Get More Information on Biotech Ingredients Market - Request Sample Report

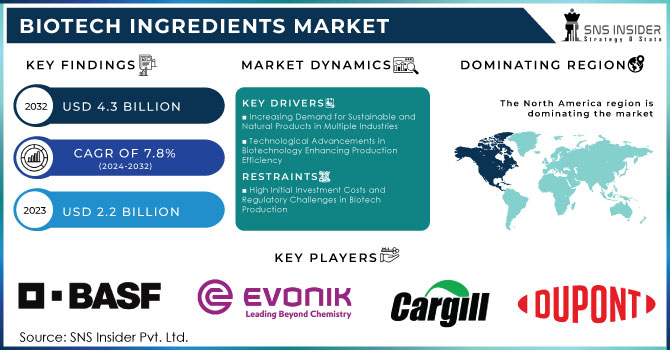

The Biotech Ingredients Market Size was valued at USD 2.2 billion in 2023 and is expected to reach USD 4.3 billion by 2032 and grow at a CAGR of 7.8% over the forecast period 2024-2032.

The biotech ingredients market is nearly entirely driven by the fast-paced adoption of biotechnological innovations in various industries, such as food and beverages, pharmaceuticals, and agriculture. With this dynamism in mind, this market finds an emerging appetite for the consumption of sustainable and eco-friendly products, thereby introducing innovative biotech solutions. The key drivers of this market involve regulatory aspects of the environment, the demand for natural ingredients by consumers, and advancements in fermentation and enzyme technology. Increasingly more people learn about their health benefits, like the probiotics and the plant-based proteins, and they're seeking healthy consumables that adhere to such lifestyles, thus driving up demand within the market.

Several companies have taken strategic moves in the past few months to enhance their strength in the biotech ingredients market. In September 2024, Zydus Lifesciences announced that it had acquired Sterling Biotech's active pharmaceutical ingredient business for INR 84 crore. The acquisition demonstrates the intent of Zydus Lifesciences to enhance its portfolio in the domain of bioactive ingredients, particularly within the pharmaceutical category. With Sterling Biotech's strengths and capabilities, Zydus would be focusing on strengthening its competitive advantage in the high-quality production of active pharmaceutical ingredients to best cope with the growing demand for medicines that come through biotechnology. In July 2023, one important deal was closed, as it was reported that Croda had acquired Solus Biotech. This development reflects the general trend in the biotech ingredients sector toward consolidation. The acquisition of Solus Biotech would help Croda to exploit the knowledge that the company has in the development of sustainable and innovative ingredients for the personal care market. It will enhance its product portfolios by adding components derived biotechnologically, thereby becoming responsive to the growing need for natural and effective solutions in the personal care market. The strategic acquisition will complement a broader market trend undergirding the sentiment of sustainability and a new direction in the application of renewable resources for cosmetic formulations. Debut and DIC Corporation announced a strategic partnership for the sustainable production of novel active ingredients designed for the beauty industry in March 2021. This partnership is a testament to the collaboration of biotech companies undertaking innovation and the development of high-performance ingredients to keep up with the needs of the demanding consumer. It reflects an important market dynamic in that consumers want to get something more than just effectiveness; they demand environmental friendliness as well. Combining resources and expertise, Debut and DIC Corporation hope to produce advanced ingredients that utilize biotechnological advances in setting a new benchmark for sustainability in beauty formulations.

Another notable trend is the increasing case of biotechnological applications in agriculture where companies are seeking bio-based alternatives that could replace synthetic chemicals used in agriculture. The drive here is predominantly regulatory and consumer demand because it increasingly becomes an avenue for safer and greener agricultural practices. Innovations in the development of bioinsecticides and biopesticides from this industry have witnessed an increase in crop production but at the same time reduced the adverse effects on the environment. As the biotech ingredient industry gains momentum, these ingredients provide immense support for overall growth and diversification, placing producers in a better position to respond to an increasingly dynamic agricultural environment.

The biotech ingredient market likely stands at the nexus of innovation because it responds to a confluence of consumer demand, regulatory change, and progress in biotechnology. It would be an unstoppable growth development for the landscape, as it continues to tap into strategic partnerships and acquisitions for developing capabilities. Biotechnological process integration into most sectors would lead to more sustainable and effective products by complying with consumer trends toward health and environmentally friendly options. Such heavy-market interplay of forces underlines the ongoing evolution within the biotech ingredients sector, which is setting up the stage for much more development soon.

Drivers:

Increasing Demand for Sustainable and Natural Products in Multiple Industries

The growing consumer awareness of environmental issues and health benefits associated with natural and sustainable products is significantly driving the biotech ingredients market. As consumers become more educated about the impacts of synthetic chemicals, they increasingly prefer products derived from biotechnology. This trend is evident across various sectors, including food and beverages, cosmetics, and pharmaceuticals, where natural ingredients are sought after for their perceived safety and efficacy. For instance, in the food industry, there is a rising demand for plant-based proteins and natural preservatives, which are often sourced from biotechnological processes. Similarly, in personal care, consumers are gravitating towards products containing biobased ingredients, driven by concerns over the long-term effects of synthetic chemicals on health and the environment. This shift is prompting manufacturers to invest in research and development to create innovative, eco-friendly products that meet consumer preferences.

• Technological Advancements in Biotechnology Enhancing Production Efficiency

Rapid advancements in biotechnology are significantly improving the production efficiency of various ingredients, propelling the market forward. Innovations in fermentation technologies, enzyme engineering, and metabolic pathways are enabling manufacturers to produce biotech ingredients more cost-effectively and at a larger scale. This has resulted in a broader range of applications for biotech products across multiple industries. For example, companies are increasingly leveraging synthetic biology to engineer microorganisms for the production of high-value ingredients. This approach not only enhances yield but also reduces resource consumption, such as water and energy, making the production process more sustainable. The implementation of cutting-edge bioprocessing techniques has also led to shorter production cycles and reduced time-to-market for new products.

Restraint:

• High Initial Investment Costs and Regulatory Challenges in Biotech Production

Despite the promising growth of the biotech ingredients market, high initial investment costs and regulatory challenges serve as significant restraints. Establishing biotechnological production facilities often requires substantial capital investment in advanced equipment, technology, and skilled personnel. This financial burden can deter smaller companies from entering the market or limit the capacity of existing firms to scale their operations effectively. Additionally, the regulatory landscape surrounding biotech ingredients is complex and varies across regions. Navigating through various approval processes, safety assessments, and compliance requirements can be both time-consuming and costly. Companies may face delays in bringing their products to market due to stringent regulations aimed at ensuring consumer safety and environmental protection. This can hinder innovation and slow the overall growth of the biotech ingredients sector.

Opportunity:

Growing Investment in Biotech Research and Development for Innovative Solutions

The increasing investment in biotech research and development presents a significant opportunity for market growth. Governments, private investors, and corporations are recognizing the potential of biotechnology to address global challenges such as food security, environmental sustainability, and health concerns. This influx of funding is driving innovation in the development of novel biotech ingredients and applications. As more resources are allocated to research initiatives, companies are better positioned to explore new biotechnological processes and develop advanced products. For instance, there is growing interest in bioplastics and biofuels, which aim to reduce reliance on fossil fuels and mitigate environmental impact. Research in these areas is leading to the creation of biodegradable materials and sustainable energy sources derived from renewable biomass. Furthermore, collaboration between academia and industry is fostering knowledge exchange and accelerating the commercialization of innovative biotech solutions. Partnerships between research institutions and biotech firms can streamline the development process, bringing new products to market more efficiently. This collaborative approach can also enhance the effectiveness of marketing strategies, helping to educate consumers about the benefits of biotech ingredients.

Challenge:

Intense Competition and Market Saturation Among Established Players

The biotech ingredients market faces significant challenges due to intense competition and potential market saturation. As the sector grows, numerous players, including startups and established companies, are vying for market share, leading to increased pressure on pricing and profit margins. This competitive landscape can make it challenging for new entrants to establish themselves, as they often struggle to differentiate their products and gain traction against well-established brands. Furthermore, as more companies enter the biotech ingredients space, the risk of market saturation rises, particularly in specific segments like enzymes or amino acids. This can lead to a commoditization of products, where price becomes the primary differentiator rather than quality or innovation. Companies may find themselves engaging in price wars, ultimately affecting their profitability and ability to invest in future growth initiatives. In addition to competition, the rapid pace of technological advancement can create challenges for businesses attempting to keep up. Companies must continuously innovate to stay relevant, requiring ongoing investment in research and development. Failure to adapt to changing market dynamics can result in a loss of competitive edge, as more agile competitors capitalize on emerging trends and consumer preferences.

By Source

In 2023, the microbial segment dominated the Biotech Ingredients Market, accounting for an estimated market share of approximately 45%. This dominance can be attributed to the increasing application of microbial fermentation processes in the production of a wide range of ingredients, including enzymes, probiotics, and bio-based chemicals. For example, companies like Novozymes and DuPont have leveraged microbial technologies to develop innovative enzymes used in various industries, such as food and beverages and detergents, enhancing product efficiency and sustainability. The microbial source is often preferred due to its ability to produce high-value ingredients in a cost-effective and environmentally friendly manner, further driving its market share. As consumer demand for sustainable and natural products continues to rise, the microbial segment is well-positioned for continued growth, supported by advancements in biotechnology and fermentation technologies.

By Type

In 2023, the enzymes segment dominated the Biotech Ingredients Market, with an estimated market share of around 35%. The widespread use of enzymes across various industries, including food and beverages, detergents, and pharmaceuticals, has significantly contributed to this segment's growth. Enzymes facilitate numerous biochemical reactions, improving efficiency and sustainability in manufacturing processes. For instance, companies like Novozymes and BASF have developed specialized enzymes for applications such as baking, where they enhance dough quality, and in detergents, where they boost cleaning performance at lower temperatures. The increasing consumer preference for eco-friendly products further drives the demand for enzyme-based solutions, positioning this segment as a leader in the biotech ingredients market. As industries continue to seek more sustainable production methods, the enzymes segment is expected to maintain its dominance and expand its market share.

By Application

In 2023, the food and beverages segment dominated the Biotech Ingredients Market, holding an estimated market share of approximately 40%. This significant share is primarily driven by the increasing consumer demand for natural and functional food products, as well as the growing trend of health and wellness. Biotech ingredients, such as enzymes and natural flavors, are extensively used in food production to enhance taste, texture, and shelf life while reducing the need for artificial additives. For example, companies like DuPont and Novozymes provide enzymes that improve the fermentation process in brewing and baking, leading to higher-quality products and improved efficiency. Additionally, the rising popularity of plant-based and functional foods has further propelled the adoption of biotech ingredients in this segment, solidifying its position as the leader in the market. As consumer preferences continue to shift towards healthier and more sustainable food options, the food and beverages segment is expected to sustain its dominance and experience continued growth.

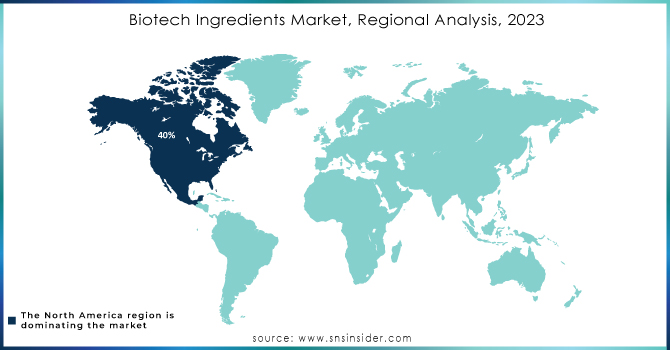

In 2023, North America dominated the Biotech Ingredients Market, holding an estimated market share of approximately 40%. This leadership can be attributed to the region's robust infrastructure for biotechnology research and development, along with the presence of major industry players and a supportive regulatory environment. The United States, in particular, has been at the forefront of biotech innovations, with companies such as DuPont and Novozymes leading the way in developing cutting-edge biotech ingredients for various applications, including food and beverages, pharmaceuticals, and personal care. Additionally, increasing consumer awareness regarding the benefits of sustainable and natural products has fueled demand for biotech ingredients in North America. The trend toward plant-based diets and functional foods has also contributed to the growth of this market, positioning North America as a key region for the continued expansion of biotech ingredients. As investment in research and development continues to rise, North America is expected to maintain its dominant position in the global biotech ingredients market.

Moreover, in 2023, the Asia-Pacific region emerged as the fastest-growing market for biotech ingredients, with an estimated compound annual growth rate (CAGR) of around 8%. This growth can be attributed to the increasing demand for natural and organic products, coupled with rising consumer awareness regarding health and sustainability. Countries like China and India are witnessing significant investments in biotechnology and biomanufacturing, leading to the development of innovative biotech ingredients for various applications, including food and beverages, agriculture, and personal care. For instance, major companies such as Cargill and BASF have expanded their operations in the Asia-Pacific region to meet the growing demand for enzymes and other biotech ingredients in food production and animal feed. Furthermore, supportive government initiatives aimed at promoting biotechnology are facilitating research and development activities, contributing to the region's rapid growth. As consumer preferences shift towards healthier and sustainable options, the Asia-Pacific region is poised for continued expansion in the biotech ingredients market.

Need any customization research on Biotech Ingredients Market - Enquiry Now

BASF SE (Lecithin, Enzymes)

Cargill, Incorporated (Soy Protein, Lactic Acid)

DuPont de Nemours, Inc. (Proteins, Enzymes)

Evonik Industries AG (Amino Acids, Biopolymers)

Genomatica, Inc. (Bio-BDO, Bio-1,4-Butanediol)

DSM (Dutch State Mines) (Amino Acids, Enzymes)

Novozymes A/S (Cellulases, Amylases)

Roche Holding AG (Biopharmaceuticals, Diagnostic Reagents)

SABIC (Saudi Basic Industries Corporation) (Biodegradable Polymers, Bio-based Chemicals)

Syngenta AG (Biofungicides, Bioinsecticides)

AB Biotek (Yeast Products, Nutritional Yeast)

Amyris, Inc. (Farnesene, Squalane)

Bayer AG (Bioinsecticides, Herbicides)

Danimer Scientific, Inc. (PHA Biopolymers, Nodax)

FMC Corporation (Biological Crop Protection, Bioinsecticides)

Kerry Group (Fermented Ingredients, Nutritional Products)

Metabolic Explorer (Lactic Acid, 1,3-Propanediol)

NatureWorks LLC (Ingeo Biopolymer, PLA)

Solvay SA (Biopolymer Solutions, Bio-based Surfactants)

Zymergen, Inc. (Microbial Products, Enzymes)

Ans: The Biotech Ingredients Market is expected to grow at a CAGR of 5.3%

Ans: The Biotech Ingredients Market Size was valued at USD 41.7 billion in 2023 and is expected to reach USD 66.1 billion by 2032.

Ans: Expansion of Product Lines in Functional Foods and Supplements is one of the opportunities in Biotech Ingredients Market.

Ans: Regulatory Hurdles and Quality Assurance in Product Development is one of the challenges faced by the Biotech Ingredients Market

Ans: The North American region dominated the Biotech Ingredients market holding the largest market share of about 40% during the forecast period.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Biotech Ingredients Market Segmentation, by Source

7.1 Chapter Overview

7.2 Microbial

7.2.1 Microbial Market Trends Analysis (2020-2032)

7.2.2 Microbial Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Plant-based

7.3.1 Plant-based Market Trends Analysis (2020-2032)

7.3.2 Plant-based Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Animal-based

7.4.1 Animal-based Market Trends Analysis (2020-2032)

7.4.2 Animal-based Market Size Estimates and Forecasts to 2032 (USD Million)

8. Biotech Ingredients Market Segmentation, by Type

8.1 Chapter Overview

8.2 Enzymes

8.2.1 Enzymes Market Trends Analysis (2020-2032)

8.2.2 Enzymes Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Amino Acids

8.3.1 Amino Acids Market Trends Analysis (2020-2032)

8.3.2 Amino Acids Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Organic Acids

8.4.1 Organic Acids Market Trends Analysis (2020-2032)

8.4.2 Organic Acids Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Biopolymers

8.5.1 Biopolymers Market Trends Analysis (2020-2032)

8.5.2 Biopolymers Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Biochemicals

8.6.1 Biochemicals Market Trends Analysis (2020-2032)

8.6.2 Biochemicals Market Size Estimates and Forecasts to 2032 (USD Million)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Biotech Ingredients Market Segmentation, by Application

9.1 Chapter Overview

9.2 Food and Beverages

9.2.1 Food and Beverages Market Trends Analysis (2020-2032)

9.2.2 Food and Beverages Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Animal Feed

9.3.1 Animal Feed Market Trends Analysis (2020-2032)

9.3.2 Animal Feed Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Pharmaceuticals

9.4.1 Pharmaceuticals Market Trends Analysis (2020-2032)

9.4.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Personal Care

9.5.1 Personal Care Market Trends Analysis (2020-2032)

9.5.2 Personal Care Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Agriculture

9.6.1 Agriculture Market Trends Analysis (2020-2032)

9.6.2 Agriculture Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Textiles

9.7.1 Textiles Market Trends Analysis (2020-2032)

9.7.2 Textiles Market Size Estimates and Forecasts to 2032 (USD Million)

9.8 Others

9.8.1 Others Market Trends Analysis (2020-2032)

9.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Biotech Ingredients Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.4 North America Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.5 North America Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.6.2 USA Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.6.3 USA Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.7.2 Canada Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.7.3 Canada Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.8.2 Mexico Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.8.3 Mexico Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Biotech Ingredients Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.6.2 Poland Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.6.3 Poland Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.7.2 Romania Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.7.3 Romania Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.8.2 Hungary Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.8.3 Hungary Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.9.2 Turkey Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.9.3 Turkey Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Biotech Ingredients Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.4 Western Europe Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.5 Western Europe Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.6.2 Germany Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.6.3 Germany Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.7.2 France Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.7.3 France Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.8.2 UK Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.8.3 UK Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.9.2 Italy Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.9.3 Italy Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.10.2 Spain Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.10.3 Spain Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.13.2 Austria Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.13.3 Austria Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Biotech Ingredients Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.4 Asia Pacific Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.5 Asia Pacific Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.6.2 China Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.6.3 China Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.7.2 India Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.7.3 India Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.8.2 Japan Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.8.3 Japan Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.9.2 South Korea Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.9.3 South Korea Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.10.2 Vietnam Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.10.3 Vietnam Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.11.2 Singapore Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.11.3 Singapore Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.12.2 Australia Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.12.3 Australia Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Biotech Ingredients Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.4 Middle East Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.5 Middle East Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.6.2 UAE Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.6.3 UAE Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.7.2 Egypt Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.7.3 Egypt Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.9.2 Qatar Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.9.3 Qatar Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Biotech Ingredients Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.4 Africa Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.5 Africa Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.6.2 South Africa Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.6.3 South Africa Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Biotech Ingredients Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.4 Latin America Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.5 Latin America Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.6.2 Brazil Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.6.3 Brazil Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.7.2 Argentina Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.7.3 Argentina Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.8.2 Colombia Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.8.3 Colombia Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Biotech Ingredients Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Biotech Ingredients Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Biotech Ingredients Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11. Company Profiles

11.1 BASF SE

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 DuPont de Nemours, Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Novozymes A/S

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 DSM (Dutch State Mines)

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 SABIC (Saudi Basic Industries Corporation)

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Evonik Industries AG

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Cargill, Incorporated

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Roche Holding AG

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Syngenta AG

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Genomatica, Inc.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Source

Microbial

Plant-based

Animal-based

By Type

Enzymes

Amino Acids

Organic Acids

Biopolymers

Biochemicals

Others

By Application

Food and Beverages

Animal Feed

Pharmaceuticals

Personal Care

Agriculture

Textiles

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Carbon Fiber Reinforced Plastics Market Size was USD 17.10 Billion in 2023 & will reach USD 32.80 Bn by 2032 & grow at a CAGR of 7.6% by 2024-2032.

The Natural Refrigerants Market size was USD 1.59 billion in 2023 and is expected to Reach USD 2.77billion by 2032 and grow at a CAGR of 6.34% over the forecast period of 2024-2032.

Mercury Analyzer Market Size was valued at USD 295.6 Million in 2023 and is expected to reach USD 520.2 Million by 2032, at a CAGR of 6.5% from 2024 to 2032.

The Water Treatment Polymers Market Size was USD 42.99 Billion in 2023 and will reach USD 76.09 Billion by 2032 and grow at a CAGR of 6.55% by 2024-2032.

Explore the Oleyl Alcohol Market, focusing on its use in cosmetics, personal care, and industrial applications. Learn about trends in sustainable sourcing, bio-based alcohols, and the growing demand for oleyl alcohol in emollients, surfactants, and lubric

The Cellulose Acetate Market size was valued at USD 5.7 Billion in 2023. It is expected to grow to USD 8.5 Billion by 2032 and grow at a CAGR of 4.5% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone