To get more information on Biometric Authentication Identification Market - Request Free Sample Report

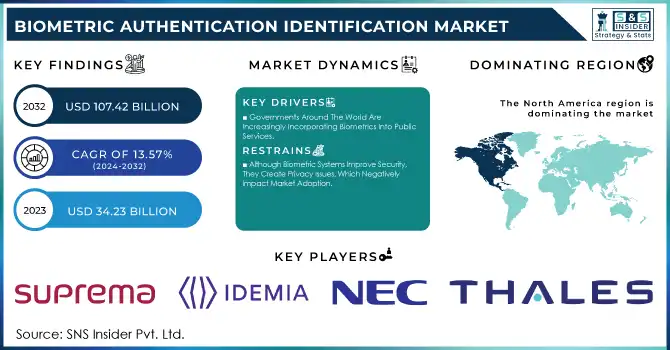

The Biometric Authentication Identification Market Size was valued at USD 34.23 Billion in 2023 and is expected to reach USD 107.42 Billion by 2032 and grow at a CAGR of 13.57% over the forecast period 2024-2032.

The Biometric Authentication Identification Market is seen to have grown considerably in 2023 and is expected to witness much larger expansion over 2024-2032 as it is fuelled by swift technological advancements, government policy initiatives, and widespread growing demand in various fields. Nations like the USA, China, Japan, Germany, France, and India are ahead of the curve in their adaptation of biometrics using the technologies for security identity validation, and operational efficiency improvement.

In the USA, government agencies have deployed facial recognition systems at more than 20 airports, streamlining the processing of some 100 million travellers by 2023. But China has taken the lion's share of biometric system deployment across surveillance, retail, and banking, as more than 1 billion facial recognition cameras go operational by year-end 2023. India continues to be in a league of its own as it signed up over 1.3 billion citizens with their biometric IDs under the AADHAAR initiative. The European Union's Schengen borders will have its Entry/Exit System fully ready by 2024, using both facial and fingerprint biometrics for millions of travellers.

Technological innovation is pushing the boundary of biometric capabilities in many ways. AI-based multimodal systems that integrate facial recognition, fingerprint recognition, and voice recognition have been developed and have gained a good deal of momentum. This reduces error rates by 80% compared to single modality solutions, which becomes an indispensable solution in high-security requirements in finance and healthcare applications. The new launches during 2023 include Fujitsu's AI-powered biometric authentication platform and NEC's upgraded NeoFace suite.

Regulatory frameworks are also driving the market. For instance, the European Union's GDPR has stringent rules about the processing of biometric data that influence such policies worldwide. Japan has instituted measures for the protection of biometric data that align with international standards. In the USA, the National Institute of Standards and Technology has published updated benchmarks for biometric performance in 2023.

KEY DRIVERS:

Governments Around The World Are Increasingly Incorporating Biometrics Into Public Services.

Government-led initiatives for national identification and border control are significant demand drivers in many countries. For example, India's AADHAAR program has digitized welfare delivery to over 99% of the adult population. The U.S. Transportation Security Administration (TSA) has increased biometric security at airports, with 50% of passengers using facial recognition in 2023.

The Entry/Exit System (EES) for the Schengen Area borders has been initiated in Europe, which relies on biometric data for the fast and secure processing. These large-scale projects depict how government adoption is what fuels the biometric authentication identification market, thereby guaranteeing a reliable, scalable framework for citizen identification.

Banks around the World Are Using Biometrics for Safe, Customer-Centric Authentication.

With cybercrime being a significant loss to the global economy, amounting to over $8 trillion per year, according to Cybersecurity Ventures, financial institutions make biometrics a priority in fraud prevention. Biometric systems like fingerprint and facial recognition have become the norm in mobile banking applications.

by 2023, more than 75% of U.S. banks had adopted biometric technology. In Asia, Alipay in China and Paytm in India used advanced biometrics for secure digital transactions, making users trust the service. This change decreases fraud risks and increases user experience, making biometric solutions critical in financial services.

RESTRAIN:

Although Biometric Systems Improve Security, They Create Privacy Issues, Which Negatively Impact Market Adoption.

Biometric authentication requires the collection and storage of sensitive personal information, creating concerns about misuse and breaches. In 2023, 65% of surveyed users in the EU expressed reservations about biometric systems, citing insufficient transparency in data handling. High-profile data breaches, such as the leak of 27 million facial records in Asia, amplify public skepticism.

Governments and companies face growing pressure to ensure robust data protection frameworks, such as compliance with GDPR in Europe or similar regulations globally. Without strict protections, the possibility of misuse of biometric data for surveillance or identity theft can prevent adoption. So, building public trust through higher security measures and clear policies is the key to sustained growth of the market.

by Modality

Multimodal Biometric Systems dominated 2023 with 65% market share due to their superior accuracy and adaptability, integrating multiple identifiers for robust authentication. Governments and enterprises favour multimodal systems to reduce fraud and enhance user convenience.

For instance, multimodal systems integrating fingerprint and facial recognition were deployed in major airports worldwide to streamline security. This segment is expected to have the highest growth with the fastest CAGR of 13.63% from 2024 to 2032 due to the rise in AI-powered analytics and adoption in industries with high-security levels, such as in defence and healthcare.

by Technology

Technologies in biometric authentication consist of fingerprint recognition, iris recognition, facial recognition, voice recognition, and palm recognition. The largest share in 2023 is accounted by fingerprint recognition, accounting for 48% market share, mainly due to the increased adoption in smartphones and banking applications.

Iris recognition, with a smaller share, will have the fastest CAGR of 14.21% during 2024-2032, as its high accuracy and contactless nature are highly sought in health care and defence applications. Further advancements in facial recognition algorithms and AI integration are changing the security landscapes in industries.

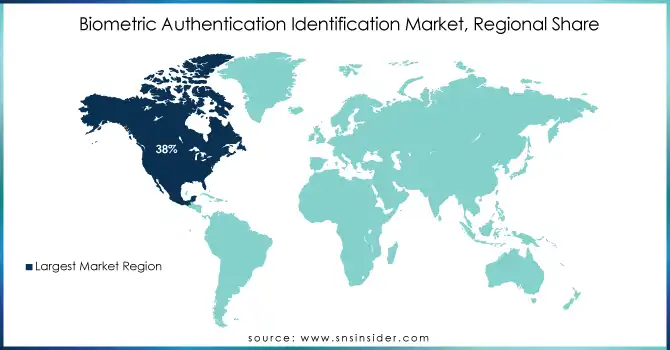

North America dominated the biometric authentication identification market in 2023, holding 38% of the market share, through government projects such as TSA's biometric expansion and rollouts of advanced systems in financial services.

Meanwhile, Europe is likely to grow at the fastest CAGR of 14.50% during 2024-2032, led by the EU's EES and rising adoption across the banking and healthcare industries. The rapid pace of digitalization in emerging markets such as Asia-Pacific also represents future growth potential.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in the Biometric Authentication Identification Market are

Thales Group (Gemalto biometric systems, fingerprint scanners)

NEC Corporation (NeoFace facial recognition, multimodal biometric solutions)

IDEMIA (MorphoWave scanners, digital identity platforms)

Suprema (BioStar 2 software, FaceStation biometrics)

HID Global (Lumidigm fingerprint sensors, access control solutions)

Fujitsu (PalmSecure palm vein scanners, biometric security solutions)

Cognitec Systems (FaceVACS software, facial recognition systems)

Bio-Key International (WEB-key software, fingerprint readers)

Aware Inc. (Knoxville SDK, biometric matching systems)

Precise Biometrics (Precise YOUNiQ, fingerprint software solutions)

ZKTeco (SpeedFace terminals, biometric access systems)

Dermalog Identification Systems (ABIS, biometric identification terminals)

Daon (IdentityX platform, biometric authentication solutions)

Innovatrics (SmartFace facial recognition, multimodal SDKs)

Crossmatch Technologies (Verifier biometric readers, DigitalPersona)

FaceTec (ZoOm 3D face authentication, liveness detection)

SecuGen (Hamster Pro fingerprint scanners, biometric software)

Stanley Security (Access control biometrics, enterprise security solutions)

Iris ID (iCAM iris scanners, access management)

Smartmatic (biometric voting solutions, identity verification platforms)

MAJOR SUPPLIERS (Components, Technologies)

3M (optical sensors, imaging components)

Sony Semiconductor Solutions (image sensors)

Qualcomm (AI processors, microchips)

Infineon Technologies (security microcontrollers)

Synaptics (biometric modules)

STMicroelectronics (custom ICs for biometrics)

Flextronics (hardware components)

LG Innotek (camera modules)

Lumentum (laser sensors)

Amkor Technology (semiconductor packaging services)

March 2024: NEC's flagship facial recognition product, NeoFace Reveal, has been advanced to Version 5 with such features as a new user interface, enhanced image improvement tools, and morphological analysis compliant with the Facial Identification Scientific Working Group standard, among others.

November 2024: Technology and blockchain solutions provider Serenity partners with IDEMIA Secure Transactions (IST) to launch sAxess, a biometric security card. The card is an innovation designed to enhance access control over data and scale to manage complex digital assets. Combining the expertise of Serenity in blockchain technology with the long experience of IDEMIA Secure Transactions, which caters to over 1,900 financial institutions and fintech clients globally with payment and connectivity solutions, this merger combines the two worlds.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 34.23 Billion |

| Market Size by 2032 | US$ 107.42 Billion |

| CAGR | CAGR of 13.57 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Modality (Market statistics, Multimodal biometric), • By Motility (Fixed, Mobile), • By Technology (Fingerprint Recognition, Iris Recognition, Facial Recognition, Voice Recognition, Palm Recognition), • By End Use (Government, Banking, Healthcare, Retail, Travel), • By Authentication Type (Single-Factor Authentication, Two-Factor Authentication, Multi-Factor Authentication), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thales Group, NEC Corporation, IDEMIA, Suprema, HID Global, Fujitsu, Cognitec Systems, Bio-Key International, Aware Inc., Precise Biometrics, ZKTeco, Dermalog Identification Systems, Daon, Innovatrics, Crossmatch Technologies, FaceTec, SecuGen, Stanley Security, Iris ID, Smartmatic. |

| Key Drivers | • Governments Around The World Are Increasingly Incorporating Biometrics Into Public Services. • Banks around the World Are Using Biometrics for Safe, Customer-Centric Authentication. |

| Restraints | • Although Biometric Systems Improve Security, They Create Privacy Issues, Which Negatively Impact Market Adoption. |

Ans: The Biometric Authentication Identification Market is expected to grow at a CAGR of 13.57% during 2024-2032.

Ans: Biometric Authentication Identification Market size was USD 34.23 Billion in 2023 and is expected to Reach USD 107.42 Billion by 2032.

Ans: The major growth factors of the Biometric Authentication Identification Market is Banks around the World Are Using Biometrics for Safe, Customer-Centric Authentication.

Ans: The Multimodal Biometric Systems segment dominated the Biometric Authentication Identification Market.

Ans: North America dominated the Biometric Authentication Identification Market in 2023.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Key Vendors and Feature Analysis, 2023

5.2 Performance Benchmarks, 2023

5.3 Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Biometric Authentication Identification Market Segmentation, by Modality

7.1 Chapter Overview

7.2 Market statistics

7.2.1 Market statistics Market Trends Analysis (2020-2032)

7.2.2 Market statistics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Multimodal biometric

7.3.1 Multimodal biometric Market Trends Analysis (2020-2032)

7.3.2 Multimodal biometric Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Biometric Authentication Identification Market Segmentation, by Motility

8.1 Chapter Overview

8.2 Fixed

8.2.1 Fixed Market Trends Analysis (2020-2032)

8.2.2 Fixed Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Mobile

8.3.1 Mobile Market Trends Analysis (2020-2032)

8.3.2 Mobile Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Biometric Authentication Identification Market Segmentation, by Technology

9.1 Chapter Overview

9.2 Fingerprint Recognition

9.2.1 Fingerprint Recognition Market Trends Analysis (2020-2032)

9.2.2 Fingerprint Recognition Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 Iris Recognition

9.3.1 Iris Recognition Market Trends Analysis (2020-2032)

9.3.2 Iris Recognition Market Size Estimates And Forecasts To 2032 (USD Billion)

9.4 Facial Recognition

9.4.1 Facial Recognition Market Trends Analysis (2020-2032)

9.4.2 Facial Recognition Market Size Estimates And Forecasts To 2032 (USD Billion)

9.5 Voice Recognition

9.5.1 Voice Recognition Market Trends Analysis (2020-2032)

9.5.2 Voice Recognition Market Size Estimates And Forecasts To 2032 (USD Billion)

9.6 Palm Recognition

9.6.1 Palm Recognition Market Trends Analysis (2020-2032)

9.6.2 Palm Recognition Market Size Estimates And Forecasts To 2032 (USD Billion)

10. Biometric Authentication Identification Market Segmentation, by End Use

10.1 Chapter Overview

10.2 Government

10.2.1 Government Market Trends Analysis (2020-2032)

10.2.2 Government Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 Banking

10.3.1 Banking Market Trends Analysis (2020-2032)

10.3.2 Banking Market Size Estimates And Forecasts To 2032 (USD Billion)

10.4 Healthcare

10.4.1 Healthcare Market Trends Analysis (2020-2032)

10.4.2 Healthcare Market Size Estimates And Forecasts To 2032 (USD Billion)

10.5 Retail

10.5.1 Retail Market Trends Analysis (2020-2032)

10.5.2 Retail Market Size Estimates And Forecasts To 2032 (USD Billion)

10.6 Travel

10.6.1 Travel Market Trends Analysis (2020-2032)

10.6.2 Travel Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Biometric Authentication Identification Market Segmentation, by Authentication Type

11.1 Chapter Overview

11.2 Single-Factor Authentication

11.2.1 Single-Factor Authentication Market Trends Analysis (2020-2032)

11.2.2 Single-Factor Authentication Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 Two-Factor Authentication

11.3.1 Two-Factor Authentication Market Trends Analysis (2020-2032)

11.3.2 Two-Factor Authentication Market Size Estimates And Forecasts To 2032 (USD Billion)

11.4 Multi -Factor Authentication

11.4.1 Multi -Factor Authentication Market Trends Analysis (2020-2032)

11.4.2 Multi -Factor Authentication Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Biometric Authentication Identification Market Estimates And Forecasts, by Country (2020-2032) (USD Billion)

12.2.3 North America Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.2.4 North America Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.2.5 North America Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.2.6 North America Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.2.7 North America Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.2.8.2 USA Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.2.8.3 USA Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.2.8.4 USA Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.2.8.5 USA Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.2.9.2 Canada Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.2.9.3 Canada Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.2.9.4 Canada Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.2.9.5 Canada Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.2.10.2 Mexico Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.2.10.3 Mexico Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.2.10.4 Mexico Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.2.10.5 Mexico Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Biometric Authentication Identification Market Estimates And Forecasts, by Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.1.8.2 Poland Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.1.8.3 Poland Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.1.8.4 Poland Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.1.8.5 Poland Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.1.9.2 Romania Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.1.9.3 Romania Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.1.9.4 Romania Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.1.9.5 Romania Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Biometric Authentication Identification Market Estimates And Forecasts, by Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.2.4 Western Europe Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.2.5 Western Europe Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.2.6 Western Europe Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.2.7 Western Europe Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.2.8.2 Germany Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.2.8.3 Germany Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.2.8.4 Germany Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.2.8.5 Germany Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.2.9.2 France Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.2.9.3 France Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.2.9.4 France Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.2.9.5 France Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.2.10.2 UK Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.2.10.3 UK Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.2.10.4 UK Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.2.10.5 UK Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.2.11.2 Italy Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.2.11.3 Italy Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.2.11.4 Italy Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.2.11.5 Italy Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.2.12.2 Spain Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.2.12.3 Spain Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.2.12.4 Spain Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.2.12.5 Spain Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.2.15.2 Austria Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.2.15.3 Austria Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.2.15.4 Austria Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.2.15.5 Austria Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Biometric Authentication Identification Market Estimates And Forecasts, by Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.4.4 Asia Pacific Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.4.5 Asia Pacific Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.4.6 Asia Pacific Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.4.7 Asia Pacific Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.4.8.2 China Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.4.8.3 China Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.4.8.4 China Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.4.8.5 China Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.4.9.2 India Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.4.9.3 India Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.4.9.4 India Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.4.9.5 India Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.4.10.2 Japan Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.4.10.3 Japan Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.4.10.4 Japan Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.4.10.5 Japan Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.4.11.2 South Korea Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.4.11.3 South Korea Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.4.11.4 South Korea Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.4.11.5 South Korea Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.4.12.2 Vietnam Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.4.12.3 Vietnam Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.4.12.4 Vietnam Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.4.12.5 Vietnam Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.4.13.2 Singapore Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.4.13.3 Singapore Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.4.13.4 Singapore Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.4.13.5 Singapore Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.4.14.2 Australia Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.4.14.3 Australia Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.4.14.4 Australia Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.4.14.5 Australia Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Biometric Authentication Identification Market Estimates And Forecasts, by Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.5.1.4 Middle East Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.5.1.5 Middle East Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.5.1.6 Middle East Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.5.1.7 Middle East Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.5.1.8.2 UAE Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.5.1.8.3 UAE Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.5.1.8.4 UAE Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.5.1.8.5 UAE Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Biometric Authentication Identification Market Estimates And Forecasts, by Country (2020-2032) (USD Billion)

12.5.2.3 Africa Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.5.2.4 Africa Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.5.2.5 Africa Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.5.2.6 Africa Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.5.2.7 Africa Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Biometric Authentication Identification Market Estimates And Forecasts, by Country (2020-2032) (USD Billion)

12.6.3 Latin America Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.6.4 Latin America Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.6.5 Latin America Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.6.6 Latin America Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.6.7 Latin America Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.6.8.2 Brazil Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.6.8.3 Brazil Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.6.8.4 Brazil Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.6.8.5 Brazil Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.6.9.2 Argentina Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.6.9.3 Argentina Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.6.9.4 Argentina Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.6.9.5 Argentina Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.6.10.2 Colombia Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.6.10.3 Colombia Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.6.10.4 Colombia Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.6.10.5 Colombia Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Biometric Authentication Identification Market Estimates And Forecasts, by Modality (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Biometric Authentication Identification Market Estimates And Forecasts, by Motility (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Biometric Authentication Identification Market Estimates And Forecasts, by Technology (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Biometric Authentication Identification Market Estimates And Forecasts, by End Use (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Biometric Authentication Identification Market Estimates And Forecasts, by Authentication Type (2020-2032) (USD Billion)

13. Company Profiles

13.1 Thales Group

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 NEC Corporation

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 IDEMIA

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 Suprema

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 HID Global

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 Fujitsu

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 Cognitec Systems

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Bio-Key International

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Precise Biometrics

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 ZKTeco

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Market Segmentation

By Modality

By Motility

By Technology

By End Use

By Authentication Type

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

Europe

Asia Pacific

Middle East & Africa

Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

The Industrial PC Market Size was USD 5.5 Billion in 2023 and is expected to reach USD 9.4 Billion by 2032 and grow at a CAGR of 5.9% by 2024-2032.

The Electronic Ceramics Market Size was valued at USD 12.57 Billion in 2023 and is expected to reach USD 20.56 Billion by 2032, and grow at a CAGR of 5.63% During 2024-2032

The Enterprise Manufacturing Intelligence Market Size was valued at USD 5.18 Billion in 2023 and is expected to grow to USD 16.11 Billion by 2032 and grow at a CAGR of 13.44% over the forecast period of 2024-2032

Industrial Safety Market Size was valued at USD 6.74 billion in 2023 and is expected to reach USD 12.39 billion by 2032 and grow at a CAGR of 7% over the forecast period 2024-2032.

The Parcel Sortation Systems Market size was valued at USD 1.75 Billion in 2023 and expected to grow at a CAGR of 8.01% to reach USD 3.50 Billion by 2032.

The Precision Planting Market Size was valued at $5.00 Billion in 2023. It is estimated to reach $12.24 Billion by 2032, at CAGR of 10.47% during 2024-2032

Hi! Click one of our member below to chat on Phone