Bioprocess Bags Market Size Analysis:

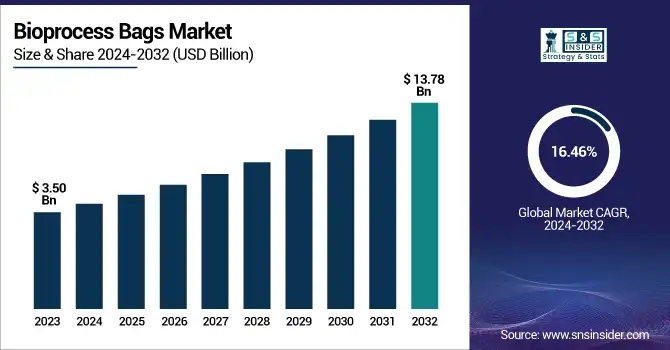

The Bioprocess Bags Market size was valued at USD 3.50 billion in 2023 and is expected to reach USD 13.78 billion by 2032, growing at a CAGR of 16.46% over the forecast period of 2024-2032. The efficiency, lower risk of contamination, and operational flexibility of single-use technologies are propelling their increasing usage rate throughout the world, says this report. The report analyzes regional and end-user biotech R&D spending patterns as well as commercial, academic, and government end-use categories, which directly affect the demand for scalable bioprocessing solutions. The growth of facility expansion and the construction of new biomanufacturing facilities, especially in new geographies, to enhance domestic manufacturing capacity, are also addressed. It also analyzes the demand split between custom and off-the-shelf bioprocess bags, considering changing manufacturer trends based on various process requirements and scalability of production.

To Get more information on Bioprocess Bags Market - Request Free Sample Report

The US Bioprocess Bags Market is expected to grow at a compound annual growth rate (CAGR) of 15.28% from 2024-2032, from its 2023 value of USD 0.77 billion to USD 2.75 billion. Heavy biotech investments, the concentration of large biopharma entities, and enabling regulatory policies favoring innovation and adoption of single-use technology are all supporting drivers of the US bioprocess bag market boom in recent years.

Bioprocess Bags Market Dynamics

Drivers

-

High growth is expected due to the rising adoption of single-use technologies and increasing Biologics production.

Single-use technologies in the bioprocess bags market are growing rapidly because there is a dramatic increase in biopharmaceutical manufacturers adopting SUTs for manufacturing. Single-Use-Bioprocess bags provide a large degree of freedom as well as less contamination risk and significantly less operational costs compared to conventional stainless steel systems. These rapid deployments have been notably on biologics and cell & gene therapy technology production. There are still significant passes from the in-line production area (in 2025, BioPlan Associates predicted that approximately 85% of all biopharmaceutical manufacturers would utilize single-use bags in upstream processing). Overshadowed by the access to demand of CDMOs, and moving toward scalable, efficient, and cost-effective bioprocessing solutions. Thermo Fisher Scientific and Sartorius have both reported double-digit growth in their respective single-use product portfolios as well. In addition, the COVID-19 pandemic has pushed the need for mature agile manufacturing as a result of an accelerated investment in single-use infrastructure for vaccines and monoclonal antibodies. Biologics pipeline (especially oncology and auto-immune disease) continues to increase support for flexible manufacturing platforms. With regulatory bodies endorsing more and more modular and disposable systems for GMP purposes, bioprocess bags are part and parcel of facility design, especially in small-batch or personalized medicine production environments.

Restraints

-

Lack of leachables, extractables poses a barrier for a more broadly adopted yet high hopes

While bioprocess bags have their own set of benefits, the main downside is leachables and extractables worries chemicals that might leach out of the plastic into the product due to leaching, extraction. These impurities and contaminants represent substantial threats in biomanufacturing, especially concerning sophisticated therapeutics often used for certain product integrity. A survey conducted in 2023 by PDA (Parenteral Drug Association) showed that more than 60% of survey respondents named extractables and leachables as a significant roadblock in the implementation of single-use systems. A similar trend of greater regulatory and guideline scrutiny exacerbating the challenges of implementation is now leading to increased complexity and cost. However, material compatibility is still seen as an obstacle, particularly in processes subjected to solvent or extreme pH conditions. The bioprocess bags, which are in most part polyethylene or ethylene vinyl acetate (EVA), might not be able to stand certain situations, thus putting a bottleneck on a material to ever work in an uncommonly selected substrate. Beyond that area of sustainability also come concerns about the environmental burden created by the plastic waste. Recycling and recyclability are being driven to help, but current solutions are not scalable enough in practice at the moment. Traditional stainless-steel systems are preferred in highly regulated or large-scale production environments where dependability and record compliance are key. The technical and regulatory hurdles cause the penetration velocity in some parts of the biopharmaceutical landscape.

Opportunities

-

Market growth opportunities with bioprocess bags are driven by emerging trends in biotechnology and material science.

Emerging trends emerging from material science and biotechnology are triggering substantial new business opportunities in the mainstream of the biocontainers market. This space is orchestrated strongly through the advancement of materials with the best performance and lowest extractables. More and more Companies are spending on state-of-the-art multilayer films that provide superior chemical resistance and very minimal leachability. This innovation could address regulatory and compatibility issues and enable bioprocess bags for advanced manufacturing applications. Perhaps the greatest of these is the explosion in personalized and precision medicine, which needs small-batch flexible manufacturing solutions. U.S FDA claims that over 40% of personalized therapies approved this year, 2023, were blockbuster drugs specifically well-suited for single-use technologies. Bioprocess bags are being used in niche therapeutic areas such as mRNA and gene therapies, and will become more so as the space grows. Tertiary sensor-enabled smart bioprocess bags are also being implemented to enable real-time monitoring, which will lead to improved process control and automation. Strategic partnerships between biopharma companies and bag manufacturers have been rolled out to help in innovation and building specialized solutions for a particular process. As the sector moves more toward decentralized and continuous manufacturing models, we predict that the bioprocess bags market will grow, which will lead to very large revenue generation for both established and emerging market players.

Challenges

-

Increasing Consumption of Single-Use Systems in bioprocess for biopharmaceuticals

Single-use technologies (SUT) in biopharmaceutical manufacturing have become mainstream practice because of the cost savings, reduced likelihood of contamination, and flexibility offered by bioprocess bags due to wider market adoption of single-use bags in bioreactors (due to reasons mentioned above). In contrast to existing systems in stainless-steel single-use bioprocess bags reduce operational costs by 30% (BioPlan Associates) through the elimination of cleaning & sterilization steps. This demand is compounded by a burgeoning biopharmaceutical sector, with over 20,000 biologics in global development (PhRMA) and recent to the innovative analytical challenges associated with vaccine manufacturing capacity and therapy. The rapid manufacturing of vaccines and therapies, as during the COVID-19 pandemic, also demonstrated the urgency for scalable, disposable. Thermo Fisher and Sartorius, among others, have expanded their single-use product ranges in response to this need. Market growth is also promoted by regulatory support, for example, in the case of FDA guidance on SUT.

Bioprocess Bags Market Segmentation Analysis

By Type

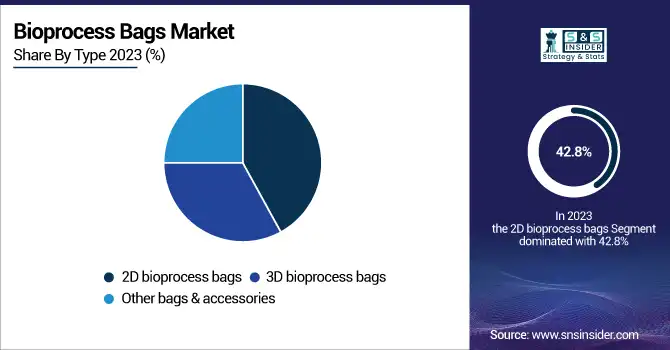

In 2023, the market share of 2D bioprocess bags was nearly 42.8% more than in the whole segment. It is largely due to how common media and buffer storage/sampling/process development are in the organisation, however, those chemicals are often stored by those companies. Easy to use, compact, and closed system interface makes them the best bags for closed cell culture transfer and are thus excellent tools for small-scale to single-use operations. They are considered the go-to solution for research and clinical applications thanks to their cost efficiency and flexibility.

In contrast, the rapidly progressing segment of 3D bioprocess bags has a projected high growth rate driven by the increased application in high-volume biomanufacturing processes. Designed for large-volume mixing and transport as well as long-term storage, enabling scalability in upstream and downstream applications. The demand for 3D bags that can accommodate over 2,000 liters is skyrocketing, especially as biopharmaceutical manufacturers are ramping up additional production capacity, particularly for monoclonal antibodies and vaccines.

By Workflow

The upstream process segment owned the workflow category share in the market with 40.6% of the market in 2023. This dominance stems from the high intensity of use of bioprocess bags in cell culture, fermentation, and media prep—the most important activities of the Upstream supply chain. The complexity of biologics and single-use bioreactors in early processing steps, to the increasing sophistication in biomanufacturing, all empower the use of bags/expellers to do their thing.

At the same time, there is the downstream process, which is expected to grow at the fastest CAGR in the coming years, driven by the introduction of new purification technologies and the necessity for sterile fluid management. Increasing need for ultra-pure biologics and stricter regulations are pushing the bioprocess bags into buffer preparation, product recovery/collection, and storage downstream applications.

By End User

In 2023, the Pharmaceutical and biopharmaceutical companies were the largest end-users, accounting for 42.8% of the market share. These companies are the primary drivers of biologics production and have significantly adopted single-use technologies to streamline manufacturing, reduce contamination risks, and cut turnaround times. Generation by the numbers, the demands for bag utilization in the manufacture of monoclonal antibody vaccines and cell therapy have entrenched them as the largest consumers of bioprocess bags.

In contrast, CMOs and CROs are the end-user segment that is assumed to be growing most rapidly. With more and more biopharma firms contracting to external development & manufacturing (cut costs and shorten time-to-market), CMOs and CROs adopt bioprocess bags, making them multi-product facilities with short manufacturing runs. They are also driven by disposability, speed, and agility, as well as the need to maintain GMP compliance with an ever-changing alphabet soup of standards.

Regional Insights

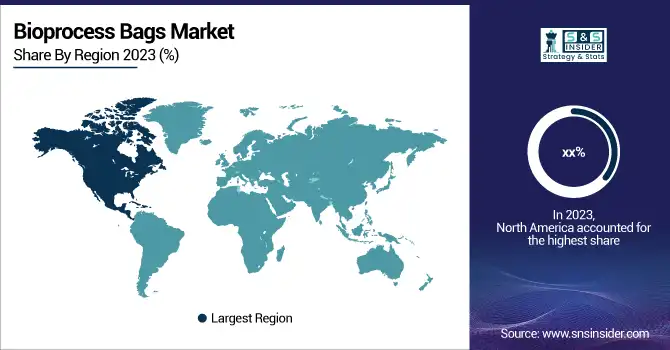

North America (2023) was considered the dominant region in the bioprocess bags market owing to the existence of a state-of-the-art biopharmaceutical infrastructure system, high R&D expenses has been done, and wide use of single-use technologies. The United States, in particular, is home to many important biopharmaceutical companies and CDMOs, and bioprocess bags have seen wide use within clinical and commercial manufacturing processes. New market access to Single-use system regulator support, and abundant US FDA approvals for bio-drug are boosting market penetrations as well. A large number of industry players like Thermo Fisher Scientific, Danaher, and Sartorius also boosted innovation and allowed domestic bag systems to get into the hands of more advanced bag systems.

Asia Pacific is going to rule the roost in terms of growth during the forecasted period due to the ramping up of biopharmaceutical manufacturing plants in China, India, and South Korea. This is accompanied by increasing investments in biosimilars, biologics, and vaccine production funded at scale by governments to be manufactured in-country. For instance, China invests heavily in setting up biomanufacturing capacity under its "Made in China 2025" program. Also, an increase in collaboration with pharma players using the global market and the presence of local CDMOs beating the trend faster ahead, drives increasing use of bioprocess bags in the region. This evolution is leading the Asia Pacific to have an impact on the global market and drive.

Get Customized Report as per Your Business Requirement - Enquiry Now

Bioprocess Bags Market Key Players

-

Thermo Fisher Scientific Inc. – HyPerforma Bioprocess Containers, Thermo Scientific Single-Use Bioprocess Containers

-

Sartorius AG – Flexsafe Bioprocess Bags, Sartobind Single-Use Bags

-

Danaher Corporation (via Cytiva and Pall Corporation) – Allegro Single-Use Systems, Ready-To-Process Bags

-

Merck KGaA (MilliporeSigma) – Mobius Single-Use Bags, Lynx CDR Systems

-

Saint-Gobain – PureFlex Bags, C-Flex Single-Use Assemblies

-

Corning Incorporated – Corning Single-Use Bioprocess Containers

-

Entegris – Aramus Single-Use Bags

-

Meissner Filtration Products, Inc. – FlexGro Single-Use Bags, TepoFlex Biocontainers

-

PROAnalytics, LLC – Custom Bioprocess Bags

-

CellBios Healthcare and Lifesciences Pvt Ltd. – CellBios 2D and 3D Bioprocess Bags, CellBios Biocontainers

Recent Developments in the Bioprocess Bags Market

In June 2024, Qosina partnered with Polestar Technologies to introduce iDOT Single-Use Sensor Bag Ports, expanding its single-use component portfolio. These gamma-stable, pre-calibrated ports enable non-invasive pH and dissolved oxygen monitoring in bioprocess bags and bioreactors, enhancing real-time process control.

In Aug 2023, Kriya Therapeutics secured an additional USD 150 million in Series C funding to advance its gene therapies into clinical trials. This new investment will support the company's efforts to bring its gene therapies closer to market, accelerating their development.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.50 billion |

| Market Size by 2032 | USD 13.78 billion |

| CAGR | CAGR of 16.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [2D bioprocess bags, 3D bioprocess bags, Other bags & accessories] • By Workflow [Upstream Process, Downstream Process, Process Development] • By End User [Pharmaceutical and Biopharmaceutical Companies, CMOs & CROs, Academic Research Institutes] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., Sartorius AG, Danaher Corporation, Merck KGaA, Saint-Gobain, Corning Incorporated, Entegris, Meissner Filtration Products, Inc., PROAnalytics, LLC, CellBios Healthcare and Lifesciences Pvt Ltd. |