Get more information on Blood Glucose Monitoring Device Market - Request Sample Report

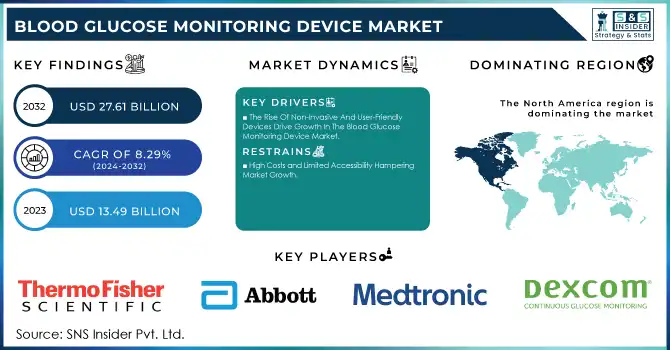

The Blood Glucose Monitoring Device Market Size was valued at USD 13.49 billion in 2023 and is expected to reach USD 27.61 billion by 2032 and grow at a CAGR of 8.29% over the forecast period 2024-2032.

The Blood Glucose Monitoring Device Market is experiencing robust growth, driven by the rising global prevalence of diabetes. According to the International Diabetes Federation, approximately 537 million adults will be living with diabetes in 2021, a number expected to grow to 643 million by 2030. Sedentary lifestyles, poor dietary habits, and an aging global population primarily drive this increase. As a result, the demand for efficient glucose monitoring devices is at an all-time high, particularly in diabetes management.

Technological innovations in Continuous Glucose Monitoring (CGM) systems also significantly influence market growth. Devices such as Abbott's FreeStyle Libre and Dexcom's CGM systems provide real-time glucose readings, offering better accuracy and less frequent need for finger pricks. Recent advancements include Abbott's Libre Rio and Lingo models, which were approved by the FDA in 2024 for over-the-counter (OTC) use. These innovations make CGMs more accessible, expanding their adoption among both diabetic and non-diabetic individuals who want to monitor their metabolic health. This OTC clearance is expected to drive adoption in the wider consumer market, beyond traditional diabetes care.

Moreover, the glucose monitoring device market is extending beyond diabetes management. Athletes and fitness enthusiasts are increasingly using CGMs to optimize performance by better managing their glucose levels. Studies have shown that CGMs can help individuals improve energy management, training efficiency, and recovery times. This growing interest in monitoring glucose levels for general wellness and performance optimization is expected to be a key market driver in the coming years.

Despite these positive developments, the market faces challenges such as the high cost of advanced monitoring systems and limited access in rural regions, particularly in low-income countries. However, government initiatives like the National Clinical Care Commission’s “All-of-Government” approach and ongoing efforts to reduce diabetes care costs and increase product accessibility are expected to mitigate some of these barriers.

Drivers

The Rise Of Non-Invasive And User-Friendly Devices Drive Growth In The Blood Glucose Monitoring Device Market

Innovations like continuous glucose monitoring systems and flash glucose monitors are enhancing accuracy and convenience, which in turn drives higher consumer adoption. These cutting-edge devices provide real-time glucose level data, empowering individuals to manage their health more effectively and prevent diabetes complications. Another significant driver is the growing emphasis on personalized medicine, where glucose monitoring solutions play an essential role in tailoring treatment plans to meet individual patient needs. These devices enable data-driven decision-making, allowing healthcare providers to enhance patient outcomes and improve overall diabetes management.

Rising Awareness About Diabetes Care Is Also Contributing To Market Growth

Governments, non-profit organizations, and healthcare providers are making concerted efforts to educate the public on the importance of blood glucose monitoring. Campaigns aimed at promoting better diabetes management and encouraging early detection of blood sugar abnormalities are boosting the demand for glucose monitoring devices. The aging population in developed and emerging markets is also a key factor driving the market's expansion. Older adults are more susceptible to developing type 2 diabetes, creating a rising demand for reliable glucose monitoring systems to manage age-related health challenges.

Restraints

High Costs and Limited Accessibility Hampering Market Growth

The Cardiac Monitoring Device Market faces significant challenges stemming from the high costs associated with advanced cardiac monitoring technologies. Devices such as implantable loop recorders, portable ECG monitors, and wearable cardiac monitors are often expensive to produce and purchase due to the integration of cutting-edge technology and sophisticated features. These elevated costs pose a barrier to adoption, particularly in low- and middle-income regions, where healthcare budgets are constrained, and a large proportion of the population remains uninsured. The affordability factor becomes a critical restraint, limiting access to these life-saving devices for economically disadvantaged patients.

Furthermore, the accessibility of cardiac monitoring devices is restricted in rural and remote areas, where healthcare infrastructure is underdeveloped, and distribution networks are insufficient. Many regions lack adequate healthcare facilities or trained professionals to recommend or manage advanced cardiac devices, hindering their penetration in these markets. The limited availability exacerbates the challenge of timely diagnosis and effective monitoring of cardiac conditions in these areas.

By Product

In 2023, self-monitoring devices dominated the blood glucose monitoring device market, holding 60% of the market share. These devices, such as traditional blood glucose meters, are widely used by diabetes patients due to their affordability, ease of use, and portability. Self-monitoring devices allow patients to track their blood glucose levels regularly at home, making them a cost-effective and accessible solution. The convenience of at-home monitoring empowers users to make timely adjustments to their lifestyle and medication, leading to improved diabetes management. This widespread adoption has contributed to the dominance of self-monitoring devices in the market.

Continuous blood glucose monitoring devices are the fastest-growing segment throughout the forecast period. These devices are gaining traction due to their ability to offer real-time, continuous tracking of glucose levels, providing users with more detailed and accurate information than traditional self-monitoring devices. CGMs help in improving the overall management of diabetes, as they provide data that allows users to monitor their glucose levels throughout the day without needing to perform multiple finger-prick tests. The increased awareness of the benefits of CGMs and technological advancements in their development has made them a preferred choice for many users.

By End-use

The hospitals segment led the market in 2023, contributing 45% of the total market share. Hospitals are primary settings for advanced diabetes care, where blood glucose monitoring devices, including both self-monitoring devices and CGMs, are used to monitor and manage glucose levels in patients. The adoption of these devices in hospitals is driven by the need for accurate and real-time glucose data for managing patients with diabetes and other related conditions. Hospitals also play a vital role in educating patients about the importance of glucose monitoring, making this segment a key area for the growth of blood glucose monitoring devices.

The home care segment is anticipated to be the fastest-growing segment over the forecast period 2024-2032, with more patients choosing to monitor their glucose levels from the comfort of their homes. This segment is increasingly important as more individuals with diabetes prefer the convenience of managing their condition outside clinical settings. Advances in blood glucose monitoring technology, particularly the development of user-friendly devices like CGMs, have contributed to the rise in home care adoption. This trend is driven by the desire for greater control over diabetes management, as well as the convenience and accessibility offered by home monitoring devices.

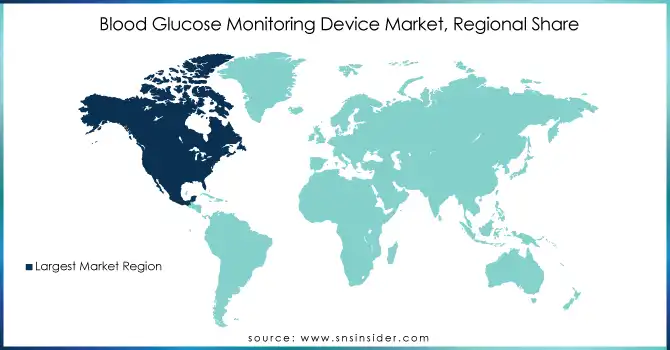

In 2023, the North American region led the blood glucose monitoring device market, accounting for a significant share due to the high prevalence of diabetes and advanced healthcare infrastructure. The United States, in particular, dominates the market owing to the increasing adoption of continuous glucose monitoring systems, government initiatives to promote diabetes awareness, and better reimbursement policies for diabetes-related technologies. The rising number of people with diabetes, combined with strong support from healthcare systems, contributes to North America's dominant market position.

The European market is also substantial, driven by growing awareness and technological advancements in glucose monitoring devices. Countries like Germany, the UK, and France are seeing increased adoption of advanced devices like CGMs and flash glucose monitors. Government-funded healthcare systems in these regions help make glucose monitoring devices more accessible, which further drives market growth.

The Asia-Pacific region is experiencing rapid growth, with the emergence of countries such as China and India. The increasing diabetic population, improving healthcare infrastructure, and growing disposable income in these countries are fueling the demand for blood glucose monitoring devices. Moreover, the adoption of innovative and affordable monitoring solutions is contributing to the expansion of the market in this region.

Need any customization research on Blood Glucose Monitoring Device Market - Enquiry Now

Thermo Fisher Scientific (Patheon)

Blood glucose test kits and diagnostic services

FreeStyle Libre, FreeStyle Precision Neo

Guardian Connect, MiniMed Insulin Pumps with CGM systems

F. Hoffmann-La Roche Ltd

Accu-Chek Guide, Accu-Chek Instant, Accu-Chek Aviva

Ascensia Diabetes Care Holdings AG

Contour Next One, Contour Next, Contour XT

Dexcom, Inc.

Dexcom G6, Dexcom G7 (Continuous glucose monitoring systems)

Sanofi

Lantus, Apidra (Diabetes management solutions)

Novo Nordisk

NovoPen, NovoLog (Insulin pens and devices integrated with glucose monitoring)

Insulet Corporation

Omnipod (Insulin management system with glucose monitoring)

Ypsomed Holdings

my life Diabetes care (Blood glucose monitoring systems)

Glysens Incorporated

Glysens Continuous Glucose Monitoring System

B. Braun Melsungen

Omnilink (Blood glucose meters)

Nipro

True Metrix (Blood glucose meters)

Arkray

Glucocard (Blood glucose meters)

Prodigy Diabetes Care

Prodigy Voice, Prodigy No Coding (Blood glucose meters)

Acon Laboratories

On-Call (Blood glucose meters)

Nova Biomedical

StatStrip (Blood glucose meters)

Lifescan

OneTouch (Blood glucose monitoring system)

Recent Development

In Sept 2024, Abbott launched its over-the-counter continuous glucose monitoring system in the U.S., becoming the second company to offer such a device, following rival Dexcom. This new product allows individuals to monitor their blood sugar levels without a prescription.

In June 2024, Prevounce Health introduced the Pylo GL1-LTE, a clinically validated, cellular-connected remote blood glucose monitoring device. Designed to improve remote patient monitoring (RPM) programs for diabetes management, the device ensures reliable data transmission across the United States.

In May 2024, Dexcom, Inc. launched the Dexcom ONE+, a continuous glucose monitoring (CGM) device designed to track real-time glucose levels for improved diabetes management. Additionally, the company unveiled the Dexcom State of Type 2 Report, highlighting alarming rates of anxiety and depression among individuals with Type 2 diabetes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 13.49 billion |

| Market Size by 2032 | USD 27.61 Billion |

| CAGR | CAGR of 8.29% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Self-monitoring Devices (Blood glucose meter, Testing Strips, Lancets), Continuous blood glucose monitoring devices (Sensors, Transmitter & Receiver, Insulin Pumps)] • By End-use [Hospitals, Home care, Diagnostic centers] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific (Patheon), Abbott, Medtronic plc, F. Hoffmann-La Roche Ltd, Ascensia Diabetes Care Holdings AG, Dexcom, Inc., Sanofi, Novo Nordisk, Insulet Corporation, Ypsomed Holdings, Glysens Incorporated, B. Braun Melsungen, Nipro, Arkray, Prodigy Diabetes Care, Acon Laboratories, Nova Biomedical, Lifescan |

| Key Drivers | • Technological Advancements and Rising Awareness Drive Growth in the Blood Glucose Monitoring Device Market |

| Restraints | • High Costs and Limited Accessibility Hampering Market Growth |

Ans: The estimated compound annual growth rate is 8.29% during the forecast period for the Blood Glucose Monitoring Device market.

Ans: The blood Glucose Monitoring Device market is estimated at USD 13.49 billion in 2023 and is expected to reach USD 27.61 billion by 2032.

Ans: Ongoing technological advancements in glucose monitoring systems, particularly the rise of non-invasive and user-friendly devices are propelling the growth of the blood glucose monitoring device market.

Ans: The expensive nature of continuous glucose monitoring systems and other advanced glucose monitoring devices can limit their accessibility, particularly in low-income regions or for uninsured individuals.

Ans: North America is the dominant region in the Blood Glucose Monitoring Device market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region, (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Service Benchmarking

6.3.1 Service specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Service launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Blood Glucose Monitoring Device Market Segmentation, by Product

7.2 Self-monitoring Devices

7.2.1 Self-monitoring Devices Market Trends Analysis (2020-2032)

7.2.2 Self-monitoring Devices Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Blood glucose meter

7.2.3.1 Blood glucose meter Market Trends Analysis (2020-2032)

7.2.3.2 Blood glucose meter Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Testing Strips

7.2.4.1 Testing Strips Market Trends Analysis (2020-2032)

7.2.4.2 Testing Strips Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Lancets

7.2.5.1 Lancets Market Trends Analysis (2020-2032)

7.2.5.2 Lancets Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Continuous blood glucose monitoring devices

7.3.1 Continuous blood glucose monitoring devices Market Trends Analysis (2020-2032)

7.3.2 Continuous blood glucose monitoring devices Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Sensors

7.3.3.1 Sensors Market Trends Analysis (2020-2032)

7.3.3.2 Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Transmitter & Receiver

7.3.4.1 Transmitter & Receiver Market Trends Analysis (2020-2032)

7.3.4.2 Transmitter & Receiver Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Insulin Pumps

7.3.5.1 Insulin Pumps Market Trends Analysis (2020-2032)

7.3.5.2 Insulin Pumps Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Blood Glucose Monitoring Device Market Segmentation, by End-use

8.2 Hospitals

8.2.1 Hospitals Market Trends Analysis (2020-2032)

8.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Home care

8.3.1 Home Care Market Trends Analysis (2020-2032)

8.3.2 Home Care Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Diagnostic centers

8.4.1 Diagnostic Centers Market Trends Analysis (2020-2032)

8.4.2 Diagnostic Centers Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Blood Glucose Monitoring Device Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.4 North America Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.5.2 USA Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.6.2 Canada Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Mexico Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Blood Glucose Monitoring Device Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.5.2 Poland Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.6.2 Romania Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Blood Glucose Monitoring Device Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.4 Western Europe Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.5.2 Germany Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.6.2 France Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.7.2 UK Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.8.2 Italy Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.9.2 Spain Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.12.2 Austria Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Blood Glucose Monitoring Device Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.4 Asia Pacific Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 China Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 India Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 Japan Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.6.2 South Korea Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Vietnam Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.8.2 Singapore Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.9.2 Australia Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Blood Glucose Monitoring Device Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.4 Middle East Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.5.2 UAE Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Blood Glucose Monitoring Device Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.4 Africa Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Blood Glucose Monitoring Device Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.4 Latin America Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.5.2 Brazil Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.6.2 Argentina Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.7.2 Colombia Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Blood Glucose Monitoring Device Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Blood Glucose Monitoring Device Market Estimates and Forecasts, by End-use (2020-2032) (USD Billion)

10. Company Profiles

10.1 Thermo Fisher Scientific (Patheon)

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Abbott

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Medtronic plc

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 F. Hoffmann-La Roche Ltd

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Ascensia Diabetes Care Holdings AG

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Dexcom, Inc.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Sanofi

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Novo Nordisk

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 B. Braun Melsungen

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Nova Biomedical

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Self-monitoring Devices

Blood glucose meter

Testing Strips

Lancets

Continuous blood glucose monitoring devices

Sensors

Transmitter & Receiver

Insulin Pumps

By End-use

Hospitals

Home care

Diagnostic centers

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Veterinary Parasiticides Market Size was valued at USD 9.2 Billion in 2023 and is expected to reach USD 18.03 Billion by 2032, growing at a CAGR of 7.8% over the forecast period 2024-2032.

The Epilepsy Device Market Size was valued at USD 0.75 billion in 2023 and is expected to reach USD 1.18 billion by 2032 and grow at a CAGR of 5.15% over the forecast period 2024-2032.

The Personalized Medicine Biomarkers Market to grow from USD 17.26 billion in 2023 to USD 58.39 billion by 2032, at a 14.54% CAGR.

The Biodegradable Medical Plastics Market Size was valued at USD 1.7 Bn in 2023 and will reach USD 4.5 Bn by 2032 and grow at a CAGR of 11.5% Over the Forecast Period of 2024-2032.

The Non-Invasive Prenatal Testing (NIPT) Market is expected to reach USD 17.75 Bn by 2031 and was valued at USD 6.4 Bn in 2023, and grow at a CAGR of 13.6% over the forecast period of 2024-2031.

DNA Sequencing Market size was valued at USD 11.5 Billion in 2023 and is expected to reach USD 52.1 Billion by 2032, growing at a CAGR of 17.8% from 2024-2032.

Hi! Click one of our member below to chat on Phone