To get more information on Blockchain in the ICT Market - Request Free Sample Report

The Blockchain in the ICT Market is changing how the data is stored, tracked, and shared among information and communication technology ecosystems; hence, it is emerging as a transformational force within ICT. Blockchain technology, an emerging ICT, is being progressively exploited in a variety of applications to enhance security, transparency, and operational efficiency by leveraging its decentralized and immutable features. It is being adopted in key areas such as supply chain optimization, identity verification, secure data sharing, fraud prevention, etc. One of the key trends is the increased adoption of blockchain across the telecommunication sector, especially for tackling fraud, and securing 5G infrastructure deployment. The number also implying the trend is leading to the adoption of blockchain systems as more than 30% of global ICT enterprises should have implemented blockchain-structured systems in 2024. Several factors contribute to the growth of the market. An unprecedented rise in the number of cyberattacks and data breaches has made the case for secure and tamper-resistant ICT systems, and blockchain can be considered a necessary remedy for ICT organizations for their remedy. Furthermore, the proliferation of IoT devices coupled with the increasing need for secure communication protocols has even more accelerated the adoption of blockchain to solve scalability and security issues. Moreover, the growth is also driven by the government and private sector investments in R&D on blockchain technology, with an approximately 25% year-on-year growth in funding for the ICT sector in 2024 showing that there is real interest and confidence in its potential.

New opportunities for innovation are being unlocked through the integration of blockchain with other emerging technologies, including artificial intelligence, machine learning, and edge computing. As a case in point, AI solutions using blockchain enable data privacy and enable real-time decision-making for communication networks. In addition, the rapid establishment of enabling regulatory regimes in North America and Europe is even accelerating blockchain adoption for ICT infrastructure environments. While challenges such as high deployment costs and interoperability problems persist, steady growth is anticipated in the segment as a result of advancing technologies, increasing digitalization, and the rising demand for secure ICTSPs. Blockchain will be at the center stage of defining the future of the ICT industry.

Drivers

The use of blockchain for fraud detection and secure deployment of 5G infrastructure.

Fraud detection via blockchain and secure deployment of 5G infrastructure has become a principal growth factor for the Blockchain in the ICT Market. Blockchain technology is paving a path in the telecommunications sector where long-pervasive issues such as fraud at the cost of billions to the industry become day by day easier to be addressed through decentralization. Used in different scopes, blockchain readily offers the perfect solution to fraud: transparent and immutable records of transactions due to its decentralized nature. Blockchain integration empowers telecom companies with higher operational security, enhanced security from loss of revenues, and higher trust from customers.

This development also involves the need for advanced security solutions to carry out the complexities of massive data flows and interconnection devices over the 5G networks. Due to the large number of transactions and communications that occur in the above 5G networks, Blockchain has become a powerful solution for managing it. It provides data integrity, and confidentiality, and ensures non-repudiation, which is fundamentally important in the highly distributed environment of 5G infrastructure, from access control to secure device authentication. Furthermore, blockchain supports spectrum sharing, resource allocation, and network slicing, which enhance the reliability and performance of 5G networks. Blockchain addresses the needs of telecom providers on two fronts: fraud prevention and implementing 5G safely and helps improve operational efficiencies while catering to the increasing need for secure and transparent communication systems. This combined role positions the blockchain industry as a game-changer, encouraging adoption and paving the way for future telecom infrastructure in the ICT domain.

Blockchain's convergence with AI, ML, and edge computing unlocks new opportunities for secure and efficient ICT solutions.

The growing need for transparency in supply chain management and data sharing enhances blockchain adoption.

Restraints

The limited availability of skilled professionals in blockchain technology hampers its effective implementation in ICT projects.

The scarcity of skilled professionals in blockchain technology is a major challenge for the Blockchain in ICT Market showing a hindrance to its seamless adoption among different projects. Blockchain is a very niche skill and requires those who are well-versed in software programming, smart contracts, distribution ledger systems, and cryptography with programming languages such as Solidity and Rust. However, the speed at which blockchain is developing has left behind the development of an able talent base, leading to a significant talent gap in the industry. However, this quick shortage in the number of experts creates problems for organizations that want to effectively adopt and integrate blockchain solutions into their ICT frameworks.

A shortage of skilled labor impacts essential aspects of the blockchain lifecycle, including system design, implementation, maintenance, and troubleshooting. Due to the lack of proper expertise, organizations often find it difficult to customize blockchain solutions for to their specific requirements and fix some of the technical issues as no cost-effective solutions are leading to inevitable delays and cost. In addition, despite the broad interdisciplinary knowledge makeup needed to implement blockchain technology, including ICT, cybersecurity, business process management, etc., the blockchain skills gap is aggravated. The lack of such talent also stifles innovation because organizations are forced to limit their development and experiment with novel blockchain applications. Particularly smaller businesses and start-ups, which may not have the means to attract top talent, are majorly hindered by this factor, delaying widespread blockchain technology adoption.

Limited transaction processing speeds and scalability issues in blockchain networks pose barriers to large-scale ICT applications.

High energy requirements for blockchain operations, particularly in proof-of-work systems, raise sustainability concerns.

By Component

The Platforms segment dominated the market and represented a significant revenue share in 2023, as they offer the infrastructure required for blockchain applications. Such platforms allow the development, administration, and implementation of decentralized applications and smart contracts. This segment is projected to remain the largest one in the market, due to the rising adoption of secure, scalable, and efficient blockchain solutions by end-users across industries. Some of the key growth factors attracting the global market are the widespread acceptance of blockchain for supply chain control, information safeguarding, and fraud detection. With more and more organizations moving to blockchain-based systems, platform providers are enriching their platforms, with improvements in scalability, interoperability, and integration with other emerging technologies. Segments such as enterprise blockchain adoption drive the segment and the ongoing growth of decentralized finance application areas signals strong growth.

The Services segment is anticipated to witness the fastest CAGR during the forecast period 2024-2032 Organizations looking to capitalize on the benefits of blockchain adoption can explore the blockchain strategy, approach to development, and post-implementation support for Web 3.0 and beyond from services providers. This growth can be attributed to a combination of the rising complexity of blockchain solutions and a growing demand for specialized skills in fields such as smart contract development, blockchain security, and scalability. The demand for blockchain implementation and management services is likely to burgeon in the next few years, owing to its rapid penetration by various enterprises for different use cases, making the services segment one of the key growth-driving segments in the blockchain technology market.

By Enterprise Size

The Large Enterprises segment dominated the market and represented a significant revenue share in 2023. The largest enterprises can afford to spend on cutting-edge blockchain solutions for their specific use cases and industries from supply chain solutions down to data security, antifraud, and much more. They leverage Blockchain to drive operational efficiency, transparency, and security at scale. Large enterprises are overwhelming drivers of growth as they must contend with enormous data volumes and navigate operational efficiencies, cloud efficiencies, and security in a way only they can do. These enterprises are blockchain early adopters in a bid to keep up with the competition in the sectors of finance, telecommunications, and logistics. We should see the segment continue to lead, buoyed by the ongoing digital transformation and the growing demand for secure and scalable blockchain solutions.

The SME segment is projected to register the fastest CAGR from 2024 to 2032. Blockchains are increasingly being adopted by SMEs to simplify processes, lower expenses and boost security, without the requirement of a full-scale infrastructure. This growth is fueled by affordable BaaS solutions, opening the way for SMEs with a low entry barrier, along with the opportunities offered by blockchain in the areas of enhancing transparency, traceability, and fraud prevention. Moreover, the ongoing growth in demand for blockchain solutions will witness a significant boost as SMEs identify blockchain benefits in their daily supply chain management and periodic secure transactions. Looking ahead, the prospects for SMEs are bright — when more blockchain tools and service offerings designed for the unique needs of SMEs become available, rapid adoption should follow.

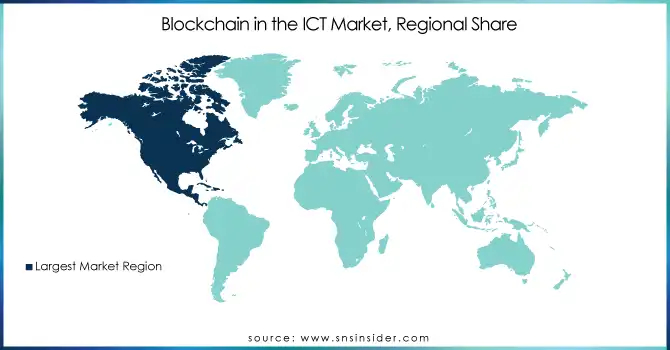

North America dominated the Blockchain in the ICT Market and represented a significant revenue share in 2023, owing to its better technological base, adoption of blockchain in the early stage, and favorable regulatory environment. It is home to major blockchain development players, including technology giants, startups, and service providers. Sectors such as finance, telecommunications, and healthcare are quickly adopting blockchain to enhance their security, and transparency and strengthen their business processes. The growth of the market is been propelled by massive investment in research and development of the blockchain for large scale and mediums of flow by private as well as public sectors. Given the continual advancement of blockchain applications across various industries, it is expected that North America will maintain its leading position with an increased need for secure and scalable solutions. Such is the nature of the innovation-based ecosystem of the region, combined with supportive regulations, that it will keep full sway in the market for a while to come.

The Asia Pacific region is expected to register the fastest CAGR during the period 2024 to 2032. Growth is driven by the high pace of digital transformation and growing investments in blockchain. Blockchain adoption is majorly taken up in countries like China, Japan, South Korea, and India in finance, supply chain management, and government services This growth is particularly driven by the APAC region which has some of the fastest-growing economies, a high adoption rate of mobile, and significant government initiatives on the integration of blockchain technology into public and private sectors. Further, an increase in the utilization of blockchain for digital currencies, trade finance & cross-border payments is also supporting market growth. Innovation continues apace and the regulatory environment is conducive to adoption, signaling a healthy outlook for blockchain in APAC as we move forward.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

IBM – IBM Blockchain

Microsoft – Azure Blockchain Service

Oracle – Oracle Blockchain Platform

Accenture – Accenture Blockchain Solutions

Amazon Web Services (AWS) – Amazon Managed Blockchain

Intel – Intel Hyperledger Sawtooth

SAP – SAP Cloud Platform Blockchain

Ripple – RippleNet

Chainalysis – Chainalysis Reactor

Coinbase – Coinbase Blockchain Solutions

VeChain – VeChainThor Blockchain

Blockchain.com – Blockchain Wallet

Hyperledger – Hyperledger Fabric

In January 2024, IBM announced the launch of its Blockchain Accelerator Program, aiming to support startups and enterprises in developing and scaling blockchain solutions.

In February 2024, Microsoft expanded its Azure Blockchain Service to include support for multiple blockchain protocols, enhancing interoperability for enterprise clients.

In November 2024, Hyperledger announced the release of Hyperledger Fabric 3.0, offering enhanced privacy features and improved performance for enterprise blockchain solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD XX Billion |

| Market Size by 2032 | USD XX Billion |

| CAGR | CAGR of XX From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Platforms, Services) • By Organization Size (Small and Medium Enterprises, Large Enterprises) • By Deployment Type (On-premises, Cloud-based) • By End-user (Telecommunication Providers, IT Service Providers, Cloud Service Providers, Networking Companies, Data Center Operators) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Microsoft, Oracle, Accenture, Amazon Web Services (AWS), Intel, SAP, Ripple, Chainalysis, Coinbase, VeChain, |

| Key Drivers | • Blockchain's convergence with AI, ML, and edge computing unlocks new opportunities for secure and efficient ICT solutions. • The growing need for transparency in supply chain management and data sharing enhances blockchain adoption. |

| RESTRAINTS | • Limited transaction processing speeds and scalability issues in blockchain networks pose barriers to large-scale ICT applications. • High energy requirements for blockchain operations, particularly in proof-of-work systems, raise sustainability concerns. |

Ans- The Blockchain in ICT Market was valued at USD XX Billion in 2023 and is expected to reach USD XX Billion by 2032, growing at a CAGR of XX% from 2024-2032.

Ans- The CAGR of the Blockchain in ICT Market during the forecast period is XX% from 2024-2032.

Ans- the Asia-Pacific is expected to register the fastest CAGR during the forecast period.

Ans- Blockchain's convergence with AI, ML, and edge computing unlocks new opportunities for secure and efficient ICT solutions.

Ans- Limited transaction processing speeds and scalability issues in blockchain networks pose barriers to large-scale ICT applications.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Blockchain in ICT Market Segmentation, by Component

7.1 Chapter Overview

7.2 Platforms

7.2.1 Platforms Market Trends Analysis (2020-2032)

7.2.2 Platforms Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3Services

7.3.1Services Market Trends Analysis (2020-2032)

7.3.2Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Blockchain in ICT Market Segmentation, by Deployment

8.1 Chapter Overview

8.2 Cloud

8.2.1 Cloud Market Trends Analysis (2020-2032)

8.2.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 On-Premise

8.3.1 On-Premise Market Trends Analysis (2020-2032)

8.3.2 On-Premise Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Blockchain in ICT Market Segmentation, by Organization Size

9.1 Chapter Overview

9.2 Large Enterprise

9.2.1 Large Enterprise Market Trends Analysis (2020-2032)

9.2.2 Large Enterprise Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 SMEs

9.3.1 SMEs Market Trends Analysis (2020-2032)

9.3.2 SMEs Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Blockchain in ICT Market Segmentation, by End-Use

10.1 Chapter Overview

10.2 Telecommunication Providers

10.2.1 Telecommunication Providers Market Trends Analysis (2020-2032)

10.2.2 Telecommunication Providers Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 IT Service Providers

10.3.1IT Service Providers Market Trends Analysis (2020-2032)

10.3.2 IT Service Providers Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Cloud Service Providers

10.4.1 Cloud Service Providers Market Trends Analysis (2020-2032)

10.4.2 Cloud Service Providers Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Networking Companies

10.5.1 Networking Companies Market Trends Analysis (2020-2032)

10.5.2 Networking Companies Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Data Center Operators

10.6.1 Data Center Operators Market Trends Analysis (2020-2032)

10.6.2 Data Center Operators Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Blockchain in ICT Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.4 North America Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.2.5 North America Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.6 North America Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.7.2 USA Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.2.7.3 USA Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.7.4 USA Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.8.2 Canada Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.2.8.3 Canada Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.8.4 Canada Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.2.9.2 Mexico Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.2.9.3 Mexico Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.9.4 Mexico Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Blockchain in ICT Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.7.2 Poland Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.7.3 Poland Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.7.4 Poland Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.8.2 Romania Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.8.3 Romania Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.8.4 Romania Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Blockchain in ICT Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.4 Western Europe Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.5 Western Europe Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.6 Western Europe Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.7.2 Germany Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.7.3 Germany Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.7.4 Germany Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.8.2 France Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.8.3 France Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.8.4 France Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.9.2 UK Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.9.3 UK Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.9.4 UK Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.10.2 Italy Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.10.3 Italy Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.10.4 Italy Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.11.2 Spain Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.11.3 Spain Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.11.4 Spain Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.14.2 Austria Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.14.3 Austria Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.14.4 Austria Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Blockchain in ICT Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.4 Asia Pacific Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.5 Asia Pacific Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.6 Asia Pacific Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.7.2 China Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.7.3 China Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.7.4 China Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.8.2 India Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.8.3 India Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.8.4 India Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.9.2 Japan Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.9.3 Japan Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.9.4 Japan Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.10.2 South Korea Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.10.3 South Korea Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.10.4 South Korea Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.11.2 Vietnam Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.11.3 Vietnam Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.11.4 Vietnam Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.12.2 Singapore Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.12.3 Singapore Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.12.4 Singapore Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.13.2 Australia Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.13.3 Australia Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.13.4 Australia Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Blockchain in ICT Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.4 Middle East Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.5 Middle East Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.6 Middle East Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.7.2 UAE Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.7.3 UAE Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.7.4 UAE Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Blockchain in ICT Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.4 Africa Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.2.5 Africa Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.6 Africa Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Blockchain in ICT Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.4 Latin America Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.5 Latin America Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.6 Latin America Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.7.2 Brazil Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.7.3 Brazil Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.7.4 Brazil Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.8.2 Argentina Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.8.3 Argentina Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.8.4 Argentina Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.9.2 Colombia Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.9.3 Colombia Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.9.4 Colombia Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Blockchain in ICT Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Blockchain in ICT Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Blockchain in ICT Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Blockchain in ICT Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

12. Company Profiles

12.1 IBM

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Microsoft

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Oracle

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Amazon Web Services (AWS)

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Accenture

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Intel

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 SAP

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 SAS Institute

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Ripple

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Chainalysis

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Platforms:

Services

By Organization Size

Small and Medium Enterprises (SMEs)

Large Enterprises

By Deployment Type

On-premises

Cloud-based

By End-user

Telecommunication Providers

IT Service Providers

Cloud Service Providers

Networking Companies

Data Center Operators

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Identity Governance and Administration Market was valued at USD 7.1 Billion in 2023 and will reach USD 23.4 Billion and CAGR of 14.24% by 2032.

The Golf Simulators Market was valued at USD 1.71 billion in 2023 and is projected to reach USD 3.69 billion by 2032, growing at a CAGR of 9.08% during the forecast period of 2024–2032.

System Infrastructure Software Market was valued at USD 161 billion in 2023 and is expected to reach USD 297.18 billion by 2032, growing at a CAGR of 7.12% from 2024-2032.

Multi-Cloud Management Market was valued at USD 9.84 billion in 2023 and will reach USD 86.24 billion by 2032, growing at a CAGR of 27.34% by 2032.

The Bare Metal Cloud Market was valued at USD 8.47 billion in 2023 and is expected to reach USD 46.14 billion by 2032, growing at a CAGR of 20.77% over the forecast period 2024-2032.

The Decision Intelligence Market is anticipated to reach from USD 12.7 billion in 2023 to USD 62.2 billion by 2032, growing at a CAGR of 19.31% over 2024-2032.

Hi! Click one of our member below to chat on Phone