Get more information on Breathalyzers Market - Request Sample Report

Breathalyzers Market was valued at USD 2.7 billion in 2023 and is expected to reach USD 10.9 billion by 2032, growing at a CAGR of 16.74% from 2024-2032.

The breathalyzers market is expected to grow with urgency on road safety improvement. Every year, about 1.19 million people die in traffic accidents worldwide. Road injuries have become the leading cause of death in young adults aged 5–29. In lower- and middle-income countries, which account for 92% of fatalities despite housing almost 60% of the world's vehicles, law enforcement is increasingly using breathalyzers. Some 37 lose their lives daily in alcohol-related crashes in the U.S., suggesting further solutions to make testing easily available.

Workplace and healthcare applications fuel expansion in the breathalyzer market. Alcohol use causes 11% of all workplace accidents, costing companies an estimated USD 2 billion annually in lost productivity and time off. High-risk industry employers are using alcohol testing to minimize accidents and improve safety in the workplace. Health care providers also use breath analyzers for monitoring the level of alcohol in their patients, particularly in treating addiction. Applications in occupational and medical sectors are thus driving growth in the market.

New market opportunities are therefore emerging from innovations in the technology of the breathalyzer especially with regard to cannabis use. Cannabis use is indeed on the rise, mainly in the U.S. where 52.5 million users reported usage. A growing demand for marijuana-specific breathalyzers is building up. Such devices are useful for reliable on the spot testing in meeting regulation needs as cannabis legalization goes on. Digital and smartphone-compatible breathalyzers have also boosted user accessibility as they are very useful both in law enforcement, in workplaces, and in personal use. As these technologies develop, the breathalyzer market shall achieve a multi-sector development across various fields.

DRIVERS

As the deaths due to alcohol-driving totaled 18% of road fatalities in UK during the year 2022, it is now raising more control over the killing safety threat from authorities. With this alcohol-related binge on driving violation, there's an always-growing demand for a portable and accurate breathalyser that the police so badly want to use for accurate roadside tests. In light of both regulator and community pressures to drive safer roads, innovative technology in breathalyzer technology for accuracy, portability, and ease of use, advanced devices now become that critical solution that will ensure impaired driving can be halted in real-time and losses on the road will stop.

New innovations for breathalyzer technology, including smartphone connectivity, fuel cell sensors, and IR spectroscopy, bring the bar up even more in terms of accuracy, usability, and industry application. Recently, in September 2022, fuel cell breathalyzer sensors have demonstrated accuracy in providing BAC between 0.00% and 0.400%, a range which provides coverage of what is desired for most uses. This precision has made fuel cell breathalyzers a necessity in law enforcement, healthcare, and workplace safety as most countries have established a legal intoxication level at 0.08% BAC. Smart phone connectivity enables the transfer of real-time data and IR spectroscopy to enhance performance in legal and forensic environments, which makes this device relevant to many industries.

RESTRAINTS

The breathalyzers are convenient for BAC measurement, although their measurements are seriously affected by external conditions, particularly by temperature. Extremes of cold or heat may cause sensor readings to become less reliable. This leads to inaccurate results. For instance, a fuel cell is highly accurate under standard conditions but is compromised if it is extremely high or low in temperatures as the performance influences its diverse environment. This sensitivity to temperature is a limitation, especially when climatic conditions change more frequently, and it needs readjustment or recalibration from time to time, thus adding to the cost of maintenance and reducing its reliability.

BY TECHNOLOGY

In 2023, fuel cell technology leads the market with about 34% in terms of revenue due to its high accuracy and reliability in providing precise BAC readings, even in diluted alcohol concentrations. Such a technology has become the preference in law enforcement and workplace testing applications where accurate results play a crucial role in maintaining public safety. On the other hand, infrared spectroscopy is expected to grow significantly in the near future and is anticipated to hold a CAGR of 18.52% during the period 2024-2032. This growth is attributed to the rising demand for sophisticated testing capabilities in forensic and clinical settings and thus the higher sensitivity and IR technology's ability to detect the existence of several substances. This classifies IR technology as the significant area for future application to be used in fields demanding high accuracy and variability.

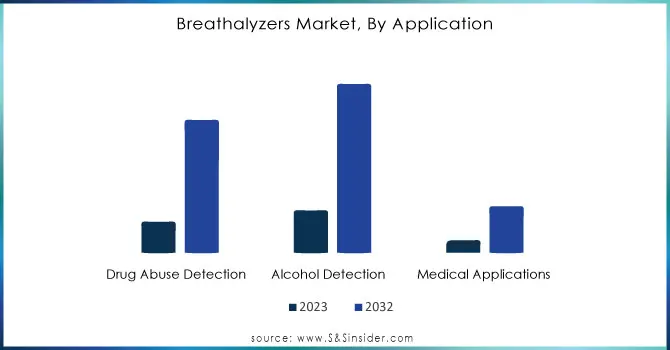

BY APPLICATION

In 2023, alcohol detection holds about 50% revenue of the breathalyzer market mainly because of heavy regulatory requirements concerning alcohol screening across law enforcement, workplace, and transportation sectors. The breathalyzer systems are highly established and known for their reliability, hence remain the devices preferred for the establishment of prompt results and potential legality. Meanwhile, growth in the segment of detecting drug abuse is projected to be significant during the foreseen forecast period; the segment is expected to attain a CAGR of 17.9% from 2024 to 2032. The factor that has primarily driven growth through a rapid rate is seen mainly in rising demand for multi-substance testing, as well as increased focus in curbing drug-impaired driving and a growing scale of drug-testing protocols becoming implemented across industries. Consequently, drug-detective breath analyzers are now an integral part of public-safety programs, thus expanding applications for breath analyzers.

Need any customization research on Breathalyzers Market - Enquiry Now

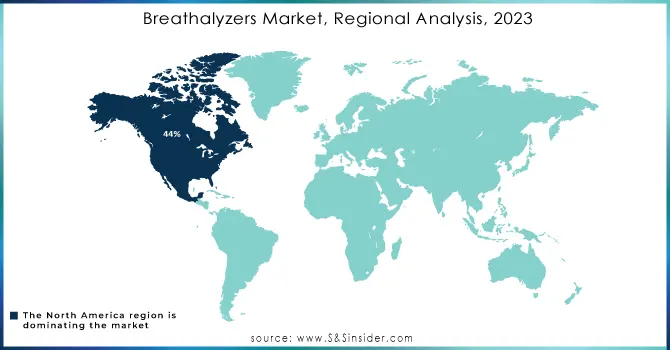

North America, accounted for the largest revenue share of around 44% in 2023. Strict regulations regarding alcohol consumption while driving, combined with the widespread use of breath testing technology throughout law enforcement and workplaces and through public transportation, have solidified this position. Furthermore, high degrees of public awareness and solid safety measures contribute to robust demand in the region for reliable breath testing solutions.

The Asia Pacific market is expected to have highest CAGR of about 17.71% between 2024-2032. This will mainly be because of the rise in rapid urbanization coupled with rising road safety issues. The demand for breathalyzers is bound to increase with the implementation of stricter DUI regulations across different countries and improvement in their public safety infrastructure in the region. Economic growth and increased emphasis on workplace safety allow for an expansion of the application for breath-analysis devices throughout Asia Pacific, which in itself is likely to be a growth hotbed for this industry.

LATEST NEWS-

In August 2024, scientists at NIST began testing a new technique of detecting cannabis use through breath tests. This is the new method that requires conducting two successive breath tests which increases the reliability in showing whether the person used it recently; this is where the challenge lies for THC test because the substance persists in the body.

In 2024, Cannabix Technologies is taking its cannabis breathalyzer technology forward through a partnership with Omega Laboratories that will help in the development of their proprietary cannabis breath testing device.

KEY PLAYERS

Lifeloc Technologies, Inc. (FC20, Phoenix 6)

Quest Products, Inc. (Q3 Breathalyzer, Alco-Sensor IV)

Intoximeters (Intoxilyzer 9000, Intoxilyzer SD)

Alcohol Countermeasure Systems Corp. (ACS 7500, ACS 2000)

AK GlobalTech Corp. (AlcoMate REVO, AlcoMate Premium)

Bedfont Scientific Ltd. (SMOKEFREE, Gastro+)

Tanita (Tanita Breath Alcohol Tester, Tanita ALCOHOL-09)

Lion Laboratories (Lion Alcolyzer, Lion 500)

Shenzhen Ztsense Hi-Tech Co., Ltd. (ZTS-1200, ZTS-1500)

Drägerwerk AG & Co. KGaA (Dräger Alcotest 6820, Dräger Alcotest 7510)

AlcoPro (AlcoPro AlcoMate, AlcoPro 5000)

Brezel GmbH (Brezel BE10, Brezel BE30)

Sentech (Sentech Breathalyzer, Sentech Alcohol Tester)

Narkomed (Narkomed Breath Analyzer, Narkomed Alcohol Tester)

AlcoDigital (AlcoDigital AEB 100, AlcoDigital AL9000)

Bactrack (Bactrack S80, Bactrack Mobile)

AEB (AEB 8000, AEB 5000)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.7 Billion |

| Market Size by 2032 | USD 10.9 Billion |

| CAGR | CAGR of 16.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Fuel Cell Technology, Semiconductor Sensor, Infrared (IR) Spectroscopy, Others) • By Application (Drug Abuse Detection, Alcohol Detection, Medical Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Lifeloc Technologies, Inc., Quest Products, Inc., Intoximeters, Alcohol Countermeasure Systems Corp., AK GlobalTech Corp., Bedfont Scientific Ltd., Tanita, Lion Laboratories, Shenzhen Ztsense Hi-Tech Co., Ltd., Drägerwerk AG & Co. KGaA, AlcoPro, Brezel GmbH, Sentech, Narkomed, AlcoDigital, Bactrack, AEB. |

| Key Drivers | • Demand for Portable Breathalyzers Surges as Stricter Regulations Address Escalating Alcohol-Impaired Driving Fatalities. • Innovative Breathalyzer Technologies Expand Market Reach with Enhanced Accuracy, Usability, and Industry Applications. |

| RESTRAINTS | • Temperature Sensitivity Challenges Breathalyzer Accuracy and Reliability in Diverse Environments and Extreme Conditions. |

Breathalyzers Market was valued at USD 2.7 billion in 2023 and is expected to reach USD 10.9 billion by 2032, growing at a CAGR of 16.74% from 2024-2032.

Alcohol-related driving accounted for 18% of road fatalities in the UK

The drug abuse detection segment is expected to grow at a CAGR of 17.9%.

Alcohol detection accounted for about 50% of the breathalyzer market revenue in 2023.

North America dominated the breathalyzer market, accounting for around 44% of revenue.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by region, (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Breathalyzers Market Segmentation, by Application

7.1 Chapter Overview

7.2 Drug Abuse Detection

7.2.1 Drug Abuse Detection Market Trends Analysis (2020-2032)

7.2.2 Drug Abuse Detection Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Alcohol Detection

7.3.1 Alcohol Detection Market Trends Analysis (2020-2032)

7.3.2 Alcohol Detection Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Medical Applications

7.4.1 Medical Applications Market Trends Analysis (2020-2032)

7.4.2 Medical Applications Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Breathalyzers Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Fuel Cell Technology

8.2.1 Fuel Cell Technology Market Trends Analysis (2020-2032)

8.2.2 Fuel Cell Technology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Semiconductor Sensor

8.3.1 Semiconductor SensorMarket Trends Analysis (2020-2032)

8.3.2 Semiconductor SensorMarket Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Infrared (IR) Spectroscopy

8.4.1 Infrared (IR) Spectroscopy Market Trends Analysis (2020-2032)

8.4.2 Infrared (IR) Spectroscopy Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Breathalyzers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.4 North America Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5.2 USA Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6.2 Canada Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7.2 Mexico Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Breathalyzers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5.2 Poland Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6.2 Romania Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Breathalyzers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.4 Western Europe Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5.2 Germany Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6.2 France Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7.2 UK Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8.2 Italy Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9.2 Spain Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12.2 Austria Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Breathalyzers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.4 Asia Pacific Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 China Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 India Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 Japan Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6.2 South Korea Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7.2 Vietnam Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8.2 Singapore Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9.2 Australia Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Breathalyzers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.4 Middle East Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5.2 UAE Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Breathalyzers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.4 Africa Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Breathalyzers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.4 Latin America Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5.2 Brazil Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6.2 Argentina Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7.2 Colombia Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Breathalyzers Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Breathalyzers Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10. Company Profiles

10.1 Lifeloc Technologies, Inc.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Quest Products, Inc.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Intoximeters

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Alcohol Countermeasure Systems Corp.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Bedfont Scientific Ltd.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Tanita

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Drägerwerk AG & Co. KGaA

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 AlcoPro

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Sentech

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Hyd AlcoDigital

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Technology

Fuel Cell Technology

Semiconductor Sensor

Infrared (IR) Spectroscopy

Others

By Application

Drug Abuse Detection

Alcohol Detection

Medical Applications

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Medical Terminology Software Market size was valued at USD 1.20 billion in 2023 and is expected to reach USD 4.95 billion by 2032 and grow at a CAGR of 17.09%.

Epilepsy Drugs Market was valued at USD 7.6 billion in 2023 and is expected to reach USD 10.9 billion by 2032, growing at a CAGR of 4.06% from 2024-2032.

The Albumin Market Size was valued at USD 6.15 billion in 2023, and is expected to reach USD 10.5 billion by 2032, and grow at a CAGR of 6.1% over the forecast period 2024-2032.

The U.S. Healthcare Payer Services Market Size was valued at USD 34.29 Billion in 2023 and is witness to reach USD 65.31 Billion by 2032 and grow at a CAGR of 7.74% over the forecast period 2024-2032.

The Digital Twins in Healthcare Market size was valued at USD 1.41 billion in 2023, and is expected to reach USD 28.88 billion by 2032, and grow at a CAGR of 40.01% over the forecast period 2024-2032.

The Blood Processing Devices and Consumables Market was valued at USD 48.3 billion in 2023 and is expected to reach USD 89.41 billion by 2032, growing at a CAGR of 7.11% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone