To get more information on Car Manufacturing Market - Request Sample Report

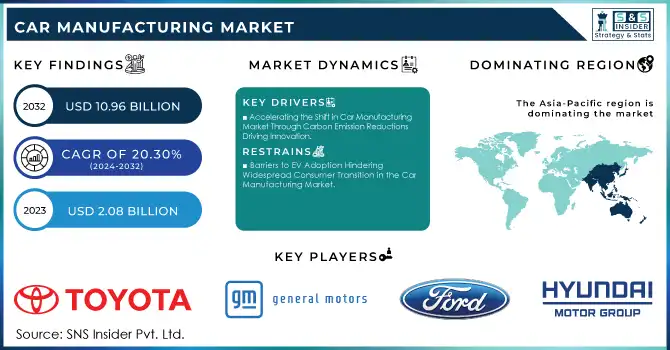

The Car Manufacturing Market Size was valued at USD 2.08 Billion in 2023 and is expected to reach USD 10.96 Billion by 2032 and grow at a CAGR of 20.30 % over the forecast period 2024-2032.

The rise in electric vehicle (EV) adoption is significantly transforming the car manufacturing market. Governments worldwide are enacting policies to reduce emissions, offering incentives, and providing funding to enhance EV infrastructure, which is accelerating the shift from traditional combustion engine vehicles. Technological advancements in battery efficiency and the expansion of charging networks have made EVs more accessible, further driving consumer interest. Major automakers are increasing investments in EV production, creating joint ventures to expand manufacturing capacities. This shift is supported by growing demand for fuel-efficient, environmentally friendly cars. By 2032, EVs are expected to dominate global car production, outpacing traditional vehicles.

The car manufacturing market's growth is fueled by manufacturers’ focus on EV production, battery manufacturing, and infrastructure development. As consumers increasingly prioritize environmentally friendly options, the market for EVs is expanding, with companies like Rivian and Volkswagen leading the way with new models and innovations. Additionally, improved vehicle range, lower long-term maintenance costs, and falling battery prices are encouraging more drivers to make the transition. Government programs, such as tax incentives and zero-emission vehicle mandates, are also bolstering the demand for EVs. Over the next decade, the employment demand in sectors related to EV design, development, and battery manufacturing is projected to grow significantly, supporting the overall market expansion. By 2032, the electric vehicle market is set to overtake traditional vehicle production, with continued growth driven by advances in technology and supportive government policies. Driven by technological advances and government incentives. Policies like the Inflation Reduction Act, which extends USD 7,500 tax credits for new EVs, and the Infrastructure Investment and Jobs Act, which allocates USD 7.5 billion for charging infrastructure, are accelerating EV adoption. Battery improvements, such as a 234-mile average range in 2021 (up from 68 miles in 2011), and lower maintenance costs, are also attracting consumers. As EV production grows, sectors like software development, expected to see 26% employment growth by 2032, are crucial to supporting this transformation.

Drivers

Accelerating the Shift in Car Manufacturing Market Through Carbon Emission Reductions Driving Innovation

The automotive industry is experiencing a significant transformation as the drive for reduced carbon emissions becomes a dominant force in shaping the future of car manufacturing. With the U.S. EPA reporting that transportation accounts for 27% of greenhouse gas emissions—57% of which come from passenger cars—automakers are focusing heavily on electric and hybrid vehicles (EVs) to meet net-zero targets. Key players like Ford and Toyota are leading the charge, setting aggressive decarbonization goals and adopting sustainable manufacturing practices such as renewable energy-powered production lines. Governments are backing these efforts with supportive regulations; for example, the Biden Administration aims for half of all new U.S. vehicle sales to be zero-emissions vehicles by 2030, and California has mandated that all new vehicles sold in the state must be ZEVs by 2035. As automakers invest in cleaner technologies, including battery innovations and sustainable materials, the market is witnessing accelerated growth in EV production. By focusing on reducing material emissions, especially through increased recycling and the use of green electricity, automakers can cut emissions from production by up to 66% by 2030, while also driving the shift toward electric vehicles. This push toward a cleaner, greener automotive industry is reshaping the market, creating new opportunities in sustainable mobility, and leading the way to a net-zero future.

Restraints

Barriers to EV Adoption Hindering Widespread Consumer Transition in the Car Manufacturing Market

A key restraint in the car manufacturing market is consumer adoption of electric vehicles (EVs). Despite growing interest in EVs, barriers like range anxiety and insufficient charging infrastructure continue to hinder widespread adoption. A significant challenge is the higher initial cost of EVs compared to traditional vehicles, which deters many potential buyers. In the U.S., 67% of consumers still prefer gasoline or diesel engines for their next vehicle, with only 21% considering a hybrid electric engine and less than 10% opting for full battery-electric models. In China, consumer preferences show a similar trend, with 33% favoring gasoline or diesel engines, while another 33% opt for battery electric vehicles. While 1.4 million EVs were registered in the U.S. in 2023, a 40% increase from 2022, this represents only a small portion of the overall automotive market. The global EV adoption rate remains well below expectations, with the market still struggling to meet targets due to affordability issues and the slow build-up of charging infrastructure. Although government incentives help ease the transition, the persistent gap in affordability and infrastructure limits the pace at which EVs can become mainstream. Until these issues are addressed, consumer adoption will remain a significant restraint, limiting the full potential of the electric vehicle market.

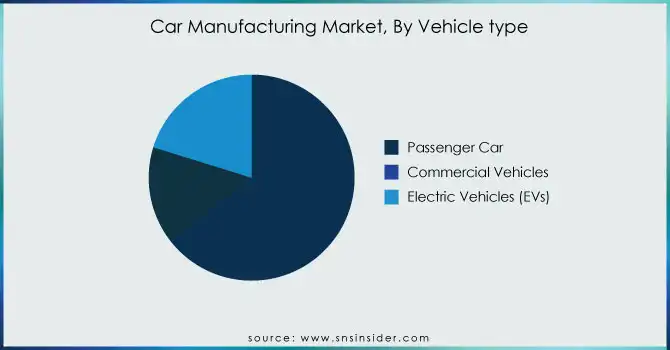

By Vehicle Type

In 2023, the passenger car segment dominated the car manufacturing market, capturing approximately 65% of the total revenue. This can be attributed to the high consumer demand for personal mobility, fuel efficiency, and the growing adoption of advanced technologies in these vehicles. Passenger cars continue to be the primary mode of transportation worldwide due to their versatility, affordability, and comfort. The increasing interest in electric vehicles (EVs) also plays a significant role, with more automakers focusing on electric and hybrid passenger cars to cater to the demand for environmentally friendly transportation. Additionally, the rise of connected and autonomous car technologies is further propelling the growth of this segment, making it a crucial driver in the car manufacturing industry.

By Mode of Operation

In 2023, automatic transmission vehicles accounted for the largest revenue share of approximately 56% in the car manufacturing market. This dominance reflects the growing consumer preference for convenience, ease of use, and improved driving comfort that automatic transmissions offer. Automatic cars are increasingly popular in urban environments where stop-and-go traffic makes manual gear shifting cumbersome. Additionally, advancements in transmission technology, such as continuously variable transmissions (CVTs) and dual-clutch systems, have enhanced fuel efficiency and driving performance, further contributing to the popularity of automatic vehicles. The rising demand for automatic cars aligns with global automotive trends, emphasizing comfort and efficiency.

In 2023, the Asia-Pacific region dominated the global car manufacturing market, capturing around 45% of total revenue. This dominance is largely attributed to key automotive players like China, Japan, and India. China stands as the largest producer and consumer of cars, driven by its rapid industrialization and rising middle class. Japan continues to lead in automotive technology, producing innovative and high-quality vehicles. India, with its growing urban population and increasing vehicle demand, plays an essential role in the region’s growth. The region benefits from cost-effective manufacturing, a competitive export market, and substantial government support for the automotive industry. These factors collectively reinforce Asia-Pacific's position as the global leader in car production.

In 2023, North America emerged as the fastest-growing region in the car manufacturing market, driven by a combination of technological advancements, strong consumer demand, and strategic investments in electric vehicle (EV) production. The U.S., as a major automotive hub, is seeing a surge in EV adoption, fueled by government incentives, expanding infrastructure, and increasing consumer interest in sustainable vehicles. The region also benefits from a robust supply chain, innovation in manufacturing processes, and a shift towards automation in production. This acceleration in manufacturing and growing market demand positions North America as the fastest-growing region in the car manufacturing market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in the Car Manufacturing Market with their products:

Toyota Motor Corporation (Toyota Corolla, Prius, RAV4)

Volkswagen Group (Volkswagen Golf, Audi A4, Porsche Cayenne)

General Motors (Chevrolet Silverado, Cadillac Escalade, GMC Sierra)

Ford Motor Company (Ford F-150, Mustang, Explorer)

Tesla Inc. (Model 3, Model Y, Cybertruck)

Hyundai Motor Group (Hyundai Tucson, Kia Seltos, Genesis G70)

BMW Group (BMW 3 Series, X5, Mini Cooper)

Daimler AG (Mercedes-Benz C-Class, GLE, Smart Fortwo)

Honda Motor Company (Honda Civic, CR-V, Accord)

Stellantis N.V. (Jeep Wrangler, Ram 1500, Peugeot 208)

Nissan Motor Corporation (Nissan Rogue, Leaf, Altima)

Renault Group (Renault Clio, Captur, Dacia Duster)

Suzuki Motor Corporation (Suzuki Swift, Vitara, Jimny)

Subaru Corporation (Subaru Outback, Forester, Impreza)

Tata Motors (Tata Nexon, Safari, Jaguar F-Type)

Geely Holding Group (Volvo XC90, Polestar 2, Lynk & Co 01)

BYD Auto (BYD Han EV, Tang EV, Dolphin)

Mazda Motor Corporation (Mazda CX-5, Mazda3, MX-5 Miata)

Mitsubishi Motors (Mitsubishi Outlander, Pajero Sport, Eclipse Cross)

Ferrari N.V. (Ferrari 488, SF90 Stradale, Purosangue)

List of key raw material and component suppliers for the car manufacturing industry:

ArcelorMittal (Steel, Aluminum)

Nippon Steel Corporation (Steel, Automotive Steel Sheets)

China Steel Corporation (Steel, Steel Plates)

Alcoa Corporation (Aluminum, Aluminum Products)

Rio Tinto Group (Iron Ore, Aluminum, Copper)

BASF SE (Chemicals, Plastics, Coatings)

Covestro AG (Plastics, Polyurethanes)

Sumitomo Chemical Co., Ltd. (Plastics, Chemicals)

Saint-Gobain (Glass, Plastics)

The Dow Chemical Company (Polymer Materials, Adhesives)

Component Suppliers:

Bosch Group (Automotive Components, Sensors, Electrical Systems)

Denso Corporation (Automotive Components, Electrical and Thermal Systems)

Magna International Inc. (Chassis, Body, Mirrors, Lighting Systems)

ZF Friedrichshafen AG (Transmission Systems, Steering, Safety Systems)

Continental AG (Tires, Brakes, Sensors, Electronic Components)

Aptiv PLC (Automotive Electronics, Wiring Systems)

Valeo S.A. (Lighting Systems, Wiper Systems, Thermal Systems)

Lear Corporation (Seating, Electrical Components, Interior Systems)

Faurecia (Exhaust Systems, Interior Components, Emissions Control)

Schaeffler Group (Bearings, Transmission Components, Automotive Parts)

November 26, 2024: BMW has advanced its car manufacturing process with the introduction of Automated Driving In-Plant (AFW) technology. Currently implemented at its Dingolfing plant in Germany, the technology allows vehicles like the 5 Series and 7 Series to drive themselves off the assembly line. This innovative development aims to enhance manufacturing efficiency and precision, marking a significant step in the automotive industry's shift toward automation.

manufacturing facility in Tamil Nadu. The state-of-the-art, greenfield plant will produce next-generation vehicles using 100% renewable energy. Tata Motors plans to invest approximately INR 9,000 crores, creating over 5,000 jobs. The plant will have an annual production capacity of 250,000 vehicles, with production ramping up over the next 5-7 years to serve both Indian and global

November 21, 2024: Mitsubishi Corporation has invested USD 25 million in Ample, a provider of battery swapping solutions for electric vehicles. The investment aims to accelerate the deployment of sustainable energy solutions and enhance Ample’s technology. CEO Khaled Hassounah expressed excitement about the collaboration, noting Mitsubishi’s expertise will play a crucial role in scaling the company’s infrastructure.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.08 Billion |

| Market Size by 2032 | USD 10.96 Billion |

| CAGR | CAGR of 20.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger car, Commercial vehicles, Electric vehicles (EVs)) • By Fuel Type (Petrol, Diesel, electric/hybrid vehicles) • By Mode of Operation( Automatic, Semi-Automatic) • By material (Steel, Aluminium, Composite) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Toyota, Volkswagen, General Motors, Ford, Tesla, Hyundai, BMW, Daimler, Honda, Stellantis, Nissan, Renault, Suzuki, Subaru, Tata Motors, Geely, BYD, Mazda, Mitsubishi, and Ferrari are key automotive manufacturers producing a range of popular models such as the Toyota Corolla, Volkswagen Golf, Chevrolet Silverado, Ford F-150, Tesla Model 3, Hyundai Tucson, BMW 3 Series, Mercedes-Benz C-Class, Honda Civic, Jeep Wrangler, Nissan Rogue, Renault Clio, Suzuki Swift, Tata Nexon, Polestar 2, BYD Han EV, Mazda CX-5, Mitsubishi Outlander, and Ferrari 488. |

| Key Drivers | • Accelerating the Shift in Car Manufacturing Market Through Carbon Emission Reductions Driving Innovation |

| Restraints | • Barriers to EV Adoption Hindering Widespread Consumer Transition in the Car Manufacturing Market |

Ans: Car Manufacturing Market is anticipated to expand by 20.30 % from 2024 to 2032.

Ans: The Car Manufacturing Market Size was valued at USD 2.08 Billion in 2023, and is expected to reach USD 10.96 Billion by 2032.

Ans: The shift toward electric and hybrid vehicles, driven by emissions regulations and consumer demand for sustainability, is the primary market driver for the car manufacturing industry.

Ans: Asia-Pacific is dominating in Car Manufacturing Market in 2023

Ans: Passenger car is the dominating segment in Car Manufacturing market

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Types Produced

5.2 Fuel Type Distribution

5.3 Average Vehicle Price

5.4 Export/Import Data

5.5 R&D Investment

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Car Manufacturing Market Segmentation, by Vehicle Type

7.1 Chapter Overview

7.2 Passenger car

7.2.1 Passenger car Market Trends Analysis (2020-2032)

7.2.2 Passenger car Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Commercial Vehicles

7.3.1 Commercial Vehicles Market Trends Analysis (2020-2032)

7.3.2 Commercial Vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Electric Vehicles (EVs)

7.4.1 Electric Vehicles (EVs) Market Trends Analysis (2020-2032)

7.4.2 Electric Vehicles (EVs) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Vehicle Type 4

7.5.1 Vehicle Type 4 Market Trends Analysis (2020-2032)

7.5.2 Vehicle Type 4 Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Vehicle Type 5

7.6.1 Vehicle Type 5 Market Trends Analysis (2020-2032)

7.6.2 Vehicle Type 5 Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Car Manufacturing Market Segmentation, by Fuel Type

8.1 Chapter Overview

8.2 Petrol

8.2.1 Petrol Market Trends Analysis (2020-2032)

8.2.2 Petrol Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Diesel

8.3.1 Diesel Market Trends Analysis (2020-2032)

8.3.2 Diesel Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Electric/Hybrid vehicles

8.4.1 Electric/Hybrid vehicles Market Trends Analysis (2020-2032)

8.4.2 Electric/Hybrid vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Fuel Type 4

8.5.1 Fuel Type 4 Market Trends Analysis (2020-2032)

8.5.2 Fuel Type 4 Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Fuel Type 5

8.6.1 Fuel Type 5 Market Trends Analysis (2020-2032)

8.6.2 Fuel Type 5 Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Car Manufacturing Market Segmentation, by Mode of Operation

9.1 Chapter Overview

9.2 Automatic

9.2.1 Automatic Market Trends Analysis (2020-2032)

9.2.2 Automatic Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Semi-Automatic

9.3.1 Semi-Automatic Market Trends Analysis (2020-2032)

9.3.2 Semi-Automatic Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Car Manufacturing Market Segmentation, by Material

10.1 Chapter Overview

10.2 Steel

10.2.1 Steel Market Trends Analysis (2020-2032)

10.2.2 Steel Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Aluminium

10.3.1 Aluminium Market Trends Analysis (2020-2032)

10.3.2 Aluminium Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Composite

10.4.1 Composite Market Trends Analysis (2020-2032)

10.4.2 Composite Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Car Manufacturing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.2.4 North America Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.2.5 North America Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.2.6 North America Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.2.7.2 USA Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.2.7.3 USA Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.2.7.4 USA Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.2.8.2 Canada Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.2.8.3 Canada Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.2.8.4 Canada Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.2.9.3 Mexico Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.2.9.4 Mexico Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Car Manufacturing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.1.7.3 Poland Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.1.7.4 Poland Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.1.8.3 Romania Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.1.8.4 Romania Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Car Manufacturing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.2.5 Western Europe Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.2.6 Western Europe Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.2.7.3 Germany Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.2.7.4 Germany Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.2.8.2 France Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.2.8.3 France Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.2.8.4 France Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.2.9.3 UK Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.2.9.4 UK Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.2.10.3 Italy Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.2.10.4 Italy Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.2.11.3 Spain Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.2.11.4 Spain Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.2.14.3 Austria Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.2.14.4 Austria Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.4 Asia-Pacific

11.4.1 Trends Analysis

11.4.2 Asia-Pacific Car Manufacturing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia-Pacific Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.4.4 Asia-Pacific Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.4.5 Asia-Pacific Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.4.6 Asia-Pacific Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.4.7.2 China Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.4.7.3 China Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.4.7.4 China Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.4.8.2 India Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.4.8.3 India Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.4.8.4 India Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.4.9.2 Japan Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.4.9.3 Japan Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.4.9.4 Japan Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.4.10.3 South Korea Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.4.10.4 South Korea Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.4.11.3 Vietnam Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.4.11.4 Vietnam Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.4.12.3 Singapore Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.4.12.4 Singapore Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.4.13.2 Australia Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.4.13.3 Australia Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.4.13.4 Australia Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia-Pacific Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia-Pacific Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia-Pacific Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Car Manufacturing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.5.1.5 Middle East Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.5.1.6 Middle East Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.5.1.7.3 UAE Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.5.1.7.4 UAE Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Car Manufacturing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.5.2.4 Africa Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.5.2.5 Africa Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.5.2.6 Africa Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Car Manufacturing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.6.4 Latin America Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.6.5 Latin America Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.6.6 Latin America Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.6.7.3 Brazil Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.6.7.4 Brazil Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.6.8.3 Argentina Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.6.8.4 Argentina Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.6.9.3 Colombia Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.6.9.4 Colombia Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Car Manufacturing Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Car Manufacturing Market Estimates and Forecasts, by Fuel Type (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Car Manufacturing Market Estimates and Forecasts, by Mode of Operation (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Car Manufacturing Market Estimates and Forecasts, by Material (2020-2032) (USD Billion)

12. Company Profiles

12.1 Toyota Motor Corporation

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Volkswagen Group

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 General Motors

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Ford Motor Company

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Tesla Inc.

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Hyundai Motor Group

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 BMW Group

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Daimler AG

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Honda Motor Company

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Stellantis N.V.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Vehicle Type

Passenger car

Commercial vehicles

Electric vehicles (EVs)

By Fuel Type

Petrol

Diesel

Electric/hybrid vehicles

By Mode of Operation

Automatic

Semi-Automatic

By material

Steel

Aluminium

Composite

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The EV Composites Market size is projected to reach USD 6.45 billion by 2032, was valued at USD 1.8 billion in 2023 and will grow at a CAGR of 17.3% over the forecast period.

The Automotive Acoustic Engineering Services Market Size was valued at USD 3.75 billion in 2023 and is expected to reach USD 7.43 billion by 2032 and grow at a CAGR of 7.9% over the forecast period 2024-2032.

The Electric Scooter Battery Market Size was valued at USD 3.38 billion in 2023 and is expected to reach USD 15.56 billion by 2031 and grow at a CAGR of 21% over the forecast period 2024-2031.

Automotive Gear Shift System Market size was valued at USD 14.11 billion in 2023 and is expected to reach USD 26.71 billion by 2031 and grow at a CAGR of 8.71% over the forecast period 2024-2031.

The Electric Vehicle Market size was estimated USD 491.7 billion in 2023 and is expected to reach USD 1570.12 billion by 2032 at a CAGR of 12.34% during the forecast period of 2024-2032.

The Automotive Conformal Coatings Market was valued USD 2.69 billion by 2032, and will reach USD 1.35 Bn by 2023, and Growing at a CAGR 7.23% by 2024-2032

Hi! Click one of our member below to chat on Phone