Bluetooth IC Market Size & Overview

The Bluetooth IC Market Size was valued at USD 10.23 Billion in 2023 and is expected to reach USD 29.30 Billion by 2032 with a growing CAGR of 12.41% over the forecast period 2024-2032.

The Bluetooth integrated circuit (IC) market is witnessing significant growth, primarily driven by the rising demand for wearable technology, including connected earbuds, smartwatches, and various innovative devices. According to IDC, shipments of wearables increased by 28.4% year-over-year in 2020, followed by a remarkable 34.4% growth in the first quarter of 2021. This surge is attributed not only to established brands but also to smaller companies introducing unique products like wearable patches, rings, and audio glasses, which are setting themselves apart from traditional wearables. As the popularity of these devices rises, there is an escalating need for advanced Bluetooth ICs that ensure seamless connectivity while prioritizing low power consumption—crucial for wearables that rely on battery longevity. The chip industry, with revenues projected to reach around USD 500 billion by the end of 2019, plays a pivotal role in facilitating technological advancements, including those in the wearable sector.

Get More Information on Bluetooth IC Market - Request Sample Report

Recent innovations in Bluetooth ICs align with developments in semiconductor technology, where chips now boast over 50 billion transistors and feature sizes shrink to mere nanometers. This progress enables manufacturers to create tailored solutions for diverse industries, including automotive and consumer electronics.as wearables continue to shrink and become more flexible, the challenge of integrating rigid components like batteries persists. Researchers are making strides in developing stretchable lithium-ion (Li-ion) batteries, with breakthroughs allowing batteries to stretch up to 5,000% their original length. Another innovative design using carbon nanotubes has shown remarkable durability, retaining 93% of capacity after 150,000 cycles of deformation. Such advancements signify a bright future for Bluetooth ICs, reinforcing their critical role in the expanding wearable tech ecosystem.

Bluetooth IC Market Dynamics

Drivers

-

The growing popularity of wireless audio devices is driving demand for Bluetooth integrated circuits due to their convenience and mobility.

The increasing consumer preference for wireless audio devices is a significant driver of growth in the Bluetooth integrated circuits (IC) market. As people seek convenience and mobility, Bluetooth technology has become the go-to solution for connecting audio devices like headphones, speakers, and sound bars. This trend is evident in a survey where 63% of respondents stated they prefer wireless headphones over wired options for convenience and ease of use. Additionally, 79% of consumers have used Bluetooth technology in audio devices, underscoring its widespread adoption. Brands that prioritize high-quality audio solutions are likely to succeed, as 74% of consumers indicate they would choose a brand based on audio quality. The rise of remote work has significantly affected the Bluetooth IC market, with about 60% of U.S. adults reporting that they worked from home during the COVID-19 pandemic. This led to increased demand for communication tools, including Bluetooth audio devices, as individuals increasingly rely on wireless headsets for clear, hands-free communication during video calls. The proliferation of streaming services—with 82% of U.S. adults subscribing to at least one—has also created a surge in demand for high-quality audio experiences. In parallel, the mobile gaming industry is projected to exceed USD 100 billion in revenue by 2025, further driving the adoption of wireless audio devices that enhance gaming experiences. With over 4 billion Bluetooth devices currently in use globally, a significant portion of these is dedicated to audio applications. As brands continue to enhance their offerings with advanced features, the Bluetooth IC market is poised for robust growth, reflecting the broader trend toward wireless technology in everyday consumer electronics. This collective momentum underscores the strong growth potential for Bluetooth ICs, driven by rising demand across various consumer segments seeking innovative and convenient audio solutions.

Restraints

-

Compatibility challenges in Bluetooth technology arise from varying standards and device compatibility, hindering seamless connectivity and user adoption across different manufacturers.

Compatibility issues represent a significant restraint in the Bluetooth integrated circuit (IC) market, stemming from the variability in Bluetooth standards and the wide range of devices available from different manufacturers. Users often encounter difficulties when trying to pair Bluetooth devices, especially if they involve products from different brands or variations of Bluetooth versions. For instance, some Bluetooth devices may not support the latest standards, leading to limitations in features and functionality. This has been highlighted by recent reports of Bluetooth problems affecting users of devices like the Google Pixel 9, where issues arose post-software updates, creating challenges for seamless connectivity. Furthermore, compatibility hurdles extend to software platforms, as seen with Windows 11's compatibility issues with Bluetooth devices that have impacted users' experiences across various applications. These challenges can lead to frustration, deter consumer adoption, and impact brand loyalty, as users may be less inclined to invest in products perceived as unreliable. Consequently, as manufacturers seek to enhance Bluetooth IC offerings, addressing compatibility issues will be crucial for fostering consumer trust and expanding market reach in an increasingly competitive landscape.

Bluetooth IC Market Segment Analysis

by Type

In 2023, the Bluetooth integrated circuit (IC) market recognized Bluetooth technology capturing a significant revenue share of around 55%, underscoring its leading position in the industry. Several factors contribute to this dominance. Primarily, Bluetooth technology is extensively utilized across various consumer electronics, including smartphones, headphones, speakers, and wearables. Its capacity for providing reliable and user-friendly wireless connectivity has made it a preferred option for both consumers and manufacturers. The surge in demand for wireless audio devices, particularly headphones and speakers, has also played a critical role in boosting the demand for Bluetooth ICs. As consumers increasingly prioritize mobility and convenience, Bluetooth-enabled devices are often chosen over traditional wired ones. Furthermore, advancements in Bluetooth standards, such as Bluetooth 5.0 and 5.2, have improved functionalities like enhanced range, faster data transfer rates, and greater energy efficiency, facilitating wider adoption. The rapid expansion of smart home devices and the Internet of Things (IoT) has broadened the ecosystem for Bluetooth technology, leading to its integration into various daily applications. This extensive use across multiple sectors, combined with ongoing innovations in Bluetooth technology, reinforces its substantial market share and suggests a bright future for growth in the Bluetooth IC market.

by Application

In 2023, audio devices accounted for a notable revenue share of approximately 35% in the Bluetooth integrated circuit (IC) market, underscoring their pivotal role in market expansion. This leadership position is largely driven by the rising consumer preference for wireless audio solutions, such as headphones, speakers, sound bars, and other audio products. The trend toward wireless audio has been propelled by several factors, including an increasing demand for convenience, portability, and an enhanced overall user experience. Consumers are increasingly seeking to eliminate the limitations posed by wired connections, making Bluetooth-enabled audio devices the preferred choice for high-quality sound without the hassle of cables. This shift has been especially pronounced with the growth of remote work and virtual communication, where Bluetooth headsets and speakers are essential for clear, hands-free interactions during video calls. Additionally, advancements in Bluetooth technology—such as better sound quality, extended battery life and effective noise-cancellation features—have further boosted the attractiveness of these audio devices. The surge in popularity of streaming services and mobile gaming has also driven the demand for superior audio experiences, emphasizing the critical role of Bluetooth ICs in audio applications. As brands continue to innovate and broaden their wireless audio offerings, the Bluetooth IC market in audio devices is set for continued growth in the future.

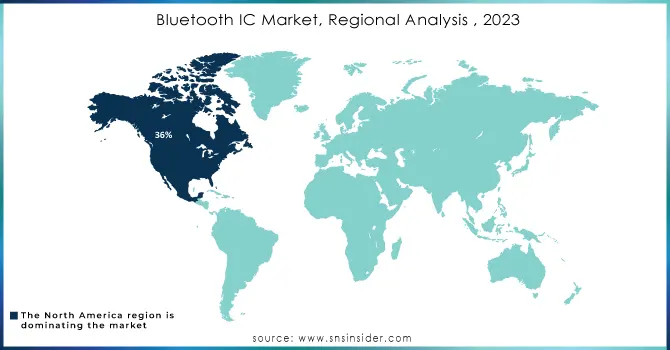

Bluetooth IC Market Regional Insights

In 2023, North America solidified its status as the leading region in the Bluetooth integrated circuit (IC) market, accounting for approximately 36% of total revenue. Several factors contribute to this dominance, establishing the region as a focal point for technological advancement and consumer electronics. The presence of major tech giants like Apple, Microsoft, and Qualcomm has been pivotal in the development and widespread adoption of Bluetooth ICs. These companies are at the forefront of designing innovative Bluetooth-enabled devices, significantly driving demand across various applications, particularly in audio devices, wearables, and smart home solutions. The growing preference for wireless audio products, including headphones and speakers, has also fueled market expansion in North America. As consumers prioritize convenience and portability, Bluetooth technology has become increasingly popular. The surge in remote work and virtual communication during the pandemic has further intensified the demand for Bluetooth headsets and speakers for seamless interaction and entertainment. Moreover, North America's robust research and development infrastructure promotes continuous innovation in Bluetooth technology. The rollout of advanced Bluetooth standards, such as Bluetooth 5.0 and 5.2, has enhanced performance metrics, making Bluetooth-enabled products more appealing. With a rising emphasis on the Internet of Things (IoT) and smart home technologies, the demand for Bluetooth ICs is expected to grow, ensuring North America's sustained leadership in this market.

In 2023, the Asia Pacific region distinguished itself as the fastest-growing market for Bluetooth integrated circuits (ICs), propelled by swift technological advancements, escalating consumer demand, and a thriving electronics manufacturing sector. A few crucial factors have driven this notable growth across the region. Countries such as China, Japan, South Korea, and India are experiencing a significant increase in consumer electronics sales, particularly in wireless audio devices, wearables, and smart home products. The rising adoption of smartphones and tablets, along with a preference for wireless solutions, has greatly heightened the demand for Bluetooth ICs. The region is home to major electronics manufacturers like Samsung, Huawei, and Sony, fostering a strong manufacturing ecosystem that supports the development of Bluetooth-enabled devices. This capability to produce high-quality products at competitive prices attracts both domestic and international consumers. Rapid technological evolution has enhanced device functionality and performance, making Bluetooth-enabled products more appealing. Urbanization in countries like India and China is also reshaping lifestyles, leading to higher disposable incomes and a growing demand for advanced electronic devices. As governments promote digital transformation through initiatives that boost connectivity and innovation, the Asia Pacific region is well positioned for continued growth in the Bluetooth IC market.

Need any customization research on Bluetooth IC Market - Enquiry Now

Key Players

Some of the Major Key Players in Bluetooth IC Market with product and solution:

-

Qualcomm (Bluetooth SoCs, Wireless Audio Solutions)

-

Broadcom Inc. (Bluetooth Transceivers, Dual-Mode Bluetooth Solutions)

-

Nordic Semiconductor (Bluetooth Low Energy ICs, SoCs)

-

Texas Instruments (Bluetooth Controllers, Low-Power Bluetooth Solutions)

-

NXP Semiconductors (Bluetooth Solutions for Automotive and IoT)

-

STMicroelectronics (Bluetooth Low Energy Solutions, Microcontrollers)

-

Microchip Technology (Bluetooth Low Energy Modules, MCUs)

-

Renesas Electronics (Bluetooth SoCs, Wireless Connectivity Solutions)

-

Cypress Semiconductor (Bluetooth Low Energy Solutions, PSoC Devices)

-

Silicon Labs (Bluetooth SoCs, Wireless Connectivity Solutions)

-

Realtek Semiconductor (Bluetooth Audio SoCs, Wireless Communication ICs)

-

Espressif Systems (ESP32 Bluetooth SoCs, Wi-Fi & Bluetooth Solutions)

-

Dialog Semiconductor (Bluetooth Low Energy ICs, Power Management ICs)

-

Mediatek (Bluetooth SoCs, Wireless Communication Solutions)

-

Infineon Technologies (Bluetooth Solutions for Automotive and Industrial Applications)

-

CSR (Cambridge Silicon Radio) (Bluetooth Audio Solutions, Low-Power Bluetooth Chips)

-

Marvell Technology (Bluetooth and Wi-Fi Solutions for IoT)

-

Broadcom (Bluetooth & Wi-Fi Integrated Solutions)

-

Honeywell (Bluetooth Low Energy Solutions for Industrial Applications)

-

Athero (Wireless Networking Solutions, Bluetooth Chipsets)

List of the Potential customers in Bluetooth IC Market

-

Apple Inc.

-

Samsung Electronics

-

Sony Corporation

-

Fitbit

-

Philips Healthcare

-

Amazon

-

Garmin

-

Toyota Motor Corporation

-

Bosch

-

Nokia

Recent Development

- On September 20, 2024, Qorvo introduced the QPG6200L system-on-chip for smart home devices, supporting Matter, Zigbee, and Bluetooth Low Energy. It enables simultaneous operation on different networks and improves security with PSA Level 2 certification.

- On September 20, 2024, David Su, CEO of Atmosic, continued his mission to develop low-power RF ICs aimed at reducing battery waste from billions of wireless and IoT devices. Building on his success at Atheros, which was later acquired by Qualcomm, Su's current efforts focus on creating more sustainable technology solutions for IoT.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.23 Billion |

| Market Size by 2032 | USD 29.30 Billion |

| CAGR | CAGR of 12.41% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Bluetooth, Bluetooth Classic, Bluetooth Low Energy, and Others) • By Application (Audio Devices, Human Interface Devices (HID), Smart Homes, Automotive, Beacons, Health & Fitness, Remote Controls, Industrial, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Qualcomm, Broadcom Inc., Nordic Semiconductor, Texas Instruments, NXP Semiconductors, STMicroelectronics, Microchip Technology, Renesas Electronics, Cypress Semiconductor, Silicon Labs, Realtek Semiconductor, Espressif Systems, Dialog Semiconductor, Mediatek, Infineon Technologies, CSR (Cambridge Silicon Radio), Marvell Technology, Honeywell, and Athero. |

| Key Drivers | • The growing popularity of wireless audio devices is driving demand for Bluetooth integrated circuits due to their convenience and mobility. |

| RESTRAINTS | • Compatibility challenges in Bluetooth technology arise from varying standards and device compatibility, hindering seamless connectivity and user adoption across different manufacturers. |