Breast Imaging Market Size & Report Overview

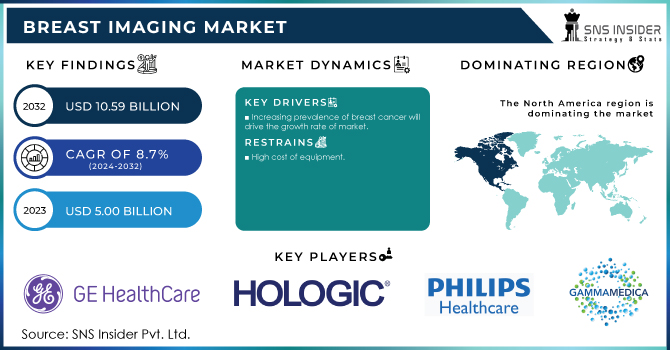

The Breast Imaging Market Size was valued at USD 5.00 Billion in 2023 and is expected to reach USD 10.59 Billion by 2032, growing at a CAGR of 8.70% over the forecast period of 2024-2032.

To Get More Information on Breast Imaging Market - Request Sample Report

The breast imaging market is evolving rapidly with advancements driven by patient-centric innovation and clinical precision. Our report reveals how patient demographics, including age and genetic factors, are influencing imaging demand worldwide. It also uncovers the surge in investments toward breast imaging startups, accelerating breakthroughs in diagnostic technologies. As imaging becomes more complex, technician and radiologist training trends are becoming vital to ensure accuracy and consistency. The report further explores the increasing cross-usage of imaging modalities per patient, reflecting a shift toward multi-layered diagnostic approaches. Additionally, the adoption of personalized risk-based screening is transforming early detection by tailoring protocols to individual risk profiles. These insights together illustrate the market’s shift toward smarter, data-driven, and patient-focused imaging solutions.

U.S. Breast Imaging Market Outlook

The US Breast Imaging Market Size was valued at USD 1.60 Billion in 2023 with a market share of around 85% and growing at a significant CAGR over the forecast period of 2024-2032.

The US breast imaging market is experiencing steady growth, fueled by rising breast cancer awareness, robust screening programs, and strong healthcare infrastructure. The American Cancer Society recommends regular mammograms starting at age 40, driving consistent demand. Initiatives like the CDC’s National Breast and Cervical Cancer Early Detection Program (NBCCEDP) further support access to screening services. Technological advancements by U.S.-based companies such as Hologic, Inc. and GE Healthcare ranging from 3D mammography to AI-powered diagnostic tools are enhancing early detection rates. Additionally, growing emphasis on personalized, risk-based screening is prompting healthcare providers to adopt more advanced and diverse imaging solutions tailored to individual patient profiles.

Breast Imaging Market Dynamics

Drivers

-

Rising Focus on Early Detection and Preventive Healthcare Boosts the Demand for Breast Imaging Technologies in Healthcare Systems

The growing focus on early cancer detection, especially breast cancer, is a significant driver in the breast imaging market. Governments, healthcare providers, and organizations such as the American Cancer Society are emphasizing the importance of early screening for improved survival rates. Routine screenings, such as mammograms, are becoming more prevalent, with increasing awareness about the need for early detection of breast cancer in women above certain age thresholds. Additionally, the ongoing push for preventive healthcare practices has led to the implementation of national screening programs, which not only increase the demand for breast imaging technologies but also promote technological advancements in the field. Early diagnosis is seen as a key factor in reducing healthcare costs and improving patient outcomes, creating a favorable environment for growth in breast imaging solutions, particularly among populations at higher risk for breast cancer, such as those with genetic predispositions.

Restraints

-

Lack of Sufficient Reimbursement Policies for Advanced Breast Imaging Services Hindering Market Expansion

Despite the advancements in breast imaging technologies, reimbursement policies remain a significant barrier to market expansion. In many regions, including parts of the United States and Europe, insurance reimbursement for new and advanced breast imaging procedures is limited or slow to evolve. This affects both healthcare providers and patients, as facilities may not be adequately compensated for offering advanced diagnostic services like 3D mammography or AI-assisted screening. Consequently, healthcare providers may be reluctant to adopt such technologies due to the financial uncertainty around reimbursement. In countries with limited or no reimbursement for advanced breast imaging services, patients may not have access to these life-saving screening options, hindering early detection and ultimately affecting the market's growth potential. A change in healthcare policies to expand coverage for advanced imaging procedures would be crucial to ensure broader adoption.

Opportunities

-

Integration of Personalized and Risk-Based Screening Protocols Offers Unprecedented Growth Potential for Breast Imaging Market

The rise of personalized medicine presents a unique opportunity for the breast imaging market to evolve through risk-based screening. As genetic testing and biomarker analysis become more commonplace, healthcare providers are increasingly tailoring breast cancer screening protocols to individual patients' genetic risk factors and family history. For instance, women with BRCA1 or BRCA2 mutations may benefit from earlier and more frequent imaging, such as MRI or ultrasound, in addition to mammography. Personalized screening offers greater precision in detecting early-stage breast cancer, improving patient outcomes and optimizing healthcare resources. With advancements in genomics and the increasing availability of genetic testing, there is a significant opportunity for the breast imaging market to incorporate risk-based, individualized screening programs. This would not only boost market demand but also improve early detection, reducing healthcare costs over time and enhancing patient care.

Challenge

-

Regulatory Hurdles and Slow FDA Approvals for New Breast Imaging Devices Delay Market Growth

Regulatory hurdles remain a significant challenge in the breast imaging market, especially in terms of securing timely approvals for new imaging devices and technologies. In markets like the United States, the process for obtaining approval from regulatory bodies like the Food and Drug Administration (FDA) can be lengthy and cumbersome. This not only delays the introduction of new technologies but also impacts manufacturers' ability to capitalize on market opportunities. As innovations in breast imaging, such as AI-driven solutions and next-generation imaging modalities, emerge, delays in approval processes can result in missed market opportunities and slow product adoption. Companies must navigate regulatory challenges efficiently to ensure their products reach the market in a timely manner to maintain competitive advantage.

Breast Imaging Market Segmentation Analysis

By Product

In 2023, the Breast Imaging Systems segment dominated the Breast Imaging Market with a market share of 70.5%. This dominance is primarily driven by the increasing demand for advanced imaging technologies for the early detection of breast cancer. Among the subsegments, full-field digital mammography (FFDM) holds the largest market share, as it is widely used due to its high-resolution imaging capabilities and efficiency in detecting early-stage breast cancer. Organizations like the American Cancer Society (ACS) have emphasized the need for routine mammography screenings, especially in women over the age of 40, which has spurred the adoption of advanced breast imaging systems. Additionally, healthcare providers such as Hologic and GE Healthcare continue to innovate with the latest imaging technologies, reinforcing the growth of this segment. Full-field digital mammography is considered the gold standard in screening, ensuring its continued dominance in the market.

By Technology

In 2023, the Ionizing Technology segment dominated the Breast Imaging Market with a market share of 60.8%. Among the subsegments, full-field digital mammography (FFDM) is the leading technology, accounting for a significant portion of this dominance. This technology remains the most widely used for breast cancer screening, offering high-resolution images and the ability to detect microcalcifications and other early signs of breast cancer. The American Cancer Society recommends annual mammograms for women aged 40 and above, which further boosts the usage of ionizing technologies. Additionally, the growing adoption of digital breast tomosynthesis (DBT), a 3D imaging technique under the full-field digital mammography category, has contributed to the shift toward ionizing technologies. Governments and healthcare organizations worldwide have endorsed these technologies due to their proven efficacy in early breast cancer detection, which strengthens their continued dominance in the market.

By End Use

In 2023, the Hospitals and Clinics segment dominated the Breast Imaging Market, accounting for a market share of 56.3%. This dominance is primarily driven by the availability of advanced breast imaging technologies in hospital settings, which are widely accessible to a large patient population. Hospitals and clinics also have the advantage of providing a comprehensive range of services, including diagnostic imaging, treatments, and follow-up care, making them the go-to choice for breast cancer screening and diagnostic services. For instance, institutions like Mayo Clinic and Cleveland Clinic provide state-of-the-art mammography services, attracting a broad patient base. Additionally, government health programs and insurance providers often offer coverage for screenings at hospitals and clinics, further boosting demand in this segment. The growing emphasis on early breast cancer detection through regular mammograms and the establishment of mammography centers within hospitals contribute to this segment's continued dominance.

Breast Imaging Market Regional Insights

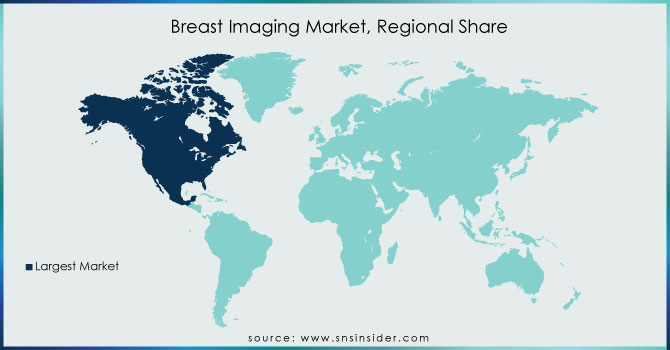

In 2023, North America dominated the Breast Imaging Market, with a market share of 37.6%. This dominance is attributed to several factors, including the advanced healthcare infrastructure, high adoption rates of breast imaging technologies, and strong awareness programs in the region. The United States, in particular, is the largest market for breast imaging, driven by a robust healthcare system, widespread access to screenings, and national breast cancer awareness campaigns. The American Cancer Society's ongoing efforts to promote early detection, including mammograms and 3D mammography, have contributed to the high uptake of breast imaging systems in the country. Additionally, government initiatives like the National Cancer Institute's Breast Cancer Surveillance Consortium further enhance access to diagnostic services. Canada is also witnessing significant growth due to increasing investments in healthcare infrastructure, while Mexico is focusing on improving breast cancer screening programs, which contributes to North America's overall market leadership.

On the other hand, Asia Pacific emerged as the fastest-growing region in the Breast Imaging Market, with a significant CAGR during the forecast period. The region is experiencing rapid economic development, which is leading to improvements in healthcare infrastructure and increasing awareness of breast cancer screening. Countries like China and India are significantly investing in healthcare technologies and cancer prevention programs, which is driving the demand for advanced breast imaging solutions. For example, China’s government has been promoting breast cancer screening programs as part of its public health agenda, and India has seen an increase in the number of breast imaging centers, particularly in urban areas. Additionally, rising disposable incomes in countries such as South Korea and Japan are enabling more women to seek breast cancer screenings. With the increasing adoption of advanced imaging systems like digital mammography and 3D mammography, Asia Pacific is poised to become a key growth hub for the global breast imaging market in the coming years.

Do You Need any Customization Research on Breast Imaging Market - Enquire Now

Leading Companies in the Breast Imaging Market

-

Aurora Imaging Technology, Inc. (Aurora 1.5T Dedicated Breast MRI System, Aurora 1.5T Bilateral Breast MRI System)

-

Canon Inc. (Aplio i-series Breast Ultrasound, Radrex-i Digital Radiography System)

-

Dilon Technologies, Inc. (Dilon 6800 Gamma Camera, Dilon Navigator Gamma Probe)

-

FUJIFILM Holdings Corporation (AMULET Innovality, AMULET Bellus II, FCR PROFECT CS Plus)

-

Gamma Medica, Inc. (LumaGEM Molecular Breast Imaging System)

-

GE Healthcare (Senographe Pristina, Invenia ABUS 2.0, LOGIQ Ultrasound)

-

Hologic, Inc. (3Dimensions Mammography System, Clarity HD Imaging Technology, Trident HD Specimen Radiography System)

-

Koninklijke Philips N.V. (Philips Healthcare) (IntelliSpace Breast Workstation, MicroDose Mammography System)

-

Leica Biosystems (Mammotome Breast Biopsy System, Aperio Digital Pathology Solutions)

-

Planmed Oy (Planmed Clarity 2D, Planmed Clarity 3D, Planmed ClarityGuide)

-

RadNet, Inc. (Digital Mammography, 3D Mammography/Tomosynthesis)

-

Siemens Healthineers (MAMMOMAT Revelation, MAMMOMAT Fusion, syngo.Breast Care)

-

SonoCine, Inc. (SonoCine Automated Whole Breast Ultrasound System)

-

Toshiba Corporation (Aplio i-series Breast Ultrasound, Xario 200 Ultrasound System)

-

United Imaging Healthcare (uMammo 890i, uCT 960+, uMR 790)

-

Volpara Health Technologies (VolparaDensity, VolparaLive!, VolparaEnterprise)

-

Zebra Medical Vision (AI1 Mammography, AI1 Breast Cancer Detection)

-

iCAD, Inc. (PowerLook Tomo Detection, ProFound AI for Digital Breast Tomosynthesis)

-

Delphinus Medical Technologies (SoftVue 3D Whole Breast Ultrasound System)

-

ScreenPoint Medical (Transpara AI for Mammography, Transpara AI for Breast Tomosynthesis)

Recent Developments in the Breast Imaging Industry

-

April 2025: RadNet plans to acquire iCAD to enhance AI-driven breast imaging, expanding its diagnostic capabilities. The merger aims to integrate iCAD’s AI tools with RadNet’s technology, impacting over 10 million mammogram screenings annually.

-

April 2025: Arkansas passed legislation mandating insurance coverage for advanced breast imaging screenings, aimed at improving early detection, especially for high-risk individuals.

-

February 2024: The Radiological Society of North America unveiled low-dose positron emission mammography, offering reduced radiation exposure while maintaining high diagnostic accuracy for early breast cancer detection.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.00 Billion |

| Market Size by 2032 | USD 10.59 Billion |

| CAGR | CAGR of 8.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Breast Imaging Systems, Software and Services, Accessories) •By Technology (lionizing [Full-field Digital Mammography, Analog Mammography, Positron Emission Mammography, Electric Impedance Tomography, Cone-Beam Computed Tomography, Others], Non-ionizing [MRI, Thermography, Ultrasound, Optical Imaging, Automated Whole-breast Ultrasound]) •By End Use (Hospitals and Clinics, Diagnostic Imaging Centers, Breast Care Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GE Healthcare, Hologic, Inc., Philips Healthcare, Gamma Medica, Inc., Siemens Healthcare, Fujifilm Holdings Corp., SonoCine, Inc., Toshiba Corporation, Dilon Technologies, Inc., Aurora Imaging Technology, Inc. and other key players |