Bitcoin ATM Machine Market Size & Trends

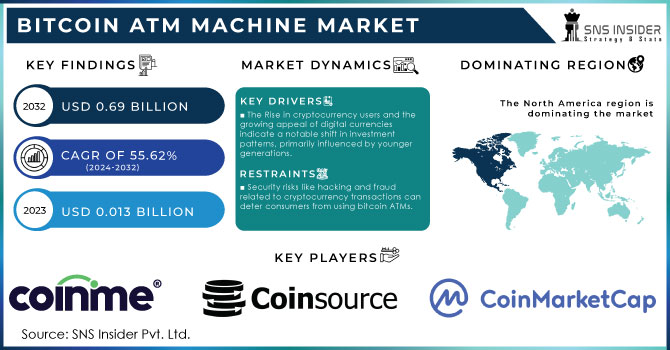

The Bitcoin ATM Machine Market Size was valued at USD 0.02 Billion in 2024, is projected to experience explosive growth, reaching USD 0.69 Billion by 2032. This remarkable expansion reflects a robust compound annual growth rate (CAGR) of 55.62% from 2025 to 2032. The rise in cryptocurrency users and the increasing popularity of digital currencies signify a significant change in investment trends, largely driven by a younger demographic. These factors are key drivers behind the growth of the bitcoin ATM market. The increasing acceptance of cryptocurrencies among businesses, the widespread availability of high-speed internet, and the rise of startups engaging in cryptocurrency-related activities are driving the growth of the bitcoin ATM machine market. Bitcoin, a popular form of digital currency, is gaining traction due to its ability to provide users with greater control over their assets and income. Governments worldwide are also embracing cryptocurrencies by installing cryptocurrency ATMs in public spaces to facilitate transactions with digital currencies.

Get More Information on Bitcoin ATM Machine Market - Request Sample Report

The increasing digitization of the economy, especially in emerging markets, is a crucial factor driving the expansion of the bitcoin ATM machine market. These ATMs are rapidly being installed in various establishments like pubs, restaurants, convenience stores, and petrol stations. The global shift towards economic digitization has led to significant advancements across industries, resulting in the emergence of alternative payment systems. With the growing interest in cryptocurrencies worldwide, many sectors are integrating technology into their operations, fueling the demand for bitcoin ATMs. These ATMs facilitate fast transactions, enabling immediate spending of cash placed into the machine for purchases and allowing users to place sell orders without waiting days for funds. They offer convenient trading options, eliminating the need for long public keys or online accounts, and popular wallet apps can easily recognize QR codes for simplified transactions. These factors contribute to the evolution and revenue growth of the bitcoin ATM machine market.

Key Bitcoin ATM Machine Market Trends:

-

Rising global acceptance of cryptocurrencies driving wider Bitcoin ATM installations.

-

Government initiatives supporting cryptocurrency adoption through public ATM deployments.

-

Increasing role of startups and fintech firms in expanding crypto transaction infrastructure.

-

Integration of Bitcoin ATMs into mainstream financial systems for easier access.

-

Emerging markets presenting high growth potential due to surging crypto adoption.

Bitcoin ATM Machine Market Growth Drivers:

-

The Rise in cryptocurrency users and the growing appeal of digital currencies indicate a notable shift in investment patterns, primarily influenced by younger generations.

The growth of the bitcoin ATM machine market is propelled by the expanding acceptance of cryptocurrencies by businesses, the widespread accessibility of high-speed internet, and the emergence of startups involved in cryptocurrency-related ventures. Bitcoin, a widely adopted digital currency, is gaining momentum because it offers users enhanced control over their finances. Additionally, governments across the globe are endorsing cryptocurrencies by installing cryptocurrency ATMs in public locations to streamline transactions with digital currencies.

Bitcoin ATM Machine Market Restraints:

-

Security risks like hacking and fraud related to cryptocurrency transactions can deter consumers from using bitcoin ATMs.

Regulatory challenges due to uncertain and evolving cryptocurrency regulations may slow down the widespread adoption of bitcoin ATMs. Additionally, security risks like hacking and fraud in cryptocurrency transactions can discourage consumers from using these ATMs. Moreover, the lack of awareness and understanding about cryptocurrencies and how bitcoin ATMs work among the general public could limit the market's growth potential.

Bitcoin ATM Machine Market Opportunities:

-

As cryptocurrencies gain broader acceptance and integration into mainstream financial systems, there is a substantial opportunity for market expansion.

The bitcoin ATM machine market has ample opportunity for expansion as cryptocurrencies gain wider acceptance and are integrated into mainstream financial systems. Additionally, emerging markets with growing cryptocurrency adoption offer significant growth potential for installing more bitcoin ATMs.

Bitcoin ATM Machine Market Segment Analysis:

By Type

In the Bitcoin ATM Machine Market, segmentation is based on type, including One Way and Two Way machines. The One Way segment holds the market majority. One-way ATMs for cryptocurrencies primarily facilitate purchases and are gaining popularity due to their simplicity and security in money transfers. Similar to traditional ATMs, one-way bitcoin ATMs are user-friendly and require minimal operational knowledge.

By Offerings

The Bitcoin ATM Machine Market is segmented based on offerings, including Hardware (such as Display, ATM printer, Printer and Quick Response (QR) Scanner, and Others) and Software. The hardware category accounts for the highest revenue generation. Manufacturers of bitcoin ATMs require various hardware components like cash recyclers, cash boxes, cash dispensers, ATM stands, and door locks to assemble these machines. Moreover, the increasing installation of bitcoin ATMs, rising investor numbers, and growing consumer awareness of cryptocurrencies are driving the demand for bitcoin ATM manufacturing.

By Application

The Bitcoin ATM Machine Market is categorized by application into Commercial spaces, Restaurants, Transportation hubs, and Standalone units, with restaurants leading in revenue generation. Restaurants and bars are increasingly investing in bitcoin ATMs to host them and generate additional income. These ATMs increase foot traffic in public spaces like cafes, bars, and restaurants by enabling users to buy and sell cryptocurrencies, similar to traditional fiat ATMs.

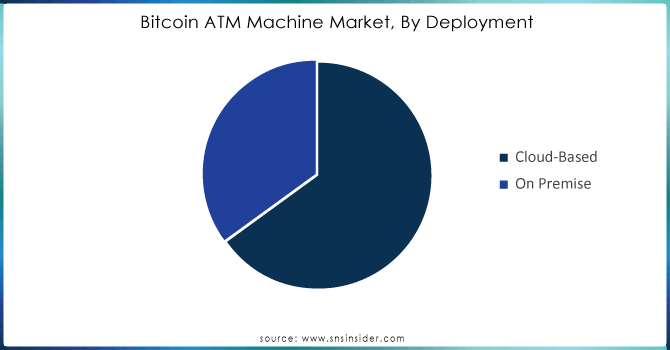

By Deployment

The Bitcoin ATM Machine Market is segmented into On-premise and Cloud-based deployment categories, with Cloud-based deployment leading in revenue. Cloud-based deployment offers advantages like real-time transaction processing, remote management, and updates. This technology enables operators to enhance security, scalability, and efficiency in monitoring and operating their Bitcoin ATMs.

Get Customized Report as per Your Business Requirement - Request For Customized Report

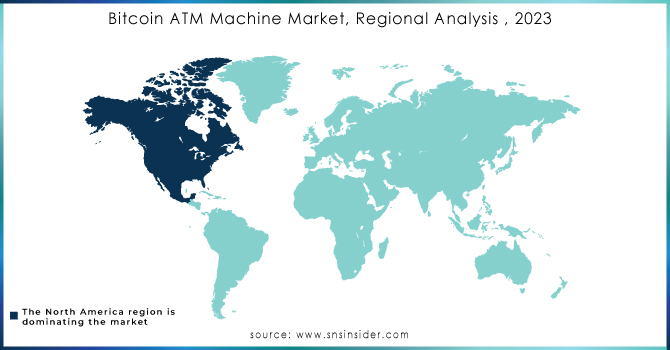

Bitcoin ATM Machine Market Regional Analysis:

North America Bitcoin ATM Machine Market Insights

The North America is expected to lead the market, primarily due to the significant presence of key players in the region, increased investment in the cryptocurrency market, advanced IT infrastructure, and widespread use of bitcoin ATMs across various industries.

Europe Bitcoin ATM Machine Market Insights

The Europe bitcoin ATM machine market holds the second-largest market share globally. Its growth is influenced by factors such as public awareness, legal regulations, and the adoption of cryptocurrencies. Countries like Austria, the United Kingdom, and Switzerland stand out for their higher number of Bitcoin ATMs compared to others. Moreover, within Europe, the German market leads in market share, while the UK market demonstrates the fastest growth among all European regions.

Asia Pacific Bitcoin ATM Machine Market Insights

The Asia-Pacific Bitcoin ATM Machine Market is anticipated to witness the fastest growth rate from 2024 to 2032, driven by the rapid digitization of the economy. Additionally, increasing consumer awareness of cryptocurrencies is expected to contribute to the region's swift growth throughout the projection period. Notably, China leads the market in terms of market share, while India demonstrates the fastest growth rate among all countries in the Asia-Pacific region.

Latin America (LATAM) and Middle East & Africa (MEA) Bitcoin ATM Machine Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) Bitcoin ATM machine market is growing steadily, driven by increasing cryptocurrency adoption, expanding fintech ecosystems, and rising interest in digital financial inclusion. In LATAM, economic volatility and high remittance flows accelerate crypto usage, while in MEA, growing youth populations and mobile banking adoption support demand. However, regulatory uncertainty and limited infrastructure remain challenges, influencing market expansion across both regions.

Bitcoin ATM Machine Companies are:

-

General Bytes

-

BitAccess

-

Coinsource

-

Lamassu

-

Covault

-

Bitcoin Depot

-

RockItCoin

-

CoinCloud

-

ByteFederal

-

LocalCoin

-

CoinFlip

-

Bitstop

-

Cryptospace

-

Shitcoins Club

-

Netcoins

-

Instacoin

-

BTCU.biz

-

CoinTime

Competitive Landscape for Bitcoin ATM Machine Market:

Kwik Trip is a leading convenience store and fuel retailer in the U.S., offering Bitcoin ATM services at select locations. The company integrates digital payment solutions to enhance customer accessibility to cryptocurrencies, supporting the growing adoption of digital assets while maintaining its focus on convenience retail and innovative financial services.

-

In 2022, Kwik Trip, operating as Kwik Star in Illinois and Iowa, revealed plans to install bitcoin ATMs at more than 800 sites across Iowa and the Midwest. The initiative is facilitated by the Coinsource bitcoin ATM network, headquartered in the United States.

A cryptocurrency ATM company specializes in providing automated teller machines that allow users to buy, sell, or exchange cryptocurrencies like Bitcoin, Ethereum, and others for cash or digital wallets. These companies develop, deploy, and maintain the ATMs, often offering secure, user-friendly interfaces and compliance with local financial regulations to facilitate seamless cryptocurrency transactions.

-

In 2022, the operator of Bitcoin Depot, a cryptocurrency ATM company, merged with GSR II Meteora Acquisition Corp. following its announcement to go public. This move is aimed at enabling the company to achieve rapid expansion.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 0.02 Billion |

| Market Size by 2032 | USD 0.69 Billion |

| CAGR | CAGR of 55.62% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Two Way & One Way) • By Offering (Hardware( Printer & Quick Response (QR) Scanner, Display, ATM Printer, & Others) • By Component ( Service & Solution) • By Application (Restaurant , Transportation Hubs, Commercial Spaces & Standalone Units) • By Deployment ( Cloud-Based & On Premise) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Genesis Coin, General Bytes, BitAccess, Coinsource, Lamassu, Covault, ChainBytes, Bitcoin Depot, RockItCoin, CoinCloud, ByteFederal, LocalCoin, CoinFlip, Bitstop, Cryptospace, Shitcoins Club, Netcoins, Instacoin, BTCU.biz, CoinTime. |