To Get More Information on Biopharmaceutical CMO Market - Request Sample Report

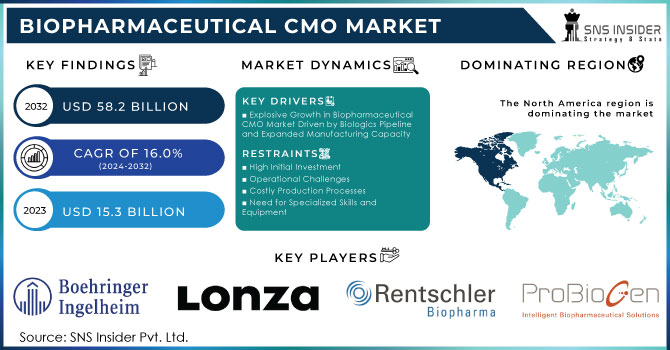

The Biopharmaceutical CMO Market size was valued at USD 15.3 billion in 2023 and is expected to reach USD 58.2 billion by 2032 with a growing CAGR of 16.0% over the forecast period of 2024-2032.

The rising demand for outsourced services such as microbial fermentation and mammalian cell culture has been critical in driving the growth of the biopharmaceutical contract manufacturing organization (CMO) market. Over the last few years, there has been an increased tendency among biopharmaceutical companies to outsource such processes to contract manufacturers primarily due to the increasing focus on the development of biologics, including recombinant proteins and monoclonal antibodies. A significant increase in developing biologics has led to an upsurge in demand for outsourcing services, which is translated directly into a need for mammalian cell culture services from CMOs.

Outsourced animal cell culture services have grown by a stunning 10% since 2019, and mammalian cell culture capacity needs grew by 30%, according to Contract Pharma. The speed of growth accelerated from the widespread impact of the COVID-19 pandemic in 2020, which gave biopharmaceuticals an unprecedented boost. Increased investments from leading players in the biopharma sector to enhance productivity and efficiency have also increased outsourcing. More and more biopharma companies now outsource these more capital- and resource-intensive steps or indeed biomanufacturing processes in their entirety to improve operational efficiency and the capital costs of the given process.

The rising demand is forcing CMOs to increase their manufacturing volumes. In one such move, Cambrex, a U.S.-headquartered CDMO, has recently announced plans to expand its biopharmaceutical testing services at its U.S. facility. During the year 2022 itself, it added 11 cGMP laboratories at its U.S. facility, reflecting the rising scale of need for quite advanced technologies, including mass spectrometry, qPCR, and NGS, in the biopharma industry.

Some of the changing facets that characterize CMOs' selection of business models and strategies include that they are becoming increasingly reliant on single-use systems, which allows for faster production turnarounds and reduced operational costs. As much as there have been gigantic strides in these latest technological innovations, contract negotiations between CMOs and their clients are complex, which is majorly due to issues around regulatory compliance, intellectual property rights, and service pricing. As the biopharmaceutical industry continues to change, CMOs keep adjusting their business models to place them in favorable positions relative to the rising demands and the intricacies of the market in which they now compete.

Major Biopharma CMO Service Providers, By Region

| Region | Company Name | Description |

|---|---|---|

|

North America |

Catalent |

Offers drug delivery solutions and manufacturing. |

|

Lonza |

Specializes in biologics and pharmaceuticals. |

|

|

Patheon |

Provides a wide range of manufacturing services. |

|

|

AMRI |

Focuses on drug development and manufacturing. |

|

|

Recipharm |

Offers contract manufacturing for pharmaceuticals. |

|

|

Europe |

WuXi AppTec |

Provides integrated services in drug development. |

|

Boehringer Ingelheim |

Known for biopharmaceutical manufacturing services. |

|

|

Rentschler Biotechnologie |

Offers development and manufacturing of biopharmaceuticals. |

|

|

Famar |

Provides services for pharmaceuticals and cosmetics. |

|

|

Vetter Pharma |

Focuses on aseptic filling and packaging services. |

|

|

Asia-Pacific |

Samsung Biologics |

Offers end-to-end biopharmaceutical contract services. |

|

Fujifilm Diosynth Biotechnologies |

Specializes in mammalian cell culture and microbial fermentation. |

|

|

Jubilant Biosys |

Provides integrated drug discovery and development services. |

|

|

Sequirus |

Offers CMO services with a focus on vaccines. |

|

|

BioFactor |

Specializes in biopharmaceutical contract manufacturing. |

|

|

Latin America |

Instituto Biológico Argentino |

Provides CMO services in vaccine and biopharmaceutical manufacturing. |

|

Biogenesis Bago |

Focuses on biopharmaceutical manufacturing. |

|

|

Middle East |

Julphar |

Offers pharmaceutical and biopharmaceutical manufacturing services. |

|

Medochemie |

Provides a range of CMO services across various therapeutic areas. |

Drivers

Explosive Growth in Biopharmaceutical CMO Market Driven by Biologics Pipeline and Expanded Manufacturing Capacity

The biopharmaceutical contract manufacturing market is likely to grow explosively since pharmaceutical and biotechnology companies continue to accelerate their investments in outsourcing services. Lastly, an excellent pipeline of biologics with several products lined up for launch during the forecast period propels this market forward. With the rising completion of the development process of biopharmaceutical products, demand for outsourced manufacturing services will surge sharply. The growing number of drugs that get approval also contributes to market growth. For example, in 2023, 55 new drugs and biological products received U.S. FDA approval: with growth moving in this direction, the sector is gaining increased momentum this way.

Biopharmaceutical CMO collaborations and acquisitions are also fueling the market. About 30 percent of recombinant commercial products are produced by CMOs; however, this is restricted to some of the largest vendors in the industry. The U.S. remains one of the key geographies for outsourcing. Among the industry respondents, 30.1 percent of those respondents said they would prefer contract manufacturing at U.S. facilities within five years.

Another push factor is the increase in the capacity of the production of biologics undertaken by several CMOs. This number will also increase as more novel drugs enter clinical pipelines. The mammalian biomanufacturing capacity is increasing at the rate of 11.5% per year. Samsung Biologics is one of the companies investing millions of dollars to meet the growing demand, for example, the USD 2 billion manufacturing facility. These trends will further advance the biopharmaceutical CMO market as more companies outsource biologics.

Restraints

High Initial Investment

Operational Challenges

Costly Production Processes

Need for Specialized Skills and Equipment

By Source

The mammalian segment remained the market leader in 2023, with a share of over 56.9%, mainly due to the lack of in-house skills in the industry. The success can be attributed to the fact that mammalian segment technology is the only one that can match human-like post-translational modifications for complex protein therapeutics. Novel and enhanced expression systems, improved process monitoring solutions, cell line engineering tools, automated screening techniques, and disposable devices have benefited mammalian segments highly.

On the other hand, the non-mammalian segment is expected to grow very rapidly with a CAGR of 7.7% during the forecast period. It is these microbial cell lines which are very efficient in terms of their production platforms that have been causing the growth of the non-mammalian segment. Innovative approaches have taken place for exploring the potential of different microbes, thereby contributing to the growth of non-mammalian biopharmaceutical manufacturing. Its use for the production of large-volume biopharmaceutical products is also increasing the revenue of this segment.

By Services

The contract manufacturing segment accounted for the largest share of the market in 2023 with more than 58.0%. Strong growth in this segment is due to the growing trend of biopharmaceutical companies outsourcing their research and development activities. A large number of CMOs, including opportunistic players, offer end-to-end services from cell cultivation to fill/finish operations, which make up for total care to biopharma companies. Companies are heavily investing to outsource the manufacturing component of their product development programs. Thus, this segment is bound to grab a considerable market share.

Contract research will witness the highest growth, at a CAGR of 6.4% in the biopharmaceutical CMO and CRO market. Contract research organizations position themselves to capture emerging opportunities within the industry. New entrants into the market, as well as small-scale biopharmas, focused on discovering new biopharmaceutical products, are expected to increasingly utilize contract research services to support their discovery and development programs, thereby driving segmental growth. Moreover, severe regulations imposed on the approval process of biopharmaceuticals will further boost this segment's growth.

By Product

The Biologics segment remained the market leader in 2023, with more than a 79.9% revenue share. This can be attributed to biologics' high specificity, complex production processes, and higher success rate than traditional drug molecules. Advanced technologies, such as one-time bioreactors, continuous purification processing, disposable plastic containers, and real-time quality analysis enable CMOs to cater to the increasing demand for biologics production efficiently. In addition, outsourced budgets spent on the development of biologics denote a large market share of the segment. The expanded market for biologics, as referred to earlier, is putting an even greater onus upon developers and regulators to catch up. As such, it is only working to accelerate the uptake of CMO services and, consequently, this segment.

The segment of biosimilars is likely to reach the fastest growth rate at a CAGR of 8.7% during the forecast period. Several companies are investing in biosimilar development to exceed the safety, efficacy, disposition, or cost of earlier in-class innovator drugs. Given this increasing competition among innovator manufacturers, CMOs are expected to benefit owing to their indispensable support in the development and production of biosimilars.

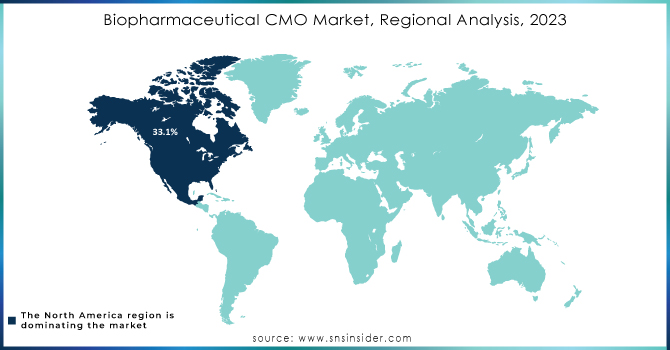

North America dominated the market in 2023, producing the highest revenue, at around 33.1% of the biopharmaceutical CMO market. It's because North America is predominant in terms of the strong local presence of several service providers and a large number of the CMOs that manufacture approved products for the U.S. Small- and mid-sized biopharmaceutical companies in the United States face challenges to set up properly equipped manufacturing facilities with limited resources and budgets. Instead, they mainly use CMOs. Thus, the interaction of CMOs and SMEs has led to a strengthening of the US market leadership. The US-based CMOs and CROs increasingly invest in advanced research and manufacturing technologies, and higher penetration of these facilities is propelling market growth. Also, the quality of services that are provided is opening enough a much-needed link between biopharma companies and CMOs in the country.

Asia Pacific is expected to grow considerably and emerge as the fastest-growing market for biopharmaceutical R&D and manufacturing, in the course of the forecast period. Such growth can be ascribed to the factors relating to better infrastructural facilities, a huge available pool of study subjects, and changes in regulations. The increasing R&D costs in the U.S. have led to the increased interest of many firms in biopharma to take up product development in Asian countries, thus broadening the scope of growth for the region. China, especially, consumed a substantial market share in 2023 with the development of rising R&D activities and also with the increased trend of outsourcing operations to local market players by overseas biopharmaceutical firms. This outsourcing enables the global innovators to restructure the efforts on R&D with low cost. Also, the Chinese government provides good funding for biotechnology, and market benefits from the expert professionals returning from the U.S. and Europe, increasing the competence of the domestic CROs and CMOs.

Do You Need any Customization Research on Biopharmaceutical CMO Market - Enquire Now

Inno Biologics Sdn Bhd

JRS Pharma

Biomeva GmbH

ProBioGen AG

Samsung Biologics

Recipharm AB

WuXi Biologics

Fujifilm Diosynth Biotechnologies U.S.A., Inc.

Toyobo Co., Ltd.

Samsung Biologics

Thermo Fisher Scientific Inc (Patheon & PPD)

CMC Biologics

WuXi Biologics

AbbVie Inc.

Binex Co., Ltd.

Charles River Laboratories International, Inc.

ICON Plc

Parexel International Corporation

Laboratory Corporation of America Holdings

Siegfried Holding AG

Catalent, Inc., and others.

In March 2024, Lonza announced an agreement to purchase Roche's big-batch biologics manufacturing facility in Vacaville, U.S., from F. Hoffmann-La Roche Ltd (Roche).

In October 2023, Vaxcyte, Inc., a U.S.-based biotechnology firm that is involved in the development of cutting-edge vaccines, announced an expansion to its collaboration with Lonza. This partnership will support the global commercial manufacturing of Vaxcyte's broad-spectrum pneumococcal conjugate vaccines (PCVs).

| Report Attributes | Details |

| Market Size in 2023 | US$ 15.3 Billion |

| Market Size by 2032 | US$ 58.2 Billion |

| CAGR | CAGR of 16.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source Outlook (Mammalian, Non-Mammalian) • By Service Outlook (Contract Manufacturing, Contact Research) • By Product outlook (Biologics, Biosimilars) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Boehringer Ingelheim GmbH, Lonza Group AG, Inno Biologics Sdn Bhd, Rentschler Biopharma SE, JRS Pharma, Biomeva GmbH, ProBioGen AG, Samsung Biologics , Recipharm AB , WuXi Biologics , Fujifilm Diosynth Biotechnologies U.S.A., Inc., Toyobo Co., Ltd., Samsung Biologics, Thermo Fisher Scientific Inc, CMC Biologics and Others |

| Key Drivers | • Explosive Growth in Biopharmaceutical CMO Market Driven by Biologics Pipeline and Expanded Manufacturing Capacity |

| Market Restraints | • High Initial Investment • Operational Challenges • Costly Production Processes • Need for Specialized Skills and Equipment |

Ans : The Biopharmaceutical CMO Market size was valued at USD 15.3 billion in 2023 and is expected to reach at USD 58.2 billion by 2032, and grow at a CAGR of 16.0% over the forecast period of 2024-2032.

Ans : Budget restrictions during a recession may cause biopharmaceutical businesses to cut back on their investment in research and development (R&D).

Ans : APAC is said to be the region which will have the highest CAGR growth rate during the forecasted period because of the technological advancement in the healthcare industry in these regions.

Ans : Market is divided in three segments by Source Outlook, by Service outlook and by Product Outlook.

Ans : The rise in the development in the Biopharmaceutical sector.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Drug Volume: Production and usage volumes of pharmaceuticals.

5.4 Healthcare Spending: Expenditure data by government, insurers, and out-of-pocket by patients.

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Biopharmaceutical CMO Market Segmentation, by Source

7.1 Chapter Overview

7.2 Mammalian

7.2.1 Mammalian Market Trends Analysis (2020-2032)

7.2.2 Mammalian Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Non-mammalian

7.3.1 Non-mammalian Market Trends Analysis (2020-2032)

7.3.2 Non-mammalian Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Biopharmaceutical CMO Market Segmentation, by Service

8.1 Chapter Overview

8.2 Contract Manufacturing

8.2.1 Contract Manufacturing Market Trends Analysis (2020-2032)

8.2.2 Contract Manufacturing Market Size Estimates and Forecasts to 2032 (USD Million)

8.2.3 Process Development

8.2.3.1 Process Development Market Trends Analysis (2020-2032)

8.2.3.2 Process Development Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Contract Research

8.3.1 Contract Research Market Trends Analysis (2020-2032)

8.3.2 Contract Research Market Size Estimates and Forecasts to 2032 (USD Million)

8.3.3 Oncology

8.3.3.1 Oncology Market Trends Analysis (2020-2032)

8.3.3.2 Oncology Market Size Estimates and Forecasts to 2032 (USD Million)

8.3.4 Inflammation & Immunology

8.3.4.1 Inflammation & Immunology Market Trends Analysis (2020-2032)

8.3.4.2 Inflammation & Immunology Market Size Estimates and Forecasts to 2032 (USD Million)

8.3.5 Cardiology

8.3.5.1 Cardiology Market Trends Analysis (2020-2032)

8.3.5.2 Cardiology Market Size Estimates and Forecasts to 2032 (USD Million)

8.3.6 Neuroscience

8.3.6.1 Neuroscience Market Trends Analysis (2020-2032)

8.3.6.2 Neuroscience Market Size Estimates and Forecasts to 2032 (USD Million)

8.3.7 Others

8.3.7.1 Others Market Trends Analysis (2020-2032)

8.3.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Biopharmaceutical CMO Market Segmentation, by Product

9.1 Chapter Overview

9.2 Biologics

9.2.1 BiologicsMarket Trends Analysis (2020-2032)

9.2.2 BiologicsMarket Size Estimates and Forecasts to 2032 (USD Million)

9.2.3 Monoclonal antibodies (MAbs)

9.2.3.1 Monoclonal antibodies (MAbs)Market Trends Analysis (2020-2032)

9.2.3.2 Monoclonal antibodies (MAbs)Market Size Estimates and Forecasts to 2032 (USD Million)

9.2.4 Recombinant Proteins

9.2.4.1 Recombinant Proteins Market Trends Analysis (2020-2032)

9.2.4.2 Recombinant Proteins Market Size Estimates and Forecasts to 2032 (USD Million)

9.2.5 Vaccines

9.2.5.1 Vaccines Market Trends Analysis (2020-2032)

9.2.5.2 Vaccines Market Size Estimates and Forecasts to 2032 (USD Million)

9.2.6 Antisense, RNAi, & Molecular Therapy

9.2.6.1 Antisense, RNAi, & Molecular Therapy Market Trends Analysis (2020-2032)

9.2.6.2 Antisense, RNAi, & Molecular Therapy Market Size Estimates and Forecasts to 2032 (USD Million)

9.2.7 Others

9.2.7.1 Others Market Trends Analysis (2020-2032)

9.2.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Biosimilars

9.3.1 Biosimilars Market Trends Analysis (2020-2032)

9.3.2 Biosimilars Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Biopharmaceutical CMO Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.4 North America Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.2.5 North America Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.6.2 USA Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.2.6.3 USA Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.7.2 Canada Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.2.7.3 Canada Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.8.2 Mexico Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.2.8.3 Mexico Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Biopharmaceutical CMO Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.6.2 Poland Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.1.6.3 Poland Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.7.2 Romania Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.1.7.3 Romania Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.8.2 Hungary Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.1.8.3 Hungary Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.9 turkey

10.3.1.9.1 Turkey Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.9.2 Turkey Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.1.9.3 Turkey Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Biopharmaceutical CMO Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.4 Western Europe Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.2.5 Western Europe Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.6.2 Germany Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.2.6.3 Germany Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.7.2 France Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.2.7.3 France Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.8.2 UK Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.2.8.3 UK Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.9.2 Italy Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.2.9.3 Italy Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.10.2 Spain Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.2.10.3 Spain Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.13.2 Austria Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.2.13.3 Austria Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Biopharmaceutical CMO Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.4 Asia Pacific Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.4.5 Asia Pacific Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.6.2 China Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.4.6.3 China Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.7.2 India Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.4.7.3 India Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.8.2 Japan Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.4.8.3 Japan Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.9.2 South Korea Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.4.9.3 South Korea Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.10.2 Vietnam Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.4.10.3 Vietnam Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.11.2 Singapore Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.4.11.3 Singapore Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.12.2 Australia Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.4.12.3 Australia Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Biopharmaceutical CMO Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.4 Middle East Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.5.1.5 Middle East Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.6.2 UAE Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.5.1.6.3 UAE Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.7.2 Egypt Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.5.1.7.3 Egypt Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.9.2 Qatar Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.5.1.9.3 Qatar Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Biopharmaceutical CMO Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.4 Africa Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.5.2.5 Africa Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.6.2 South Africa Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.5.2.6.3 South Africa Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Biopharmaceutical CMO Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.4 Latin America Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.6.5 Latin America Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.6.2 Brazil Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.6.6.3 Brazil Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.7.2 Argentina Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.6.7.3 Argentina Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.8.2 Colombia Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.6.8.3 Colombia Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Biopharmaceutical CMO Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Biopharmaceutical CMO Market Estimates and Forecasts, by Service (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Biopharmaceutical CMO Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

11. Company Profiles

11.1 Boehringer Ingelheim GmbH

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Lonza Group AG

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Inno Biologics Sdn Bhd

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Rentschler Biopharma SE

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 JRS Pharma

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Biomeva GmbH

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 ProBioGen AG

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Samsung Biologics

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Recipharm AB

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 WuXi Biologics

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusio

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segmentation

By Source

Mammalian

Non-mammalian

By Service

Contract Manufacturing

Process Development

Contract Research

Oncology

Inflammation & Immunology

Cardiology

Others

By Product

Biologics

Monoclonal antibodies (MAbs)

Recombinant Proteins

Vaccines

Antisense, RNAi, & Molecular Therapy

Others

Biosimilars

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Electronic Trial Master File (eTMF) Systems Market Size was valued at USD 1.68 billion in 2023, and is expected to reach USD 4.40 billion by 2031 and grow at a CAGR of 12.8% over the forecast period 2024-2031.

The Rare Disease Genetic Testing Market was valued at USD 1.05 billion in 2023 and is expected to reach USD 3.79 billion by 2032, growing at a CAGR of 15.36% over the forecast period of 2024-2032.

The Mass Spectrometry Market size was valued at USD 5.76 billion in 2023 and is projected to reach USD 11.25 billion by 2032 at a CAGR of 7.74% from 2024 to 2032

The Central Nervous System (CNS) Treatment Market size was valued at USD 145.04 Bn in 2023 and is expected to reach USD 273.30 Bn by 2032 and grow at a CAGR of 7.31% over the forecast period of 2024-2032.

The Alopecia Treatment Market Size was valued at USD 8.80 Billion in 2023, and is expected to reach USD 20.70 Billion by 2032, and grow at a CAGR of 10.48%.

The Calcium Supplements Market Size was valued at USD 510.00 Million in 2023 and is expected to reach USD 908.83 Million by 2032, growing at a CAGR of 6.63% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone