Get More Information on Capability Centers Market - Request Sample Report

The Capability Centers Market size is projected to reach USD 453.94 billion by 2032 and was valued at USD 128.55 billion in 2023. The estimated CAGR is 13.51% for 2024-2032.

The rising need for cost optimization is the major key driver, where companies can save 30% to 50% with the help of GCCs in strategic locations such as India and Eastern Europe. Another key driver is the intensification of the pursuit of digital transformation; nearly 65% of enterprises use GCCs for more advanced capabilities, such as AI, data analytics, and cloud computing. Increasing the demand for global business services is further emphasized by the fact that 40% of GCCs now support multi-functional services across finance, IT, and human resources. Availability of talent and skills development is also important, as 70% of organizations choose locations based on the skilled labor pool available to enhance operational efficiency. Another critical area which is emphasized upon relates to the impetus of innovation: 55% of GCCs use innovation-driven projects in order to create better products and experience for customers. Cybersecurity and regulatory compliance are emerging as significant demands, with 45% of GCCs contributing to risk management and governance initiatives. These, along with the rising trend toward remote and hybrid working models, are pushing up the potential for GCCs as businesses follow resilient and scalable operational models to stay relevant in a globalized market.

It help the companies to achieve a stronger presence in local markets, hence service their customers better.

Global Capability Centers, GCCs, become an integral means of supporting the establishment of greater presence for companies in local markets, that is with improved customer service and operational efficiency. Localization of services enables companies to offer services that can best portray and cater for regional needs and, hence, garner customer satisfaction of about 30% higher than other studies have reported from industry surveys. Local solutions of companies directly arrive to understand cultural preferences and the dynamics of the market. It helps in improving customer loyalty by up to 25%.

Also, businesses consolidate back-office operations through GCCs, reducing the overall cost of operations by 20%. This helps in streamlining and automating processes with GCCs, which can involve sophisticated analytics, providing a 35% increase in process efficiency. In addition to these factors, GCCs ensure quicker response time, with a 40% reduction in delivery time of service, and decrease the inconvenience for the customer. Local talent pools also become an attribute to the success of GCCs as more than 60% companies witness an increase in recruitment and retention levels since these centers are attractive for the employees. The strategic use of GCCs in highly competitive markets allows companies to differentiate themselves by offering superior customer engagement and operational effectiveness.

Restrains:

Rising collaboration between GCC teams and headquarters is challenging because of the differences in geography as well as culture.

GCCs are often situated across different time zones and culture environments. Such a distance from headquarters might compromise the effectiveness of communications, making it challenging to align one's approaches toward the strategic objectives of the parent organization. In fact, in a 2023 study, it has been ascertained that 45% of global companies maintaining GCCs complained about discrepancies between the work done in the various centers and the goals maintained at the head office. A similar percentage of GCC teams were concerned about the channels of clear communication with the head office as 60% of them complained about lags in project implementation due to unclear channels of communication.

Cultural differences also feature predominantly nearly 35% of employees from the GCCs cited difficulty in adapting to the parent company's work culture, affecting overall team synergy. To overcome this, companies have ensured regular cross-border meetings between the two teams by making use of video conferencing tools, which has resulted in improving delivery timelines by 25% for the projects. Among other practices, inter-cultural communications training programs have been quite effective, with positive feedback from GCC employees on team integration increasing by 40%.

By Service Type:

Information Technology (IT) services held the largest share, holding approximately 50% market share. As the dependence on digital transformation, cloud computing, and cybersecurity increases for businesses, IT services become inevitable and hence the biggest and most significant sector. As BPM is able to make work processes within an organization more efficient, less costly, and easier to serve customers, it holds the second biggest market share of around 30%. Knowledge Process Outsourcing KPO 20% Market Share KPO provides data analytics, financial research, and legal procedures, which are higher-value services and address more specialized needs of the global markets. Engineering and R&D Services Market Complete with 8% market share. Innovation and product development in sectors such as automotive, healthcare, aerospace require more critical and sensitive work in R&D. The large share of IT services is speaking to the digital shift in business operations across the world, while the large proportion of BPMs speaks again to the increasing requirement for efficiency and outsourcing. KPO being smaller reflects the demand for specialized knowledge and expertise whereas engineering services gave emphasis on innovation in competitive industries.

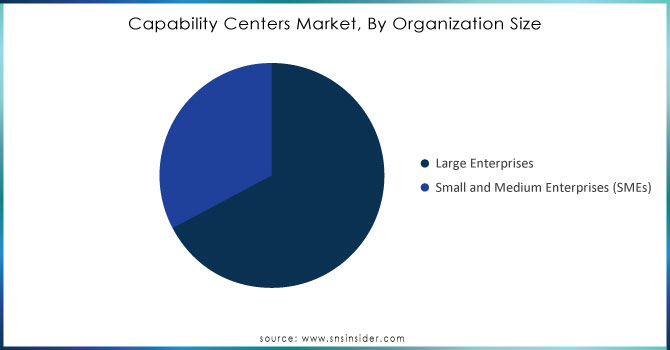

By Organization Size:

Large Enterprises held 73% of the market share. This dominance can be attributed to their advantage of investing heavily on infrastructure, technology, and talent. Large corporations typically use GCCs for simplifying very complex business processes, managing costs, and centralized functions such as IT, HR, and finance. Primarily large corporations operate cross-border, which demands sophisticated coordination and support that GCCs are well-built for.

On the contrary, in terms of SME, its usage accounted for 36% of the market. Its share is less, but the usage is always on increase in GCCs. Notably, in a macro level, SMEs can gain access to specialized skills, even enhance their efficiency as they trim down many of the operational costs that would have been necessitated by large in-house teams. As digital transformation and cloud services increased in prevalence, the SMES can now join the GCC market because these innovations de-conflate the barriers to entry.

Need any customization research on Capability Centers Market - Enquiry Now

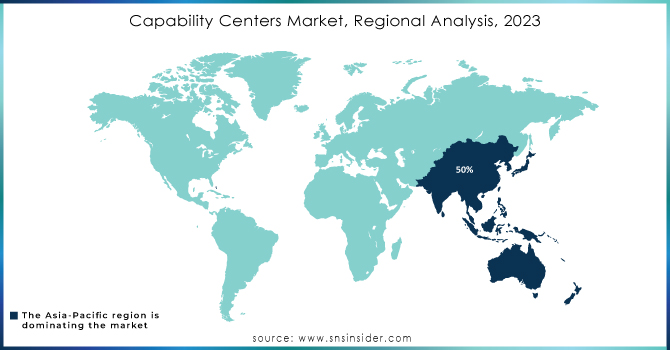

Regional Analysis:

The Asia-Pacific region has been the market leader with a heavy share. India and the Philippines have driven growth in this region, making them important entry points for GCCs. These countries have such a massive share in the market because of low labor costs and a highly skilled workforce; highly favourable government policies have also attracted the largest share to India, which now accounts for nearly 50% of global GCCs. With this imperative, larger American and European companies have been strengthening their number of capability centers in the Asia-Pacific to ride the tide of efficient operations and near-shore strategic proximity to emerging markets.

North America follows suit, in which the portion takes about 18% of the global market. Here, multinationals look forward to eliminating the inefficiencies of operations through GCCs. The demand for emerging advanced technologies like AI, automation, and cloud services highly contribute to the growth of the GCC in the region primarily for innovation and R&D purposes.

Europe holds around 10% of the market and key countries such as Poland and Ireland become GCC destinations for organizations looking to service the broader European market. Favorable regulatory environments and access to multilingual talent support Europe's growth in this sector.

Others include Latin America and Middle East & Africa, making up the remainder 7%. These regions are slowly but surely gaining grounds as emerging GCC hubs as more organizations seek entry into these untapped markets.

Accenture: (Digital Transformation Services, Industry-Specific Solutions)

Capgemini: (Intelligent Automation, Customer Experience Transformation)

Cognizant: (Cloud and Infrastructure Services, Digital Engineering and Operations)

Infosys: (AI and Machine Learning, Digital Workplace Solutions)

Tata Consultancy Services (TCS): (Business Process Reengineering, Internet of Things (IoT) Solutions)

Wipro: (Data Analytics and Business Intelligence, Digital Experience Platforms)

Genpact: (Healthcare Process Outsourcing, Procurement and Supply Chain Management)

HCL Technologies: (Engineering and R&D Services, Digital Marketing and Commerce Solutions)

Mindtree: (Digital Transformation Consulting, Product Engineering Services)

Tech Mahindra: (Network and Security Solutions, Digital Transformation for Telecoms)

Neustar: (Real-time Communications Solutions, Identity and Security Solutions)

Teleperformance: (Omnichannel Customer Experience, Language Services)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 128.55 billion |

| Market Size by 2032 | USD 453.94 Billion |

| CAGR | CAGR of 13.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type: (Information Technology (IT) Services, Business Process Management (BPM), Knowledge Process Outsourcing (KPO), Engineering and R&D Services) • By Industry Vertical: (Banking, Financial Services, and Insurance (BFSI), Healthcare and Life Sciences, Retail and Consumer Goods, Manufacturing and Automotive, Telecom & IT) • By Organization Size: (Large Enterprises, Small and Medium Enterprises (SMEs)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, Capgemini, Cognizant, Infosys, Tata Consultancy Services (TCS, Wipro, Genpact, HCL Technologies, Mindtree, Tech Mahindra, Neustar, Teleperformance |

| Key Drivers | It help the companies to achieve a stronger presence in local markets, hence service their customers better. |

| RESTRAINTS | Rising collaboration between GCC teams and headquarters is challenging because of the differences in geography as well as culture. |

Ans: The Capability Centers Market size is projected to reach USD 453.94 billion by 2032.

Ans: It help the companies to achieve a stronger presence in local markets, hence service their customers better.

Ans: The estimated CAGR will be 13.51% over 2024-2032.

Ans: The Capability Centers Market is divided into three major segments.

Ans; Asia Pacific will be dominating the market over the forecast period.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Feature Analysis, 2023

5.2 User Demographics, 2023

5.3 Integration Capabilities, by Software, 2023

5.4 Impact on Decision-making

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Capability Centers Market Segmentation, by Service Type

7.1 Chapter Overview

7.2 Information Technology (IT) Services

7.2.1 Information Technology (IT) Services Market Trends Analysis (2020-2032)

7.2.2 Information Technology (IT) Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Business Process Management (BPM)

7.3.1 Business Process Management (BPM) Market Trends Analysis (2020-2032)

7.3.2 Business Process Management (BPM) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Knowledge Process Outsourcing (KPO)

7.4.1 Knowledge Process Outsourcing (KPO) Market Trends Analysis (2020-2032)

7.4.2 Knowledge Process Outsourcing (KPO) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Engineering and R&D Services

7.5.1 Engineering and R&D Services Market Trends Analysis (2020-2032)

7.5.2 Engineering and R&D Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Capability Centers Market Segmentation, by Industry Vertical

8.1 Chapter Overview

8.2 Banking, Financial Services, and Insurance (BFSI)

8.2.1 Banking, Financial Services, and Insurance (BFSI) Market Trends Analysis (2020-2032)

8.2.2 Banking, Financial Services, and Insurance (BFSI) Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Healthcare and Life Sciences

8.3.1 Healthcare and Life Sciences Market Trends Analysis (2020-2032)

8.3.2 Healthcare and Life Sciences Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Retail and Consumer Goods

8.4.1 Retail and Consumer Goods Market Trends Analysis (2020-2032)

8.4.2 Retail and Consumer Goods Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Manufacturing and Automotive

8.5.1 Manufacturing and Automotive Market Trends Analysis (2020-2032)

8.5.2 Manufacturing and Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Telecom & IT

8.6.1 Telecom & IT Market Trends Analysis (2020-2032)

8.6.2 Telecom & IT Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Capability Centers Market Segmentation, by Organization Size

9.1 Chapter Overview

9.2 Large Enterprises

9.2.1 Large Enterprises Market Trends Analysis (2020-2032)

9.2.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Small and Medium Enterprises (SMEs)

9.3.1 Small and Medium Enterprises (SMEs) Market Trends Analysis (2020-2032)

9.3.2 Small and Medium Enterprises (SMEs) Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.4 North America Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.2.5 North America Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.6.2 USA Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.2.6.3 USA Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.7.2 Canada Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.2.7.3 Canada Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.2.8.3 Mexico Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.1.6.3 Poland Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.1.7.3 Romania Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.5 Western Europe Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.6.3 Germany Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.7.2 France Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.7.3 France Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.8.3 UK Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.9.3 Italy Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.10.3 Spain Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.13.3 Austria Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.5 Asia Pacific Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.6.2 China Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.6.3 China Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.7.2 India Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.7.3 India Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.8.2 Japan Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.8.3 Japan Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.9.3 South Korea Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.10.3 Vietnam Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.11.3 Singapore Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.12.2 Australia Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.12.3 Australia Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.1.5 Middle East Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.1.6.3 UAE Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.4 Africa Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.2.5 Africa Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Capability Centers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.4 Latin America Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.6.5 Latin America Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.6.6.3 Brazil Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.6.7.3 Argentina Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.6.8.3 Colombia Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Capability Centers Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Capability Centers Market Estimates and Forecasts, by Industry Vertical (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Capability Centers Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11. Company Profiles

11.1 Accenture

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Capgemini

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Cognizant

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Infosys

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Tata Consultancy Services (TCS):

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Wipro

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Genpact

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 HCL Technologies

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Mindtree

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Tech Mahindra

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Market Segments:

By Service Type:

Information Technology (IT) Services

Business Process Management (BPM)

Knowledge Process Outsourcing (KPO)

Engineering and R&D Services

By Industry Vertical:

Banking, Financial Services, and Insurance (BFSI)

Healthcare and Life Sciences

Retail and Consumer Goods:

Manufacturing and Automotive

Telecom & IT

By Organization Size:

Large Enterprises

Small and Medium Enterprises (SMEs)

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Vietnam

Singapore

Australia

Rest of Asia Pacific

The Connected Toys Market Size was valued at USD 9.67 Billion in 2023, and is expected to reach USD 53.37 Billion by 2032, and grow at a CAGR of 20.09% over the forecast period 2024-2032.

The Animation Software Market Size was valued at USD 141.8 Billion in 2023 and will reach USD 191.1 Billion by 2032, growing at a CAGR of 3.4% by 2032.

Digital signage market size was valued at USD 25.52 Billion in 2023. It is expected to Reach USD 49.48 Billion by 2032 and grow at a CAGR of 7.65% over the forecast period of 2024-2032.

The Physical Security Information Management Market was valued at USD 3.61 billion in 2023 and is expected to reach USD 12.0 Billion by 2032, growing at a CAGR of 21.30% from 2024-2032.

The Consumer IoT Market was valued at USD 243.28 billion in 2023 and is expected to reach USD 647.65 billion by 2032, growing at a CAGR of 11.53% over the forecast period 2024-2032.

The Automatic Identification and Data Capture Market, valued at USD 60.0 billion in 2023 is expected to grow to USD 175.4 billion by 2032, at a CAGR of 12.68%.

Hi! Click one of our member below to chat on Phone