Get more information on Biopharmaceutical Excipients Market - Request Sample Report

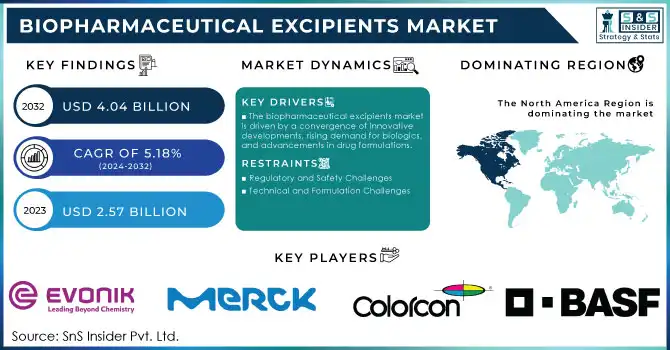

The Biopharmaceutical Excipients Market Size was valued at USD 2.57 billion in 2023 and is expected to reach USD 4.04 billion by 2032 and grow at a CAGR of 5.18% over the forecast period 2024-2032.

The biopharmaceutical excipients market is witnessing remarkable growth, driven by the rapid expansion of biologics and biosimilar therapies, alongside advancements in high-concentration drug formulations. Traditionally regarded as inactive components, excipients have evolved into active contributors to drug formulation, ensuring stability, enhanced solubility, and efficient delivery mechanisms. Surfactants like polysorbates are integral to over half of the monoclonal antibody formulations, addressing critical stability and aggregation challenges. Similarly, polymers such as polyethylene glycol (PEG) have seen significant adoption, with an annual application growth rate of approximately 12%, underscoring their importance in biopharmaceutical innovations.

The rise of high-concentration biologic formulations has highlighted the necessity for advanced excipients to overcome viscosity and protein aggregation issues. Over 70% of novel excipients are tailored specifically to meet the unique challenges of biologic drug formulations, including mRNA vaccines and monoclonal antibodies. Multifunctional excipients, which stabilize active ingredients while offering controlled-release functionalities, are experiencing a growth rate of nearly 15% annually, reflecting their expanding application across diverse drug delivery systems.

Sustainability is a key trend in this market, with more than 20% of newly developed excipients designed to align with eco-friendly and green chemistry standards. This aligns with increasing industry demands for sustainable production practices while maintaining stringent safety and efficacy requirements. Additionally, regulatory support for innovative excipients has accelerated, with multiple approvals granted each year, facilitating their integration into cutting-edge pharmaceutical formulations.

This robust growth trajectory highlights the critical role of biopharmaceutical excipients in advancing drug efficacy, optimizing manufacturing processes, and meeting the complex needs of next-generation therapeutics.

Drivers

The biopharmaceutical excipients market is driven by a convergence of innovative developments, rising demand for biologics, and advancements in drug formulations.

One key driver is the increasing prevalence of chronic diseases, such as cancer and autoimmune disorders, which has fueled the demand for biologics. This has heightened the need for excipients that stabilize proteins, reduce aggregation, and ensure drug efficacy over extended storage periods. Another significant driver is the rise of high-concentration biologic formulations, necessitating excipients that address challenges such as high viscosity and solubility. Cyclodextrins and novel surfactants are increasingly employed to enhance injectability and patient compliance. For instance, over 70% of new excipients are designed to tackle specific issues in high-concentration biologic drugs.

Additionally, the development of multifunctional excipients, such as those enabling both stabilization and controlled drug release, is accelerating innovation in drug delivery systems. Multifunctional excipients are projected to grow at an annual rate of 15%, reflecting their adoption in next-generation therapies. Technological advancements, including single-use technologies in biopharmaceutical manufacturing, have further augmented the demand for excipients compatible with such systems. Moreover, sustainability concerns have led to the introduction of eco-friendly excipients, with over 20% of newly developed products incorporating green chemistry principles.

The increasing complexity of biopharmaceutical formulations and regulatory support for novel excipients underscore their indispensable role in addressing industry challenges while meeting growing therapeutic demands. These drivers collectively shape a vibrant, innovation-led excipient market.

Restraints

Regulatory and Safety Challenges

Novel excipients often require extensive toxicological and compatibility testing, leading to delays in approval processes. The high costs and lengthy timelines associated with these regulatory hurdles limit the adoption of innovative excipients.

Technical and Formulation Challenges

The complexity of biopharmaceutical formulations, including issues like excipient-drug interactions, stability under various conditions, and protein aggregation, poses a significant restraint. Incompatibilities between excipients and biologic drugs can lead to formulation failures, impacting the development and scalability of advanced therapeutics.

By Product

Solubilizers and surfactants/emulsifiers dominated the biopharmaceutical excipients market in 2023, accounting for approximately 42.0% of the market share. Their dominance is attributed to their essential role in enhancing the solubility and stability of biologics, particularly monoclonal antibodies and high-concentration protein formulations. These excipients mitigate aggregation issues and ensure consistent drug delivery, making them indispensable for injectable formulations.

Polyols are the fastest-growing product segment due to their widespread use as stabilizers in biologics. They prevent protein aggregation and oxidative stress, crucial for maintaining the efficacy of advanced biologics such as gene therapies and mRNA-based vaccines. The rising demand for these complex therapeutics has driven the rapid adoption of polyols in the market.

By Formulation

Injectable formulations held the largest share in 2023, capturing 55.0% of the market. The dominance is due to the growing prevalence of chronic diseases requiring biologics, many of which are delivered via injections. Injectables ensure precise dosing and high bioavailability, making them the preferred choice for biologic therapies.

Topical formulations are the fastest-growing segment, driven by innovations in dermatological biologics and transdermal delivery systems. These advancements cater to patients' demand for non-invasive treatments while ensuring localized and targeted drug delivery, boosting their adoption across various therapeutic areas.

In North America, the market in terms of both revenue and innovation, accounted for the largest share in 2023. This dominance was primarily attributed to the robust pharmaceutical industry in the U.S., coupled with significant investments in biopharmaceutical research and development. The region also benefited from favorable regulatory frameworks that expedited the approval of new excipients and biologics, making it a hotspot for excipient innovations and production.

Europe followed closely, driven by increasing R&D activities, a well-established pharmaceutical sector, and a growing preference for biologics in therapeutic areas such as oncology and autoimmune diseases. The region also focused on sustainability, with many companies opting for green chemistry principles in excipient production. The approval of new excipients by the European Medicines Agency (EMA) further bolstered market growth.

In Asia-Pacific, the market is expected to experience the highest growth rate over the next few years. The expansion is fueled by increasing investments in biopharmaceutical manufacturing capabilities, particularly in China and India, which are becoming major hubs for both the production and consumption of biologics. Additionally, the rising prevalence of chronic diseases and growing healthcare access in emerging economies are driving demand for excipients tailored to high-concentration biologic formulations.

Need Any Customization Research On Biopharmaceutical Excipients Market - Inquiry Now

Embulix, Glucaflux

Colorcon (BPSI Holdings Inc.)

Polyplasdone, Primojel, Opadry, Aquacoat

Kollicoat, Eudragit

Associated British Foods plc

Pharmasoft, PharmaGlide

Signet Excipients Pvt. Ltd (IMCD)

Imwitor

Sigachi Industries Limited

Sigacel

Spectrum Chemical Manufacturing Corp.

Hydroxypropyl Methylcellulose (HPMC)

Roquette Frères

Polyols, Mannogem

Clariant

Crosfield, Lupasol

DFE Pharma

Pharmaflow, Spheron

J. RETTENMAIER & SÖHNE GmbH + Co KG

VIVAPUR

Evonik Industries AG

Eudragit, SmartGels

In July 2023, Roquette acquired Qualicaps to enhance its expertise and capabilities in developing pharmaceutical excipients.

In June 2023, Lubrizol Corporation entered into a licensing agreement with Welton Pharma, enabling Welton to utilize the Apisolex excipient across multiple regions. This collaboration aims to advance the development and commercialization of a new SN-38 formulation for treating colorectal and gastrointestinal cancers.

In March 2023, Evonik Industries AG initiated the construction of a new facility in Indiana, U.S., aimed at enhancing the global supply chain for functional excipients, specifically for RNA medicines. This expansion is set to significantly support the biopharmaceutical excipients market and bolster the production capabilities needed for RNA-based therapies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.57 Billion |

| Market Size by 2032 | US$ 4.04 Billion |

| CAGR | CAGR of 5.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Solubilizes & Surfactants/Emulsifiers (Triglycerides, Esters, Others), Polyols (Mannitol, Sorbitol, Others), Carbohydrates (Sucrose, Dextrose, Starch, Others)] • By Formulation (Oral, Topical, Injectables) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Merck KGaA, Colorcon (BPSI Holdings Inc.), BASF SE, Associated British Foods plc, Signet Excipients Pvt. Ltd (IMCD), Sigachi Industries Limited, Spectrum Chemical Manufacturing Corp., Roquette Frères, Clariant, DFE Pharma, J. RETTENMAIER & SÖHNE GmbH + Co KG, Evonik Industries AG. |

| Key Drivers | • The biopharmaceutical excipients market is driven by a convergence of innovative developments, rising demand for biologics, and advancements in drug formulations. |

| Restraints | • Regulatory and Safety Challenges • Technical and Formulation Challenges |

Ans. The projected market size for the Pharmaceutical Excipients Market is USD 17.8 Billion by 2032.

Ans: The Asia Pacific region dominated the Pharmaceutical Excipients Market in 2023.

Ans. The CAGR of the Pharmaceutical Excipients Market is 7.2% During the forecast period of 2024-2032.

Ans: Advancements in formulation technologies, such as lipid-based drug delivery systems and 3D printing, are revolutionizing drug development and increasing demand for specialized excipients.

Ans: The Organic chemicals Product segment dominated the Pharmaceutical Excipients Market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Biopharmaceutical Excipients Usage by Therapeutic Area (2023)

5.2 R&D and Technological Innovations in Excipients (2023)

5.3 Biopharmaceutical Excipients Pricing Trends (2023-2032)

5.4 Regulatory and Approval Trends (2023-2032)

5.5 Supply Chain and Manufacturing Trends (2023)

5.6 Adoption of Excipients in Emerging Therapies (2023-2032)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Service Benchmarking

6.3.1 Service specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Service launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Biopharmaceutical Excipients Market Segmentation, by Product

7.2 Solubilizes & Surfactants/Emulsifiers

7.2.1 Solubilizes & Surfactants/Emulsifiers Market Trends Analysis (2020-2032)

7.2.2 Solubilizes & Surfactants/Emulsifiers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Triglycerides

7.2.3.1 Triglycerides Market Trends Analysis (2020-2032)

7.2.3.2 Triglycerides Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Esters

7.2.4.1 Esters Market Trends Analysis (2020-2032)

7.2.4.2 Esters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Others

7.2.5.1 Others Market Trends Analysis (2020-2032)

7.2.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Polyols

7.3.1 Polyols Market Trends Analysis (2020-2032)

7.3.2 Polyols Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Mannitol

7.3.3.1 Mannitol Market Trends Analysis (2020-2032)

7.3.3.2 Mannitol Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Sorbitol

7.3.4.1 Sorbitol Market Trends Analysis (2020-2032)

7.3.4.2 Sorbitol Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Others

7.3.5.1 Others Market Trends Analysis (2020-2032)

7.3.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Carbohydrates

7.4.1 Carbohydrates Market Trends Analysis (2020-2032)

7.4.2 Carbohydrates Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.3 Sucrose

7.4.3.1 Sucrose Market Trends Analysis (2020-2032)

7.4.3.2 Sucrose Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.4 Dextrose

7.4.4.1 Dextrose Market Trends Analysis (2020-2032)

7.4.4.2 Dextrose Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.5 Starch

7.4.5.1 Starch Market Trends Analysis (2020-2032)

7.4.5.2 Starch Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.6 Others

7.4.6.1 Others Market Trends Analysis (2020-2032)

7.4.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Biopharmaceutical Excipients Market Segmentation, by Formulation

8.2 Oral

8.2.1 Oral Market Trends Analysis (2020-2032)

8.2.2 Oral Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Topical

8.3.1 Topical Market Trends Analysis (2020-2032)

8.3.2 Topical Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Injectables

8.4.1 Injectables Market Trends Analysis (2020-2032)

8.4.2 Injectables Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Biopharmaceutical Excipients Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.4 North America Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.5.2 USA Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.6.2 Canada Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Mexico Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Biopharmaceutical Excipients Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.5.2 Poland Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.6.2 Romania Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Biopharmaceutical Excipients Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.4 Western Europe Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.5.2 Germany Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.6.2 France Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.7.2 UK Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.8.2 Italy Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.9.2 Spain Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.12.2 Austria Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Biopharmaceutical Excipients Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.4 Asia Pacific Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 China Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 India Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 Japan Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.6.2 South Korea Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Vietnam Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.8.2 Singapore Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.9.2 Australia Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Biopharmaceutical Excipients Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.4 Middle East Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.5.2 UAE Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Biopharmaceutical Excipients Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.4 Africa Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Biopharmaceutical Excipients Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.4 Latin America Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.5.2 Brazil Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.6.2 Argentina Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.7.2 Colombia Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Biopharmaceutical Excipients Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Biopharmaceutical Excipients Market Estimates and Forecasts, by Formulation (2020-2032) (USD Billion)

10. Company Profiles

10.1 Merck KGaA

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Colorcon (BPSI Holdings Inc.)

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 BASF SE

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Associated British Foods plc

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Signet Excipients Pvt. Ltd (IMCD)

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Sigachi Industries Limited

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Spectrum Chemical Manufacturing Corp.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Roquette Frères

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 DFE Pharma

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Evonik Industries AG

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Solubilizes & Surfactants/Emulsifiers

Triglycerides

Esters

Others

Polyols

Mannitol

Sorbitol

Others

Carbohydrates

Sucrose

Dextrose

Starch

Others

By Formulation

Oral

Topical

Injectables

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Global Radiopharmaceuticals Market Size was USD 5.0 billion in 2023 & projected to grow at a CAGR of 10.4%, reaching USD 16.6 billion by 2032.

Hemophilia Market Size was valued at USD 13.7 Billion in 2023 and is expected to reach USD 24.2 Billion by 2032, growing at a CAGR of 6.5% over 2024-2032.

Tangential Flow Filtration Market was valued at USD 2.02 billion in 2023 and is expected to reach USD 5.75 billion by 2032, growing at a CAGR of 12.24% from 2024-2032.

The Diabetes Devices Market Size was valued at USD 30.26 Billion in 2023, and is expected to reach USD 57.15 Billion by 2032, and grow at a CAGR of 7.66%.

The Cleanroom Technologies Market Size was valued at USD 8.1 billion in 2023 and is expected to reach USD 14.76 billion by 2032 and grow at a CAGR of 6.8%.

The global Biologics Market size valued at USD 433.77 billion in 2023, is projected to reach USD 977.36 billion by 2032, growing at 9.46% CAGR from 2024-2032.

Hi! Click one of our member below to chat on Phone