Biologics Market Size:

The global Biologics Market size valued at USD 433.77 billion in 2023, is projected to reach USD 977.36 billion by 2032, growing at 9.46% CAGR over the forecast period of 2024-2032.

To get more information on Biologics Market - Request Free Sample Report

The biologics market has emerged as a cornerstone of modern healthcare, addressing complex medical challenges with innovative and targeted solutions. Biologics, encompassing monoclonal antibodies, vaccines, cell and gene therapies, and recombinant proteins, have proven highly effective in treating diseases like cancer, autoimmune disorders, and diabetes. For example, Keytruda, an immunotherapy for various cancers, has significantly improved survival rates in non-small cell lung cancer, while Humira continues to be a leading therapy for rheumatoid arthritis and Crohn’s disease.

The rising prevalence of chronic diseases is a key driver for biologics. According to the World Health Organization, chronic illnesses such as cancer and diabetes account for more than 60% of global deaths, creating a substantial demand for advanced treatments. In oncology, biologics like Herceptin have revolutionized care, with HER2-positive breast cancer patients experiencing improved survival rates of over 30% when treated with this targeted therapy.

Biosimilars are further expanding the market by improving accessibility and affordability. Regulatory bodies such as the FDA and EMA have approved over 40 biosimilars, including Zarxio, the first FDA-approved biosimilar, which offers a cost-effective alternative to Neupogen. These products have already saved healthcare systems billions, with biosimilar adoption in Europe reducing costs by an estimated USD 1.65 billion annually.

Technological advancements are propelling innovation within the biologics space. CRISPR gene-editing technology has paved the way for groundbreaking therapies like Kymriah, the first FDA-approved CAR-T cell therapy for leukemia. mRNA technology, popularized by the Pfizer-BioNTech and Moderna COVID-19 vaccines, has demonstrated the potential for rapid development of effective vaccines and is now being explored for cancer and other diseases.

With over 1,000 biologics in clinical trials, ranging from gene therapies to regenerative medicine, the market is positioned to address unmet medical needs on a global scale. As biologics continue to evolve, they are set to redefine therapeutic landscapes, improve patient outcomes, and drive innovation in healthcare delivery.

Biologics Market Dynamics

Drivers

-

The increasing global burden of chronic diseases such as cancer, diabetes, and autoimmune disorders is a major driver for the biologics market.

According to the International Agency for Research on Cancer, the number of new cancer cases is projected to rise to 28.4 million by 2040, fueling demand for targeted biologics like monoclonal antibodies and immunotherapies. Similarly, the International Diabetes Federation estimates that 1 in 9 adults worldwide will have diabetes by 2030, highlighting the critical need for advanced biologics such as recombinant insulin. Biologics offer unparalleled specificity and efficacy, making them essential in managing these complex conditions, thereby driving their adoption.

-

Technological Advancements in Biopharmaceutical Manufacturing

The biologics market is benefiting from cutting-edge technological advancements such as CRISPR gene editing, mRNA technology, and CAR-T cell therapies. These innovations enable the development of highly personalized and effective treatments, particularly in oncology and rare genetic disorders. For example, CAR-T cell therapies like Kymriah and Yescarta have revolutionized hematological cancer treatment by leveraging the body’s immune system to target and destroy cancer cells. Moreover, mRNA vaccine technology, which proved transformative during the COVID-19 pandemic, is now being explored for other conditions like HIV and melanoma. These technological breakthroughs are not only expanding the scope of biologics but also reducing development timelines, thereby driving market growth.

-

Streamlined regulatory frameworks and government initiatives to enhance healthcare access are accelerating biologics market growth.

Policies like the FDA’s Biosimilars Action Plan have facilitated the approval of over 40 biosimilars, increasing the availability of affordable alternatives. Europe, a leader in biosimilar adoption, has achieved substantial cost savings, enabling broader patient access. Additionally, emerging markets are witnessing expanded healthcare budgets and infrastructure improvements, encouraging the adoption of biologics. Collaborative efforts between governments, industry players, and non-profits are further enhancing the reach of life-saving therapies to underserved populations, solidifying biologics’ role in addressing critical healthcare needs globally.

Restraints

-

High Cost and Affordability Concerns

One of the significant restraints for the biologics market is the high cost of production and the subsequent pricing of biologic therapies. Biologics are often expensive due to the complexity involved in their development, manufacturing, and regulatory approval processes. For instance, Zolgensma, a gene therapy for spinal muscular atrophy, costs around USD 2.1 million per patient, making it one of the most expensive drugs in the world. This high cost creates challenges for patients, healthcare systems, and insurance providers, especially in low- and middle-income countries where access to expensive therapies is limited. The affordability issue also impacts the uptake of biologics in developed markets, where even insured patients may struggle with out-of-pocket expenses. While biosimilars offer a more cost-effective alternative, they still face challenges in gaining widespread adoption, and the pricing disparity between originators and biosimilars continues to be a barrier to universal access.

Biologics Market Segmentation Insights

By Source

In 2023, mammalian cells continued to dominate biologics production, accounting for 65% of the market. Mammalian cell systems, like Chinese hamster ovary (CHO) cells, are particularly favored for their ability to produce complex biologics that require human-like post-translational modifications, which are critical for the therapeutic efficacy of many biologics. This includes monoclonal antibodies, vaccines, and recombinant proteins, making mammalian-based production systems the preferred choice in the industry. Mammalian cells are used for the production of key biologic drugs such as Humira (adalimumab) and Herceptin (trastuzumab), which are widely used for treating autoimmune diseases and cancers.

The microbial source for biologics production is anticipated to be the fastest growth in 2023, driven by its cost-effectiveness, scalability, and efficiency in producing therapeutic proteins. Microbial systems, particularly Escherichia coli (E. coli) and yeast cells, are becoming increasingly popular in the production of vaccines, recombinant proteins, and other biologics due to their rapid fermentation capabilities and low production costs compared to mammalian systems. Microbial systems are used in producing essential biologics like insulin and growth hormones, as well as vaccines for infectious diseases. This segment’s growth was significant, contributing to an expanding share of the biologics market.

By Product

Monoclonal antibodies (mAbs) were the dominant product segment in the biologics market in 2023, making up nearly 45% of the total biologics market. These therapies are widely used in the treatment of various chronic diseases, including cancer, autoimmune disorders, and infectious diseases. Monoclonal antibodies offer high specificity, targeting specific antigens with minimal side effects, contributing to their high adoption in clinical treatments. Drugs such as Keytruda (pembrolizumab) for cancer treatment and Humira (adalimumab) for autoimmune conditions have significantly contributed to the segment’s dominance.

Among the product segments, antisense and RNAi therapeutics emerged as the fastest-growing throughout the forecast period. This segment's rapid expansion is largely due to advancements in gene-based therapies, targeting specific RNA molecules to treat genetic disorders and diseases caused by abnormal protein production. The success of Spinraza, a therapy for spinal muscular atrophy (SMA), has highlighted the potential of RNA-based therapeutics. The interest in RNA-based vaccines, particularly those developed for COVID-19, has further accelerated the growth of this segment, expanding its potential applications for other diseases. The increased focus on precision medicine and genetic treatments has positioned antisense and RNAi therapeutics as one of the most promising and rapidly evolving areas in biologics.

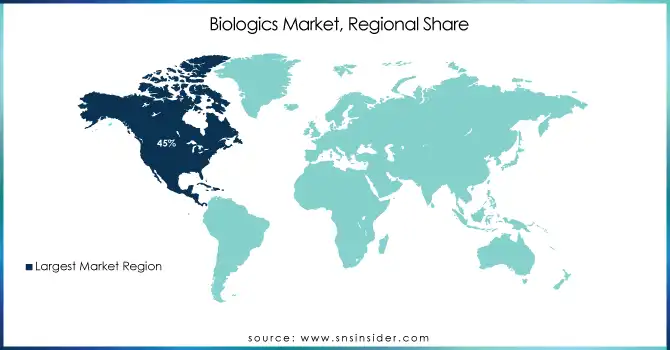

Biologics Market Regional Overview

North America remained the dominant region, accounting for the largest share of the biologics market at 45% in 2023. This growth is driven by robust healthcare infrastructure, advanced research facilities, and a high demand for biologic treatments. The U.S. is a major contributor, with substantial investments in the development of biologics, particularly monoclonal antibodies and gene therapies. The FDA's support for innovation and regulatory pathways for biologics, including biosimilars, further bolstered market growth.

Europe followed closely, contributing significantly to the biologics market. The region's market expansion is driven by established pharmaceutical hubs and a growing emphasis on biosimilars. Countries like Germany, the UK, and France are prominent players in biologics production and adoption. The European Medicines Agency (EMA) has been instrumental in providing regulatory frameworks for the approval of biosimilars, expanding access to biologic therapies.

Asia-Pacific is the fastest-growing region, experiencing an increasing demand for biologics driven by the rising prevalence of chronic diseases, expanding healthcare access, and growing investments in biotechnology. China and India are emerging as key contributors to biologics production and clinical trials, especially in biosimilars and affordable biologic therapies. This growth is expected to continue due to technological advancements and cost-effective manufacturing capabilities.

Get Customized Report as per Your Business Requirement - Enquiry Now

List of Key Players in Biologics Market

-

-

Contract Development and Manufacturing Organization (CDMO) services for biologics.

-

-

-

Humira

-

Enbrel

-

-

Novo Nordisk A/S

-

NovoLog

-

Ozempic

-

-

AbbVie Inc.

-

Humira

-

-

Sanofi

-

Dupixent

-

-

Johnson & Johnson Services, Inc.

-

Remicade

-

-

Celltrion Healthcare Co., Ltd.

-

Remsima

-

-

Bristol-Myers Squibb Company

-

Opdivo

-

-

Eli Lilly and Company

-

Humalog

-

-

F. Hoffmann-La Roche Ltd.

-

Rituxan

-

-

GlaxoSmithKline PLC

-

Benlysta

-

-

Merck & Co.

-

Keytruda

-

-

Pfizer Inc.

-

Ibrance

-

-

AstraZeneca PLC

-

Tagrisso

-

Recent Developments

In Jan 2025, The U.S. FDA accepted Eisai Co., Ltd. and Biogen Inc.'s Biologics License Application (BLA) for LEQEMBI (lecanemab-irmb), a subcutaneous autoinjector for weekly maintenance dosing in the treatment of early Alzheimer's disease (Mild Cognitive Impairment and mild dementia). The Prescription Drug User Fee Act (PDUFA) action date is scheduled for August 31, 2025.

In Jan 2025, Cytovance Biologics and PolyPeptide partnered to provide an integrated solution for the development and manufacturing of peptide drugs expressed through microbial and mammalian systems. This collaboration offers scalable options to meet diverse product requirements for outsourcing.

In Jan 2025, Samsung Biologics secured its largest-ever CMO deal, valued at USD 1.4 billion, with a European pharmaceutical company. This agreement accounts for 40% of the company's total orders expected in 2024.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 433.77 Billion |

| Market Size by 2032 | USD 977.36 Billion |

| CAGR | CAGR of 9.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source [Microbial, Mammalian, Others] • By Product [Monoclonal Antibodies {MABs by Application (Diagnostic {Biochemical Analysis, Diagnostic Imaging}, (Therapeutic {Direct MAB Agents, Targeting MAB Agents (Protein Purification, Others)}, {MABs by Type (Murine, Chimeric, Humanized, Human, Others)}, Vaccines, Recombinant Proteins, Antisense & RNAi Therapeutics, Others] • By Disease Category [Oncology, Infectious Diseases, Immunological Disorders, Cardiovascular Disorders, Hematological Disorders, Others] • By Manufacturing [Outsourced, In-house] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Propeller Health, Hewlett-Packard (HP), Medtronic, AstraZeneca, Becton Dickinson (BD), Mylan Pharmaceuticals, Biocorp, Teva Pharmaceutical Industries, Insulet Corporation, Sonova, Roche, Johnson & Johnson, Novo Nordisk, Meda Pharmaceuticals, Biogen, Eli Lilly and Co., Sandoz (Novartis), Philips Healthcare, F. Hoffmann-La Roche, Xhale. |

| Key Drivers | • The increasing global burden of chronic diseases such as cancer, diabetes, and autoimmune disorders is a major driver for the biologics market. • Technological Advancements in Biopharmaceutical Manufacturing • Streamlined regulatory frameworks and government initiatives to enhance healthcare access are accelerating biologics market growth. |

| Restraints | • High Cost and Affordability Concerns |