Blood Group Typing Market Report Scope & Overview:

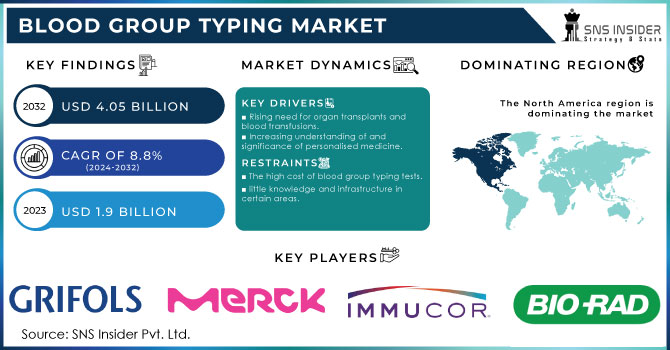

The Blood Group Typing market size was USD 2.26 billion in 2023 and is expected to reach USD 4.82 billion by 2032 and grow at a CAGR of 8.80% over the forecast period of 2024-2032. The report provides in-depth insights into market trends, key drivers, restraints, and opportunities shaping the industry. It highlights the rising demand for blood transfusions, the increasing prevalence of chronic diseases, and advancements in automated blood typing technologies. The report also examines regulatory frameworks, the growing adoption of molecular blood typing methods, and trends in blood donation rates globally. Detailed segment analysis by product, test type, technique, and end-user is included. Additionally, regional dominance, competitive landscape, and key developments by major players are covered. The report offers statistical insights, including blood bank inventories, transfusion rates, and disease screening trends, to provide a holistic market overview.

Get More Information on Blood Group Typing Market - Request Sample Report

The U.S. dominated the Blood Group Typing Market in North America with a market size of USD 0.768 million, holding a significant 74% market share in 2023. This dominance is driven by the high demand for blood transfusions, a well-established healthcare infrastructure, and the presence of leading diagnostic companies. The country has a high rate of voluntary blood donations, supported by organizations like the American Red Cross and AABB. Additionally, the adoption of advanced molecular blood typing techniques, including PCR-based and microarray methods, has accelerated market growth. The rising prevalence of chronic diseases, such as cancer and blood disorder, further fuels the need for accurate blood typing. Government initiatives to improve blood safety regulations and investments in automated testing technologies continue to strengthen the U.S. position as the market leader.

Market Dynamics

Drivers

-

The growing demand for blood transfusion and organ transplantation drives the blood group typing market growth.

The increasing demand for blood transfusions and organ transplantation procedures is a major driver of the Blood Group Typing Market. With the rising prevalence of chronic diseases, trauma cases, and complex surgeries, the need for accurate blood group identification has grown significantly. According to the World Health Organization (WHO), over 118 million blood donations occur globally each year, emphasizing the need for reliable typing methods. Additionally, advancements in automated and molecular blood typing techniques, such as gel column agglutination and PCR-based testing, enhance accuracy and efficiency. Government initiatives promoting safe blood donation practices and expanding healthcare infrastructure further support market growth. The integration of AI-driven diagnostic tools and automated blood typing analyzers by key players is also expected to improve efficiency, accuracy, and accessibility in blood group typing.

Restrain

-

High cost of automated blood group typing technologies hampers market growth.

The high cost associated with automated blood group typing systems and molecular diagnostic techniques poses a significant restraint in market expansion. Traditional serological blood typing methods are cost-effective and widely used, whereas automated analyzers and genetic-based blood typing solutions require high capital investment and skilled personnel. Small and mid-sized blood banks and healthcare facilities, especially in developing regions, struggle to afford advanced diagnostic equipment, limiting adoption. Furthermore, regular maintenance and reagent costs add to the financial burden, making it challenging for resource-constrained settings to implement automated solutions. Despite technological advancements, accessibility remains an issue due to limited reimbursement policies in several countries, restricting the widespread adoption of expensive blood typing methods. Addressing cost barriers through government funding and affordable diagnostic solutions could help overcome this restraint.

Opportunity

-

Rising demand for molecular blood typing and DNA-based testing creates growth opportunities.

The growing adoption of molecular blood typing and DNA-based blood testing presents a significant opportunity in the Blood Group Typing Market. Unlike traditional serological methods, molecular blood typing provides greater accuracy and is particularly useful for complex cases such as rare blood types, prenatal screening, and blood disorders like sickle cell disease. Companies like Bio-Rad Laboratories and Grifols are actively developing highly sensitive DNA-based assays to improve blood compatibility testing. Additionally, the integration of next-generation sequencing (NGS) and polymerase chain reaction (PCR) techniques allows for precise blood antigen detection, reducing transfusion-related risks. Governments and healthcare organizations are investing in advanced diagnostic research to enhance transfusion safety. With increasing awareness and technological advancements, molecular blood typing is expected to revolutionize the market and drive long-term growth.

Challenge

-

Challenges in ensuring blood safety and minimizing transfusion-related infections in blood group typing.

Despite advancements in blood typing technology, ensuring blood safety and minimizing transfusion-related infections remains a critical challenge. The risk of mismatched transfusions, alloimmunization, and transfusion-transmitted infections (TTIs), such as HIV, Hepatitis B, and Hepatitis C, continues to pose a threat to patient safety. Inaccurate blood group identification due to manual errors, reagent variability, or inadequate screening procedures can lead to serious complications. Regulatory bodies, such as the FDA and WHO, emphasize the importance of stringent blood screening protocols and the adoption of nucleic acid testing (NAT) for enhanced detection. However, many regions, especially in low-income countries, lack proper screening infrastructure, leading to inconsistent blood safety standards. Addressing this challenge requires global standardization of testing procedures, regulatory reforms, and enhanced technological adoption to ensure safe and efficient blood transfusions.

Segmentation Analysis

By Product

The largest revenue share 48% for the blood group typing market, was held by the Consumables segment (reagents, antisera, and test kits), supported by the increasing demand for rapid and accurate blood typing solutions. Biological ensures the accuracy and reliability of blood typing reagents and gel-based testing in advanced testing systems with the new wet blood typing reagents and gel-based testing kits for laboratories like BioRad Laboratories and Grifols. The rising volume of blood donations, transfusions, and organ transplants is another prominent factor accelerating the demand for affordable and easy-to-use consumables. The consumables segment is expected to continue to dominate with the introduction of new products and regulatory approvals. Furthermore, automation-driven AI consumable-based blood testing solutions that are being increasingly integrated by the key players are contributing to achieving high precision while testing blood hence further reinforcing its role in blood safety and compatibility on a global level.

By Technique

Assay-based techniques held the largest market share at 28% in 2023. It is owing to its high specificity, efficiency, and scalability in blood typing. Microplate-based and gel column agglutination assays for high throughput blood typing have been introduced into the market by companies such as Ortho Clinical Diagnostics and Immucor. These ideas are commonly done through blood banks and medical centers correct antigen-antibody reactions for guaranteed transfusion and blood. This segment has further benefitted from the increasing demand for automated assay systems, such as the Grifols DG Gel System. With the need for rapid and accurate blood typing methods among healthcare facilities, the ever-growing focus on standardization and scalability of testing solutions is expected to enable the adoption of assay-based techniques, as these are affordable, possess the ability to process a larger number of samples, and reduce the margins of error.

By Test Type

The ABO Blood Tests segment is projected to capture 28% of the market. ABO blood grouping is key for transfusions, organ transplants, and prenatal diagnostics. Quotient Limited, Ideally, automated abo blood type analyzers, are major players and Bio-Rad laboratories have developed automated ABO blood typing analyzer and are expected to follow traditional methods of blood testing, offering improved accuracy and efficiency. The rising demand for rapid and efficient blood group testing, particularly during emergencies and mass screening programs, is encouraging the adoption of these devices. Also, introduction of AI based blood typing analyzers and molecular based ABO testing are improving accuracy and minimizing human errors. As demand for safe blood transfusion practices is increasing all over the world, diagnosis laboratories have remained one of the main fronts for ABO blood tests, thus creating a significant shareholder in the blood group typing market.

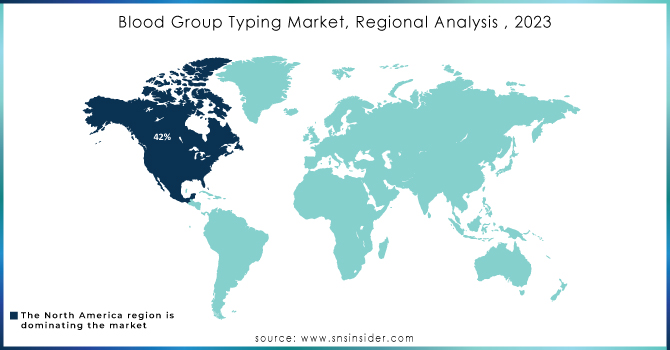

Regional Analysis

The North America dominated blood group typing market with a share of 46% in 2023, higher blood donation rates, advanced healthcare infrastructure, and a rising number of organ transplants are a few factors driving the growth of the market in the region. Each year, nearly 6.8 million people donate blood (U.S. Red Cross), driving the need for solutions to automate and perform blood typing accurately. However, there are automated blood typing analyzers developed by companies such as Ortho Clinical Diagnostics and Immucor that have brought in increased efficiency to be used in hospitals and blood banks. Moreover, stringent regulatory bodies (such as FDA) in this region provide standard, secure blood testing procedures, which is likely to contribute to market growth in North America. North America is expected to show high growth rate in the blood typing systems and molecular based techniques due to the rapidly opening AI powered blood typing systems with the molecular-based techniques applications this move at a fast pace to ensure the blood safety and compatibility testing.

Asia Pacific held the significant market share. As blood transfusions are required for an increasing number of surgeries, trauma cases, and chronic diseases, the growth of the total blood transfusions market is also on the rise. Nations like China and India see a climb within the numbers of voluntary blood donations as government support and campaigns on awareness maintain to protect among the populations. As an example, National Blood Transfusion Council of India is spearheading a push to promote 100% voluntary blood donation, thus, raising the demand for swift blood typing solutions. Moreover, the companies such as Bio-Rad and Grifols are also expanding their automated blood typing systems in hospitals and diagnostic lab thereby propelling the market growth. In addition, the region is dominating the technology segment due to increased acceptance of molecular blood typing and next-generation sequencing.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Grifols S.A. (Erytra Eflexis, DG Gel Cards)

-

Merck KGaA (Millipore Blood Typing Reagents, Simplicon RNA Reagents)

-

Bio-Rad Laboratories, Inc. (IH-500 System, ID-MTS Gel Cards)

-

Immucor Inc. (Echo Lumena, PreciseType HEA Test)

-

Novacyt Group (Genesig Real-Time PCR, SNPsig Assays)

-

Danaher Corporation (Beckman Coulter PK7300, PK7400)

-

Agena Bioscience, Inc (MassARRAY System, iPLEX Pro Reagents)

-

Ortho Clinical Diagnostics (ORTHO VISION Analyzer, ORTHO BioVue System)

-

Quotient Ltd. (MosaiQ Platform, Alba Reagents)

-

QuidelOrtho (Quidel Triage, Sofia2 Analyzer)

-

Thermo Fisher Scientific (TaqPath Blood Typing Kit, Applied Biosystems 7500)

-

Siemens Healthineers (ADVIA Centaur, Atellica IM)

-

Roche Diagnostics (Cobas 8000, Elecsys Anti-D)

-

Abbott Laboratories (Alinity s System, ARCHITECT i1000SR)

-

Beckman Coulter (UniCel DxH 800, DxH 900)

-

Becton Dickinson (BD Vacutainer, BD Veritor)

-

Sysmex Corporation (XN-Series Hematology Analyzers, UF-Series Urine Analyzers)

-

BioMérieux (Vitek 2, BACT/ALERT 3D)

-

MedGenome (SeqType Blood Typing, OncoMD)

-

Luminex Corporation (xMAP Technology, ARIES System)

Recent Development:

-

In May 2023, Bio-Rad Laboratories, Inc. introduced the IH-500™ NEXT System, a fully automated platform aimed at minimizing instrument downtime and enhancing laboratory efficiency. This advanced system provides greater flexibility by supporting the use of both Bio-Rad's Reagent Red Blood Cells (RBCs) and third-party RBCs.

-

In May 2024, Thermo Fisher Scientific introduced the Applied Biosystems Axiom BloodGenomiX Array and Software, a pioneering solution aimed at enhancing blood genotyping precision in clinical research. This array is capable of detecting over 40 genes and 260 antigens across 38 blood group systems, including tissue (HLA) and platelet (HPA) types, within a single, high-throughput assay.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD2.26 Billion |

| Market Size by 2032 | USD 4.82 Billion |

| CAGR | CAGR of8.80 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Consumables, Instruments, Services), • By Technique (PCR-based and Microarray Techniques, Assay-based Techniques, Massively Parallel Sequencing Techniques, Others), • By Test Type (Antibody Screening, HLA Typing, Cross-matching Tests, ABO Blood Tests, Antigen Typing), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | LyondellBasell Industries, W. R. Grace & Co., Clariant AG, China Petrochemical Corporation, Mitsui Chemicals, Inc., BASF SE, Evonik Industries AG, Univation Technologies, LLC, Sumitomo Chemical Co., Ltd., INEOS Group Holdings S.A., ExxonMobil Chemical, Japan Polypropylene Corporation, Reliance Industries Limited, Borealis AG, Wacker Chemie AG, Albemarle Corporation, UOP LLC, Shell Chemicals, SABIC, Axens SA |