The Biosensors Market Size was valued at USD 27.84 Billion in 2023 and is expected to reach USD 56.54 Billion by 2032 and grow at a CAGR of 8.2% over the forecast period 2024-2032.

The Biosensors Market has experienced significant growth over the past few years and is expected to continue its expansion due to increasing advancements in healthcare, agriculture, food safety, and environmental monitoring. Biosensors are analytical devices that combine a biological component, such as enzymes, antibodies, or cells, with a physicochemical detector to measure a specific substance or process. These sensors have become indispensable in a variety of applications ranging from medical diagnostics to environmental monitoring and food quality testing.

Get more information on Biosensors Market - Request Sample Report

The increasing demand for point-of-care (POC) testing, as consumers and healthcare providers seek rapid, convenient diagnostic solutions outside of traditional laboratories. The rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer is further fueling this demand, as biosensors offer continuous monitoring and early detection, crucial for managing these health issues.

Additionally, the growing emphasis on personalized healthcare solutions is propelling the need for real-time, patient-specific data, which biosensors can deliver. The expansion of biosensor applications beyond healthcare, such as in agriculture, food safety, and environmental monitoring, is broadening the market's potential. These combined factors are contributing to the rapid growth and diversification of the U.S. biosensors market, positioning it as a dynamic and critical sector for future advancements in healthcare and other industries.

Key Drivers:

Rising Demand for Point-of-Care Diagnostics and Real-Time Monitoring Solutions Drives the Growth of the Biosensors Market

The increasing demand for point-of-care (POC) diagnostics is one of the major growth drivers of the biosensors market. With advancements in healthcare technologies, the need for quick, accurate, and accessible testing has grown significantly, especially for patients requiring continuous monitoring. Biosensors provide rapid results, enabling healthcare professionals to make timely decisions, which is crucial for patients with chronic conditions like diabetes, cardiovascular diseases, and infectious diseases.

This shift toward decentralized testing, where patients can test outside of medical facilities, empowers individuals with the ability to monitor their health regularly, improving long-term management and outcomes. Additionally, the rise in health-conscious individuals and the need for personalized healthcare solutions are further propelling the adoption of biosensors in various healthcare applications, such as early diagnosis, disease prevention, and management.

Technological Advancements in Biosensor Materials and Integration with Digital Health Platforms Drive Market Expansion

Technological innovations in biosensor materials and detection technologies are significantly advancing the biosensor market. These developments are making biosensors more efficient, cost-effective, and applicable across various industries. For instance, the integration of nanotechnology and the use of advanced sensor materials have enhanced the sensitivity, specificity, and portability of biosensors. These innovations enable biosensors to detect even the smallest biological changes, making them suitable for a wider range of applications, including medical diagnostics, environmental monitoring, and food safety.

Furthermore, the integration of biosensors with digital health platforms, such as mobile apps and cloud-based systems, has made real-time data collection and analysis more accessible to both consumers and healthcare providers. Wearable biosensors are now able to communicate with smartphones and other devices, enabling users to track their health data seamlessly. This connectivity facilitates personalized healthcare, as data from biosensors can be used for continuous monitoring, remote consultations, and even predictive health analytics.

Restrain:

High Manufacturing Costs and Complex Regulatory Approvals Pose Challenges for Biosensors Market Growth

Despite the promising growth prospects of the biosensors market, one of the major challenges hindering its expansion is the high manufacturing costs associated with biosensor production. Developing advanced biosensors often involves complex materials and technologies, such as nanotechnology, which can significantly increase production expenses. These high costs are particularly challenging for small and medium-sized companies that may lack the resources to scale up production.

Another significant barrier to market growth is the complex regulatory approval process for biosensor devices, especially in highly regulated industries like healthcare and food safety. Biosensors, particularly medical devices, must undergo stringent testing and approval procedures set by regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The lengthy and costly approval process can delay the time-to-market for new biosensor technologies, reducing the pace at which innovations reach consumers.

By Product

In 2023, the Non-Wearable Biosensors segment accounted for the largest market share, with a revenue share of 64.00%. This dominance is largely due to the extensive application of non-wearable biosensors in medical diagnostics, environmental monitoring, and food safety. Non-wearable biosensors, such as glucose meters, pregnancy tests, and diagnostic test kits, have become integral in healthcare due to their high accuracy and ease of use.

For example, companies like Abbott Laboratories have launched advanced glucose monitoring systems, such as the Freestyle Libre, which offers accurate blood glucose measurement without the need for multiple daily finger pricks.

The Wearable Biosensors segment is experiencing the largest CAGR of 8.89% within the forecasted period, reflecting growing consumer and healthcare interest in continuous, real-time health monitoring solutions. Wearable biosensors, which include devices like smartwatches, fitness trackers, and medical monitoring devices, are revolutionizing personal healthcare by enabling individuals to track vital health metrics such as heart rate, blood oxygen levels, and glucose levels.

By Application

In 2023, the Medical Testing Application segment dominated the biosensors market with a substantial revenue share of 42.00%. This dominance is driven by the increasing need for rapid, accurate, and cost-effective diagnostic solutions in healthcare. Biosensors play a critical role in monitoring disease biomarkers, managing chronic conditions like diabetes, and enabling early detection of various health issues.

For instance, Abbott Laboratories launched the Freestyle Libre 3, a continuous glucose monitoring (CGM) system, which provides real-time glucose data without the need for finger pricks, revolutionizing diabetes management.

The Agricultural Testing Application segment is witnessing the largest compound annual growth rate (CAGR) of 10.75% within the forecasted period. This growth is attributed to the rising need for sustainable farming practices, enhanced crop yields, and efficient resource utilization in agriculture. Biosensors in agriculture are increasingly used for detecting soil conditions, monitoring crop health, and ensuring food safety by detecting pathogens or contaminants.

For example, companies like Agilent Technologies have developed biosensor technologies used to measure various environmental parameters and soil quality, enabling farmers to make data-driven decisions to optimize agricultural output.

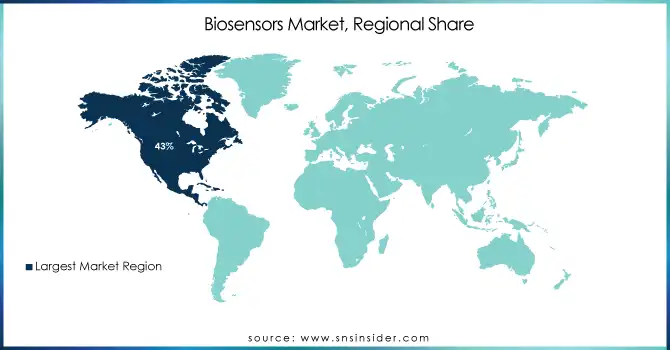

In 2023, North America dominated the biosensors market, holding a significant share of approximately 43%. This dominance is attributed to the region’s advanced healthcare infrastructure, technological innovations, and strong demand for diagnostic solutions. The United States, in particular, plays a key role, with its well-established medical device industry and growing adoption of biosensor technologies for both medical and non-medical applications.

Additionally, North America benefits from substantial investments in research and development (R&D) in biosensor technologies, as well as government support through initiatives like the U.S. Food and Drug Administration (FDA) approvals, which streamline the introduction of new biosensor products into the market.

In 2023, the Middle East & Africa (MEA) region emerged as the fastest-growing region in the biosensors market, with an estimated CAGR of 10.34%. This rapid growth can be attributed to several factors, including an increasing emphasis on healthcare improvements, rising chronic disease incidences, and growing government investments in healthcare infrastructure.

For instance, the Saudi government has been investing in health tech to modernize the healthcare infrastructure, and initiatives such as "Vision 2030" are prioritizing technological integration into healthcare systems.

Get Customized Report as per your Business Requirement - Request For Customized Report

Some of the major players in the Biosensors Market are:

Bio-Rad Laboratories Inc. (Droplet Digital PCR System, Bio-Plex Multiplex Immunoassays)

Medtronic (Guardian Connect Continuous Glucose Monitoring System, Enlite Sensor)

Miltenyi Biotec (MACSQuant Analyzer, CliniMACS Prodigy)

Intricon Corporation (Micro-Medical Sensors, Integrated BioMonitors)

Abbott Laboratories (FreeStyle Libre, i-STAT System)

Biosensors International Group, Ltd. (BioMatrix Alpha, BioMatrix NeoFlex)

Pinnacle Technologies Inc (FlexiForce Sensors, Capacitive Pressure Sensors)

Ercon, Inc. (Conductive Inks, Thick Film Biosensor Materials)

DuPont Biosensor Materials (Kapton Polyimide Films, Intexar Smart Sensors)

Johnson & Johnson (OneTouch Verio Reflect, Thermocare Smart Temperature Sensor)

Koninklijke Philips N.V. (IntelliVue Guardian Solution, Lumify Handheld Ultrasound)

LifeScan, Inc. (OneTouch Ultra, OneTouch Verio IQ)

QTL Biodetection LLC (Rapid Pathogen Detection Kits, Handheld Bio-Sensors)

Molecular Devices Corp. (SpectraMax iD3 Microplate Reader, FLIPR Penta High-Throughput Cellular Screening System)

Nova Biomedical (StatStrip Glucose Meter, Lactate Plus Analyzer)

Molex LLC (Temp-Flex Micro-Coaxial Cables, Premo-Flex Cable Jumpers)

TDK Corp. (Micronas Hall Sensors, TMR Angle Sensors)

Zimmer & Peacock AS (Screen-Printed Electrodes, Glucose Sensors)

Siemens Healthcare (ADVIA Centaur XP Immunoassay System, RAPIDPoint 500e Blood Gas System)

In February 2023, Miltenyi Biotec acquired Lino Biotech AG, a leader in the development of innovative biosensors aimed at enhancing quality control in bioprocessing, measuring viral load in cell and gene therapy production, and testing for off-target responses in living cells to aid drug discovery.

In January 2023, Intricon Corporation, known for its development and manufacturing of medical devices powered by advanced miniaturized electronics, launched a new Biosensors Center of Excellence (CoE). This center is dedicated to advancing the integration of biosensor devices into the medical industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 27.84 Billion |

| Market Size by 2032 | USD 56.54 Billion |

| CAGR | CAGR of 8.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Wearable Biosensors, Non-Wearable Biosensors) • By Type (Sensor Patch, Embedded Device) • By Technology (Piezoelectric Biosensors, Thermal Biosensors, Electrochemical Biosensors, Optical Biosensors, Nanomechanical Biosensors) • By Application (Medical Testing, Industrial Process, Agricultural Testing, Home Diagnostics, Research Labs, Environmental Monitoring, Food & Beverages, Biodefense) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bio-Rad Laboratories Inc., Medtronic, Abbott Laboratories, Biosensors International Group, Ltd., Pinnacle Technologies Inc., Ercon, Inc., DuPont Biosensor Materials, Johnson & Johnson, Koninklijke Philips N.V., LifeScan, Inc., QTL Biodetection LLC, Molecular Devices Corp., Nova Biomedical, Molex LLC, TDK Corp., Zimmer & Peacock AS, Siemens Healthcare. |

| Key Drivers | • Rising Demand for Point-of-Care Diagnostics and Real-Time Monitoring Solutions Drives the Growth of the Biosensors Market. • Technological Advancements in Biosensor Materials and Integration with Digital Health Platforms Drive Market Expansion. |

| Restraints | • High Manufacturing Costs and Complex Regulatory Approvals Pose Challenges for Biosensors Market Growth. |

Ans: The Biosensors Market is expected to grow at a CAGR of 8.2% during 2024-2032.

Ans: The Biosensors Market size was USD 27.84 billion in 2023 and is expected to Reach USD 56.54 billion by 2032.

Ans: The major growth factor of the Biosensors Market is the increasing demand for point-of-care diagnostics and personalized healthcare solutions.

Ans: Non-Wearable Biosensors dominated the Biosensors Market.

Ans: North America dominated the Biosensors Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Wafer Production Volumes, by Region (2023)

5.2 Chip Design Trends (Historic and Future)

5.3 Fab Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Biosensors Market Segmentation, By Product

7.1 Chapter Overview

7.2 Wearable Biosensors

7.2.1 Wearable Biosensors Market Trends Analysis (2020-2032)

7.2.2 Wearable Biosensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Non-Wearable Biosensors

7.3.1 Non-Wearable Biosensors Market Trends Analysis (2020-2032)

7.3.2 Non-Wearable Biosensors Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Biosensors Market Segmentation, By Type

8.1 Chapter Overview

8.2 Sensor Patch

8.2.1 Sensor Patch Market Trends Analysis (2020-2032)

8.2.2 Sensor Patch Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Embedded Device

8.3.1 Embedded Device Market Trends Analysis (2020-2032)

8.3.2 Embedded Device Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Biosensors Market Segmentation, By Technology

9.1 Chapter Overview

9.2 Piezoelectric Biosensors

9.2.1 Piezoelectric Biosensors Market Trends Analysis (2020-2032)

9.2.2 Piezoelectric Biosensors Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Thermal Biosensors

9.3.1 Thermal Biosensors Market Trends Analysis (2020-2032)

9.3.2 Thermal Biosensors Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Electrochemical Biosensors

9.4.1 Electrochemical Biosensors Market Trends Analysis (2020-2032)

9.4.2 Electrochemical Biosensors Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Optical Biosensors

9.5.1 Optical Biosensors Market Trends Analysis (2020-2032)

9.5.2 Optical Biosensors Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Nanomechanical Biosensors

9.6.1 Nanomechanical Biosensors Market Trends Analysis (2020-2032)

9.6.2 Nanomechanical Biosensors Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Biosensors Market Segmentation, By Application

10.1 Chapter Overview

10.2 Medical Testing

10.2.1 Medical Testing Market Trends Analysis (2020-2032)

10.2.2 Medical Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Industrial Process

10.3.1 Industrial Process Market Trends Analysis (2020-2032)

10.3.2 Industrial Process Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Agricultural Testing

10.4.1 Agricultural Testing Market Trends Analysis (2020-2032)

10.4.2 Agricultural Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Home Diagnostics

10.5.1 Home Diagnostics Market Trends Analysis (2020-2032)

10.5.2 Home Diagnostics Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Research Labs

10.6.1 Research Labs Market Trends Analysis (2020-2032)

10.6.2 Research Labs Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 Environmental Monitoring

10.7.1 Environmental Monitoring Market Trends Analysis (2020-2032)

10.7.2 Environmental Monitoring Market Size Estimates and Forecasts to 2032 (USD Billion)

10.8 Food & Beverages

10.8.1 Food & Beverages Market Trends Analysis (2020-2032)

10.8.2 Food & Beverages Market Size Estimates and Forecasts to 2032 (USD Billion)

10.9 Biodefense

10.9.1 Biodefense Market Trends Analysis (2020-2032)

10.9.2 Biodefense Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Biosensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.2.4 North America Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.5 North America Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.6 North America Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.2.7.2 USA Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.7.3 USA Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.7.4 USA Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.2.8.2 Canada Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.8.3 Canada Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.8.4 Canada Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.2.9.2 Mexico Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.9.3 Mexico Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.9.4 Mexico Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Biosensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.7.2 Poland Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.7.3 Poland Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.7.4 Poland Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.8.2 Romania Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.8.3 Romania Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.8.4 Romania Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Biosensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.4 Western Europe Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.5 Western Europe Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.6 Western Europe Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.7.2 Germany Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.7.3 Germany Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.7.4 Germany Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.8.2 France Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.8.3 France Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.8.4 France Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.9.2 UK Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.9.3 UK Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.9.4 UK Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.10.2 Italy Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.10.3 Italy Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.10.4 Italy Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.11.2 Spain Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.11.3 Spain Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.11.4 Spain Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.14.2 Austria Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.14.3 Austria Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.14.4 Austria Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Biosensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.4 Asia Pacific Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.5 Asia Pacific Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.6 Asia Pacific Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.7.2 China Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.7.3 China Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.7.4 China Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.8.2 India Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.8.3 India Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.8.4 India Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.9.2 Japan Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.9.3 Japan Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.9.4 Japan Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.10.2 South Korea Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.10.3 South Korea Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.10.4 South Korea Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.11.2 Vietnam Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.11.3 Vietnam Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.11.4 Vietnam Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.12.2 Singapore Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.12.3 Singapore Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.12.4 Singapore Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.13.2 Australia Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.13.3 Australia Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.13.4 Australia Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Biosensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.4 Middle East Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.5 Middle East Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.6 Middle East Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.7.2 UAE Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.7.3 UAE Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.7.4 UAE Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Biosensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.2.4 Africa Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.5 Africa Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.6 Africa Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Biosensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.4 Latin America Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.5 Latin America Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.6 Latin America Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.7.2 Brazil Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.7.3 Brazil Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.7.4 Brazil Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.8.2 Argentina Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.8.3 Argentina Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.8.4 Argentina Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.9.2 Colombia Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.9.3 Colombia Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.9.4 Colombia Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Biosensors Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Biosensors Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Biosensors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Biosensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12. Company Profiles

12.1 Bio-Rad Laboratories Inc.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Medtronic

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Miltenyi Biotec

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Intricon Corporation

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Abbott Laboratories

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Biosensors International Group, Ltd.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Pinnacle Technologies Inc.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Ercon, Inc.

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 DuPont Biosensor Materials

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Johnson & Johnson

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Wearable Biosensors

Non-Wearable Biosensors

By Type

Sensor Patch

Embedded Device

By Technology

Piezoelectric Biosensors

Thermal Biosensors

Electrochemical Biosensors

Optical Biosensors

Nanomechanical Biosensors

By Application

Medical Testing

Industrial Process

Agricultural Testing

Home Diagnostics

Research Labs

Environmental Monitoring

Food & Beverages

Biodefense

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest Of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Drone Sensor Market Size was valued at USD 1.26 Billion in 2023 and is expected to grow at a CAGR of 11.12% to reach USD 3.25 Billion by 2032.

The AR and VR in Education Market size was valued at USD 3.80 billion in 2023 and is expected to grow to USD 28.36 billion by 2032 and grow at a CAGR of 25.07 % over the forecast period of 2024-2032.

The Speed Sensor Market Size was valued at USD 8.68 Billion in 2023 and is expected to grow at a CAGR of 4.35% to reach USD 12.73 Billion by 2032.

The Door and Window Automation Market was valued at USD 18.26 billion in 2023 and is projected to reach USD 30.07 billion by 2032, growing at a CAGR of 5.70% from 2024 to 2032.

The Man-Portable Communication Systems Market Size was USD 3.47 Billion in 2023 and will reach USD 5.11 Bn by 2032 and grow at a CAGR of 4.4% by 2024-2032.

The Electronic Nose (E-Nose) Market Size was valued at USD 25.64 Billion in 2023 and is expected to reach USD 70.49 Billion at 11.93% CAGR, From 2024-2032

Hi! Click one of our member below to chat on Phone