Brewery Equipment Market Report Scope & Overview:

Get More Information on Brewery Equipment Market - Request Sample Report

The Brewery Equipment Market size was USD 17.43 billion in 2023 and is expected to Reach USD 29.45 billion by 2032 and grow at a CAGR of 6.0 % over the forecast period of 2024-2032.

Brewery equipment is the machinery and devices used to make beer. Based on Equipment type they are categorized as Macro Brewery and Craft Brewery. In 2022, microbrewery equipment dominated the market, accounting for 83.1% of total sales. This segment is expected to maintain its dominance in the foreseeable future, as demand for a standard style of beer rises as a result of the easy availability of beer from different brands at varying price points. The usage of this machinery is ideal for large-scale beer production.

Based on Mode of Operation they are categorized as Automatic, Semi-automatic, and Manual. Automatic brewery equipment led the market, accounting for 55.2% of worldwide revenue in 2022. Automation is increasingly being used in the craft brewing process to streamline the process. The big players are investing in the development of automated equipment for high-quality beer manufacturing.

MARKET DYNAMICS

KEY DRIVERS

-

Advertising of beer

-

Increase in consumption of beer in countries

The rise in beer consumption has been aided by the popularity of craft beer. A form of beer known as "craft beer" is produced on a small scale, usually by independent breweries. Craft beer is getting more and more well-liked among consumers since it is frequently thought to be of superior quality than mass-produced beer. Additionally, people tend to spend more on luxuries like alcohol when per capita incomes rise. The increase in sales of low-alcohol and non-alcoholic beers is being driven by the aging population in many wealthy nations.

RESTRAIN

-

The high cost of brewery equipment, energy, and power

Brewery equipment can be pricey, which makes it difficult for small brewers to get started. Brewery equipment can range in price from a few thousand dollars to several million dollars depending on the size and complexity of the brewery. Small breweries may not have the funds to invest in such expensive machinery, therefore this can be a big expenditure. Additionally, energy is needed for refrigerators used in breweries. This is so that the brewing process may utilize materials like malt and hops, as well as cold water. These cold things are kept in the refrigerators, which are also used to cool the wort.

OPPORTUNITY

-

Substantial growth in beer culture and market presence

More and more people are drinking beer, which is contributing to the global growth of the beer culture. This is being fueled by several variables, including the rising demand for imported beer, the expansion of microbreweries, and the popularity of craft beer. Since breweries need to invest in equipment to create beer, the expanding beer culture is driving demand for brewery equipment. As breweries proliferate all over the world, the demand for brewery equipment is expanding.

CHALLENGES

-

Rising health concerns

-

Rise in demand for non-alcoholic beverages

Due to increased health concerns and the popularity of health and wellness trends, there is an increase in the demand for functional and non-alcoholic beverages. This is due to the perception that non-alcoholic beverages are healthier than alcoholic ones. Breweries will need to make equipment investments to create these sorts of beverages, which could hurt the market for brewery equipment.

IMPACT OF RUSSIA UKRAINE WAR

Russia Ukraine war has negatively affected production and sales of beer and brewery equipment. Supply chain disruption has led to a decrease in the supply of aluminum, steel, crops, plastic, etc. Increased gasoline prices have unavoidably required truckers and farmers to charge more for transportation, raising supply costs and, as a result, affecting the final price of the product. The price of steel, a key component in brewery equipment, has increased by 30% since the start of the war. The delivery time for brewery equipment has increased in FY22 since the start of the war.

IMPACT OF ONGOING RECESSION

The cost of manufacturing beer is currently about 62% greater than it was two years ago, according to the Beer Index. Based on the essential ingredients used to make beer, such as malt, wheat, rice, barley, aluminum, and fuel, this analysis was conducted. Glass and aluminum are needed to make the mini-bottles, standard bottles, and aluminum cans that are vital parts of beer. the increased energy costs brought on by the Russian supply being cut off since glass manufacture requires 80% natural gas.

MARKET SEGMENTATION

By Equipment Type

-

Macro brewery

-

Craft Brewery

By Mode of Operation

-

Automatic

-

Semi-automatic

-

Manual

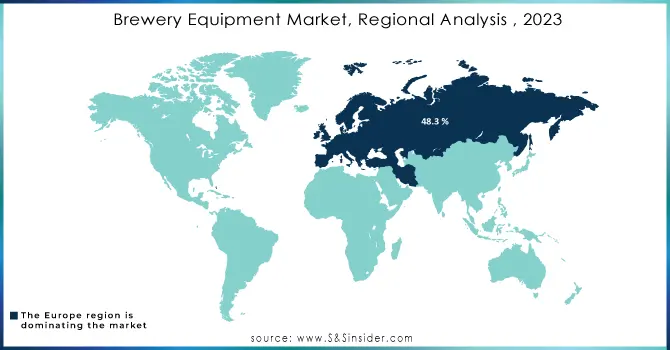

REGIONAL ANALYSIS

Europe region is leading the market which accounted for a 48.3 % share of the global revenue in 2023. In addition, France is shifting its drinking patterns away from wine and toward beer. Various key beer manufacturers such as SABMiller, Heineken N.V., and Carlsberg A/S are present in Europe, which produces beer on a large scale, resulting in a high use of brewery equipment in the region, as well as rising beer consumption in Europe, which is expected to boost market growth.

Asia Pacific is a growing market for brewery equipment market. Rapid increasing population and changing consumer preferences towards craft beer have driven the growth. Beer consumption in countries such as China, Japan, and others is predicted to expand rapidly during the projection period. Consumers in China choose low-calorie or no-alcohol beer as their understanding of healthy lifestyles and eating habits improves, and demand for craft beer grows as multiple health benefits are associated with it.

The North American brewery equipment market is expected to grow with a CAGR of 7.5 %. This is attributable to the region's growing desire for craft beer. The increased emphasis of various businesses in economies such as the United States and Canada on offering premium taste drinks and novel tastes is predicted to drive North American demand for brewery equipment.

Latin America, the Middle East, and Africa are expected to have significant market growth. Governments in several economies, such as Argentina and Brazil, are projected to ease limitations and standards limiting the construction of breweries, benefiting industry growth.

Need Any Customization Research On Brewery Equipment Market - Inquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

ALFA LAVAL, Praj Industries, GEA Group Aktiengesellschaft, PAUL MUELLER COMPANY, DELLA TOFFOLA USA, ABE Equipment, Ampco Pumps Company, LEHUI, Krones AG, CRIVELLER GROUP, Hypro, SCHULZ, and other key players are mentioned in the final report.

RECENT DEVELOPMENTS

In 2023 Mackinnon Brothers Brewing Co. in Kingston, Ontario, is utilizing carbon capture technology. The new apparatus gathers and pressurizes CO2. It is then reintroduced into the beer later in the process, resulting in the white foamy head that beer is famous for.

In 2022 Falcon, an Indian producer of microbrewery equipment, organizes India's Biggest Oktoberfest celebration in collaboration with partner breweries across India.

In 2021 Alfa Laval has introduced a new decanter, the Alfa Laval Foodec Hygiene Plus, to assist the food business in meeting and exceeding these growing needs.

| Report Attributes | Details |

| Market Size in 2023 | USD 17.43 Billion |

| Market Size by 2032 | USD 29.45 Billion |

| CAGR | CAGR of 6.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment Type (Macro Brewery, Craft Brewery) • By Mode of Operation (Automatic, Semi-automatic, Manual) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | ALFA LAVAL, Praj Industries, GEA Group Aktiengesellschaft, PAUL MUELLER COMPANY, DELLA TOFFOLA USA, ABE Equipment, Ampco Pumps Company, LEHUI, Krones AG, CRIVELLER GROUP, Hypro, SCHULZ |

| Key Drivers | • Advertising of beer • Increase in consumption of beer in countries |

| Market Challenges | • Rising health concerns • Rise in demand for non-alcoholic beverages |