Get More Information on Blood Screening Market - Request Sample Report

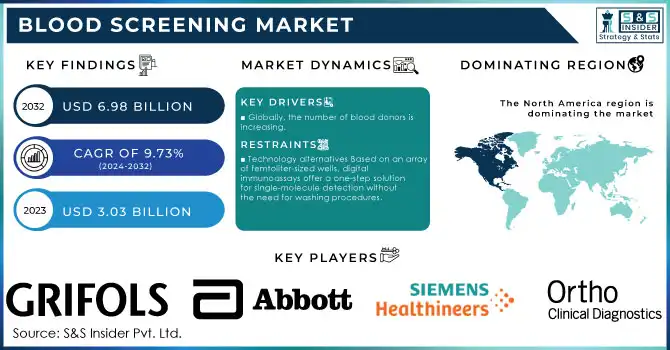

The Blood Screening Market size was estimated at USD 3.03 billion in 2023 and is expected to reach USD 6.98 billion by 2032 at a CAGR of 9.73% during the forecast period of 2024-2032.

The new research report consists of a market and industry trend analysis. The new research report includes industry trends, price analysis, patent analysis, conference and webinar materials, important stakeholders, and market purchasing behaviour. The growing frequency of infectious illnesses, as well as the increased demand for donated blood, are driving market expansion. Blood screening is used to identify probable illnesses and problems in people who are asymptomatic. Detection, lifestyle changes, and surveillance are methods for minimising the risk of disease or detecting it early enough to get the best therapy, resulting in more cures or longer lives. This potential has resulted in public health programmes recommending that the population undergo periodic blood screening checks for the detection of particular chronic illnesses such as cancer, diabetes, and cardiovascular disease, among others. Furthermore, physicians, nurses, and other healthcare personnel are becoming more aware of the early indicators of cancer. This allows healthcare organisations to deliver the best possible treatment in real time. Furthermore, blood transfusion therapy is required for the treatment of a variety of haematological and other diseases illnesses.

One of the most essential components of blood transfusion safety is the prevention of TTIs (Transfusion-Transmitted Infectious Agents). As a result, blood screening is used in a variety of blood banks and healthcare institutions to discover infection indicators in order to prevent infected blood discharge and other blood components for therapeutic use.

DRIVERS

Globally, the number of blood donors is increasing.

The availability and need for sophisticated surgical treatments, such as cardiovascular and transplant surgery, trauma care, and therapy for cancer and blood illnesses, are increasing the need for donated blood. Every year, around 238 million major operations are performed globally, including 65 million traumatic, over 34 million cancer-related, and 12 million pregnancy-related.

RESTRAIN

Technology alternatives Based on an array of femtoliter-sized wells, digital immunoassays offer a one-step solution for single-molecule detection without the need for washing procedures.

OPPORTUNITY

Emerging economies.

Because of rising disposable incomes and improved healthcare infrastructure, emerging regions such as India, the Middle East, and Africa present significant potential for blood screening sector participants.

CHALLENGES

High cost of blood screening technologies.

Given the rise in donations of blood, awareness about blood safety, and the expenditure on healthcare across the globe, newer technologies are extensively used in high-income countries and will be successfully adopted in middle- and lower-income countries in the next decade. However, many developing countries, such as India and China, currently rely on ELISA. In the current timeframe, the growth of the blood screening market for NAT is majorly inhibited. The advanced tests with high costs have driven the greater use of first-generation ELISA, which is older and less efficient.

As the number of deaths and injuries in conflict zones rises, so does the need for blood transfusions and associated goods. Blood screening is essential for ensuring the safety of given blood and reducing the spread of infectious illnesses.

In conflict-affected communities, the risk of bloodborne illnesses such as HIV, hepatitis B, and hepatitis C may rise owing to interrupted healthcare infrastructure, poor sanitation, and insufficient infection control measures. Blood screening is critical for detecting and preventing the spread of certain illnesses. In wartime, population displacement and migration are common, with individuals seeking sanctuary in safer locations or even crossing borders. This migration of individuals may provide additional issues in blood screening, as screening standards may change between areas or nations, making it more difficult to ensure consistent screening practises.

IMPACT OF ONGOING RECESSION

According to the research and study of updated new the access to healthcare services is restricted. Job losses, limited insurance coverage, and financial challenges for people and families can all result from economic downturns. As a result, consumers may postpone or avoid non-essential healthcare procedures such as blood screening tests. This may result in reduced use of blood screening services and have an influence on the market. Cost-cutting measures Healthcare providers and organisations may use cost-cutting methods to manage their finances during recessions. This might involve decreasing or deferring expenditures on new blood screening methods or equipment, restricting screening programme extension, or negotiating reduced screening supply pricing. These policies may have an impact on the growth and development of the blood screening industry.

By Product & Service

Reagents & Kits

NAT Reagents & Kits

Enzymes & Polymerases

Standards & Controls

Probes & Primers

Buffers, Nucleotides, and Solutions

Labelling & Detection Reagents

ELISA Reagents & Kits

Immunosorbents

Controls

Conjugates

Substrates

Sample Diluents & Wash Solutions

Other Reagents & Kits

Instruments

Rental Purchase

Outright Purchase

Software & Services

By Technology

Nucleic Acid Test

Transcription-mediated Amplification

Real-time PCR

ELISA

Chemiluminescent Immunoassays

Fluorescent Immunoassays

Colorimetric Immunoassays

Rapid Tests

Western Blot Assays

By End User

Blood Banks

Hospitals

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

REGIONAL ANALYSES

North America had the highest revenue share. The existence of important industry participants, growing acceptance of the blood screening procedure, rigorous FDA transfusion restrictions, and higher patient affordability are all responsible for the company's position remaining stable over the projected period.

Asia Pacific is the fastest-growing area, owing to increased public awareness of blood donation, improved patient affordability, and a growing focus on new markets in the region By key industry participants. In the Asia-Pacific area, important contributors include China, Japan, India, Singapore, and Australia.

Get Customized Report as per Your Business Requirement - Request For Customized Report

The major players are Grifols, F. Hoffmann-La Roche, Abbott Laboratories, Biomérieux, Bio-Rad Laboratories, Inc., Siemens Healthineers, Ortho Clinical Diagnostics, Inc , BD, DiaSorin S.p.A. and others.

Beckmann-Coulter: In May 2021, Beckmann-Coulter developed SARS-CoV-2 IgG.

Roche Diagnostics: In September 2021, Roche Diagnostics has bought TIB Molbiol Group. This purchase will expand Roche's vast array of molecular diagnostic solutions with a wide range of tests for infectious illnesses, such as detecting SARS-CoV-2 variations.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.03 Bn |

| Market Size by 2032 | USD 6.98 Bn |

| CAGR | CAGR of 9.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Service (Reagents & Kits, Instruments, Software & Services) • By Technology (Nucleic Acid Test, ELISA, Rapid Tests, Western Blot Assays, Next-generation Sequencing) • By End User (Blood Banks, Hospitals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Grifols, F. Hoffmann-La Roche, Abbott Laboratories, Biomérieux, Bio-Rad Laboratories, Inc., Siemens Healthineers, Ortho Clinical Diagnostics, Inc, BD, DiaSorin S.p.A. |

| Key Drivers | • Globally, the number of blood donors is increasing. |

| Market Restraints | • Technology alternatives Based on an array of femtoliter-sized wells, digital immunoassays offer a one-step solution for single-molecule detection without the need for washing procedures. |

Ans: The Blood Screening Market is expected to grow at 9.73% CAGR from 2024 to 2032.

Ans: According to our analysis, the Blood Screening Market is anticipated to reach USD 6.98 billion By 2032.

Ans: Grifols, S.A., F. Hoffmann-La Roche, BD, DiaSorin S.p.A. are some of the companies included in the Blood Screening Market.

Ans: Increasing number of blood donations coupled with increasing prevalence of Transfusion-Transmissible infections (TTl’s) are expected to drive the adoption of blood screening market.

Ans: Yes, you may request customization based on your company's needs.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of the Ukraine- Russia War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Blood Screening Market Segmentation, By Product & Service

8.1Reagents & Kits

8.2 Instruments

8.3 Software & Services

9. Blood Screening Market Segmentation, By Technology

9.1 Nucleic Acid Test

9.2 ELISA

9.3 Rapid Tests

9.4 Western Blot Assays

9.5 Next-generation Sequencing

10. Blood Screening Market Segmentation, By End User

10.1 Blood Banks

10.2 Hospitals

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Blood Screening Market by Country

11.2.2North America Blood Screening Market By Product & Service

11.2.3 North America Blood Screening Market By Technology

11.2.4 North America Blood Screening Market By End-User

11.2.5 USA

11.2.5.1 USA Blood Screening Market By Product & Service

11.2.5.2 USA Blood Screening Market By Technology

11.2.5.3 USA Blood Screening Market By End-User

11.2.6 Canada

11.2.6.1 Canada Blood Screening Market By Product & Service

11.2.6.2 Canada Blood Screening Market By Technology

11.2.6.3 Canada Blood Screening Market By End-User

11.2.7 Mexico

11.2.7.1 Mexico Blood Screening Market By Product & Service

11.2.7.2 Mexico Blood Screening Market By Technology

11.2.7.3 Mexico Blood Screening Market By End-User

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Blood Screening Market by Country

11.3.1.2 Eastern Europe Blood Screening Market By Product & Service

11.3.1.3 Eastern Europe Blood Screening Market By Technology

11.3.1.4 Eastern Europe Blood Screening Market By End-User

11.3.1.5 Poland

11.3.1.5.1 Poland Blood Screening Market By Product & Service

11.3.1.5.2 Poland Blood Screening Market By Technology

11.3.1.5.3 Poland Blood Screening Market By End-User

11.3.1.6 Romania

11.3.1.6.1 Romania Blood Screening Market By Product & Service

11.3.1.6.2 Romania Blood Screening Market By Technology

11.3.1.6.4 Romania Blood Screening Market By End-User

11.3.1.7 Turkey

11.3.1.7.1 Turkey Blood Screening Market By Product & Service

11.3.1.7.2 Turkey Blood Screening Market By Technology

11.3.1.7.3 Turkey Blood Screening Market By End-User

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Blood Screening Market By Product & Service

11.3.1.8.2 Rest of Eastern Europe Blood Screening Market By Technology

11.3.1.8.3 Rest of Eastern Europe Blood Screening Market By End-User

11.3.2 Western Europe

11.3.2.1 Western Europe Blood Screening Market By Product & Service

11.3.2.2 Western Europe Blood Screening Market By Technology

11.3.2.3 Western Europe Blood Screening Market By End-User

11.3.2.4 Germany

11.3.2.4.1 Germany Blood Screening Market By Product & Service

11.3.2.4.2 Germany Blood Screening Market By Technology

11.3.2.4.3 Germany Blood Screening Market By End-User

11.3.2.5 France

11.3.2.5.1 France Blood Screening Market By Product & Service

11.3.2.5.2 France Blood Screening Market By Technology

11.3.2.5.3 France Blood Screening Market By End-User

11.3.2.6 UK

11.3.2.6.1 UK Blood Screening Market By Product & Service

11.3.2.6.2 UK Blood Screening Market By Technology

11.3.2.6.3 UK Blood Screening Market By End-User

11.3.2.7 Italy

11.3.2.7.1 Italy Blood Screening Market By Product & Service

11.3.2.7.2 Italy Blood Screening Market By Technology

11.3.2.7.3 Italy Blood Screening Market By End-User

11.3.2.8 Spain

11.3.2.8.1 Spain Blood Screening Market By Product & Service

11.3.2.8.2 Spain Blood Screening Market By Technology

11.3.2.8.3 Spain Blood Screening Market By End-User

11.3.2.9 Netherlands

11.3.2.9.1 Netherlands Blood Screening Market By Product & Service

11.3.2.9.2 Netherlands Blood Screening Market By Technology

11.3.2.9.3 Netherlands Blood Screening Market By End-User

11.3.2.10 Switzerland

11.3.2.10.1 Switzerland Blood Screening Market By Product & Service

11.3.2.10.2 Switzerland Blood Screening Market By Technology

11.3.2.10.3 Switzerland Blood Screening Market By End-User

11.3.2.11.1 Austria

11.3.2.11.2 Austria Blood Screening Market By Product & Service

11.3.2.11.3 Austria Blood Screening Market By Technology

11.3.2.11.4 Austria Blood Screening Market By End-User

11.3.2.12 Rest of Western Europe

11.3.2.12.1 Rest of Western Europe Blood Screening Market By Product & Service

11.3.2.12.2 Rest of Western Europe Blood Screening Market By Technology

11.3.2.12.3 Rest of Western Europe Blood Screening Market By End-User

11.4 Asia-Pacific

11.4.1 Asia-Pacific Blood Screening Market by Country

11.4.2 Asia-Pacific Blood Screening Market By Product & Service

11.4.3 Asia-Pacific Blood Screening Market By Technology

11.4.4 Asia-Pacific Blood Screening Market By End-User

11.4.5 China

11.4.5.1 China Blood Screening Market By Product & Service

11.4.5.2 China Blood Screening Market By Technology

11.4.5.3 China Blood Screening Market By Type

11.4.6 India

11.4.6.1 India Blood Screening Market By Product & Service

11.4.6.2 India Blood Screening Market By Technology

11.4.6.3 India Blood Screening Market By End-User

11.4.7 Japan

11.4.7.1 Japan Blood Screening Market By Product & Service

11.4.7.2 Japan Blood Screening Market By Technology

11.4.7.3 Japan Blood Screening Market By End-User

11.4.8 South Korea

11.4.8.1 South Korea Blood Screening Market By Product & Service

11.4.8.2 South Korea Blood Screening Market By Technology

11.4.8.3 South Korea Blood Screening Market By End-User

11.4.9 Vietnam

11.4.9.1 Vietnam Blood Screening Market By Product & Service

11.4.9.2 Vietnam Blood Screening Market By Technology

11.4.9.3 Vietnam Blood Screening Market By End-User

11.4.10 Singapore

11.4.10.1 Singapore Blood Screening Market By Product & Service

11.4.10.2 Singapore Blood Screening Market By Technology

11.4.10.3 Singapore Blood Screening Market By End-User

11.4.11 Australia

11.4.11.1 Australia Blood Screening Market By Product & Service

11.4.11.2 Australia Blood Screening Market By Technology

11.4.11.3 Australia Blood Screening Market By End-User

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Blood Screening Market By Product & Service

11.4.12.2 Rest of Asia-Pacific Blood Screening Market By Technology

11.4.12.3 Rest of Asia-Pacific Blood Screening Market By End-User

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Blood Screening Market by Country

11.5.1.2 Middle East Blood Screening Market By Product & Service

11.5.1.3 Middle East Blood Screening Market By Technology

11.5.1.4 Middle East Blood Screening Market By End-User

11.5.1.5 UAE

11.5.1.5.1 UAE Blood Screening Market By Product & Service

11.5.1.5.2 UAE Blood Screening Market By Technology

11.5.1.5.3 UAE Blood Screening Market By End-User

11.5.1.6 Egypt

11.5.1.6.1 Egypt Blood Screening Market By Product & Service

11.5.1.6.2 Egypt Blood Screening Market By Technology

11.5.1.6.3 Egypt Blood Screening Market By End-User

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Blood Screening Market By Product & Service

11.5.1.7.2 Saudi Arabia Blood Screening Market By Technology

11.5.1.7.3 Saudi Arabia Blood Screening Market By End-User

11.5.1.8 Qatar

11.5.1.8.1 Qatar Blood Screening Market By Product & Service

11.5.1.8.2 Qatar Blood Screening Market By Technology

11.5.1.8.3 Qatar Blood Screening Market By End-User

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Blood Screening Market By Product & Service

11.5.1.9.2 Rest of Middle East Blood Screening Market By Technology

11.5.1.9.3 Rest of Middle East Blood Screening Market By End-User

11.5.2 Africa

11.5.2.1 Africa Transfusion Diagnostics Market by Country

11.5.2.2 Africa Blood Screening Market By Product & Service

11.5.2.3 Africa Blood Screening Market By Technology

11.5.2.4 Africa Blood Screening Market By End-User

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Blood Screening Market By Product & Service

11.5.2.5.2 Nigeria Blood Screening Market By Technology

11.5.2.5.3 Nigeria Blood Screening Market By End-User

11.5.2.6 South Africa

11.5.2.6.1 South Africa Blood Screening Market By Product & Service

11.5.2.6.2 South Africa Blood Screening Market By Technology

11.5.2.6.3 South Africa Blood Screening Market By End-User

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Blood Screening Market By Product & Service

11.5.2.7.2 Rest of Africa Blood Screening Market By Technology

11.5.2.7.3 Rest of Africa Blood Screening Market By End-User

11.6 Latin America

11.6.1 Latin America Blood Screening Market By country

11.6.2 Latin America Blood Screening Market By Product & Service

11.6.3 Latin America Blood Screening Market By Technology

11.6.4 Latin America Blood Screening Market By End-User

11.6.5 Brazil

11.6.5.1 Brazil America Blood Screening Market By Product & Service

11.6.5.2 Brazil America Blood Screening Market By Technology

11.6.5.3 Brazil America Blood Screening Market By End-User

11.6.6 Argentina

11.6.6.1 Argentina America Blood Screening Market By Product & Service

11.6.6.2 Argentina America Blood Screening Market By Technology

11.6.6.3 Argentina America Blood Screening Market By End-User

11.6.7 Colombia

11.6.7.1 Colombia America Blood Screening Market By Product & Service

11.6.7.2 Colombia America Blood Screening Market By Technology

11.6.7.3 Colombia America Blood Screening Market By End-User

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Blood Screening Market By Product & Service

11.6.8.2 Rest of Latin America Blood Screening Market By Technology

11.6.8.3 Rest of Latin America Blood Screening Market By End-User

12. Company profile

12.1 Grifols.

12.1.1 Company Overview

12.1.2 Financials

12.1.3 Product/Services/Offerings

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 F. Hoffmann-La Roches.

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/Services/Offerings

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Abbott Laboratories.

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/Services/Offerings

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Biomérieux.

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/Services/Offerings

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Bio-Rad Laboratories, Inc.

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/Services/Offerings

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Siemens Healthineers.

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/Services/Offerings

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Ortho Clinical Diagnostics, Inc.

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/Services/Offerings

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 BD.

12.8.2 Financials

12.8.3 Product/Services/Offerings

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 DiaSorin S.p.A.

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/Services/Offerings

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Roche Diagnostics.

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Product/Services/Offerings

12.10.4 SWOT Analysis

12.10.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Medical Imaging Devices Market size was valued at USD 39.7 billion in 2023 and is expected to reach USD 61.58 billion by 2032 and grow CAGR of 5%.

The Biomarkers Market size was USD 67.92 billion in 2023, projected to hit USD 184.80 billion by 2032, growing at 11.78% CAGR.

Clear Aligners Market size was valued at USD 4.21 billion in 2023 and is projected to reach USD 45.98 billion by 2032, with a CAGR of 29.20% from 2024 to 2032.

The Hirsutism Market was valued at USD 3.21 billion in 2023 and is expected to reach USD 6.02 billion by 2032, growing at a CAGR of 7.25% over the forecast period of 2024-2032.

The Global Genetic Testing Market Size, valued at USD 17.48 billion in 2023, is expected to grow to USD 46.29 billion by 2032, with a CAGR of 11.34%.

The Healthcare Asset Management Market size was valued at USD 25.7 billion in 2023, and is expected to reach USD 166.82 billion by 2032 and grow at a CAGR of 23.1% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone