Burial Insurance Market Size Analysis:

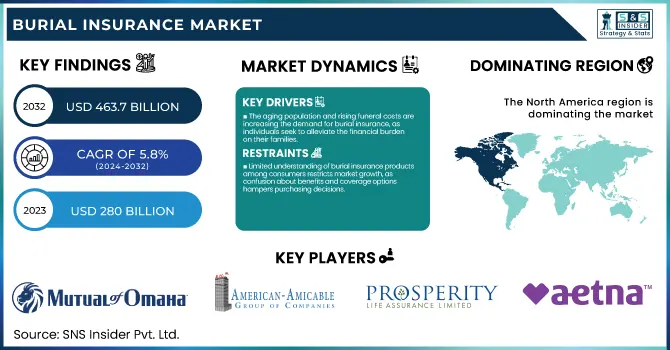

The Burial Insurance Market size was valued at USD 280 billion in 2023 and is expected to reach USD 463.7 billion by 2032, growing at a CAGR of 5.8% over the forecast period 2024-2032.

The Burial Insurance Market Report provides key statistical insights and trends, including policyholder demographics, analyzing adoption rates across different age groups and income levels. It analyzes pricing and trends in policy premiums, showing variability in the cost and benefits of policies. The report also reviews claims payout and beneficiary statistics, analyzing the rate of settlement and the timeline for payout.

To Get more information on Burial Insurance Market - Request Free Sample Report

It also analyses the channels of distribution and trends in sales volume, identifying the significance of agents, online platforms, and financial institutions. Similarly, section covers the regulatory landscape and compliance trends that summarize the recent policy changes, legal frameworks that affect the market. The report provides a detailed insight of consumer behaviour and awareness levels, including major purchasing determinants and perceptions affecting demand. This analysis helps stakeholders understand growth drivers and market dynamics. The burial insurance market is rapidly growing due to aging population and a rise in funeral costs.

Burial Insurance Market Dynamics

Drivers

-

The aging population and rising funeral costs are increasing the demand for burial insurance, as individuals seek to alleviate the financial burden on their families.

The factors driving the growth of the burial insurance market include the changing global demographic trend towards an aging population and increasing costs related to funeral services. According to recent statistics, the number of people 65 years old and over is projected to more than double from 703 million in 2019 to 1.5 billion in 2050. This significant jump reflects an increasing demand for financial products such as burial insurance that help offset final expenses. At the same time, funeral prices have also been climbing. In the U.K, for example, the average funeral cost has risen by 15% in the last year ringing in at £5,212. Notably, burial services can reach up to £11,348, while cremations may cost up to £9,529. The rising expenses put a significant financial burden on families, making burial insurance a popular policy to relieve such burdens. Growing awareness and demand for burial insurance has been driven in part by the convergence of a rapidly aging global population and the rising costs of funerals. With increasing awareness regarding the significance of covering end-of-life expenses in advance, the burial insurance market is expected to keep flourishing, providing policyholders and their families with the assurance and financial security needed during such difficult times.

Restraint:

-

Limited understanding of burial insurance products among consumers restricts market growth, as confusion about benefits and coverage options hampers purchasing decisions.

Lack of consumer awareness and understanding of burial insurance products significantly hinders market growth as confusion related to the benefits and coverage options hinders purchase decisions. A recent study in the UK revealed that nearly half of adults have not written a will, with 30% believing they are not old enough and 19% unsure where to start. Additionally, 24% would struggle to cover the cost of a family bereavement, and 21% are uncertain about their ability to manage these expenses. The same applies to burial insurance; with such limited knowledge and awareness of burial insurance, the market growth is stunted. Many people don't know of burial insurance or do not know enough about it to make a plan and consequently are not financially prepared for the end of their lives. This helps in creating awareness and educating consumers better about burial insurance products and how they can benefit from them.

Opportunity:

-

Expanding digital distribution channels and online platforms can enhance accessibility and convenience, attracting a broader customer base seeking burial insurance policies.

The growing number of digital distribution channels is a significant growth opportunity for the burial insurance market, improving access and convenience for a wider customer audience. As the trend toward buying insurance online continues to gain traction, insurance companies are offering online platforms for purchasing, enabling consumers to compare policies, receive quotes, and complete purchases without requiring in-person meetings. This addresses the increasing demand for digital transactions, especially among tech-savvy individuals and those who prefer seamless digital solutions.

For instance, in September 2024, Transamerica introduced FE Express, an online platform for final expense insurance that includes lifetime coverage of up to $50,000 with guaranteed level premiums. Applications can be completed in as little as 10 minutes, and online management and optional funeral concierge services are available. In addition, digital tools allow insurers to provide tailored recommendations for policies according to specific customer needs and preferences, improving customer satisfaction and engagement. Online management of policies, from paying premiums to changing beneficiaries, only strengthens this appeal for digital platforms. The trend of consumers shifting towards online-based financial services and the increasing adoption of digital distribution channels for burial insurance only appear to be laying the groundwork for swift growth to service modern customer needs.

Challenge:

-

Intense market competition, with new entrants offering innovative and cost-effective products, pressures existing insurers to differentiate and maintain profitability.

The burial insurance market is presenting some of the strongest competition to date, as new startups launch with innovative products and existing insurers look for ways to differentiate themselves. In March 2024, InsurTech startup PolicyPal launched an AI-driven platform that compatibly analyzes customer needs and proposes tailor-made burial insurance packages to improve customer experience and streamline policy management. Others, such as Sentinel Security Life Insurance Company and Colonial Penn Life Insurance Company, are utilizing blockchain for improved transparency and security in policy management. These trends put pressure on traditional insurers to adapt and innovate to remain competitive. Established insurers must invest considerably more in research and development to remain competitive. For example, In March 2024, Allianz SE announced an investment of $500 million in research to develop new digital platforms for expanding customer experience and streamlining policy management. In April 2024, Aviva PLC released a new simplified burial insurance product to find its way to the market by further reducing expenses and premiums, and mid-sized insurers are finding new ways of adapting as well. While these measures can certainly help traditional insurers mitigate their disadvantages, the pace of technological change is so rapid, and new entrants can be so agile, that it is often difficult for them to keep up without a particular focus on innovation and agility in the evolving market.

Burial Insurance Market Segmentation Analysis

By Coverage Type

In 2023, the modified or graded death benefit segment was the largest revenue contributor 44%. This is due in part to its accessibility for those with preexisting conditions and its low cost compared to traditional life insurance policies. The U.S. Department of Health and Human Services estimates that approximately 85% of older adults have at least one chronic health condition, while 60% have at least two chronic conditions. As the older population suffers from such a high prevalence of health issues, modified or graded types of death benefit policies become appealing.

In addition, the National Association of Insurance Commissioners (NAIC) indicates that graded death benefit policies come with a waiting period of around two to three years before full benefits are paid out, enabling insurers to provide coverage to high-risk individuals. That waiting period lowers the insurer’s risk, which makes these policies more widely available and affordable. According to the 2022 Economic Well-Being of U.S. Households report published by the U.S. Federal Reserve, 32% of U.S. adults would have difficulty paying a $400 emergency expense, emphasizing that burial insurance options should be accessible and affordable. Modified or graded death benefit policies are also popular due to their flexibility. These policies are also flexible in terms of adjusting coverage amounts and premium payments, making them adaptable to changing financial circumstances. That flexibility is especially important now, when a lot of Americans are worried about the economy. The Bureau of Labor Statistics previously reported that the Consumer Price Index for All Urban Consumers (CPI-U) increased 3.1 percent over the 12 months ended January 2024.

By End User

The over 70 segment held the largest revenue share of 33% in 2023. This large proportion in the market is due to many of the factors that are relevant to the elderly population and their needs. Based on the U.S. Census Bureau’s 2020 population estimates, an estimated 38 million Americans are aged 70 or older, making for a significant and growing demographic. An increasing awareness around end-of-life planning among this segment is one of the main drivers for its dominance. According to the National Funeral Directors Association’s 2021 Consumer Awareness and Preferences Study, 66.2 percent of adults aged 40 and older said it was important to inform family members of their funeral plans and wishes prior to their own death. This percentage is most likely higher among older adults, as they have a better awareness of their mortality and the financial impact of their death.

In addition, according to the Social Security Administration, the average life expectancy for a 70-year-old is around 15 years for men and 17 years for women in 2023. However, increased life expectancy means that people now have more years in which to plan for and save for their final expenses. The U.S. Government Accountability Office reported in 2019 on retirement security and found that approximately 48% of households 55 and older have no retirement savings at all, highlighting the need for financial products like burial insurance to help cover end-of-life costs. The Centers for Medicare & Medicaid Services also found that healthcare spending for the 65 and older population was $19,098 per person in 2019, well above the average of $11,582 for the full population. Such an increase in healthcare spending may prompt older adults to find ways to mitigate possible financial burdens on their families, including the purchase of burial insurance.

Burial Insurance Market Regional Insights

North America dominated the burial insurance market in 2023, accounting for a 36% market share. This leadership position can be attributed to several factors, including a well-established insurance industry, high awareness of financial planning, and an aging population. The U.S. Census Bureau projects that by 2030, all baby boomers will be older than 65, expanding the size of the older population to 1 in every 5 residents. This demographic shift is driving demand for burial insurance products. The region's dominance is further supported by the high cost of funerals in North America. The National Funeral Directors Association reports that the median cost of a funeral with viewing and burial in the United States was $7,848 in 2021, not including cemetery, monument, or marker costs. This financial burden encourages many Americans to seek pre-planning options like burial insurance.

Meanwhile, the Asia-Pacific region is experiencing the fastest growth, with a significant CAGR from 2024 to 2032. This rapid expansion is driven by increasing awareness of financial planning, rising disposable incomes, and changing cultural attitudes towards end-of-life preparations. According to the United Nations Economic and Social Commission for Asia and the Pacific, the number of people aged 65 and above in the region is expected to more than double from 535 million in 2019 to 1.3 billion by 2050, creating a substantial market for burial insurance products. In China, the largest market in the Asia-Pacific region, the National Bureau of Statistics reported that the population aged 65 and above reached 209 million in 2022, accounting for 14.9% of the total population. This aging demographic, combined with the country's rapid economic growth, is fueling the demand for burial insurance and other end-of-life financial products.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Burial Insurance Market

Key Service Providers/Manufacturers

-

American Amicable

-

Prosperity Life Group

-

Aetna (Accendo)

-

Transamerica

-

Guarantee Trust Life Insurance

-

Gerber Life Insurance Company

-

AIG (American International Group)

-

Foresters Financial

-

Fidelity Life Association

-

Colonial Penn

-

State Farm

-

New York Life Insurance Company

-

Lemonade

-

Globe Life

-

Allianz Life

-

The Baltimore Life Companies

-

Zurich Insurance

-

Ethos

Recent Developments in the Burial Insurance Market

-

In January 2024, the Colonial Penn Life Insurance Company introduced an online purchasing platform, enabling customers to purchase burial insurance online and complete the entire application process that way. The move is designed to streamline purchasing and attract tech-savvy seniors.

-

In March 2024, Mutual of Omaha Insurance Company announced that the company had expanded its guaranteed, whole life insurance product line, burial insurance, to include the Xelerator Whole Life product series. The new products provide consumers with higher coverage limits and more flexible payment options to align with their needs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 280 Billion |

| Market Size by 2032 | USD 463.7 Billion |

| CAGR | CAGR of 5.78% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Coverage (Level Death Benefit, Guaranteed Acceptance, Modified or Graded Death Benefit) • By End Use (Over 50, Over 60, Over 70, Over 80) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Mutual of Omaha, American Amicable, Prosperity Life Group, Royal Neighbors of America, Aetna (Accendo), Transamerica, Guarantee Trust Life Insurance, Gerber Life Insurance Company, AIG (American International Group), Foresters Financial, Fidelity Life Association, Colonial Penn, State Farm, New York Life Insurance Company, Lemonade, Globe Life, Allianz Life, The Baltimore Life Companies, Zurich Insurance, Ethos. |