Caps & Closures Market Key Insights:

Get More Information on Caps & Closures Market - Request Sample Report

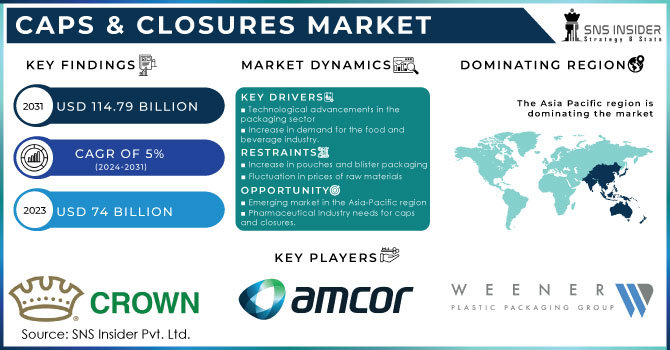

The Caps & Closures Market size was valued at USD 74 billion in 2023 and is expected to reach USD 114.79 billion by 2032 with a growing CAGR of 5% over the forecast period of 2024-2032.

The Caps & Closure market is involved in the production as well as supply of caps and closures-related packaging solutions to various types of industries such as pharmaceuticals, food industry, alcohol packaging, and beer industry. Caps and closures are protective barriers to stop getting products exposed to direct sunlight, air, and water which can damage the product. Plastic is the major raw material used in caps & closures followed by metal, glass, rubber, and many other materials.

There is high demand for caps and closures in the food and beverage industry as there is a high risk of products getting damaged. People’s awareness about healthy lifestyles is also rising the demand for this industry. A wide range of caps and closures is available based on types and safety such as screw caps and pump closures.

There is high competition in this market from MNCs to small manufacturers. In the pharmaceutical industry, the need for caps and closures packaging is high for public health and safety.

Overall, the caps & closure market is vast and is growing its demand in upcoming years, due to the high need for end-use industries.

MARKET DYNAMICS

KEY DRIVERS:

-

Technological advancements in the packaging sector

This is the major driver for the caps & closure market. Investment in technology and research and development has allowed companies to innovate new products and not stick to traditional ways of packaging products. Innovation also attracts the consumer market, as the market is always in demand for new products. Research and development have brought up products that are more beneficial in regard to safety, and shelf life and are reusable. Thus, rapid technological innovation is a key driver for the growth of the caps & closure market.

-

Increase in demand for the food and beverage industry.

RESTRAIN:

-

Increase in pouches and blister packaging

Substitutes products available in the market for caps and closure is major restrain. Pouches and blister packaging have many benefits to manufacturers. They reduce the cost of production. FMCG companies opt for pouch packaging because it causes convenience to customers.

-

Fluctuation in prices of raw materials

OPPORTUNITY:

-

Emerging market in the Asia-Pacific region

Asia-Pacific region is likely to grow the market for caps & closures due to an increase in the food and beverage industry. In terms of value market for caps and closure is also high. Packaged drinking water need is also high in the APAC region. There is also an emerging market for the e-commerce sector which will be in high demand for caps and closures required for the packaging of products and delivery.

-

Pharmaceutical Industry needs for caps and closures.

CHALLENGES:

-

Recycling Challenges

Sustainability is also a major challenge to this market. Making sustainable products that can give the same performance is difficult for this market. This will require huge investments in technology and research which is adding more cost to the manufacturing industry for this market. Recycling various materials used to prepare caps and closures is also difficult. Waste materials needed to be segregated before recycling which is a complex process.

-

Government rules and regulations

IMPACT OF ONGOING RECESSION

During the recession period, the demand for caps and closure market decreased as the consumer buying behaviour changed, consumer tends not to waste money in buying products that can affect their income. Hence food and beverage industry show a decline and a result of which caps and closure market also show a decline. As a result of the recession, there are low sales and low revenue generated.

In the recession, there is a delay in research and innovation, which will stop the development of new caps and closure products, hence overall growth of the market is affected.

IMPACT OF COVID-19

The global Gable Top Caps and Closure market has been significantly impacted by the COVID-19 pandemic, with many businesses now having to contend with supply chain issues, decreased demand, and financial constraints. However, it is projected that the industry would gradually recover as countries loosen their prohibitions on shutdowns and enterprises resume operations. The market for Gable Top Caps and Closure is expected to grow in the approaching years as a consequence of the developing e-commerce and digital marketing trends. The use of cutting-edge technologies like artificial intelligence and machine learning, as well as the expanding popularity of cloud-based solutions, are other factors that are expected to contribute to the market's continued growth.

KEY MARKET SEGMENTS

By Raw Material

-

Plastic

-

Metal

-

Others

By Product type

-

Roll-On Balls

-

Plastic Caps

-

Closures

-

Other Caps

By End Use

-

Food

-

Pharmaceutical

-

Cosmetics

-

Beverage

-

Automotive

-

Packaged Water Bottle

-

Others

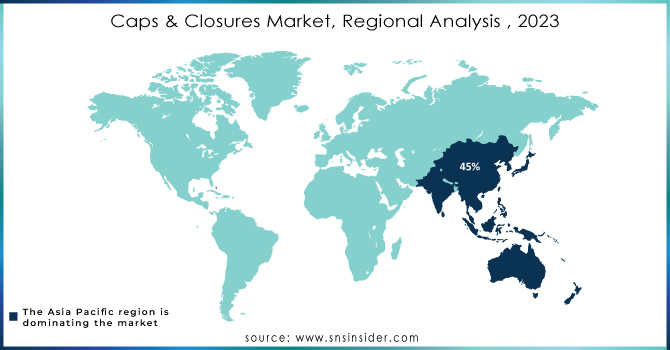

REGIONAL ANALYSIS

Asia Pacific region will be the largest growing market for caps and closures with the market share of 45%. The market in developing countries such as India will grow at the fastest CAGR during forecast period. The demand for food and beverage in populous countries like India and China, is driving the market. In countries like Japan and Korea, the demand for cosmetic products packaging and hygienic products is increasing which is growing the market for caps and closures.

North American region is the second largest emerging market for caps and closures due to increased beverage consumption.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin American

Key Players:

Some of the major players in the Caps & Closures Market are Crown Holding Inc, Amcor Plc, Nippon Closures Co Ltd, Weener Plastics, Secure Industries Private Limited, UNITED CAPS, Guala Closures S.p.A, Aptar Group, Berry Global Inc, Samhwa Crown & Closure, and other players.

| Report Attributes | Details |

| Market Size in 2023 | US$ 73 Bn |

| Market Size by 2032 | US$ 114.79 Bn |

| CAGR | CAGR of 5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw material (Plastic, Metal, Others) • By Product Type (Roll-On Balls, Plastic Caps, Closures, Other Caps) • By End Use (Food, Pharmaceutical, Cosmetics, Beverage, Automotive, Packaged Water Bootle, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Crown Holding Inc, Amcor Plc, Nippon Closures Co Ltd, Weener Plastics, Secure Industries Private Limited, UNITED CAPS, Guala Closures S.p.A, Aptar Group, Berry Global Inc, Samhwa Crown & Closure |

| Key Drivers | • Technological advancements in the packaging sector |

| Market Opportunities | • High market in the Asia-Pacific region |