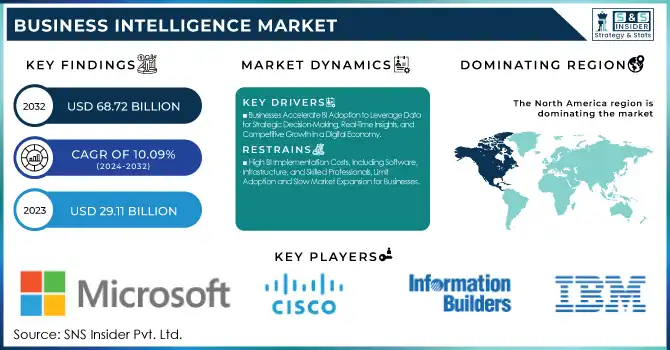

The Business Intelligence Market was valued at USD 29.11 billion in 2023 and is expected to reach USD 68.72 billion by 2032, growing at a CAGR of 10.09% from 2024-2032. This report covers the adoption of emerging technologies, investment trends, user behavior, regional incidence of cybersecurity events, and their impact on decision-making. The growing dependence on data-powered marketing is driving growth, as businesses turn to AI, analytics, and cloud solutions to refine operations. Investments are driven by increasing cybersecurity concerns and maturing user demand, and regional trends affirm differences in technological and maturity levels and risk management practices.

Get More Information on Business Intelligence Market - Request Sample Report

Drivers

Businesses Accelerate BI Adoption to Leverage Data for Strategic Decision-Making, Real-Time Insights, and Competitive Growth in a Digital Economy

Enterprises are increasingly embracing business intelligence to tap the true potential of data for making strategic decisions. The volume of structured and unstructured data created by a firm puts a need to get meaningful insights. Advanced analytics, powerful visualization, and AI-based BI solutions allow organizations to recognize trends, optimize processes and processes, and improve customers' engagement. Real-time processing of data improves the accuracy of forecasting, risk management, and overall efficiency. Digital transformation and automation across industries would further accelerate the adoption of BI, as companies can make fast data-driven decisions. When data volumes are continuously being created, BI tools have become an absolute necessity for businesses to obtain agility, growth, and sustain long-term success in a data-driven economy.

Restraints

High BI Implementation Costs, Including Software, Infrastructure, and Skilled Professionals, Limit Adoption and Slow Market Expansion for Businesses.

One of the biggest challenges in the implementation of Business Intelligence for an organization is the high investment it requires. Advanced software, cloud infrastructure, data storage, and skilled professionals can be too expensive for small and medium-sized enterprises. Besides these costs, maintenance, upgrade, and training expenses of the system also incur continuous expenses. Due to such costs, most businesses cannot afford to adopt BI, and the use of data-driven insights remains unexploited. The cloud-based and self-service BI solutions aim to lower the costs but still are not a result of the initial investment, limiting market growth. Thus, overcoming the barrier calls for cost-effective deployment models and scalable solutions that enhance accessibility in various industries.

Opportunities

AI and Machine Learning Enhance BI with Automation, Predictive Analytics, and Real-Time Insights, Driving Innovation and Business Growth.

Business Intelligence is transforming with AI and machine learning integration, offering deeper insights, automation, and predictive analytics. Organizations are now using AI-driven BI tools to process vast amounts of structured and unstructured data, hidden patterns, and enhanced real-time decision-making. The accuracy of forecasts, operations, and personalized business recommendations is optimized by machine learning algorithms. It reduces manual effort, enhances efficiency, and provides a competitive advantage to businesses. Increasing levels of AI have been making various companies across several industries embrace the intelligent BI for innovation, to streamline workflows and maximize profitability. The growing need for AI analytics is unlocking BI market expansion through new opportunities.

Challenges

Inconsistent and Unstructured Data Reduces BI Accuracy, Leading to Integration Issues, Poor Analytics, and Flawed Decision-Making for Businesses.

Business Intelligence solutions rely on high-quality, well-integrated data to generate accurate and actionable insights. However, many organizations struggle with inconsistent, incomplete, and unstructured data from multiple sources, leading to inaccurate analytics and flawed decision-making. Integrating data from legacy systems, third-party applications, and diverse formats often results in discrepancies, duplication, and inefficiencies. Poor data governance and a lack of standardization further complicate the process, reducing the reliability of BI outputs. Without robust data cleansing, validation, and integration mechanisms, businesses face difficulties in fully leveraging BI capabilities. Ensuring high data quality and seamless integration is crucial for organizations aiming to maximize the value of their BI investments and drive strategic growth.

By Component

The Solution segment dominated the Business Intelligence Market with a 69% revenue share in 2023, driven by the increasing adoption of AI-powered analytics, data visualization tools, and self-service BI platforms. Businesses prioritize BI solutions to enhance decision-making, automate processes, and gain competitive insights.

The Services segment is expected to grow at the fastest CAGR of 11.67% from 2024-2032, due to rising demand for consulting, integration, and managed services. Organizations seek expert support for seamless BI implementation, customization, and optimization, boosting service adoption.

By Deployment Mode

The On-premises segment dominated the Business Intelligence Market with a 52% revenue share in 2023, primarily due to greater data security, compliance requirements, and control over infrastructure. Large enterprises and regulated industries prefer on-premises BI solutions to safeguard sensitive information and ensure seamless system integration.

The Cloud segment is expected to grow at the fastest CAGR of 10.60% from 2024-2032, due to its scalability, cost efficiency, and ease of deployment. The shift toward remote work and real-time data access further accelerates cloud BI adoption.

By Organization Size

The Large Enterprises segment dominated the Business Intelligence (BI) Market with a 64% revenue share in 2023, driven by their extensive data needs, advanced analytics adoption, and substantial IT budgets. Large organizations leverage BI for strategic decision-making, operational efficiency, and competitive advantage.

The Small and Medium-sized Enterprises segment is expected to grow at the fastest CAGR of 11.12% from 2024-2032 due to increasing awareness of data-driven decision-making, cost-effective cloud BI solutions, and the rising adoption of self-service analytics tools.

By End Use

The BFSI segment dominated the Business Intelligence Market with a 25% revenue share in 2023, driven by the industry's need for fraud detection, risk management, regulatory compliance, and customer analytics. Financial institutions leverage BI to optimize operations, enhance security, and improve decision-making.

The Healthcare segment is expected to grow at the fastest CAGR of 12.82% from 2024-2032 due to the rising demand for data-driven patient care, predictive analytics, and operational efficiency. BI adoption in healthcare is accelerating with advancements in AI-driven diagnostics and personalized treatment planning.

By Business Function

The Finance segment dominated the Business Intelligence Market with a 32% revenue share in 2023, driven by the need for financial planning, risk assessment, fraud detection, and regulatory compliance. Organizations rely on BI to analyze financial data, optimize budgeting, and enhance decision-making.

The Human Resource segment is expected to grow at the fastest CAGR of 11.75% from 2024-2032 due to the increasing adoption of BI for workforce analytics, talent management, performance tracking, and employee engagement strategies, improving HR efficiency and decision-making.

In 2023, North America dominated the Business Intelligence Market with a 38% revenue share, driven by the region’s strong technological infrastructure, early adoption of AI-driven analytics, and the presence of major BI solution providers. Enterprises across industries, particularly in BFSI, healthcare, and retail, leveraged BI tools to enhance decision-making, improve operational efficiency, and gain a competitive edge. Additionally, stringent regulatory requirements and a high focus on data security fueled the demand for advanced BI solutions.

Asia Pacific is expected to grow at the fastest CAGR of 12.57% from 2024 to 2032, propelled by rapid digital transformation, increasing cloud adoption, and rising investments in data analytics. As businesses across emerging economies embrace BI to optimize operations and improve customer insights, the demand for cost-effective and scalable solutions is surging. Government initiatives supporting AI and data-driven innovation further accelerate BI adoption, positioning Asia Pacific as a key growth hub.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Microsoft (Power BI, Azure Synapse Analytics)

Tableau Software (Salesforce) (Tableau Desktop, Tableau Server)

IBM (Cognos Analytics, Watson Studio)

Qlik (Qlik Sense, QlikView)

SAP (SAP BusinessObjects, SAP Analytics Cloud)

Oracle (Oracle Analytics Cloud, OBIEE)

Redash (Databricks) (Redash, Databricks SQL)

Mode Analytics (Mode Studio, Mode Business)

Infor (Infor Birst, Infor Coleman AI)

SAS (SAS Visual Analytics, SAS Enterprise Guide)

Google (Looker, BigQuery BI Engine)

AWS (Amazon QuickSight, AWS Glue)

Salesforce (Tableau, Einstein Analytics)

MicroStrategy (MicroStrategy ONE, HyperIntelligence)

Teradata (Vantage, Teradata Data Lab)

DOMO (Domo BI, Domo Data Science)

TIBCO (TIBCO Spotfire, TIBCO Data Virtualization)

Information Builders (WebFOCUS, iWay Data Management)

Sisense (Sisense Fusion, Sisense Analytics)

Yellowfin (Yellowfin BI, Yellowfin Signals)

Board International (Board, Board Marketplace)

Dundas (Dundas BI, Dundas Dashboard)

Targit (TARGIT Decision Suite, TARGIT InMemoryDB)

Zoho (Zoho Analytics, Zoho Creator)

Vphrase (Phrazor, Explorazor)

dotdata (dotdata Enterprise, dotdata Stream)

Amlgo Labs (Amlgo BI, Amlgo AI Insights)

Pentation Analytics (Pentation InsurTech, Pentation AI Suite)

Hitachi Vantara (Pentaho, Lumada)

Outlier (Outlier AI, Outlier Explorer)

ConverSight AI (ConverSight Assistant, ConverSight Insights)

Element Data (Element AI, Decision Intelligence Platform)

Alteryx (Alteryx Designer, Alteryx Intelligence Suite)

ThoughtSpot (ThoughtSpot Cloud, ThoughtSpot Everywhere)

In 2024, Microsoft enhanced Fabric to offer AI-powered development, a unified data estate, and embedded insights in Microsoft 365 apps, encouraging enterprises to adopt the platform.

In 2024, Salesforce launched Tableau Einstein, an AI-powered analytics platform that enhances CRM insights with real-time data analysis. It integrates AI-driven predictions and automation to improve decision-making and streamline business workflows.

In October 2024, IBM unveiled the next generation of business intelligence (BI) powered by its Granite foundation models. This advancement integrates AI-driven features into IBM Cognos Analytics, offering users enhanced data discovery, automated insights, and predictive analytics through a conversational, natural language interface.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 29.11 Billion |

| Market Size by 2032 | USD 68.72 Billion |

| CAGR | CAGR of 10.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Deployment Mode (Cloud, On-premises) • By Organization Size (Large Enterprises, Small and Medium-sized Enterprises) • By Business Function (Human Resource, Finance, Operations, Sales and Marketing) • By End-use Industry (BFSI, IT and Telecommunication, Retail and Consumer Goods, Manufacturing, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft, Tableau Software (Salesforce), IBM, Qlik, SAP, Oracle, Redash (Databricks), Mode Analytics, Infor, SAS, Google, AWS, Salesforce, MicroStrategy, Teradata, DOMO, TIBCO, Information Builders, Sisense, Yellowfin, Board International, Dundas, Targit, Zoho, Vphrase, dotdata, Amlgo Labs, Pentation Analytics, Hitachi Vantara, Outlier, ConverSight AI, Element Data, Alteryx, ThoughtSpot |

Ans. Business Intelligence Market was valued at USD 29.11 billion in 2023 and is expected to reach USD 68.72 billion by 2032, growing at a CAGR of 10.09% from 2024-2032

Ans. The Solution segment led the market with a 69% revenue share.

Ans: Asia Pacific is projected to grow at a CAGR of 12.57% from 2024-2032, fueled by rapid digital transformation.

Ans: The Finance segment held a 32% market share in 2023, as BI helps organizations with financial planning, risk assessment, fraud detection.

Ans: The BFSI sector led with a 25% revenue share, leveraging BI for fraud detection, risk management, regulatory compliance, and enhanced customer analytics.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Investment Trends

5.3 Customer & User Insights

5.4 Cybersecurity Incidents, by Region

5.5 Impact on Decision-making

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Business Intelligence Market Segmentation, By Component

7.1 Chapter Overview

7.2 Solutions

7.2.1 Solutions Market Trends Analysis (2020-2032)

7.2.2 Solutions Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Business Intelligence Market Segmentation, By End Use

8.1 Chapter Overview

8.2 BFSI

8.2.1 BFSI Market Trends Analysis (2020-2032)

8.2.2 BFSI Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 IT and Telecommunication

8.3.1 IT and Telecommunication Market Trends Analysis (2020-2032)

8.3.2 IT and Telecommunication Market Size Estimates And Forecasts To 2032 (USD Billion)

8.4 Retail and Consumer Goods

8.4.1 Retail and Consumer Goods Market Trends Analysis (2020-2032)

8.4.2 Retail and Consumer Goods Market Size Estimates And Forecasts To 2032 (USD Billion)

8.5 Manufacturing

8.5.1 Manufacturing Market Trends Analysis (2020-2032)

8.5.2 Manufacturing Market Size Estimates And Forecasts To 2032 (USD Billion)

8.6 Healthcare

8.6.1 Healthcare Market Trends Analysis (2020-2032)

8.6.2 Healthcare Market Size Estimates And Forecasts To 2032 (USD Billion)

8.7 Sales and Marketing

8.7.1 Sales and Marketing Market Trends Analysis (2020-2032)

8.7.2 Sales and Marketing Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Business Intelligence Market Segmentation, By Business Function

9.1 Chapter Overview

9.2 Human Resource

9.2.1 Human Resource Market Trends Analysis (2020-2032)

9.2.2 Human Resource Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 Finance

9.3.1 Finance Market Trends Analysis (2020-2032)

9.3.2 Finance Market Size Estimates And Forecasts To 2032 (USD Billion)

9.4 Operations

9.4.1 Operations Market Trends Analysis (2020-2032)

9.4.2 Operations Market Size Estimates And Forecasts To 2032 (USD Billion)

9.5 Sales and Marketing

9.5.1 Sales and Marketing Market Trends Analysis (2020-2032)

9.5.2 Sales and Marketing Market Size Estimates And Forecasts To 2032 (USD Billion)

10. Business Intelligence Market Segmentation, By Deployment Mode

10.1 Chapter Overview

10.2 Cloud

10.2.1 Cloud Market Trends Analysis (2020-2032)

10.2.2 Cloud Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 On-premises

10.3.1 On-premises Market Trends Analysis (2020-2032)

10.3.2 On-premises Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Business Intelligence Market Segmentation, By Organization Size

11.1 Chapter Overview

11.2 Large Enterprises

11.2.1 Large Enterprises Market Trends Analysis (2020-2032)

11.2.2 Large Enterprises Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 Small and Medium-sized Enterprises

11.3.1 Small and Medium-sized Enterprises Market Trends Analysis (2020-2032)

11.3.2 Small and Medium-sized Enterprises Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Business Intelligence Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.4 North America Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.2.5 North America Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.2.6 North America Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.7 North America Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.8.2 USA Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.2.8.3 USA Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.2.8.4 USA Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.8.5 USA Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.9.2 Canada Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.2.9.3 Canada Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.2.9.4 Canada Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.9.5 Canada Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.2.10.2 Mexico Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.2.10.3 Mexico Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.2.10.4 Mexico Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.10.5 Mexico Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Business Intelligence Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.8.2 Poland Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.1.8.3 Poland Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.1.8.4 Poland Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.8.5 Poland Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.9.2 Romania Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.1.9.3 Romania Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.1.9.4 Romania Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.9.5 Romania Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Business Intelligence Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.4 Western Europe Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.5 Western Europe Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.2.6 Western Europe Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.7 Western Europe Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.8.2 Germany Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.8.3 Germany Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.2.8.4 Germany Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.8.5 Germany Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.9.2 France Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.9.3 France Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.2.9.4 France Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.9.5 France Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.10.2 UK Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.10.3 UK Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.2.10.4 UK Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.10.5 UK Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.11.2 Italy Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.11.3 Italy Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.2.11.4 Italy Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.11.5 Italy Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.12.2 Spain Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.12.3 Spain Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.2.12.4 Spain Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.12.5 Spain Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.15.2 Austria Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.15.3 Austria Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.2.15.4 Austria Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.15.5 Austria Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Business Intelligence Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.4 Asia Pacific Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.4.5 Asia Pacific Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.4.6 Asia Pacific Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.7 Asia Pacific Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.8.2 China Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.4.8.3 China Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.4.8.4 China Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.8.5 China Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.9.2 India Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.4.9.3 India Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.4.9.4 India Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.9.5 India Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.10.2 Japan Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.4.10.3 Japan Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.4.10.4 Japan Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.10.5 Japan Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.11.2 South Korea Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.4.11.3 South Korea Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.4.11.4 South Korea Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.11.5 South Korea Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.12.2 Vietnam Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.4.12.3 Vietnam Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.4.12.4 Vietnam Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.12.5 Vietnam Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.13.2 Singapore Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.4.13.3 Singapore Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.4.13.4 Singapore Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.13.5 Singapore Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.14.2 Australia Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.4.14.3 Australia Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.4.14.4 Australia Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.14.5 Australia Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Business Intelligence Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.4 Middle East Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.5.1.5 Middle East Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.5.1.6 Middle East Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.7 Middle East Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.8.2 UAE Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.5.1.8.3 UAE Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.5.1.8.4 UAE Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.8.5 UAE Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Business Intelligence Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.4 Africa Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.5.2.5 Africa Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.5.2.6 Africa Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.7 Africa Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Business Intelligence Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.4 Latin America Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.6.5 Latin America Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.6.6 Latin America Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.7 Latin America Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.8.2 Brazil Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.6.8.3 Brazil Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.6.8.4 Brazil Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.8.5 Brazil Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.9.2 Argentina Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.6.9.3 Argentina Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.6.9.4 Argentina Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.9.5 Argentina Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.10.2 Colombia Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.6.10.3 Colombia Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.6.10.4 Colombia Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.10.5 Colombia Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Business Intelligence Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Business Intelligence Market Estimates And Forecasts, By End Use (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Business Intelligence Market Estimates And Forecasts, By Business Function (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Business Intelligence Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Business Intelligence Market Estimates And Forecasts, By Organization Size (2020-2032) (USD Billion)

13. Company Profiles

13.1 Microsoft

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 Tableau Software (Salesforce)

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 IBM

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 Qlik

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 SAP

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 Oracle

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 Redash (Databricks)

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Mode Analytics

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Looker (Google)

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Infor

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By component

Solutions

Services

By deployment mode

Cloud

On-premises

By organization size

Large Enterprises

Small and Medium-sized Enterprises

By business function

Human Resource

Finance

Operations

Sales and Marketing

By End-use Industry

BFSI

IT and Telecommunication

Retail and Consumer Goods

Manufacturing

Healthcare

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

Accounts Receivable Automation Market was valued at USD 3.5 billion in 2023 and is expected to reach USD 10.5 billion by 2032 and grow at a CAGR of 13.1% from 2024- 2032.

Robotic Process Automation Market size was valued at USD 2.8 Billion in 2023 and is expected to grow to USD 38.4 Billion by 2032 and grow at a CAGR of 33.8% over the forecast period of 2024-2032.

The Broadcast Scheduling Software Market Size was valued at USD 1.6 Billion in 2023 and is expected to reach USD 7.84 Billion by 2032, growing at a CAGR of 19.34% over the forecast period 2024-2032.

The Bare Metal Cloud Market was valued at USD 8.47 billion in 2023 and is expected to reach USD 46.14 billion by 2032, growing at a CAGR of 20.77% over the forecast period 2024-2032.

The Performance Marketing Software Market was valued at USD 15.2 billion in 2023 and will reach USD 30.9 Billion by 2032, growing at a CAGR of 8.23% by 2032.

Business Rules Management System Market was valued at USD 1.48 billion in 2023 and is expected to reach USD 3.35 billion by 2032, growing at a CAGR of 9.52% from 2024-2032.

Hi! Click one of our member below to chat on Phone