Get more information on Cancer Biopsy Market - Request Sample Report

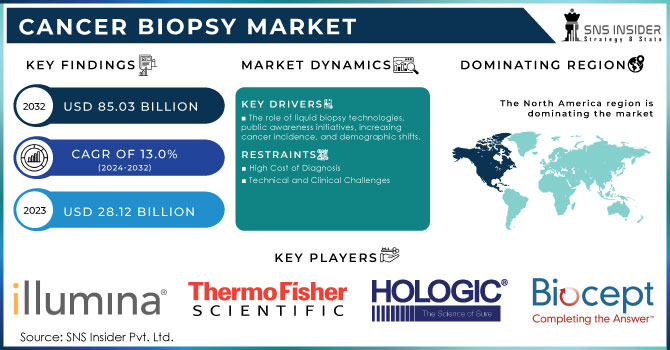

The Cancer Biopsy Market Size was valued at USD 28.12 billion in 2023 and is expected to reach USD 85.03 billion by 2032 and grow at a CAGR of 13.0% over the forecast period 2024-2032.

The cancer biopsy market is growing at a significant rate, mainly due to the rising incidence of cancer, which calls for innovative diagnostic solutions that will, in turn, allow for early detection and efficient treatment of patients. Recently, according to the 2022 update from the National Cancer Institute (NCI), the U.S. alone documented nearly 20 million new cancer cases, with nearly 9.7 million cancer-related deaths worldwide. The worrying trend calls for more advanced diagnostic techniques, especially liquid biopsy. Some of these technologies associated with liquid biopsy are gaining popularity because they are cost-effective and due to the minimally invasive nature in which the cancer may be detected. Liquid biopsy evaluates the heterogeneity of the tumor as well as gene profiling and, thus, is crucial in diagnosing many forms of cancers, including prostate, breast, non-small-cell lung, colorectal, and ovarian cancers.

Detection of cancer in its early stage greatly improves patients' chances of survival. Studies have shown that early-stage detection stages are likely to multiply the patient's chances of survival by 5-10 times compared to the survival chances of late-stage diagnosis patients. Other various organizations, including the CDC and WHO, initiate campaigns encouraging patients to embrace awareness of screening against cancer, particularly cervical cancer. Some of the most important campaigns are the U.S. The FDA Oncology Center of Excellence's National Black Family Cancer Awareness campaign seeks to enlighten underserved populations about clinical trials and the importance of early detection.

Despite these growth potentials in the market, there are big challenges to be met, and these relate particularly to the high cost of diagnostic tests, burdening the patients, especially in developing countries and mostly with no cover. However, this landscape is changing as medical tourism in countries such as India and Malaysia offers more affordable diagnostic solutions.

Additionally, the moderate level of mergers and acquisitions activity is reflected in the overall volume of acquisitions that companies engage in to expand product lines and raise technological capabilities. The trend underlines that change will continue in the landscape of biopsy; an increase in the adoption rate by healthcare providers of advanced biopsy solutions for enhanced outcomes for cancer detection and treatment. Overall, growth in the cancer biopsy market will be strong, with a sustained drive from the technology and increasing awareness regarding the critical importance of early diagnosis.

Cancer Biopsy Market Dynamics

Drivers

The role of liquid biopsy technologies, public awareness initiatives, increasing cancer incidence, and demographic shifts.

The market for cancer biopsy will be on a high growth trajectory mainly due to the advent of liquid biopsy technologies and growing public awareness about cancer. Liquid biopsies are a boon in the diagnosis of cancer without being invasive, as they help in the analysis of circulating tumor DNA (cfDNA) in the blood. For example, Labcorp's newly launched blood test from June of 2023 detects cancer-related biomarkers, and by doing so, patients will be exposed to the best available treatment quickly. Through this innovation, the detection of cancer cases becomes more efficient and forms part of personalized plans regarding treatment.

In addition, awareness campaigns by governments and health institutions increase public knowledge about cancer. Programs such as the National Cancer Control Program offered by the World Health Organization intend to reduce cancer mortality and enhance the quality of life in its patients so that patients are empowered with proactive care for their health.

The increasing incidence of cancer across the world also offers great opportunities for all market stakeholders. According to American Cancer Society Projections, in 2023, over 1.9 million new cancer cases were found in the U.S. Furthermore, the aging population is likely to fuel demand in the market because elderly patients often require sophisticated assessments for cancer treatment. With the size of the population aged 60 plus doubling by 2050, the demand for effective cancer biopsy solutions will keep increasing.

Restraints

High Cost of Diagnosis

Technical and Clinical Challenges

by Product

Kits and consumables held the dominant share of 61.8% in 2023. The increasing adoption and use of these kits for effective screening and diagnostic solutions have topped the market. Technological advancements in biopsy methods also help support growth in the market. The advent of advanced biopsy needles, specialized collection containers, as well as advanced tissue preservation solutions, which enhance the efficiency and accuracy of biopsy procedures, is boosting demand.

The instrument is expected to have the highest CAGR of 9.3% during the forecast period. This segment is expected to grow further as development in technology advances along with the rising necessity of precise diagnostic tools. At this juncture, the increase in the incidence of cancer begins to show on the foremost scale, and with this increase, requirements for intricate biopsy tools to detect and analyze the tumors also increase. This is further going to improve due to advancements in biopsy technology, which include automated tissue processors, advanced imaging systems, and precision-guided biopsy needles.

by Type

Tissue biopsy accounted for the largest market share in 2023 at 61.7%. This trend can be because of increasing cases of cancer and improved biopsy technologies. The trend toward personalized medicine, which requires highly accurate molecular and genetic characterization of tumors, has significantly increased the demand for advanced tissue biopsy techniques. Besides, minimally invasive biopsy techniques have begun to improve patient experiences through less discomfort and faster recovery periods. The increasing healthcare infrastructure and rising awareness regarding the importance of early detection also add to the rising demand for tissue biopsies.

Liquid biopsy, on the other hand, is expected to hold the highest compound annual growth rate of 9.0% during the forecast period. Liquid biopsy is a new test technology for the diagnosis of tumor-associated genetic alterations and also has been applied to characterize tumors, guiding treatment tailoring in precision oncology. For instance, at the beginning of 2023, the FDA authorized Guardant Health liquid biopsy assay, Guardant360 CDx, as a companion diagnostic to identify mutant ESR1-breast cancer. The emergence of new developments and innovations in the market, which make it possible to introduce liquid biopsy, are furthering the evolution of the market. The advantages being provided by liquid biopsy technologies make Next-Generation Sequencing or massively parallel sequencing ever more not only a key technology but increasingly find applications in diverse diseases afflicting humans. The consequent increased identification of molecular alterations in various cancer types justifies the integration of NGS into clinical settings because it is a cost-effective, especially time-efficient, way to detect cancer.

by Application

In the year 2023, the breast cancer segment held a market share of 15.7%. The developing research and developments in advanced screening tools are expected to increase this segment considerably soon. A new breast cancer screening test utilizing MMP-1 and miR-21 urinary exosomal levels of expression is presented in a September 2019 article published in Scientific Reports. This test has been demonstrated to successfully identify 95% of cancers at a pre-metastatic stage. In addition, the researchers concluded that both markers are highly specific and sensitive, well-suited for screening. Apart from that, the high penetration of new product launches in the market is also expected to propel the market growth during the forecast period; for instance, in February 2023, NGeneBio announced the launch of an NGS-based breast cancer diagnostic test in Thailand.

The kidney cancer segment is expected to foresee the highest CAGR at a rate of 10.3% over the forecast period. This increase is expected to be higher with further studies carried out by esteemed academic and research centers. A new study published by the University of Michigan Rogel Cancer Center, in April 2020, aimed at identifying biomarkers in kidney cancer. Scientists relied on next-generation RNA sequencing to determine the gene expression profile of ChRCC and evaluated the expression of three newly discovered biomarkers to diagnose. Besides, research scientists from Ghent University have collaborated with the researchers at the University of Turku, in addition to developing the method for biomarker discovery in urological cancers further adding growth potential to this segment.

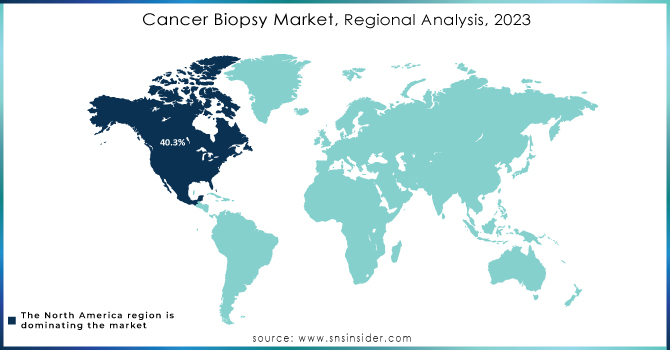

North America was the market leader in 2023, accounting for a 40.3% share of the cancer biopsy market. This is primarily attributed to the region's dominant medical infrastructure and higher health expenditure, resulting in the widespread use of diagnostic technologies. Other than this, several launches and funding are likely to propel further growth in the market. For example, biotechnology company Freenome reported in February 2024 that it had raised USD 254 million in fresh and existing funds in a bid to advance its single-cancer and tailored Multicancer Early Detection (MCED) tests.

In 2023, the European market for cancer biopsy held a major share of the market due to an increase in approval levels, competitive dynamics across companies, government initiatives, and enhanced reimbursement scenarios. In the UK, commercial partnerships between the government and key players are driving the market in respect of routine use of cancer biopsies. Established and new product manufacturers are expected to boost the growth of the market in France by following continuous organic as well as inorganic growth strategies.

Ongoing healthcare reforms are expected to fuel the Asia Pacific cancer biopsy market at the highest compound annual growth rate during the forecast period. Other factors driving this market include growth in population, improvement of health infrastructure, and entry of new market players. This geographic region has a massive population base and high incidence of cancer; for instance, Global Cancer Statistics state that approximately 10.5 million new cancer cases in Asia were recorded in 2022.

Need Any Customization Research On Cancer Biopsy Market - Inquiry Now

Key Players

QIAGEN

Illumina, Inc.

Hologic, Inc.

Biocept, Inc.

BD (Becton, Dickinson, and Company)

Thermo Fisher Scientific, Inc.

Genesystems, Inc. (Genesys Biolabs)

Danaher

F. Hoffmann-La Roche Ltd.

Lucence Health Inc.

GRAIL, Inc.

Natera, Inc.

Personalis Inc.

Guardant Health Inc.

Oncimmune

Epigenomics AG

HelioHealth (Laboratory for Advanced Medicine)

Freenome Holdings, Inc.

Biodesix (Integrated Diagnostics)

Chronix Biomedical, Inc.

Personal Genome Diagnostics Inc. and others.

Recent Developments

In August 2024, Illumina, Inc. gained approval for its TruSight Oncology (TSO) test, an in vitro diagnostic (IVD) tool designed to rapidly match cancer patients with appropriate targeted therapies using biomarker testing and companion diagnostics.

In June 2024, Guardant Health, Inc. released an updated version of its Guardant360 TissueNext test that detects 498 genes in tissue. This allows oncologists to better determine and target more suitable treatment therapies for patients with advanced cancer.

In May 2024, VESICA HEALTH, INC. announced the availability of the first of their laboratory-developed tests, AssureMDX, marking a new stage in diagnosing bladder cancer and having claimed it would therefore improve earlier detection and treatment available for patients.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 28.12 Billion |

| Market Size by 2032 | USD 85.03 Billion |

| CAGR | CAGR of 13.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instrument, Kits and Consumables, Services) • By Type (Tissue Biopsies, Liquid Biopsies, Others) • By Application (Breast Cancer, Colorectal Cancer, Cervical Cancers, Lung Cancers, Prostate Cancers, Skin Cancers, Blood Cancers, Kidney Cancers, Liver Cancers, Pancreatic Cancers, Ovarian Cancers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | QIAGEN, Illumina, Inc., ANGLE plc, Hologic, Inc., Biocept, Inc., BD (Becton, Dickinson, and Company), Myriad Genetics, Inc., Thermo Fisher Scientific, Inc., Genesystems, Inc. (Genesys Biolabs), Danaher, Hoffmann-La Roche Ltd., Lucence Health Inc., GRAIL, Inc., Natera, Inc., Personalis Inc., Guardant Health Inc., Exact Sciences Corporation, Oncimmune, Epigenomics AG, HelioHealth (Laboratory for Advanced Medicine), Freenome Holdings, Inc., Biodesix (Integrated Diagnostics), Chronix Biomedical, Inc., Personal Genome Diagnostics Inc. and Others |

| Key Drivers | • The role of liquid biopsy technologies, public awareness initiatives, increasing cancer incidence, and demographic shifts |

| Restraints | • High Cost of Diagnosis • Technical and Clinical Challenges |

Kits and consumables, which are essential at various phases of biopsies, made for the greatest sales share

North America had the largest share of almost 40.0 percent. Throughout the projected period, the area is expected to maintain its lead, with the United States contributing significantly to regional revenue.

Cancer Biopsy Market is divided into three segments and they are By Product, By Type, and By Application

Biopsy Procedure-Related Risks, Reimbursement possibilities that are unclear are the restraints of the Cancer Biopsy market.

Cancer Biopsy market is expected grow at a CAGR of 13.0% over the forecast period 2024-2032.

Table of Content:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of Cancer, by Type (2023)

5.2 Adoption Trends of Liquid and Tissue Biopsy Techniques, by Region (2023)

5.3 Volume of Cancer Biopsy Procedures, by Region (2020-2032)

5.4 Healthcare Spending on Cancer Biopsies, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

5.5 Trends in Cancer Biopsy Technology and Innovation (2023)

5.6 Regulatory Approvals and Guidelines for Cancer Biopsy Devices and Methods (2023)

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Cancer Biopsy Market Segmentation, by Product

7.1 Chapter Overview

7.2 Instrument

7.2.1 Instrument Market Trends Analysis (2020-2032)

7.2.2 Instrument Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Kits and Consumables

7.3.1 Kits and Consumables Market Trends Analysis (2020-2032)

7.3.2 Kits and Consumables Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Services

7.4.1 Services Market Trends Analysis (2020-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Cancer Biopsy Market Segmentation, by Type

8.1 Chapter Overview

8.2 Tissue Biopsies

8.2.1 Tissue Biopsies Market Trends Analysis (2020-2032)

8.2.2 Tissue Biopsies Market Size Estimates and Forecasts to 2032 (USD Million)

8.2.3 Tissue Biopsies

8.2.3.1 Tissue Biopsies Market Trends Analysis (2020-2032)

8.2.3.2 Tissue Biopsies Market Size Estimates and Forecasts to 2032 (USD Million)

8.2.4 Needle Biopsies

8.2.4.1 Needle Biopsies Market Trends Analysis (2020-2032)

8.2.4.2 Needle Biopsies Market Size Estimates and Forecasts to 2032 (USD Million)

8.2.5 Surgical Biopsies

8.2.5.1 Surgical Biopsies Market Trends Analysis (2020-2032)

8.2.5.2 Surgical Biopsies Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Liquid Biopsies

8.3.1 Liquid Biopsies Market Trends Analysis (2020-2032)

8.3.2 Liquid Biopsies Market Size Estimates and Forecasts to 2032 (USD Million)

8.3.3 Fine Needle Aspiration (FNA)

8.3.3.1 Fine Needle Aspiration (FNA)Market Trends Analysis (2020-2032)

8.3.3.2 Fine Needle Aspiration (FNA)Market Size Estimates and Forecasts to 2032 (USD Million)

8.3.4 Core Needle Biopsy (CNB)

8.3.4.1 Core Needle Biopsy (CNB) Market Trends Analysis (2020-2032)

8.3.4.2 Core Needle Biopsy (CNB) Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Cancer Biopsy Market Segmentation, by Application

9.1 Chapter Overview

9.2 Breast Cancer

9.2.1 Breast Cancer Market Trends Analysis (2020-2032)

9.2.2 Breast Cancer Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Colorectal Cancer

9.3.1 Colorectal Cancer Market Trends Analysis (2020-2032)

9.3.2 Colorectal Cancer Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Cervical Cancers

9.4.1 Cervical Cancers Market Trends Analysis (2020-2032)

9.4.2 Cervical Cancers Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Lung Cancers

9.5.1 Lung Cancers Market Trends Analysis (2020-2032)

9.5.2 Lung Cancers Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Prostate Cancers

9.6.1 Prostate Cancers Market Trends Analysis (2020-2032)

9.6.2 Prostate Cancers Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Skin Cancers

9.7.1 Skin Cancers Market Trends Analysis (2020-2032)

9.7.2 Skin Cancers Market Size Estimates and Forecasts to 2032 (USD Million)

9.8 Blood Cancers

9.8.1 Blood Cancers Market Trends Analysis (2020-2032)

9.8.2 Blood Cancers Market Size Estimates and Forecasts to 2032 (USD Million)

9.9 Kidney Cancers

9.9.1 Kidney Cancers Market Trends Analysis (2020-2032)

9.9.2 Kidney Cancers Market Size Estimates and Forecasts to 2032 (USD Million)

9.10 Liver Cancers

9.10.1 Liver Cancers Market Trends Analysis (2020-2032)

9.10.2 Liver Cancers Market Size Estimates and Forecasts to 2032 (USD Million)

9.11 Pancreatic Cancers

9.11.1 Pancreatic Cancers Market Trends Analysis (2020-2032)

9.11.2 Pancreatic Cancers Market Size Estimates and Forecasts to 2032 (USD Million)

9.12 Ovarian Cancers

9.12.1 Ovarian Cancers Market Trends Analysis (2020-2032)

9.12.2 Ovarian Cancers Market Size Estimates and Forecasts to 2032 (USD Million)

9.13 Others

9.13.1 Others Market Trends Analysis (2020-2032)

9.13.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Cancer Biopsy Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.4 North America Cancer Biopsy Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.5 North America Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.6.2 USA Cancer Biopsy Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.6.3 USA Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.7.2 Canada Cancer Biopsy Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.7.3 Canada Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.8.2 Mexico Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.2.8.3 Mexico Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Cancer Biopsy Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.1.5 Eastern Europe Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.6.2 Poland Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.1.6.3 Poland Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.7.2 Romania Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.1.7.3 Romania Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.8.2 Hungary Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.1.8.3 Hungary Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.9 turkey

10.3.1.9.1 Turkey Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.9.2 Turkey Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.1.9.3 Turkey Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Cancer Biopsy Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.4 Western Europe Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.2.5 Western Europe Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.6.2 Germany Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.2.6.3 Germany Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.7.2 France Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.2.7.3 France Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.8.2 UK Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.2.8.3 UK Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.9.2 Italy Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.2.9.3 Italy Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.10.2 Spain Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.2.10.3 Spain Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.2.11.3 Netherlands Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.2.12.3 Switzerland Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.13.2 Austria Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.2.13.3 Austria Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Cancer Biopsy Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.4 Asia Pacific Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.4.5 Asia Pacific Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.6.2 China Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.4.6.3 China Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.7.2 India Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.4.7.3 India Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.8.2 Japan Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.4.8.3 Japan Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.9.2 South Korea Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.4.9.3 South Korea Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.10.2 Vietnam Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.4.10.3 Vietnam Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.11.2 Singapore Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.4.11.3 Singapore Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.12.2 Australia Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.4.12.3 Australia Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Cancer Biopsy Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.4 Middle East Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.5.1.5 Middle East Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.6.2 UAE Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.5.1.6.3 UAE Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.7.2 Egypt Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.5.1.7.3 Egypt Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.9.2 Qatar Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.5.1.9.3 Qatar Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Cancer Biopsy Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.4 Africa Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.5.2.5 Africa Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.6.2 South Africa Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.5.2.6.3 South Africa Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.5.2.7.3 Nigeria Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Cancer Biopsy Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.4 Latin America Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.6.5 Latin America Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.6.2 Brazil Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.6.6.3 Brazil Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.7.2 Argentina Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.6.7.3 Argentina Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.8.2 Colombia Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.6.8.3 Colombia Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Cancer Biopsy Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Cancer Biopsy Market Estimates and Forecasts, by Type(2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Cancer Biopsy Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11. Company Profiles

11.1 QIAGEN

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Illumina, Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Thermo Fisher Scientific Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Genesystems, Inc. (Genesys Biolabs)

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Danaher

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Natera, Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Lucence Health Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Exact Sciences Corporation

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Hologic, Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 ANGLE plc

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segmentation

By Product

Instrument

Kits and Consumables

Services

By Type

Tissue Biopsies

Needle Biopsies

Surgical Biopsies

Liquid Biopsies

Fine Needle Aspiration (FNA)

Core Needle Biopsy (CNB)

Others

By Application

Breast Cancer

Colorectal Cancer

Cervical Cancers

Lung Cancers

Prostate Cancers

Skin Cancers

Blood Cancers

Kidney Cancers

Liver Cancers

Pancreatic Cancers

Ovarian Cancers

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Respiratory Syncytial Virus Therapeutics (RSV) Market size was USD 1.37 Bn in 2023 & will reach USD 4.64 Bn by 2032 & grow at a CAGR of 14.5%.

The Military Wearable Medical Device Market Size was valued at USD 7.84 billion in 2023 and is expected to reach USD 64.47 billion by 2032, and grow at a CAGR of 26.40% over the forecast period 2024-2032.

The Urinary Incontinence Treatment Devices Market Size was valued at USD 3.15 billion in 2023 and is expected to reach USD 6.38 billion by 2032 and grow at a CAGR of 8.18% over the forecast period 2024-2032.

The Antibody Drug Conjugates [ADC] Market was valued at USD 10.28 billion in 2023 and is expected to reach USD 29.10 billion by 2032, growing at a CAGR of 12.29% from 2024-2032.

Nerve Repair and Regeneration Market Size was valued at USD 9.14 billion in 2023 and is expected to reach USD 25.67 billion by 2032, growing at a CAGR of 12.19% over the forecast period 2024-2032

The Medical Device Contract Manufacturing Market Size was valued at USD 69.75 Billion in 2023 and is expected to reach USD 191.40 Billion by 2032 and grow at a CAGR of 11.89% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone