 Asia Pacific Car Rental Market Segmentation, By Vehicle Type

11.4.4 Asia Pacific Car Rental Market Segmentation, By Application

11.4.5 China

11.4.5.1 China Car Rental Market Segmentation, By Vehicle Type

11.4.5.2 China Car Rental Market Segmentation, By Application

11.4.6 India

11.4.6.1 India Car Rental Market Segmentation, By Vehicle Type

11.4.6.2 India Car Rental Market Segmentation, By Application

11.4.7 Japan

11.4.7.1 Japan Car Rental Market Segmentation, By Vehicle Type

11.4.7.2 Japan Car Rental Market Segmentation, By Application

11.4.8 South Korea

11.4.8.1 South Korea Car Rental Market Segmentation, By Vehicle Type

11.4.8.2 South Korea Car Rental Market Segmentation, By Application

11.4.9 Vietnam

11.4.9.1 Vietnam Car Rental Market Segmentation, By Vehicle Type

11.4.9.2 Vietnam Car Rental Market Segmentation, By Application

11.4.10 Singapore

11.4.10.1 Singapore Car Rental Market Segmentation, By Vehicle Type

11.4.10.2 Singapore Car Rental Market Segmentation, By Application

11.4.11 Australia

11.4.11.1 Australia Car Rental Market Segmentation, By Vehicle Type

11.4.11.2 Australia Car Rental Market Segmentation, By Application

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Car Rental Market Segmentation, By Vehicle Type

11.4.12.2 Rest of Asia-Pacific Car Rental Market Segmentation, By Application

11.5 Middle East & Africa

11.5.1 Trend Analysis

11.5.2 Middle East

11.5.2.1 Middle East Car Rental Market Segmentation, By Country

11.5.2.2 Middle East Car Rental Market Segmentation, By Vehicle Type

11.5.2.3 Middle East Car Rental Market Segmentation, By Application

11.5.2.4 UAE

11.5.2.4.1 UAE Car Rental Market Segmentation, By Vehicle Type

11.5.2.4.2 UAE Car Rental Market Segmentation, By Application

11.5.2.5 Egypt

11.5.2.5.1 Egypt Car Rental Market Segmentation, By Vehicle Type

11.5.2.5.2 Egypt Car Rental Market Segmentation, By Application

11.5.2.6 Saudi Arabia

11.5.2.6.1 Saudi Arabia Car Rental Market Segmentation, By Vehicle Type

11.5.2.6.2 Saudi Arabia Car Rental Market Segmentation, By Application

11.5.2.7 Qatar

11.5.2.7.1 Qatar Car Rental Market Segmentation, By Vehicle Type

11.5.2.7.2 Qatar Car Rental Market Segmentation, By Application

11.5.2.8 Rest of Middle East

11.5.2.8.1 Rest of Middle East Car Rental Market Segmentation, By Vehicle Type

11.5.2.8.2 Rest of Middle East Car Rental Market Segmentation, By Application

11.5.3 Africa

11.5.3.1 Africa Car Rental Market Segmentation, By Country

11.5.3.2 Africa Car Rental Market Segmentation, By Vehicle Type

11.5.3.3 Africa Car Rental Market Segmentation, By Application

11.5.3.4 Nigeria

11.5.3.4.1 Nigeria Car Rental Market Segmentation, By Vehicle Type

11.5.3.4.2 Nigeria Car Rental Market Segmentation, By Application

11.5.3.5 South Africa

11.5.3.5.1 South Africa Car Rental Market Segmentation, By Vehicle Type

11.5.3.5.2 South Africa Car Rental Market Segmentation, By Application

11.5.3.6 Rest of Africa

11.5.3.6.1 Rest of Africa Car Rental Market Segmentation, By Vehicle Type

11.5.3.6.2 Rest of Africa Car Rental Market Segmentation, By Application

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America Car Rental Market Segmentation, By Country

11.6.3 Latin America Car Rental Market Segmentation, By Vehicle Type

11.6.4 Latin America Car Rental Market Segmentation, By Application

11.6.5 Brazil

11.6.5.1 Brazil Car Rental Market Segmentation, By Vehicle Type

11.6.5.2 Brazil Car Rental Market Segmentation, By Application

11.6.6 Argentina

11.6.6.1 Argentina Car Rental Market Segmentation, By Vehicle Type

11.6.6.2 Argentina Car Rental Market Segmentation, By Application

11.6.7 Colombia

11.6.7.1 Colombia Car Rental Market Segmentation, By Vehicle Type

11.6.7.2 Colombia Car Rental Market Segmentation, By Application

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Car Rental Market Segmentation, By Vehicle Type

11.6.8.2 Rest of Latin America Car Rental Market Segmentation, By Application

12. Company Profiles

12.1 Enterprise Holdings Inc

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Uber Technologies, Inc.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Avis Budget Group Inc

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Hertz Global Holdings Inc

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 ANI Technologies Pvt. Ltd.

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Europcar

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Carzonrent India Pvt Ltd

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 SIXT

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 Eco Rent a Car

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Localiza

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. USE Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Mobility as a Service Market Size was USD 402.46 billion in 2023 and will reach to USD 2613.7 bn by 2032 with a CAGR of 23.12 % by 2024-2032.

The Automotive Pressure Plates Market Size was valued at USD 27.60 billion in 2023 and is expected to reach USD 38.33 billion by 2031 and grow at a CAGR of 4.1% over the forecast period 2024-2031.

The Autonomous Trucks Market size is expected to reach USD 66.50 Bn by 2030, the market was valued at USD 29.80 Bn in 2022 and will grow at a CAGR of 10.6% over the forecast period of 2023-2030.

The Automotive Intelligence Park Assist System Market size was valued at USD 10.93 billion in 2023 and is expected to reach USD 25.12 billion by 2031 and grow at a CAGR of 11.05% over the forecast period 2024-2031.

The Automotive Chip Market Size was valued at USD 38.82 billion in 2023 and is expected to reach USD 92.49 billion by 2031 and grow at a CAGR of 11.87% over the forecast period 2024-2031.

The Autonomous Emergency Braking System Market Size was $36.75 billion in 2023 & will hit $236.81 billion by 2032 & grow at a CAGR of 23% by 2024-2032

Hi! Click one of our member below to chat on Phone