Bonding Sheet Market Report Scope & Overview:

Get More Information on Bonding Sheet Market - Request Sample Report

The Bonding Sheet Market Size was valued at USD 406.33 Million in 2023 and is expected tot reach at USD 777.60 Million by 2032, and grow at a CAGR of 7.48% over the forecast period 2024-2032.

The bonding sheet market is experiencing substantial growth, fueled by the automotive and aerospace industries' need for lightweight materials that improve fuel efficiency and performance. In automotive manufacturing, bonding sheets enable the joining of metals and composites without compromising structural integrity, reducing vehicle weight and meeting stringent emissions standards. Companies like LG Chem are strengthening their presence in the automotive adhesives market to address these needs. Similarly, the aerospace sector benefits from bonding sheets to optimize performance while minimizing weight, ensuring safety and efficiency. With the rise of electric vehicles (EVs), which require advanced materials, bonding sheets are increasingly essential in supporting the electrification of transportation. Additionally, the booming consumer electronics sector presents new opportunities for bonding sheet applications, where precise adhesion is crucial.

Innovations in bonding technology, such as Loctite's form-in-place gasket material, DELO’s Monopox MG3727 adhesive with high compression shear strength, and Flash bond UV-8300LV for strong substrate adhesion, are pushing the market forward. Furthermore, biocompatible adhesives like EO-97M and Setworx-60 offer unique properties, such as curing at low temperatures and providing impact resistance, expanding bonding sheet applications in various industries. Water vapor plasma-assisted bonding (WVPAB) is a key innovation, allowing direct bonding of gold electrodes on ultra flexible polymer substrates without heat or pressure, resulting in highly flexible, stable, and durable bonds. This method, which lasts over 10,000 bending cycles, has been successfully applied in the integration of organic light-emitting diodes (OLEDs) and organic photovoltaics (OPVs) without performance degradation. The growing demand for lightweight, high-performance materials ensures the continued growth of the bonding sheet market across diverse industries.

Market Dynamics

Drivers

-

Bonding Sheet Market Growth Driven by Innovations and Diverse Applications Across Industries

Innovative advancements and the growing range of applications across various sectors are driving progress. Significant developments at Chemours Washington Works highlight advancements in chemical bonding technologies, which are essential for enhancing the performance and durability of bonding sheets, especially in the construction and automotive industries. The increasing demand for high-quality adhesives is evident in the rising popularity of versatile products like landscaping glue, which illustrates the effectiveness of bonding materials in various contexts. In the U.S. market, prominent players such as Chemours are well positioned to capitalize on these trends, reflecting a significant shift towards sustainable and efficient bonding solutions. Additionally, the market is likely to see heightened investment in research and development, as companies focus on enhancing product formulations and expanding their applications. This proactive approach indicates that the bonding sheet market is gaining momentum and becoming integral to contemporary manufacturing and construction processes, underscoring its critical importance in meeting the demands of modern industries.

Restraints

-

Temperature resistance restricts the bonding sheet market, as polymer adhesives are weaker than metals, limiting high-temperature applications.

One of the primary challenges is temperature resistance; adhesives, typically made from polymers, plastics, or synthetic resins, have limited strength compared to metals. As temperatures increase, bond strength tends to decrease, with a transition from elastic to plastic properties occurring between 20°C and 220°C (68°F and 428°F). This limitation restricts the applications of bonding sheets in high-temperature environments. Additionally, chemical resistance is crucial, as the durability of bonded joints relies heavily on the adhesive's polymer properties, necessitating careful selection to withstand exposure to solvents and oxidizing agents. Curing time also complicates production, as many adhesives do not achieve maximum bond strength immediately, requiring support during the bonding process. Surface preparation plays a vital role; inadequate wetting of surfaces can lead to poor bond quality, further complicating manufacturing. The need for stringent quality management standards, such as those specified in ISO 9000, adds to production complexity, requiring specialized controls to ensure consistent results. Moreover, health and safety concerns regarding the chemicals used in high-performance adhesives necessitate strict precautions during handling and application. Together, these factors create challenges for the bonding sheet market, compelling manufacturers to innovate and adapt their processes to meet these constraints effectively while striving for quality and reliability.

Segment Analysis

By Adhesive Material

In 2023, polyimides (PI) accounted for the largest revenue share of approximately 35% in the bonding sheet market, owing to their exceptional thermal stability, chemical resistance, and mechanical properties. Their ability to withstand high temperatures—exceeding 250 °C (482 °F)—is particularly beneficial in demanding industries like aerospace and automotive, where materials must endure extreme conditions. Additionally, polyimides exhibit excellent chemical resistance, allowing them to endure exposure to various solvents, which extends the lifespan of bonded joints and reduces maintenance costs for end-users. Their versatility is another significant advantage, as they can bond to a wide range of substrates, including metals, ceramics, and plastics, making them suitable for electronic components, flexible printed circuits, and composite materials. Recent innovations, such as DuPont's Kapton films and 3M's new line of polyimide bonding sheets, highlight ongoing advancements in this segment, improving adhesion strength and curing times. The increasing demand for lightweight materials and the trend toward miniaturization in electronics further drive the adoption of polyimides. As manufacturers focus on developing high-performance adhesives, polyimides are expected to maintain their leading position in the bonding sheet market.

By Adhesive Thickness

Based on Adhesive Thickness, 12µM (0.5MIL) is captured the largest share revenue in Bonding sheet market of around 30% in 2023.This thickness is favored for its optimal balance of flexibility and strength, making it suitable for a wide range of applications across various industries. The thin profile of 12µM adhesive sheets enables seamless integration into compact designs, which is particularly beneficial in sectors such as electronics, automotive, and aerospace. The ability to bond materials effectively while maintaining a low profile is essential for manufacturers seeking to create lightweight and space-efficient products. Additionally, the adhesive’s excellent performance characteristics, including strong adhesion and durability, contribute to its widespread adoption. As industries increasingly prioritize miniaturization and lightweight solutions, the demand for 12µM bonding sheets is anticipated to grow. Advancements in adhesive technology are enhancing the properties of these thin sheets, allowing for improved adhesion strength and faster curing times. This trend underscores the importance of the 12µM segment in meeting the evolving needs of manufacturers aiming for efficient and reliable bonding solutions. As a result, 12µM bonding sheets are poised to maintain their leadership position in the market going forward.

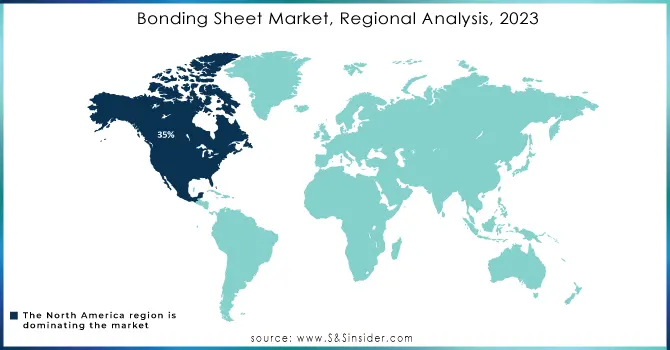

Regional Analysis

In 2023, North America established itself as the leading region in the bonding sheet market, capturing about 35% of the total revenue share. This dominance stems from a robust industrial base, encompassing key sectors such as aerospace, automotive, electronics, and construction, all of which require high-performance bonding solutions. The region is a hub of technological innovation, with ongoing developments in bonding materials that improve heat resistance, chemical stability, and adhesion strength. Stringent regulatory standards also drive manufacturers to adopt high-quality bonding sheets. With a focus on sustainability and eco-friendly solutions, the North American bonding sheet market is poised for continued growth, reinforcing its position as a key player in the global landscape.

In 2023, the Asia Pacific region emerged as the fastest-growing market for bonding sheets, driven by rapid industrialization and increased manufacturing capabilities. Countries like China, India, and Japan are leading this growth, particularly in automotive production, electronics manufacturing, and construction. The region's diverse industries are demanding lightweight, high-performance bonding materials, fueled by technological innovations that enhance properties such as heat resistance and adhesion strength. Recent developments include Henkel’s new bonding sheets for electronics; 3M’s advanced polyimide solutions for the automotive sector, and Sika AG’s sustainable bonding solutions for construction. As a result, Asia Pacific's bonding sheet market is set for continued expansion, supported by ongoing infrastructure investments and the rise of electric vehicles.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in Bonding Sheet Market with their product:

-

3M Company (3M VHB Tape)

-

Henkel AG & Co. KGaA (Loctite Adhesives)

-

DuPont de Nemours, Inc. (Tyvek Protective Materials)

-

BASF SE (Elastollan TPU)

-

Fujikura Ltd. (Fujikura Bonding Films)

-

Nitto Denko Corporation (Nitto Bonding Tapes)

-

Shin-Etsu Polymer Co. Ltd. (Shin-Etsu Bonding Sheets)

-

Avery Dennison Corporation (Avery Dennison Adhesive Solutions)

-

Tesa SE (tesa ACXplus Acrylic Adhesive Tapes)

-

Sika AG (SikaBond Adhesives)

-

Lord Corporation (Lord Structural Adhesives)

-

Permabond LLC (Permabond 105 & 205)

-

Dow Inc. (DOWSIL Adhesive Sealants)

-

H.B. Fuller Company (H.B. Fuller Adhesives)

-

Scapa Group plc (Scapa Bonding Solutions)

-

Momentive Performance Materials Inc. (Momentive Adhesive Solutions)

-

Cytec Solvay Group (Cytec Adhesive Technologies)

-

ITW (Illinois Tool Works) (ITW Performance Polymers)

-

Masterbond Inc. (MasterBond Epoxy Adhesives)

-

Mitsubishi Chemical Corporation (Mitsubishi Bonding Films)

Bonding sheet market features a variety of key suppliers known for their innovative products across different applications. Here are some notable suppliers in this market:

-

DuPont

-

3M

-

Henkel AG & Co. KGaA

-

Sika AG

-

Avery Dennison

-

Nitto Denko Corporation

-

Toray Industries, Inc.

-

Bostik

-

H.B. Fuller

-

Tesa SE

Recent Development

-

In November 2023, Henkel, a global leader in adhesives, sealants, and functional coatings, continued to advance sustainability across markets. As part of its efforts to reduce its plastic footprint, the company began relaunching its bonding and sealing product portfolio for consumers and craftsmen in Europe. The new packaging concept significantly cuts down on the use of virgin plastic by incorporating up to 95% recycled plastic sourced from post-consumer recyclate (PCR).

-

In April 2024, Shin-Etsu Chemical Co., Ltd. (Headquarters: Tokyo; President: Yasuhiko Saitoh) reached an agreement to acquire dry adhesive technology based on biomimicry, developed by Setex Technologies, Inc. (Headquarters: Pennsylvania, USA; CEO: Nick Kuhn). The acquisition aims to create a new market, with Shin-Etsu Chemical focusing on the corporate sector, while Setex continues to concentrate on the consumer market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 406.33 Million |

| Market Size by 2032 | US$ 777.60 Million |

| CAGR | CAGR of 7.48% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By adhesive material (Polyesters (PET), Polyimides (PI), Acrylics, Modified Epoxies, Others) • By adhesive thickness (12µM (0.5MIL), 25µM (1MIL), 50µM (2MIL), 75µM (3MIL), 100µM (4MIL)) • By application (Electronics/Optoelectronics, Telecommunication/5G Communication, Automotive, Building & Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Key suppliers in the bonding sheet market include 3M Company, Henkel AG & Co. KGaA, DuPont de Nemours, Inc., BASF SE, Fujikura Ltd., Nitto Denko Corporation, Shin-Etsu Polymer Co. Ltd., Avery Dennison Corporation, Tesa SE, Sika AG, Lord Corporation, Permabond LLC, Dow Inc., H.B. Fuller Company, Scapa Group plc, Momentive Performance Materials Inc., Cytec Solvay Group, ITW (Illinois Tool Works), Masterbond Inc., and Mitsubishi Chemical Corporation. |

| Key Drivers | • Bonding Sheet Market Growth Driven by Innovations and Diverse Applications Across Industries |

| Market Restraints | • Temperature resistance restricts the bonding sheet market, as polymer adhesives are weaker than metals, limiting high-temperature applications. |