Bioprocess Validation Market Report Scope & Overview:

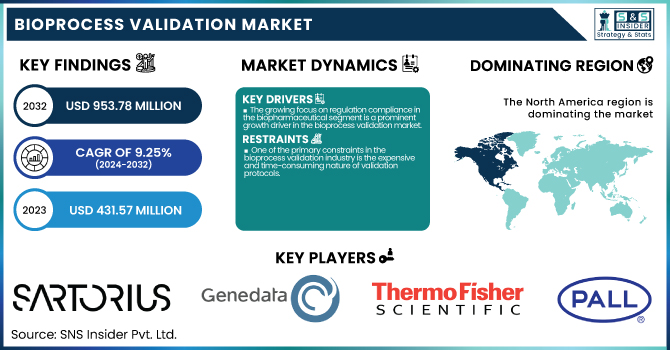

The Bioprocess Validation Market was valued at USD 431.57 million in 2023 and is expected to reach USD 953.78 million by 2032, growing at a CAGR of 9.25% from 2024 to 2032.

To Get more information on Bioprocess Validation Market - Request Free Sample Report

The Bioprocess Validation Market report provides detailed information on major validation trends, such as the number of bioprocess validation studies performed in various regions in 2023, with a focus on geographic differences in regulatory compliance and industry practices. It also analyzes adoption trends of bioprocess validation services, including a regional split of how pharmaceuticals, biotechnology, CMOs, and CROs incorporate validation into their processes. Furthermore, the report examines validation testing volume between, providing a long-term view of market growth. It provides bioprocess validation expenditure patterns, classifying investments by industry players to reflect financial trends influencing the industry.

Bioprocess Validation Market Dynamics

Drivers

-

The growing focus on regulation compliance in the biopharmaceutical segment is a prominent growth driver in the bioprocess validation market.

Regulators like the FDA, EMA, and WHO require stringent validation protocols to verify the safety, efficacy, and consistency of biopharmaceutical products. Vast amounts of extractables and leachables testing, viral clearance studies, and filtration efficiency validation have to be conducted by firms to comply with Good Manufacturing Practices (GMP) regulations. In recent years, the FDA has increased the monitoring of process validation procedures, contributing to increased expenditure on bioprocess validation service and technology. The growth in biosimilars and the production of cell and gene therapy have also propelled the demand for validation services further. Recent progress has seen new advanced single-use systems and automated validation solutions unveiled, enhancing efficiency while maintaining compliance with regulations.

-

The trend toward single-use bioprocessing technologies in the manufacturing of biologics is considerably fueling the bioprocess validation market.

Single-use technologies have advantages such as fewer contamination risks, cost-effectiveness, and greater flexibility in biopharmaceutical production. Yet their implementation requires thorough leachables and extractables testing, filter integrity validation, and sterility assurance, raising demand for validation services. According to market reports, more than 85% of biomanufacturers today use single-use technologies in some form, reflecting their increased role within contemporary production suites. Furthermore, Sartorius, Pall Corporation, and Thermo Fisher Scientific, among others, continue to introduce optimized disposable bioreactor systems with enhanced scalability. The increasing use of continuous bioprocessing and hybrid systems has also driven faster validation needs as companies strive to validate process robustness and product quality.

Restraint

-

One of the primary constraints in the bioprocess validation industry is the expensive and time-consuming nature of validation protocols.

The stringent regulatory environment requires rigorous testing, documentation, and process qualification, resulting in high operational costs for biopharmaceutical companies. Extractables and leachables studies, viral clearance testing, and process qualification require specialized tools, experienced experts, and lengthy testing periods, making it an expensive endeavor. Moreover, small and mid-size biotech companies have difficulty with the cost of validation, thus constraining their involvement in the market. Current trends in the industry show that comprehensive validation activities take months to years, hence protracting product commercialization. Increased complexity in biologics, cell and gene therapies, and personalized medicines further stretch the cost and time factors, presenting a major challenge to market expansion in the face of escalating demand for biopharmaceuticals.

Opportunities

-

The growth in the adoption of single-use technologies (SUTs) in bioprocessing is a major opportunity for the bioprocess validation market.

With the transition of biopharmaceutical companies from stainless-steel equipment to disposable bioreactors, filtration units, and chromatography systems, the demand for extensive validation to verify product safety and regulatory compliance is on the rise. Single-use systems minimize the chance of cross-contamination but are subject to rigorous extractables and leachables testing, sterility validation, and performance qualification before deployment. Industry developments of late indicate that regulatory bodies like the FDA and EMA are taking closer looks at SUT components, adding further impetus to the need for validation services. In addition, the scalability and adaptability of single-use systems have promoted their implementation in emerging biologics production at an increased pace, requiring validation to become a critical process to guarantee the integrity and reproducibility of bioprocess operations.

Challenges

-

The complexity and variability across regions of regulatory compliance are one of the primary challenges in the bioprocess validation market.

Regulatory bodies like the FDA, EMA, and PMDA (Japan) have rigorous but different specifications for biopharmaceutical validation, posing challenges for multi-region operating companies. The absence of harmonized global specifications compels manufacturers to have multiple validation studies for various markets, adding costs and schedule time. More importantly, changing guidelines related to biosimilars, personalized medicines, and advanced therapies necessitate periodic process updates and revalidation, making compliance more challenging. Firms need to spend on regulatory intelligence and competency to handle these complexities, but the quick advances in bioprocessing make it challenging to keep pace with the newest demands. This fragmentation in regulations leads to operational inefficiencies and decelerates the commercialization of novel biologic medicines.

Bioprocess Validation Market Segmentation Analysis

By Testing Type

The Bioprocess residual testing accounted for the largest share of the bioprocess validation market in 2023 because of its imperative function of eliminating process-related impurities, including host cell proteins, residual DNA, endotoxins, and antibiotic residues, from biopharmaceutical products. Stringent regulations from governing agencies like the FDA and EMA are placed on residual testing to ensure biologics' safety, efficacy, and purity. Increased production of monoclonal antibodies (mAbs), cell and gene therapies, and biosimilars has increased the need for deep validation of residual impurities. The increasing use of high-throughput analytical methods and automation in bioprocessing protocols has further enhanced the dominance of the segment, making it possible to validate residual impurities in biopharmaceutical production at a quicker and more efficient pace.

The Extractables & Leachables (E&L) Testing segment is anticipated to record the fastest growth over the forecast period as single-use bioprocessing systems, disposable bioreactors, and flexible plastic-based parts gain more widespread adoption in biopharmaceutical production. With the increased move toward continuous bioprocessing and modularized facilities, more focus is given to the concern about the leaching of toxic chemicals from tubing, filters, bags, and container closures into biologics. Regulatory agencies, like the USP, EMA, and ICH, have strengthened regulations of E&L testing, boosting market demand. Growing concern regarding patient safety hazards, along with improvements in mass spectrometry, chromatography, and risk-based assessment methodologies, has led to the increasing use of E&L testing, which has become one of the fastest-growing segments in bioprocess validation.

By Stage

The Continued Process Verification (CPV) segment dominated the bioprocess validation market with a 42.55% market share in 2023 as a result of growing regulatory focus on regular monitoring and control of biopharmaceutical production processes. The FDA, EMA, and ICH regulatory bodies have enforced their guidelines rigorously, rendering CPV a prerequisite to achieve consistent product quality, efficacy, and safety over the entire lifecycle of manufacturing. In contrast to conventional validation methods, CPV incorporates real-time data analysis, statistical process control, and predictive analytics, which allow manufacturers to identify deviations in advance and improve production efficiency.

The emergence of advanced bioprocessing technologies, including continuous manufacturing, automation, and real-time monitoring systems, has further accelerated the demand for CPV to ensure strict quality standards. The increased usage of biologics, biosimilars, and personalized medicine has made process consistency even more important, fueling the need for strong validation frameworks. Digital transformation in biopharma, such as artificial intelligence (AI), machine learning (ML), and big data analytics, has improved CPV implementation, enabling proactive quality control and minimizing batch failure. With the movement of companies towards data-driven process validation, CPV is likely to become an integral part of bioprocess validation, resulting in its swift market growth.

By Mode

The In-house segment dominated the bioprocess validation market with a 68.42% market share in 2023 because more biopharmaceutical firms have been emphasizing having strict regulatory compliance, data protection, and process control within their facilities. The reason is that firms want in-house validation since it provides more control and personalization of bioprocess workflows so that proprietary biologics and biosimilars of their companies will have the best quality. Moreover, major pharma and biotech companies have invested heavily in advanced manufacturing and quality control facilities, which allow them to validate bioprocesses in-house. The increased use of single-use bioprocessing systems and automation has also driven this trend by making validation processes easier and less dependent on third-party service providers.

The Outsourced segment is expected to register the fastest growth in the forecast years with 10.2% CAGR because of the growing use of Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) for bioprocess validation services. Small- and mid-sized biotech companies and emerging biopharma companies lack the infrastructure, expertise, and funds to carry out validation in-house and therefore tend to outsource, which proves cost-effective and effective. In addition, regulatory bodies across the globe have increased compliance demands, prompting firms to look for specialized third-party validation providers with established expertise and global regulatory acumen. The increasing demand for biologics, biosimilars, and cell and gene therapies, along with the increasing complexity of bioprocess validation, further justify the swift growth of outsourcing services in this market.

Bioprocess Validation Market Regional Analysis

North America dominated the bioprocess validation market with a 40.10% market share in 2023 as a result of its established biopharmaceutical sector, robust regulatory environment, and heavy R&D expenditure. The dominance of top biopharmaceutical organizations such as Pfizer, Amgen, and Bristol-Myers Squibb has fueled demand for strict validation processes to ensure compliance with FDA regulations. Furthermore, the region has a superior rate of single-use technology, advanced biologics, and gene therapies that necessitate strong process validation. The growth of CDMOs (Contract Development and Manufacturing Organizations) and rising biopharmaceutical outsourcing further solidify North America's dominance in this market. Additionally, recent advances in high-throughput process validation, automation, and data-driven validation models have improved the efficiency and reliability of validation processes, adding to North America's leading position.

Asia Pacific is the fastest growing region in the bioprocess validation market with 10.22% CAGR throughout the forecast period because of the high growth of the biopharmaceutical industry, increasing investments in the production of biosimilars, and government support for biologics manufacturing. China, India, and South Korea are emerging as biologics and vaccine manufacturing hubs globally, spurred by cost benefits and the availability of skilled labor. Regulatory bodies such as China's NMPA (National Medical Products Administration) and India's CDSCO (Central Drugs Standard Control Organization) are harmonizing with global validation standards, driving market expansion. Furthermore, growing collaborations among international pharma companies and local CDMOs, along with the growing use of single-use bioprocessing systems, are driving demand for bioprocess validation services. As biopharmaceutical industries develop their presence within emerging Asian economies, the region finds itself continuously growing in validation needs.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players in Bioprocess Validation Market

-

Sartorius AG (Automated Cell Banking System, Single-Use Bioreactors)

-

Genedata (Genedata Screener, Genedata Biologics)

-

Thermo Fisher Scientific (Lab Products, Clinical Trial Services)

-

Pall Corporation (Allegro Single-Use Systems, Pegasus Prime Virus Removal Filters)

-

Merck KGaA (Mobius Single-Use Systems, Pellicon Tangential Flow Filtration Devices

-

GE Healthcare Life Sciences (ÄKTA Chromatography Systems, ReadyToProcess Single-Use Bioreactors)

-

Danaher Corporation (Bioprocessing Solutions, Analytical Instruments)

-

Lonza Group (MODA-EM Environmental Monitoring, Nucleofector Technology)

-

Charles River Laboratories (Endosafe Endotoxin Testing, Accugenix Microbial Identification)

-

WuXi AppTec (Biologics Testing Solutions, Cell Line Development Services)

-

Eurofins Scientific (Viral Clearance Studies, Analytical Testing Services)

-

SGS Life Sciences (Extractables and Leachables Testing, Bioanalytical Services)

-

Tosoh Bioscience (TSKgel Chromatography Columns, TOYOPEARL Resins)

-

Agilent Technologies (1260 Infinity II LC System, Seahorse XF Analyzers)

-

Bio-Rad Laboratories (NGC Chromatography Systems, Bio-Plex Multiplex Immunoassay Systems)

-

PerkinElmer (LabChip GXII Touch Protein Characterization System, NexION ICP-MS)

-

Repligen Corporation (XCell ATF Systems, OPUS Pre-packed Chromatography Columns)

-

Eppendorf AG (BioFlo Fermentors and Bioreactors, epMotion Automated Pipetting Systems)

-

MilliporeSigma (Steritest Symbio Pumps, Clarigard Capsule Filters)

-

3M Company (Emphaze AEX Hybrid Purifier, Zeta Plus Depth Filtration Media)

Suppliers (these suppliers provide bioprocess validation products and services, including single-use bioreactors, chromatography systems, filtration and purification solutions, endotoxin testing, viral clearance studies, analytical testing, and microbial identification solutions) in the Bioprocess Validation Market

-

Sartorius AG

-

Thermo Fisher Scientific

-

Pall Corporation

-

Merck KGaA

-

GE Healthcare Life Sciences (Cytiva)

-

Danaher Corporation

-

Lonza Group

-

Charles River Laboratories

-

WuXi AppTec

-

Eurofins Scientific

Recent Developments in the Bioprocess Validation Market

-

November 2024 – Sartorius Stedim Biotech, a leading biopharmaceutical industry partner, has opened its new Center for Bioprocess Innovation in Marlborough, Massachusetts. This state-of-the-art facility is intended to promote collaboration, co-development, and experiential learning with customers and external innovation partners, bringing Sartorius's most advanced technologies into actual bioprocess workflows.

-

August 2024 – Genedata, a global leader in enterprise solutions for biopharmaceutical R&D, has announced a new release of Genedata Selector. This sophisticated platform assists agriculture biotechnology organizations with creating innovative seeds, expediting the market introduction of even more sustainable crops.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 431.57 million |

| Market Size by 2032 | US$ 953.78 million |

| CAGR | CAGR of 9.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Testing Type (Extractables & Leachables Testing, Bioprocess Residuals Testing, Viral Clearance Testing, Filtration & Fermentation Systems Testing, Others) • By Stage (Process Design, Process Qualification, Continued Process Verification) • By Mode (In-house, Outsourced) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sartorius AG, Genedata, Thermo Fisher Scientific, Pall Corporation, Merck KGaA, GE Healthcare Life Sciences, Danaher Corporation, Lonza Group, Charles River Laboratories, WuXi AppTec, Eurofins Scientific, SGS Life Sciences, Tosoh Bioscience, Agilent Technologies, Bio-Rad Laboratories, PerkinElmer, Repligen Corporation, Eppendorf AG, MilliporeSigma, 3M Company, and other players. |