Biometric Sensor Market Size:

Get More Information on Biometric Sensor Market - Request Sample Report

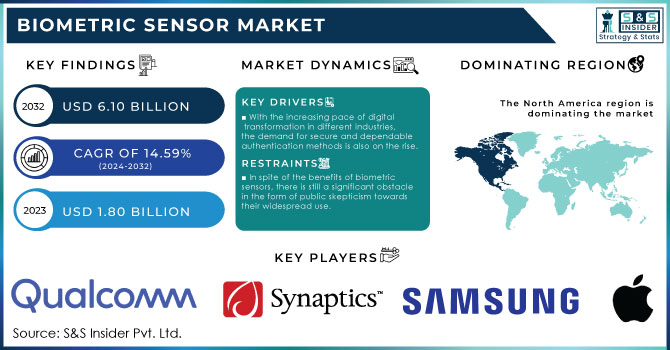

The Biometric Sensor Market size was valued at USD 1.80 Billion in 2023. It is estimated to reach USD 6.10 Billion by 2032, growing at a CAGR of 14.59% during 2024-2032.

The biometric sensor market has experienced substantial growth in recent years, fueled by technological advancements, heightened security concerns, and an increasing demand for personalized user experiences. Traditional security measures, such as passwords and PINs, are becoming less effective against the rising tide of cyberattacks and identity theft. In contrast, biometric authentication offers a more secure and reliable method of authentication by leveraging unique physiological traits that are difficult to replicate. The adoption of biometric technology on smartphones is particularly notable, with a remarkable 81% of devices now enabling features like fingerprint sensors and facial recognition technology. This shift is mirrored in the travel sector, where the usage of biometrics at airports has surged significantly; 46% of passengers utilized these systems in 2023, up from 34% in 2022. Additionally, a striking 75% of travelers now prefer biometric solutions over traditional identification methods. In the United States, more than 176 million people engage with facial recognition technology, with 68% using it to unlock their devices. The acceptance of this technology for safety measures is notably high, particularly among travelers, with 55% supporting its use in airports and 54% in banking institutions.

The banking sector is also witnessing a transformation in customer authentication processes through biometric sensors. Financial institutions are increasingly implementing fingerprint and facial recognition systems within mobile banking applications. This innovation not only enhances security but also significantly improves the overall customer experience, making transactions quicker and more user-friendly. Furthermore, biometric authentication helps mitigate the risk of fraudulent activities, a critical concern for financial institutions in today's digital age.

Market Dynamics

Drivers

-

With the increasing pace of digital transformation in different industries, the demand for secure and dependable authentication methods is also on the rise.

Conventional security measures like passwords and PINs are being viewed as insufficient because of their susceptibility to hacking and social engineering tactics. This has caused organizations to investigate biometric authentication as a more secure option. By examining distinct physical or behavioral traits, biometric sensors enhance security by allowing only authorized persons to reach sensitive data or areas. The growing occurrence of cyber threats and data breaches continues to drive the need for innovative security solutions. Biometric technologies like fingerprint, facial recognition, iris scanning, and voice recognition are becoming more popular in diverse areas, such as mobile devices, financial services, and physical access control systems. Organizations are eager to introduce biometric systems to improve security and user convenience by removing the necessity of recalling complicated passwords. Furthermore, with increased regulations on data protection, businesses are facing the demand to implement strong authentication methods, driving the expansion of the biometric sensor industry.

-

Governments across the globe are more and more acknowledging the advantages of biometric technology in improving national security and public safety.

Biometric systems are being used for a range of purposes, such as verifying identity, controlling borders, and conducting criminal investigations. Governments are using biometric sensors in passport control, national identification programs, and law enforcement databases to verify identification and deter identity theft. The use of biometric systems in law enforcement agencies is especially significant because they help with criminal identification and tracking. Facial recognition technology allows law enforcement to compare images captured by surveillance cameras with databases containing information on known criminals. These applications not only increase the efficiency of policing but also enhance public safety, leading to government funding in biometric technology. The rising demand for strong identity management systems in government operations is anticipated to drive the expansion of the biometric sensor market.

Restraints

-

In spite of the benefits of biometric sensors, there is still a significant obstacle in the form of public skepticism towards their widespread use.

A lot of people are cautious about new technologies, particularly ones that gather personal data. Worries about privacy, security, and the possibility of surveillance may cause a lack of faith in biometric systems. This doubt may result in a reluctance to use biometric technology, even in places where it could improve security and convenience. Organizations need to educate consumers about the advantages of biometric technologies and deal with their worries to promote acceptance. Building trust and promoting adoption could be hindered in the biometric sensor market due to the difficulty of overcoming public skepticism, which may impede its growth.

Market Segmentation

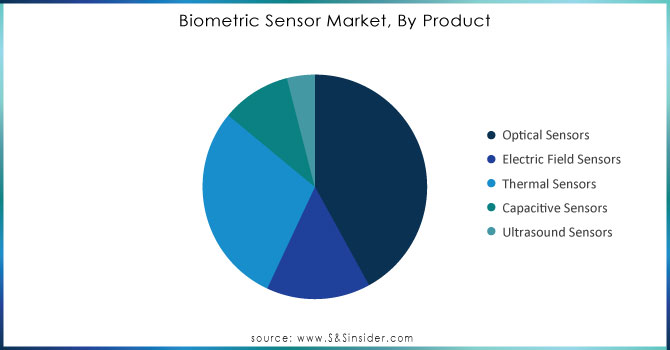

By Product

Optical sensors led with a 42% market share in 2023 in the biometric sensor market because of their broad range of uses and consistent functionality. These sensors use light to identify and secure biometric information like fingerprints, facial characteristics, and iris designs. Optical sensors are preferred for their precision and quickness in identification tasks, making them perfect for security systems, smartphones, and access control applications. Apple and Samsung have incorporated advanced optical fingerprint sensors in their smartphones, offering users secure and convenient authentication options.

The thermal sensor segment is experiencing rapid growth in the biometric sensor market due to the rising need for contactless identification options. These sensors can identify specific thermal patterns related to various biometrics like faces and bodies by detecting the heat given off by people. FLIR Systems and Honeywell are at the forefront with cutting-edge thermal imaging solutions that make quick, hands-free screening possible. Moreover, the incorporation of thermal sensors in security systems and smart devices is gaining popularity, as these sensors provide a reliable way to improve biometric security without the need for physical contact, meeting the rising demand for cleanliness and safety in technology.

Need Any Customization Research On Biometric Sensor Market - Inquiry Now

By Application

The finger scan segment dominated with a 35% market share in the biometric sensor market in 2023 due to its widespread adoption and established technology. Fingerprint recognition is user-friendly, cost-effective, and offers high accuracy, making it a preferred choice for various applications such as mobile devices, access control systems, and time attendance solutions. Companies like Apple and Samsung have integrated fingerprint scanners into their smartphones, allowing users to unlock devices and authorize transactions seamlessly.

The facial scan segment is expected to become the fastest-growing during 2024-2032 within the biometric sensor market, fueled by advancements in artificial intelligence and machine learning technologies. Facial recognition systems have gained traction in various sectors, including retail, security, and healthcare, for applications such as customer identification, attendance tracking, and secure access control. Companies like Amazon and Facebook are leveraging facial recognition technology to enhance user experiences, such as automating photo tagging and improving security protocols.

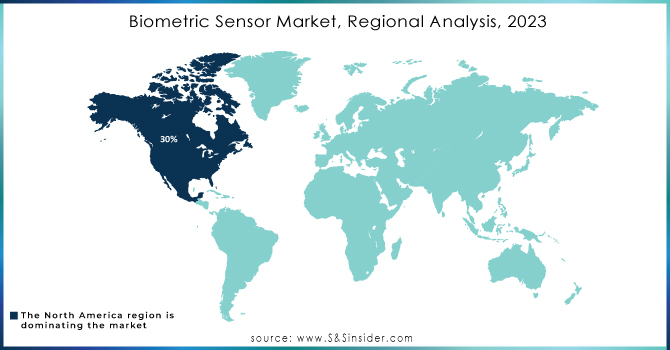

Regional Analysis

North America held a market share of 30% in 2023 in the biometric sensor market, driven by advanced technological infrastructure, a strong emphasis on security, and significant investment in research and development. The increasing need for biometric solutions in the area is driven by different uses in industries like healthcare, banking, and government services. Large corporations like Apple and Microsoft have incorporated biometric technologies, like fingerprint and facial recognition, into their products to improve user authentication and security.

The Asia-Pacific region is anticipated to become the fastest-growing during 2024-2032 largely due to the rapid adoption of biometric technologies across various sectors. Nations such as China, India, and Japan are making significant investments in biometric technology for use in security, financial services, and smart city initiatives. One example is the widespread use of China's facial recognition technology in city surveillance and public safety measures, with firms such as SenseTime at the forefront of AI-based biometric solutions. Moreover, India's efforts to promote digital identification with projects like Aadhaar underscore the increasing significance of biometric verification in the area.

Key Players

The key players in the Biometric Sensor Market are:

-

Apple Inc. (Touch ID, Face ID)

-

Samsung Electronics (Galaxy S20 Fingerprint Scanner, Galaxy Note 20 Ultra Facial Recognition)

-

Synaptics Incorporated (Natural ID Fingerprint Sensors, Clear ID Fingerprint Sensors)

-

Qualcomm (Snapdragon Sense ID, 3D Sonic Sensor)

-

HID Global (Fargo DTC4500e Card Printer, Biometrics Authentication Solutions)

-

NEC Corporation (NeoFace Facial Recognition, Bio-Idiom Fingerprint Authentication)

-

Thales Group (Gemalto Cogent Automated Biometric Identification System, Fingerprint Sensors)

-

Idemia (Morphowave Compact, MorphoSmart 3D Fingerprint Reader)

-

Crossmatch (Verifinger SDK, Guardian Fingerprint Scanner)

-

Silead Inc. (G+ Fingerprint Sensor, S-Fingerprint Sensor)

-

HoloSens (HoloFace Facial Recognition System, HoloFinger Fingerprint Sensor)

-

Integrated Biometrics (Columbo Fingerprint Scanner, Sherlock Fingerprint Scanner)

-

Hikvision (DS-K1T671TM-3XF Face Recognition Terminal, DS-K1T331W Fingerprint Terminal)

-

Fingerprints AB (T-Shape Fingerprint Sensor, FPC1025 Sensor)

-

Cypress Semiconductor (CapSense Fingerprint Sensors, TrueTouch Fingerprint Solutions)

-

Gemalto (Cinterion M2M Modules, Biometric Passport Readers)

-

ZKTeco (iClock Series Biometric Time Attendance, F18 Fingerprint Reader)

-

Biometric Security Solutions (SecurOS Biometric, Biometric Access Control)

-

M2SYS Technology (M2SYS Hybrid Biometric Platform, Bio-Plugin Fingerprint SDK)

-

AuthenTec (now part of Apple) (AES2810 Fingerprint Sensor, AES1660 Fingerprint Sensor)

Component Suppliers

-

Texas Instruments (Microcontrollers, Signal Processors)

-

NXP Semiconductors (RFID Chips, Secure Elements)

-

STMicroelectronics (MEMS Sensors, Microcontrollers)

-

Infineon Technologies (Security Controllers, Fingerprint Sensors)

-

Analog Devices (Signal Processing Components, ADCs)

-

ON Semiconductor (Thermal Sensors Sensors, Microcontrollers)

-

Microchip Technology (MCUs, ADCs)

-

Vishay Intertechnology (Resistors, Capacitors)

Recent Development

-

Oct 2024: Infineon Technologies launched two freshly-developed fingerprint sensor ICs, named CYFP10020A00 and CYFP10020S00, specifically crafted for biometric verification in automobiles.

-

July 2024: Google plans to release the long-awaited Pixel 9 series on August 13, ahead of its typical launch timeline. Anticipated upgrades in the upcoming series include a revamped look.

-

September 2024: TVS Electronics Limited (TVS-E), a top competitor in the electronics manufacturing industry, has introduced its Biometric Security Solutions, providing comprehensive electronic solutions from design to end-of-life services.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.80 Billion |

| Market Size by 2032 | USD 6.10 Billion |

| CAGR | CAGR of 14.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Optical Sensors, Electric Field Sensors, Thermal Sensors, Capacitive Sensors, Ultrasound Sensors) • By Application (Finger Scan, Facial Scan, Hand Scan, Voice Scan, Vein Scan, Iris Scan) • By End User (Consumer Electronics, Construction, Defense, Medical, BFSI, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Samsung Electronics, Synaptics Incorporated, Qualcomm, HID Global, NEC Corporation, Thales Group, Idemia, Crossmatch, Silead Inc., HoloSens, Integrated Biometrics, Hikvision, Fingerprints AB, Cypress Semiconductor, Gemalto, ZKTeco, Biometric Security Solutions, M2SYS Technology, AuthenTec. |

| Key Drivers | • With the increasing pace of digital transformation in different industries, the demand for secure and dependable authentication methods is also on the rise. • Governments across the globe are more and more acknowledging the advantages of biometric technology in improving national security and public safety. |

| Restraints | • In spite of the benefits of biometric sensors, there is still a significant obstacle in the form of public skepticism towards their widespread use. |