Blockchain IoT Market Size & Overview:

To Get More Information on Blockchain IoT Market - Request Sample Report

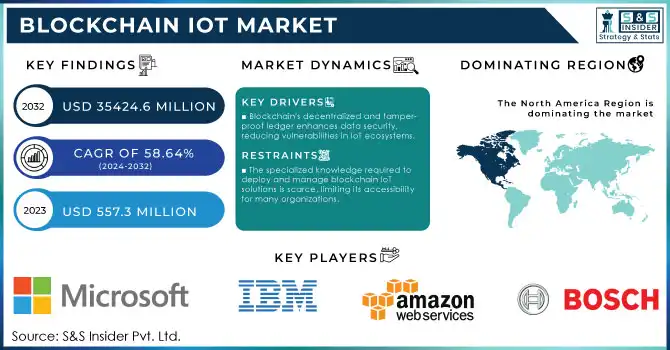

The Blockchain IoT Market was valued at USD 557.3 million in 2023 and is expected to reach USD 35424.6 million by 2032, growing at a CAGR of 58.64% over 2024-2032.

The Blockchain IoT market is witnessing rapid growth as it effectively addresses key challenges in IoT ecosystems, including bolstering data security, enhancing transparency, and improving operational efficiency. By integrating blockchain's decentralized and tamper-proof ledger with the vast data generated by IoT devices, industries can mitigate risks such as data breaches, fraud, and inefficiencies. The increasing adoption of IoT devices and the need for secure data management systems. Blockchain’s integration into IoT applications is particularly prominent in areas like smart contracts and asset tracking. In 2023, smart contracts contributed 33% of the market share by automating processes, reducing reliance on intermediaries, and ensuring streamlined compliance. Asset tracking, representing over 25% of the market, leverages blockchain to enhance supply chain transparency and logistics accuracy. For example, logistics companies use blockchain-powered IoT systems for real-time shipment tracking, reducing counterfeiting risks and improving reliability.

Healthcare has emerged as a critical adopter of blockchain IoT, using it to secure patient data, facilitate seamless data sharing, and ensure pharmaceutical supply chain integrity. Other industries such as retail, energy, and manufacturing are increasingly deploying blockchain IoT solutions to enhance data accuracy, prevent fraud, and optimize operational efficiency. These sectors highlight blockchain IoT's transformative potential in automating complex workflows and supporting regulatory compliance.

Looking forward, innovations in IoT hardware, blockchain protocols, and integration technologies are set to drive further advancements. Companies are focusing on creating interoperable, cost-efficient solutions to broaden the application of blockchain IoT across varied sectors. As the technology matures, blockchain IoT is positioned to revolutionize traditional systems, enabling secure, transparent, and efficient networks, thereby transforming industries and paving the way for smarter, more resilient ecosystems.

Blockchain IoT Market Dynamics

Drivers

-

The rapid proliferation of IoT devices generating massive amounts of sensitive data requires secure management solutions, driving the demand for blockchain integration.

-

Blockchain's decentralized and tamper-proof ledger enhances data security, reducing vulnerabilities in IoT ecosystems.

-

The adoption of smart contracts to streamline processes, reduce intermediaries, and ensure compliance is propelling market growth.

The adoption of smart contracts in the Blockchain IoT market plays a pivotal role in accelerating growth by addressing inefficiencies and transforming operational workflows. Smart contracts are self-executing protocols where terms and conditions are embedded in the blockchain, enabling automated execution without requiring intermediaries like banks or brokers. This automation enhances transparency, reduces transaction costs, and streamlines processes, making smart contracts a cornerstone of efficiency in IoT ecosystems. By facilitating secure and autonomous interactions among connected devices, smart contracts ensure seamless execution of predefined actions without human oversight.

In the supply chain sector, smart contracts have revolutionized operations by automating critical tasks. For instance, they can trigger payments as soon as IoT-enabled shipments arrive at their destination under stipulated conditions, such as maintaining specific temperatures during transit. This not only reduces delays and errors but also builds trust by creating an immutable, tamper-proof record of all transactions. Such features are vital for ensuring compliance with agreements and improving supply chain reliability.

Moreover, smart contracts have a transformative impact on regulatory compliance. Industries like healthcare, logistics, and energy often face stringent reporting and documentation requirements. Smart contracts simplify this by integrating regulatory checks directly into their code. For example, pharmaceutical supply chains use IoT sensors in conjunction with smart contracts to verify that drugs are transported within the required conditions. If a deviation occurs, the system alerts relevant parties and halts the process, safeguarding regulatory adherence and product quality. The cost efficiency provided by smart contracts is another significant driver of their adoption. By eliminating intermediaries, businesses save on fees while optimizing transaction speed and accuracy. This advantage is particularly critical in sectors with high transaction volumes or complex supply chains, where inefficiencies can result in substantial financial losses.

The integration of smart contracts into Blockchain IoT systems simplifies workflows, ensures compliance, builds trust, and reduces costs. These attributes position smart contracts as a foundational driver of innovation and growth, highlighting their transformative potential across diverse industries.

Restraints

-

Blockchain’s processing speed and storage limitations can struggle to handle the vast data volume generated by IoT devices, hindering its adoption in large-scale applications.

-

The initial investment required for integrating blockchain with IoT systems, including infrastructure, hardware, and training, is often prohibitively expensive for small and medium-sized enterprises.

-

The specialized knowledge required to deploy and manage blockchain IoT solutions is scarce, limiting its accessibility for many organizations.

A lack of required knowledge and staff expertise to harness Blockchain IoT solutions poses a significant barrier, especially for smaller firms or businesses without a tech team of their own. Blockchain IoT implementation requires well-versed knowledge of blockchain technology and IoT systems. They need to know how to integrate the secure, decentralized ledger that blockchain provides with Internet-connected devices, and this requires experience in software development, security protocols, and network architecture. Moreover, employees need an awareness of data protection regulations, compliance, and instant data management.

Blockchain IoT systems go beyond deployment, they require monitoring, updates, and security management to ensure proper protection of decentralized networks. The complexity increases when we have to deal with issues such as scalability, low latency, high throughput on stream processing data, and interoperability between various types of IoT devices. The consensus mechanisms of blockchain—as with Proof-of-Work or Proof-of-Stake—also include more-than-basic knowledge for maintaining optimal performances and low operational costs. This skills gap is particularly challenging for small and medium-sized enterprises (SMEs), who frequently do not have the resources to implement Blockchain IoT solutions. This has resulted in a lot of organizations having to rely on consultants or third-party vendors at an extra implementation cost. Lack of talent often increases the time to market Blockchain IoT solutions and proves to impede scaling up.

For these challenges, focused education and training programs on blockchain and IoT technologies are necessary. Such initiatives will close the knowledge gap and pave the way for broader adoption of Blockchain IoT solutions in various industries. The lack of skilled experts will continue to restrict the adoption and growth scope of Blockchain IoT solutions unless upskilling initiatives are in place.

Blockchain IoT Market Segment Analysis

By Component

In 2023, the largest revenue share of 52.8% was held by the software and platform component segment. The demand for efficient communication and data management in various IoT applications is further propelling demand for specialized hardware that caters to these requirements, thus facilitating the growth of this segment due to the necessity for more security and data consistency. In addition, the rising need for transparency and traceability in supply chains improves the software and platform segment over the forecast period.

The hardware component segment is expected to represent the maximum CAGR of 55.0% over the forecast period. Increasing IoT device implementations in various sectors such as industrial automation, smart homes, smart cities, and healthcare is expected to add to the segment growth.

By Vertical

The transportation & logistics segment held the largest revenue share of 22.7% in 2023 and is projected to do the same over the forecast period. Its ability to create transparent and immutable records of transactions and events is driving this growth in the transportation and logistics ecosystem. Additionally, by creating accurate & real-time data concerning inventory availability, the firms linked with transportation & logistics can function more efficiently. Such characteristics are anticipated to fuel the growth of the segment over the analysis timeframe.

The healthcare segment is expected to witness the fastest CAGR during the forecast period. This is due to the effectiveness of the solution in tracking and tracing the movement of pharmaceutical products through the supply chain, which in turn drives the healthcare segment growth. Such ability will verify the vaccine genuineness and origin will help reduce the counterfeit drug problem, reduce the risk of medication errors, and improve patient safety, thus is expected to have a positive impact on the growth of the healthcare segment.

By Organization Size

The small- & medium-sized enterprises (SMEs) segment held the largest revenue share of 62.8% in 2023 and will dominate the trend throughout the forecast period. The segment growth is attributed to the deployment of solutions that enable SMEs to achieve regulatory compliance. The ability of blockchain technology to maintain audit trails in a transparent and easy-to-audit manner is expected to fuel the segment growth over the forecast period and help SMEs maintain accurate records, protect their privacy, and prove compliance with industry regulators.

The large enterprises segment is anticipated to grow at a significant CAGR over the forecast period due to the increasing demand for security, efficiency, transparency, traceability, etc. Likewise, the blockchain IoT offers a decentralized and clear ledger which makes sure to keep the data safe and shared between permitted members. This not only increases data integrity but also enables large enterprises to make enhanced and data-driven decisions. Properties exhibiting those traits are anticipated to drive segment growth through the forecast period.

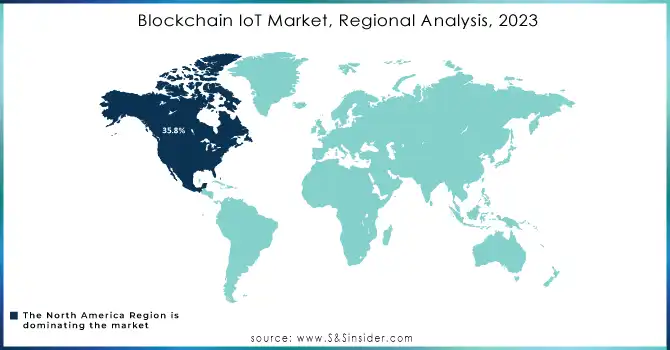

Blockchain IoT Market Regional Analysis

In 2023, North America dominated the market and represented the largest revenue share of 35.8% which is expected to see high growth over the forecast period. The presence of major players such as IBM Corporation, Microsoft Corporation, and Amazon, along with the region's rapid adoption of emerging technologies is a key factor responsible for driving the market growth in this region.

Asia Pacific is expected to be the highest-growing regional market, over the forecast period. Governments of countries like China, Japan, and India have been actively promoting the use of this technology within their framework. For example, SETS and UIDAI joined forces in March 2023 for some R&D focused on deep tech, IoT Security, Blockchain Technology, Quantum Security, etc. as part of the ‘Make in India’ initiative by the Indian government to enhance capacity and strengthen self-reliance on information security. This government initiative will increase the demand for technology in the region.

Do You Need any Customization Research on Blockchain IoT Market - Enquire Now

Key Players

The major key player along with their products are:

-

IBM – IBM Blockchain for IoT

-

Microsoft – Azure IoT Blockchain Solution

-

Intel – Intel IoT Solutions with Blockchain

-

Cisco Systems – Cisco Kinetic for Blockchain

-

Amazon Web Services (AWS) – AWS IoT Blockchain Solutions

-

Honeywell – Honeywell Blockchain IoT Platform

-

Samsung Electronics – Samsung Blockchain IoT Solution

-

Bosch – Bosch Blockchain IoT Solutions

-

VeChain – VeChain Thor Blockchain for IoT

-

IOTA Foundation – IOTA Tangle for IoT

-

BigchainDB – BigchainDB Blockchain for IoT

-

Modum – Modum Blockchain for IoT Logistics

-

Chronicled – Chronicled IoT Blockchain Supply Chain

-

Waltonchain – Waltonchain Blockchain for IoT Supply Chain

-

Filament – Filament Blockchain for IoT Networks

-

Tendermint – Cosmos Network for IoT Blockchain

-

Enegra – Enegra IoT Blockchain Platform

-

Lition Blockchain – Lition Blockchain for IoT Data Storage

-

Securekey Technologies – Securekey Blockchain IoT Identity Management

-

R3 – Corda Blockchain IoT Solutions

Recent Developments in the Blockchain IoT Market

-

February 2024: IBM has continued to expand its blockchain and IoT integration, focusing on its hybrid cloud platform that enhances real-time data collection, sharing, and asset management. This development targets industries such as manufacturing, logistics, and supply chain by streamlining operations through secure, transparent transactions enabled by blockchain technology.

-

March 2024: Microsoft has strengthened its offerings with Azure IoT Hub, adding enhanced blockchain solutions for secure and scalable IoT ecosystems. These integrations provide robust security features and are aimed at automating processes in supply chains and enhancing data integrity across various industries.

| Report Attributes | Details |

| Market Size in 2023 | US$ 557.3 Mn |

| Market Size by 2032 | US$ 35,424.6 Mn |

| CAGR | CAGR of 58.64% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software and platform, Services) • By Application (Data Security, Smart Contracts, Asset Tracking & Management, Others) • By Organization Size (SMEs, Large Enterprises) • By Vertical (Transportation & Logistics, Manufacturing, Healthcare, Retail, Consumer Electronics, Smart City, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Microsoft, Intel, Cisco Systems, Amazon Web Services, Honeywell, Samsung Electronics, Bosch, VeChain, IOTA Foundation, BigchainDB, Modum, Chronicled, Waltonchain, Filament, Tendermint, Enegra, Lition Blockchain, Securekey Technologies, R3 |

| Key Drivers | • The rapid proliferation of IoT devices generating massive amounts of sensitive data requires secure management solutions, driving the demand for blockchain integration. • Blockchain's decentralized and tamper-proof ledger enhances data security, reducing vulnerabilities in IoT ecosystems. • The adoption of smart contracts to streamline processes, reduce intermediaries, and ensure compliance is propelling market growth. |

| Market Restraints | • Blockchain’s processing speed and storage limitations can struggle to handle the vast data volume generated by IoT devices, hindering its adoption in large-scale applications. • The initial investment required for integrating blockchain with IoT systems, including infrastructure, hardware, and training, is often prohibitively expensive for small and medium-sized enterprises. • The specialized knowledge required to deploy and manage blockchain IoT solutions is scarce, limiting its accessibility for many organizations. |