Blockchain in Aerospace & Defence Market Report Scope & Overview:

The Blockchain in Aerospace & Defence Market Size was USD 3.27 Billion in 2023 and is expected to Reach USD 98.4 Billion by 2032 and grow at a CAGR of 46.22% over the forecast period of 2024-2032.

Get More Information on Blockchain in Aerospace & Defence Market - Request Sample Report

Blockchain technology is increasingly being adopted in the aerospace and defense sectors due to its ability to improve security, transparency, and efficiency in operations. One of the most significant applications is in supply chain management, where blockchain provides a secure and transparent system for tracking components and materials. This helps prevent counterfeit parts from entering the supply chain, ensuring that only verified, quality-assured components are used in aerospace manufacturing and defense systems. Blockchain enables real-time tracking of parts, reducing delays, improving accountability, and streamlining procurement processes. Additionally, it ensures a transparent audit trail for every part, which is critical in these highly regulated industries. In aircraft maintenance, blockchain plays a pivotal role by providing a decentralized and immutable digital record of an aircraft’s maintenance history. This makes it easier for maintenance crews and operators to access and update maintenance records, ensuring compliance with safety regulations and enhancing operational efficiency. The use of blockchain in this context reduces the risk of fraud, as each update to the record is time-stamped and cannot be altered retroactively.

Blockchain’s integration with smart contracts also brings significant improvements to procurement and contract management in aerospace and defense. Smart contracts automate the execution of agreements, reducing the need for manual interventions, paperwork, and human errors. This increases the speed of transactions, reduces administrative costs, and minimizes the risk of contractual disputes. Furthermore, blockchain technology strengthens data security in the aerospace and defense sectors by providing decentralized encryption and reducing the chances of cyberattacks. Given the sensitive nature of the information handled by these industries, blockchain ensures that data exchanges, communications, and contract executions are secure and tamper-proof.

| Feature | Description | Commercial Products |

|---|---|---|

| Security | Ensures data security with immutable transaction records and encryption methods. | IBM Blockchain for Aerospace, VeChain Aerospace Blockchain |

| Traceability | Provides detailed tracking of materials, components, and parts throughout the supply chain. | Blockchain in Aerospace Traceability System, Aeron Blockchain |

| Smart Contracts | Automates agreements and processes without intermediaries, ensuring efficiency and compliance. | Accenture Aerospace Smart Contracts, AEROSPACECHAIN |

| Cost Efficiency | Reduces costs by eliminating middlemen and automating processes such as payments and record-keeping. | LedgerX Blockchain Solutions, FULCRUM Blockchain |

| Supply Chain Optimization | Enhances transparency and efficiency in tracking and verifying components in the aerospace supply chain. | Boeing’s Blockchain Pilot, Honeywell Blockchain System |

| Data Integrity | Provides consistent and verified data in a decentralized ledger that prevents fraud or tampering. | AWS Blockchain for Aerospace, Lockheed Martin Blockchain |

| Operational Efficiency | Streamlines operational processes with blockchain-enabled systems to reduce downtime and improve response time. | T-Systems Aerospace Blockchain, Airbus Blockchain Integration |

| Regulatory Compliance | Facilitates adherence to industry regulations by recording every transaction and change in real-time. | Arianespace Blockchain System, Siemens Aerospace Blockchain |

| Interoperability | Ensures smooth integration between various platforms and technologies used in aerospace operations. | SAP Blockchain Integration, IBM Aerospace Blockchain |

| Transparency | Provides a transparent system for all stakeholders to view records and transactions in real time. | ConsenSys Blockchain for Aerospace, CloudSigma Aerospace Blockchain |

Blockchain in Aerospace & Defence Market Dynamics

Drivers

-

Blockchain improves security and data integrity in aerospace and defense by creating a decentralized, tamper-proof ledger that protects against data breaches and unauthorized access.

The Blockchain in Aerospace & Defense Market is driven by the increasing need for enhanced security, transparency, and operational efficiency within these industries. Blockchain technology provides a decentralized and immutable ledger system that significantly improves data integrity and prevents tampering critical requirements in aerospace and defense sectors. Aerospace and defense companies are increasingly leveraging blockchain to secure sensitive information, especially as these sectors handle vast amounts of confidential data, including intellectual property, contracts, and mission-critical communications. The primary advantage of blockchain in these sectors is its ability to prevent unauthorized access, fraud, or data breaches. By distributing data across multiple nodes, blockchain ensures there is no central point of failure, which is a key vulnerability in traditional systems. In the supply chain management of aerospace and defense, blockchain plays a crucial role in tracking and verifying components and materials to prevent counterfeit parts from entering the system, enhancing both security and compliance.

The end-to-end encryption provided by blockchain protects sensitive data in transit and at rest, ensuring that classified or mission-critical information remains secure from cyber threats. The transparent nature of blockchain also facilitates easy auditing and compliance checks, which are essential in these highly regulated industries. As the Blockchain in Aerospace & Defense Market continues to grow, its applications are expected to expand further. This includes the use of blockchain for contract management, where smart contracts can automate and secure the execution of agreements, reducing the risk of disputes and improving operational efficiency.

-

Blockchain streamlines procurement, contract management, and transaction verification by eliminating intermediaries, reducing costs, and enhancing operational efficiency.

Blockchain technology is transforming the aerospace and defense sectors by enhancing operational efficiency, reducing costs, and improving security. In industries that deal with high-value contracts, strict compliance regulations, and intricate supply chains, blockchain automates and streamlines processes such as procurement, contract management, and transaction verification. One of the key benefits of blockchain is its ability to optimize procurement. In aerospace and defense, procurement often involves numerous intermediaries, including suppliers, contractors, and government agencies, which increases complexity and cost. Blockchain’s decentralized ledger eliminates these intermediaries, lowering administrative costs, reducing the chance of errors, and accelerating procurement cycles. This leads to faster approvals and more efficient contract execution, which helps mitigate operational delays.

Additionally, blockchain’s implementation of smart contracts revolutionizes contract management. Traditional contract processes are often slow and prone to disputes due to manual steps and reliance on third-party intermediaries. Smart contracts, powered by blockchain, automatically execute predefined conditions, ensuring accuracy and eliminating manual intervention. This reduces administrative overheads, accelerates contract fulfillment, and enhances overall efficiency, driving down costs in the sector. Finally, blockchain ensures secure and transparent transaction verification. By providing an immutable ledger, blockchain guarantees data integrity without needing third-party verification. This reduces the risk of fraud and enhances accountability across the aerospace and defense supply chain. The ability to trace goods, services, and payments improves transparency, reduces errors, and further contributes to cost reduction and operational efficiency. The continued adoption of blockchain technology in these industries is setting the stage for more streamlined, secure, and cost-effective operations.

Restrain

-

The integration of blockchain with legacy systems in aerospace and defense presents several challenges, which can directly impact the growth and adoption of blockchain in the aerospace and defense market.

Integrating blockchain into aerospace and defense sectors presents a complex set of challenges due to the reliance on legacy systems that were developed before blockchain technology became prominent. These older, proprietary systems often manage mission-critical functions such as procurement, inventory, and secure communications, making the integration of blockchain difficult. The decentralized and immutable nature of blockchain requires significant modifications to existing infrastructure, including updates to data storage, networking, and security protocols, which can be costly and time-consuming. Ensuring seamless interoperability between blockchain platforms and legacy systems can slow down the adoption process and increase project costs, deterring organizations from moving forward with blockchain integration. The process of integrating blockchain also requires re-engineering existing workflows, particularly in supply chain and contract management, to capture and record transactions on the blockchain in real-time. This can disrupt daily operations and further complicate the adoption process. Additionally, the integration requires substantial investments in training personnel or hiring new blockchain experts, as many companies lack the in-house expertise to deploy and manage blockchain technology effectively. The scarcity of skilled professionals increases costs and could result in temporary disruptions as staff adapts to new systems. These barriers high integration costs, infrastructure upgrades, a shortage of blockchain professionals, and the need for workflow re-engineering can slow the adoption of blockchain in aerospace and defense, limiting its market growth potential and delaying its benefits in improving transparency, efficiency, and security in the sector.

Blockchain in Aerospace & Defence Market Segmentation Overview

By Type

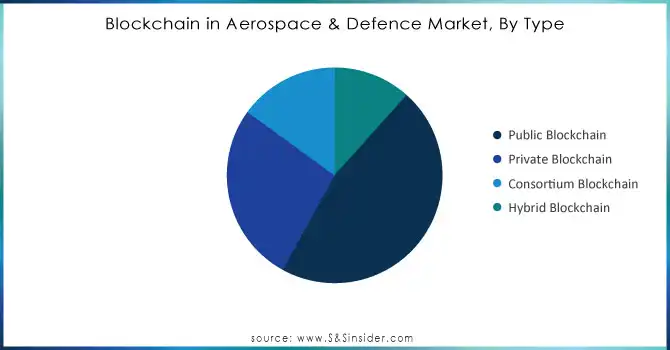

The Private Blockchain segment holds the dominant market share of over 46.99% in the blockchain technology used in aerospace and defense, primarily due to its superior security features and robust control over data management. In this sector, where the handling of sensitive and classified information is crucial, private blockchains offer a high level of confidentiality and integrity. They provide a permission-based access system, ensuring that only authorized entities can access, view, or modify the data stored on the blockchain. This makes private blockchains particularly well-suited for defense contractors and aerospace companies, where the confidentiality of operations, intellectual property, and security data is a top priority.

Need Any Customization Research On Blockchain in Aerospace & Defence Market - Inquiry Now

By Deployment Mode

The Cloud-Based segment holds the dominant market share of over 63.61% and fastest-growing segment in the Blockchain in Aerospace & Defence Market due to several compelling reasons. Cloud-based solutions offer unparalleled scalability, which is essential for large organizations in aerospace and defence that need to process vast amounts of data and transactions efficiently. Additionally, cloud solutions provide significant cost efficiency by reducing the need for expensive infrastructure and ongoing maintenance, offering a more flexible and economical option for enterprises in this sector. The accessibility and security offered by cloud platforms make them particularly attractive, as they ensure that sensitive data and transactions are securely handled while being accessible globally, a key consideration for aerospace and defence operations.

Blockchain in Aerospace & Defence Market Regional Analysis

The North American region currently dominates the Blockchain in Aerospace & Defense market, holding a significant share of 44.56% in 2023. This dominance is largely driven by the strong presence of key industry players, advanced technological infrastructure, and substantial investments in blockchain solutions. North America benefits from a well-established aerospace and defense sector, with major companies leveraging blockchain to enhance security, streamline supply chains, and improve data management, particularly in military applications and defense logistics.

The Asia-Pacific region is the fastest-growing for blockchain in aerospace and defense market. Rapid technological advancements, increasing defense budgets, and the growing adoption of blockchain for security and operational efficiency are key drivers in this region. Countries such as China, Japan, and India are focusing on modernizing their aerospace and defense industries, driving demand for innovative solutions like blockchain. As these nations continue to expand their aerospace and defense capabilities, the market in Asia-Pacific is expected to grow at a significant pace.

Some of the major key players of Blockchain in aerospace & defence Market

-

SIMBA Chain Inc. (Blockchain-based supply chain management solutions)

-

Accenture (Blockchain consulting and implementation services)

-

Aeron Labs (Blockchain-powered aviation safety and maintenance record tracking)

-

Guardtime (Blockchain-based cybersecurity solutions for aerospace and defense)

-

Amazon Web Services (AWS) (AWS Blockchain templates and managed blockchain services)

-

Oracle Corporation (Blockchain Cloud Service for aerospace and defense applications)

-

Consensys (Blockchain-based decentralized applications for aerospace supply chains)

-

Microsoft (Azure Blockchain Service and integration with aerospace and defense systems)

-

Infosys (Blockchain technology for secure transactions and logistics in defense)

-

IBM (IBM Blockchain for secure data sharing and smart contracts in aerospace)

-

SAP SE (SAP Leonardo Blockchain for improving operational efficiency in defense)

-

3IPK (Blockchain solutions for aerospace supply chain and logistics management)

Suppliers provides blockchain consulting services for the aerospace and defense sectors, assisting in the development of secure, scalable blockchain solutions for asset tracking, data integrity, and supply chain management of Blockchain in aerospace & defence Market

-

IBM

-

Microsoft

-

Accenture

-

Lockheed Martin

-

Boeing

-

Honeywell

-

SAP

-

Airbus

-

Palantir Technologies

Recent Development

In November 2024: Honeywell launched a new blockchain-based platform designed to streamline the buying and selling of aircraft parts. This initiative aims to enhance the transparency, security, and efficiency of transactions within the aerospace industry. By leveraging blockchain, the platform promises to offer real-time tracking of aircraft parts, which is expected to improve supply chain management and reduce fraud.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.27 Billion |

| Market Size by 2032 | USD 98.4 Billion |

| CAGR | CAGR of 46.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Public Blockchain, Private Blockchain, Consortium Blockchain, Hybrid Blockchain) • By Deployment Mode (On-Premises, Cloud-Based) • By Application (Supply Chain Management, Identity Management and Authentication, Smart Contracts, Compliance and Audit, Payments and Transaction Processing, Risk Management and Cybersecurity) • By End User (Aerospace Industry, Defense Sector) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SIMBA Chain Inc., Accenture, Aeron Labs, Guardtime, Amazon Web Services (AWS), Oracle Corporation, Consensys, Microsoft, Infosys, IBM, SAP SE, 3IPK |

| Key Drivers | • Blockchain enhances security and data integrity in aerospace and defense by providing a decentralized, immutable ledger that ensures tamper-proof records and reduces the risk of data breaches or unauthorized access. • Blockchain automates and simplifies processes like procurement, contract management, and transaction verification, reducing intermediary reliance, lowering costs, and improving operational efficiency. |

| RESTRAINTS | • Integrating blockchain with legacy systems in aerospace and defense is complex, costly, and time-consuming, requiring significant infrastructure upgrades and staff training. |