Cable Blowing Equipment Market Size:

Get more information on Cable Blowing Equipment Market - Request Sample Report

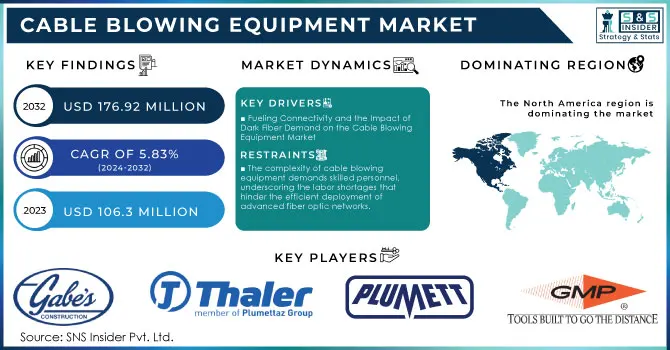

The Cable Blowing Equipment Market Size was valued at USD 106.3 Million in 2023 and is expected to reach USD 176.92 Million by 2032, and grow at a CAGR of 5.83% over the forecast period 2024-2032.

The Cable Blowing Equipment market is experiencing significant growth, driven by the escalating demand for fiber optic networks worldwide. The increasing volume of internet traffic and the necessity for faster data transmission are compelling telecommunications companies to expand their fiber optic installations. As operators strive to meet these demands, the adoption of efficient cable blowing technologies has become essential. This market segment encompasses various tools and equipment that facilitate the installation of fiber optic cables into existing ducts, enabling quicker and more cost-effective network deployment.

Increasing demand for high-speed internet and dependable connectivity as telecommunications networks evolve. The exponential rise in internet traffic, coupled with the necessity for efficient fiber optic installations, is prompting service providers to adopt advanced installation methods. Although telecom equipment revenues are projected to decline by 8% in Q2 2024 due to a slowdown in network capital expenditures (capex), companies are adapting by optimizing operations to control costs while meeting the growing expectations of consumers. In Malaysia, the dark fiber market is anticipated to expand by USD 1.739 Million from 2024 to 2028, fueled by the global surge in internet traffic linked to advancements in artificial intelligence. Moreover, Adtran is focusing on enhancing fiber optic technology, aligning with the expected growth in the US optical network market, which is set to expand through 2024 to 2029 with an emphasis on network virtualization and software-defined networking. Technological advancements in cable blowing equipment play a crucial role in market expansion by enabling quicker installations with minimal disruption. Innovations are allowing operators to seamlessly integrate high-density optical fiber cables into existing duct networks, thereby enhancing efficiency and reducing costs. A recent development underscores this trend, with Open reach acquiring over 100 sets of equipment from Plummeted, highlighting the increasing reliance on advanced cable installation techniques. The Cable Blowing Equipment market is well positioned for growth, driven by the expansion of telecom networks, rising fiber optic installations, and ongoing technological innovations. This growth trajectory reflects the adaptability of service providers in responding to evolving consumer demands and competitive pressures.

Cable Blowing Equipment Market Dynamics

Drivers

-

Fueling Connectivity and the Impact of Dark Fiber Demand on the Cable Blowing Equipment Market

The increasing demand for dark fiber is a key driver of growth in the cable blowing equipment market. As advancements in artificial intelligence and the need for enhanced connectivity reshape the telecommunications landscape, service providers are eager to expand their fiber optic networks. Dark fiber refers to unused or "dark" optical fibers that can be leased to businesses for their private network infrastructure, enabling organizations to address their growing data requirements. This demand is especially strong in urban areas, where high-speed data transfer is essential to support various applications, including cloud computing and IoT deployments. Recent initiatives by companies to roll out high-speed dark fiber networks highlight the market's potential; for example, Ziply Fiber's introduction of a new 50 Gbps plan demonstrates a significant commitment to upgrading digital infrastructure. This heightened interest in dark fiber networks is closely linked to the rising need for advanced cable blowing equipment, as service providers must efficiently install more fiber optic cables to meet increasing demand. With the ongoing expansion of digital infrastructure, the cable blowing equipment market is poised for substantial growth.

-

Driving Innovation in the Cable Blowing Equipment Market Through Network Virtualization and SDN

The growing adoption of network virtualization and software-defined networking (SDN) in the telecommunications industry is significantly driving the demand for cable blowing equipment. As networks evolve to become more dynamic and adaptable, the need for efficient installation and management of fiber optic infrastructure has never been more critical. Network virtualization enables multiple virtual networks to run on a single physical infrastructure, streamlining operations and enhancing resource utilization. This transformation places an emphasis on the effective deployment of fiber optic cables, which are essential for high-speed connectivity and data transfer. Cable blowing equipment plays a crucial role in this context, as it allows service providers to install fiber optic cables more efficiently and with minimal disruption to existing networks. by leveraging advanced installation techniques, telecom companies can quickly scale their networks to support, the increasing demands of data traffic driven by technologies such as IoT and cloud computing. As organizations continue to prioritize agility and performance in their networking strategies, the cable blowing equipment market is set to benefit from this trend toward virtualization and SDN.

Restraints

-

The complexity of cable blowing equipment demands skilled personnel, underscoring the labor shortages that hinder the efficient deployment of advanced fiber optic networks.

The evolution of cable blowing equipment has brought forth advanced technologies that significantly improve the efficiency and effectiveness of fiber optic installations. However, this complexity necessitates a higher level of expertise among the personnel responsible for operating and maintaining these systems. Skilled operators must grasp the intricacies of the equipment, including its components, operational procedures, and troubleshooting techniques. The increasing demand for specialized training and technical knowledge poses a considerable challenge, as a shortage of qualified professionals can lead to various issues, such as project delays, rising operational costs, and diminished equipment utilization rates. As cable technology continues to evolve, staying updated with the latest advancements becomes crucial, particularly as the market transitions from traditional cable TV to streaming services and other innovative technologies. Organizations often struggle to find suitable candidates with the requisite skills, leading to a reliance on less experienced staff who may require additional training and oversight. This gap in skilled labor can hinder the effective deployment of sophisticated cable blowing technologies, ultimately impacting service providers' ability to expand and optimize their fiber optic networks. To mitigate these challenges, companies must invest in comprehensive training programs, forge partnerships with educational institutions, and implement ongoing professional development initiatives.

Cable Blowing Equipment Market Segment Overview

by Power

In the cable blowing equipment market, pneumatically powered systems dominate, capturing 40% of the revenue share in 2023. This leading position can be attributed to several critical factors that enhance their effectiveness in fiber optic installations. Firstly, pneumatic systems are recognized for their high-speed capabilities, utilizing compressed air to propel cables through ducts, thereby significantly shortening installation times compared to manual or other powered methods. This efficiency is vital for the rapid deployment of fiber optic networks. Moreover, these systems are versatile, adaptable to various environments and cable types, making them suitable for both urban and rural applications. Although the initial investment may be higher, the operational efficiency of pneumatic systems often leads to reduced long-term costs, minimizing the need for manual labor and accelerating project timelines. Additionally, they allow for installations with minimal disruption, which is especially advantageous in densely populated areas where traditional methods may cause significant interruptions. The growing demand for high-speed internet further fuels their adoption, as telecommunications companies seek to upgrade their networks. Continuous advancements in pneumatic technology also promise improved performance, ensuring this segment remains well positioned for sustained growth and innovation in the expanding fiber optic market.

by Cable

In the cable blowing equipment market, normal ducts capture a significant revenue share of approximately 58% in 2023, highlighting their advantages for fiber optic installations and solidifying their status as a preferred option for service providers. Normal ducts are prevalent in both residential and commercial applications, offering a well-known and accessible solution for cable installations, which contributes to their popularity among project managers. The installation costs associated with normal duct systems are generally lower than those for specialized alternatives, as their compatibility with a broad range of cable types minimizes the need for additional equipment investments, resulting in considerable overall project savings. Furthermore, normal ducts facilitate straightforward installation, allowing technicians to work more effectively and reducing the risk of errors, which is vital given the increasing demand for rapid deployment of fiber optic networks. Their ability to accommodate different cable sizes and configurations makes them versatile for various applications, whether urban or rural, and their compatibility with existing infrastructure eases integration into current networks, minimizing disruptions and enabling smoother transitions to upgraded systems. Overall, the dominance of normal ducts in the cable blowing equipment market can be attributed to their cost-effectiveness, ease of installation, and wide applicability, positioning them well for continued growth in the expanding telecommunications sector.

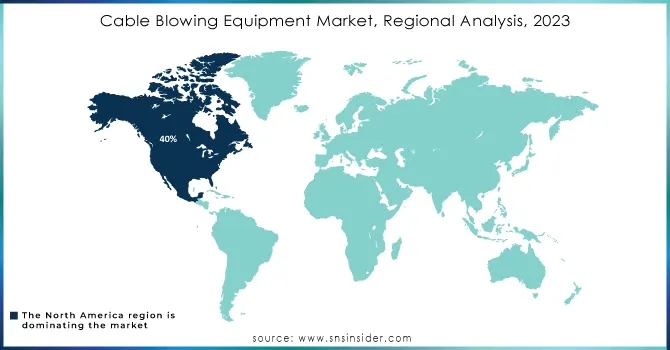

Cable Blowing Equipment Market Regional Outlook

In 2023, North America emerged as the leading region in the cable blowing equipment market, capturing approximately 40% of total revenue, driven by several key factors that highlight its strategic significance in telecommunications. Significant investments in telecommunications infrastructure, particularly in fiber optic networks, have been made by major service providers like AT&T, Verizon, and Comcast to meet the growing demand for high-speed internet, leading to increased adoption of advanced cable blowing equipment. The region also stands at the forefront of technological innovation, with companies such as Tuff-N-Uff and Ditch Witch continuously developing solutions that enhance installation efficiency and reduce operational costs. Supportive government initiatives in the U.S. and Canada, aimed at promoting broadband access and digital infrastructure development, have further fostered a favorable regulatory environment, driving demand for efficient cable installation solutions. The rising need for reliable connectivity due to remote work, online streaming, and IoT applications has prompted service providers to invest more in fiber optic installations. Companies like Kabeltec and Eaton Corporation are making notable advancements in this market, while initiatives like the FCC's Rural Digital Opportunity Fund in the U.S. and Canada’s ambitious broadband targets are fueling infrastructure growth. Moreover, North America benefits from a skilled workforce trained in telecommunications technology, ensuring a steady supply of qualified personnel to support market expansion. Together, these factors solidify North America's position as a pivotal player in the cable blowing equipment market.

In 2023, the Asia Pacific region emerged as the second fastest-growing market for cable blowing equipment, propelled by rapid urbanization, rising demand for high-speed internet, and substantial investments in telecommunications infrastructure. As millions migrate to cities, countries like India and China are heavily investing in fiber optic networks to enhance connectivity in both urban and rural areas, which is driving the need for efficient cable blowing equipment. Government initiatives, such as India’s National Broadband Mission and China’s extensive 5G rollout, are fostering an environment conducive to digitalization and broadband expansion. Companies like Kabeltec and HDD Robotics are introducing innovative products tailored to urban challenges, while Ditch Witch has expanded its offerings to include trenchless solutions. Additionally, technological advancements from manufacturers such as S&B Engineers and KROHNE are enhancing installation efficiency and reducing costs. The surge in digital services, including streaming and IoT applications, further fuels the demand for high-speed connectivity. Countries like India and Australia are seeing significant growth in telecommunications infrastructure, supported by government initiatives like Australia's National Broadband Network. Overall, a competitive market landscape and a focus on skilled workforce development position the Asia Pacific region as a vital player in the cable blowing equipment market.

Need Any Customization Research On Cable Blowing Equipment Market - Inquiry Now

Key Players

Some of the major key players in Cable Blowing Equipment Market along with their products:

-

Adishwar Tele-Networks (Cable Blowing Machines)

-

Gabe's Construction (Cable Installation Equipment)

-

Jakob Thaler GmbH (Cable Blowing Systems)

-

Ningbo Eastern-Grid Power (Cable Blowing Machines)

-

Plumettaz (Cable Blowing Solutions)

-

Stanlay (Cable Blowing Equipment)

-

Plumett (Cable Installation Machines)

-

General Machine Products (Cable Blowing and Installation Tools)

-

FOK Cable Blowing Machines (Cable Blowing Equipment)

-

CBS Products (Cable Installation Solutions)

-

Bagela (Cable Blowing Technology)

-

Huaxiang Dongfang (Cable Blowing Machines)

-

Prayaag Technologies (Cable Blowing Equipment)

-

Anfkom (Cable Installation Equipment)

-

Hexatronic Group (Cable Blowing Solutions)

-

Jetting AB (Cable Blowing and Installation Systems)

-

Ningbo Marshine Power Technology (Cable Blowing Machines)

-

Skyfiber Tech (Cable Blowing Equipment)

-

Upcom Telekomunikasyon (Cable Installation Equipment)

-

Fremco (Cable Blowing Systems)

-

Condux International (Cable Installation Tools)

-

LANCIER CABLE GmbH (Cable Blowing Machines)

-

TT Technologies Inc (Cable Installation Solutions)

-

Asian Contec Ltd (Cable Blowing Equipment)

-

Genius Engineers (Cable Installation Tools)

List of Suppliers that are significant players in the industry, offering a variety of cable blowing equipment and solutions.

-

Plumettaz

-

Hexatronic Group

-

Gabe's Construction

-

Ningbo Eastern-Grid Power

-

Stanlay

-

Jakob Thaler GmbH

-

General Machine Products

-

Fremco

-

Adishwar Tele-Networks

-

Condux International

Recent Development

-

In Feb 2024, a recent development in FTTH installation equipment is the advancement of fusion splicers, which have become more efficient and user-friendly. These splicers now feature enhanced precision and faster splicing times, enabling operators to quickly and effectively join fiber optic cables with minimal signal loss, thus accelerating the overall deployment of fiber optic networks.

-

In September 2023, Prysmian Group and BT Openreach introduced the Karona Overblow System, a new fibre installation technique that significantly accelerates FTTH rollouts by allowing the installation of small diameter cables into existing sub-ducted routes. This innovative system streamlines the installation process, reduces costs, and minimizes disruption, with trials demonstrating substantial savings and efficiency improvements in cable deployments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 106 Million |

| Market Size by 2032 | USD 176.92 Million |

| CAGR | CAGR of 5.83% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Power (Hydraulically Powered, Battery Powered, Drill-Driven, Pneumatically Powered, Electric-Driven, Other) • By Cable (Normal Duct, Micro-Duct, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Adishwar, Gabe's Construction, Jakob Thaler GmbH, Ningbo Eastern-Grid Power, Plumettaz, Stanlay, Plumett, General Machine Products, FOK, CBS Products, Bagela, Huaxiang Dongfang, Prayaag Technologies, Anfkom, Hexatronic Group, Jetting AB, Ningbo Marshine Power Technology, Skyfiber Tech, Upcom Telekomunikasyon, Fremco, Condux International, LANCIER CABLE GmbH, TT Technologies Inc, Asian Contec Ltd, and Genius Engineers are key players in the cable blowing equipment market. |

| Key Drivers | • Fueling Connectivity and the Impact of Dark Fiber Demand on the Cable Blowing Equipment Market • Driving Innovation in the Cable Blowing Equipment Market Through Network Virtualization and SDN |

| RESTRAINTS | • The complexity of cable blowing equipment demands skilled personnel, underscoring the labor shortages that hinder the efficient deployment of advanced fiber optic networks. |