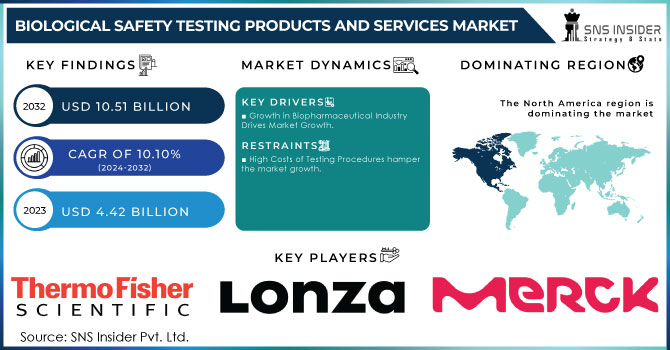

The Biological Safety Testing Products and Services Market was valued at USD 4.62 billion in 2023 and is expected to reach USD 11.58 billion by 2032, growing at a CAGR of 10.77% over the forecast period of 2024-2032. This report profiles the adoption and market penetration of biological safety testing by region, driven by strict regulatory environments and increasing demand for biopharmaceuticals. The research analyzes the trend shift from outsourced to in-house testing, with a trend towards contract research organizations (CROs) gaining popularity driven by economic efficiency and regulatory knowledge. Furthermore, it considers changing compliance trends, which are key drivers for shaping testing strategies and market growth. The study explores the influence of biopharmaceutical industry expansion on testing demand, with growing drug development pipelines demanding rigorous safety testing. New technologies in biological safety testing, including automated detection systems and AI-based analytics, are improving testing accuracy and efficiency. Emerging contaminants and the growing demand for advanced testing solutions are also pushing innovation in the market, ensuring product safety across biologics, vaccines, and gene therapies. In addition, R&D and healthcare expenditures on biological safety testing are region-specific, with government, commercial, and private investments defining market trends.

The U.S. Biological Safety Testing Products and Services Market was valued at USD 1.36 billion in 2023 and is expected to reach USD 3.09 billion by 2032, growing at a CAGR of 9.54% over the forecast period of 2024-2032. In the United States, the market is growing as a result of increasing FDA regulations, higher investment in biotech R&D, and a rise in government-sponsored programs for biopharmaceutical innovation and quality control.

Market Dynamics

Drivers

The expanding biopharmaceutical industry and the increasing regulatory requirements for product safety.

The increasing incidence of chronic diseases and infectious outbreaks has driven up demand for biologics, vaccines, and gene therapies, all of which need stringent safety testing. As an example, mRNA-based vaccine and monoclonal antibody drug development has spawned increased levels of endotoxin, sterility, and mycoplasma testing. Regulatory bodies, such as the FDA, EMA, and WHO, have enforced strict regulations requiring thorough biological safety testing to guarantee product efficacy and patient safety. Non-compliance with these regulations leads to product recalls and delays, compelling manufacturers to invest in sophisticated biosafety testing solutions. Also, the growing use of cell and gene therapies has further propelled the demand for advanced testing, including adventitious agent screening and viral clearance testing. The trend of pharmaceutical companies outsourcing more activities to contract research organizations (CROs) for biosafety testing services is also propelling market growth. Advances in technology in swift microbiological test techniques, e.g., real-time PCR and next-generation sequencing (NGS), are streamlining efficiency, minimizing turnaround time, and raising contamination detection specificity, making biologic safety testing a necessity for the entire biopharmaceutical sector.

Restraints

High Cost and Complex Regulatory Approvals Impacting Market Expansion

One of the key restraints on the biological safety testing market is the expensive nature of testing and compliance. The adoption of sophisticated biosafety testing protocols entails substantial investment in sophisticated equipment, reagents, and trained personnel, raising operational costs for biopharmaceutical firms. The cost of endotoxin and sterility testing per batch may average anywhere from USD 5,000 to USD 15,000, rendering periodic testing costly, particularly for small and medium-sized biotech companies. In addition, lengthy and intricate regulatory approval procedures are the biggest challenge to manufacturers. Novel biologics, such as vaccines and gene therapies, need to be subject to numerous safety tests, typically resulting in lengthy approval times. The rigorous regulatory specifications imposed by regulatory bodies like the FDA, EMA, and ICH impose massive documentation and validation, raising costs and timelines for market release.

Opportunities

The increasing adoption of rapid microbiological methods (RMMs) and the rising demand for outsourced biosafety testing services.

Traditional biological safety testing methods tend to be time-consuming, with sterility tests taking as long as 14 days to yield results. But new rapid testing technologies like real-time PCR, flow cytometry, and biosensors are making it possible to detect contamination more quickly and accurately, compressing turnaround times from days to hours. The increasing application of artificial intelligence (AI) and automation in biosafety testing is also increasing efficiency and accuracy. Further, the growth of contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) is developing new business opportunities. More than 60% of the biotech and pharma firms are outsourcing biological safety testing to expert third-party service providers to cut operating expenses and regulatory burdens. In addition, the growing interest in the development of biosimilar and cell therapy is increasing the need for customized safety testing solutions. Firms that are investing in new in vitro test models, LAL assay synthetic alternatives, and high-throughput screening platforms are best positioned to benefit from this increasing market. Increased development of biologics production plants and new regulatory routes for advanced therapies are further creating promising opportunities in the market.

Challenges

The frequent changes in regulatory requirements and the increasing risk of microbial and viral contamination in biopharmaceutical manufacturing.

Regulatory bodies such as the FDA, EMA, and WHO are constantly refining biosafety standards, prompting manufacturers to change with increasing standards and introduce more testing methods. This uncertainty makes compliance planning more difficult and raises the expense of retaining regulatory clearance. Furthermore, increased cases of contamination in biopharmaceutical manufacturing represent a substantial challenge. For example, over the past few years, various vaccine makers experienced mycoplasma and endotoxin contamination, which resulted in expensive recalls and delays. The increasing sophistication of gene and cell therapy production processes also raises the risk of contamination, as these treatments are sensitive to handling, need strict sterility, and undergo rigorous viral clearance testing. The limited shelf life of biologics and personalized drugs creates another level of challenge in maintaining quality control within limited time windows. In addition, the lack of experienced personnel with knowledge in biological safety testing and regulatory compliance is slowing down the adoption of novel safety evaluation technologies. Overcoming these challenges needs ongoing investment in workforce development, enhanced contamination control strategies, and flexible regulatory compliance solutions to assure smooth biologic and vaccine production.

By Product

In 2023, the reagents & kits segment maintained a dominant revenue share of more than 38.5% and was the largest category in the biological safety testing market. The reason for their dominance lies in the common utilization of consumables in day-to-day testing methods like endotoxin, sterility, and mycoplasma testing. The continuous need for reagents and kits among pharmaceuticals, biotechnology companies, and contract research organizations has helped increase their market share by a considerable amount.

Conversely, the instruments segment is likely to register the most rapid growth till 2032, spurred by the growing utilization of sophisticated technology for automated biological safety testing. The surging demand for RMMs, real-time PCR systems, and NGS to detect contamination is fueling the growth of the segment. Progress in high-throughput testing solutions is also becoming more cost-efficient, thereby expanding their adoption further.

By Application

The vaccines & therapeutics segment held the largest revenue share in 2023, controlling the market through the influx in vaccine manufacturing, such as for infectious diseases and oncology. With growing worldwide demand for biologics, high regulatory standards on the safety of vaccines, and increased use of monoclonal antibody therapies, the segment is still leading the market. The widespread use of biological safety testing in the assurance of the sterility and purity of vaccines and therapeutic biologics has further cemented its supremacy.

The gene therapy segment is anticipated to expand at the highest growth rate during 2032, led by the fast growth of cell and gene therapy research, FDA approvals of gene-based therapies, and increasing clinical trials. The accelerating demand for rigorous biological safety testing of viral vectors during manufacturing and the avoidance of adventitious agent contamination is further accelerating this segment's growth. Gene therapy, as it continues to redefine the biopharmaceuticals industry, will further accelerate the demand for highly specialized safety testing services.

By Test Type

In 2023, the endotoxin tests segment held the largest market share in terms of revenue, as these tests are indispensable for the detection of bacterial endotoxins in biopharmaceuticals, medical devices, and injectable pharmaceuticals. Endotoxin testing is required by regulatory bodies for all injectable and implantable medical devices to guarantee patient safety and compliance. The frequent testing and extensive use of limulus amebocyte lysate (LAL)-based assays have established this segment as the market leader.

The bioburden tests segment is expected to show the highest growth until 2032 due to a growing emphasis on contamination control in biopharmaceutical production. With regulatory authorities imposing tighter limits on microbial contamination, demand for bioburden testing is growing, especially in the fields of cell therapy, gene therapy, and vaccine development. The increasing trend toward faster and automated bioburden testing technologies is also propelling the segment toward rapid growth.

Regional Analysis

North America led the biological safety testing products and services market in 2023 with high usage of biopharmaceuticals, sophisticated healthcare infrastructure, and stringent regulatory norms established by the FDA and USP. The United States is the largest contributor, with a strong sector for manufacturing biologics, higher gene therapy investments, and extensive outsourcing to contract research organizations (CROs). Moreover, the availability of dominant market players and robust government support for R&D has further strengthened North America's dominance in biological safety testing. Europe is a close second, with stringent regulatory guidelines enforced by the EMA and increasing emphasis on biosimilar manufacturing.

Asia-Pacific is expected to be the fastest-growing region up to 2032, driven by growing biopharmaceutical manufacturing centers in China, India, South Korea, and Japan, as well as increasing government efforts to enhance regulatory compliance. China and India are seeing more investment in contract testing services and vaccine manufacturing, which is driving demand for biological safety testing considerably. In addition, affordable manufacturing and increasing partnerships between international pharma companies and APAC-based CDMOs are driving regional market growth. Increasing use of accelerated microbiological tests and automated test solutions also further establish the Asia-Pacific region as a principal growth driver for the industry.

Charles River Laboratories – Endosafe nexgen-PTS, Accugenix Microbial Identification System

BSL Bioservice – Mycoplasma Detection Assays, Adventitious Agent Testing Services

Merck KGaA (MilliporeSigma) – Steritest NEO System, PyroMAT System

Samsung Biologics – Viral Clearance Testing Service, Endotoxin & Bioburden Testing

Sartorius AG – Microsart Filtration System, Sartoclear Dynamics Lab Filtration

Eurofins Scientific – GMP Sterility Testing, Residual Host Cell Protein Analysis

SGS Société Générale de Surveillance SA – Mycoplasma Testing Service, Bioburden & Endotoxin Testing

Thermo Fisher Scientific Inc. – Applied Biosystems qPCR Kits, EndoPrep Endotoxin Testing

BIOMÉRIEUX – BACT/ALERT 3D, Endozyme Endotoxin Detection Assays

Lonza – PyroGene Recombinant Factor C Assay, MycoAlert Mycoplasma Detection Kits

Recent Developments

In Oct 2024, Merck launched a €290 million biosafety testing facility in Rockville, Maryland, USA, to address the rising global demand for advanced biological safety testing solutions. This expansion strengthens its capacity to support biopharmaceutical manufacturers with stringent regulatory compliance and quality assurance.

| Report Attributes | Details |

| Market Size in 2023 | USD 4.62 billion |

| Market Size by 2032 | USD 11.58 billion |

| CAGR | CAGR of 10.77% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Reagents & Kits, Services, Instruments] • By Application [Vaccines & Therapeutics (Vaccines, Monoclonal Antibodies, Recombinant Protein), Blood & Blood-based Products, Gene Therapy, Tissue & Tissue-based Products, Stem Cell] • By Test Type [Endotoxin Tests, Sterility Tests, Cell Line Authentication & Characterization Tests, Bioburden Tests, Adventitious Agent Detection Tests, Residual Host Contamination Detection Tests, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Charles River Laboratories, BSL Bioservice, Merck KGaA (MilliporeSigma), Samsung Biologics, Sartorius AG, Eurofins Scientific, SGS Société Générale de Surveillance SA, Thermo Fisher Scientific Inc., BIOMÉRIEUX, Lonza. |

Ans: The Biological Safety Testing Products and Services Market was valued at USD 4.62 billion in 2023.

Ans: The expected CAGR of the global Biological Safety Testing Products and Services Market during the forecast period is 10.77%.

Ans: The vaccines & therapeutics will grow rapidly in the Biological Safety Testing Products and Services Market from 2024-2032.

Ans: Growth in Biopharmaceutical Industry Drives Market Growth.

Ans: The U.S. led the Biological Safety Testing Products and Services Market in the North America region with the highest revenue share in 2023.

Table of contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research & Academic Institutes Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research & Academic Institutes Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption & Market Penetration of Biological Safety Testing (2023), by Region

5.2 Growth in Outsourced vs. In-house Biological Safety Testing (2020-2032)

5.3 Regulatory Compliance Trends and Their Impact on Testing Market (2023-2032)

5.4 Biopharmaceutical Industry Expansion and Its Impact on Testing Market (2020-2032)

5.5 Advancements in Biological Safety Testing Technologies and Market Impact (2023-2032)

5.6 Emerging Contaminants and the Need for Enhanced Testing Solutions (2023-2032)

5.7 R&D and Healthcare Spending on Biological Safety Testing, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and Promotional Activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Biological Safety Testing Products and Services Market Segmentation, by Product

7.1 Chapter Overview

7.2 Kits & Reagents

7.2.1 Kits & Reagents Market Trends Analysis (2020-2032)

7.2.2 Kits & Reagents Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Instruments

7.4.1 Instruments Market Trends Analysis (2020-2032)

7.4.2 Instruments Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Biological Safety Testing Products and Services Market Segmentation, by Application

8.1 Chapter Overview

8.2 Vaccines & Therapeutics

8.2.1 Vaccines & Therapeutics Market Trends Analysis (2020-2032)

8.2.2 Vaccines & Therapeutics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.3 Vaccines

8.2.3.1 Vaccines Market Trends Analysis (2020-2032)

8.2.3.2 Vaccines Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.4 Monoclonal Antibodies

8.2.4.1 Monoclonal Antibodies Market Trends Analysis (2020-2032)

8.2.4.2 Monoclonal Antibodies Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.5 Recombinant Protein

8.2.5.1 Recombinant Protein Market Trends Analysis (2020-2032)

8.2.5.2 Recombinant Protein Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Blood & Blood-based Products

8.3.1 Blood & Blood-based Products Market Trends Analysis (2020-2032)

8.3.2 Blood & Blood-based Products Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Gene Therapy

8.4.1 Gene Therapy Market Trends Analysis (2020-2032)

8.4.2 Gene Therapy Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Tissue & Tissue-based Products

8.5.1 Tissue & Tissue-based Products Market Trends Analysis (2020-2032)

8.5.2 Tissue & Tissue-based Products Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Stem Cell

8.6.1 Stem Cell Market Trends Analysis (2020-2032)

8.6.2 Stem Cell Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Biological Safety Testing Products and Services Market Segmentation, by Test Type

9.1 Chapter Overview

9.2 Endotoxin Tests

9.2.1 Endotoxin Tests Market Trends Analysis (2020-2032)

9.2.2 Endotoxin Tests Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Sterility Tests

9.3.1 Sterility Tests Market Trends Analysis (2020-2032)

9.3.2 Sterility Tests Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Cell Line Authentication & Characterization Tests

9.4.1 Cell Line Authentication & Characterization Tests Market Trends Analysis (2020-2032)

9.4.2 Cell Line Authentication & Characterization Tests Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Bioburden Tests

9.5.1 Bioburden Tests Market Trends Analysis (2020-2032)

9.5.2 Bioburden Tests Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Adventitious Agent Detection Tests

9.6.1 Adventitious Agent Detection Tests Market Trends Analysis (2020-2032)

9.6.2 Adventitious Agent Detection Tests Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Residual Host Contamination Detection Tests

9.7.1 Residual Host Contamination Detection Tests Market Trends Analysis (2020-2032)

9.7.2 Residual Host Contamination Detection Tests Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Others

9.8.1 Others Market Trends Analysis (2020-2032)

9.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Biological Safety Testing Products and Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.4 North America Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 North America Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.6.2 USA Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6.3 USA Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.7.2 Canada Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7.3 Canada Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.8.2 Mexico Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Biological Safety Testing Products and Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.6.2 Poland Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.7.2 Romania Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.1.9 turkey

10.3.1.9.1 Turkey Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Biological Safety Testing Products and Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.4 Western Europe Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.6.2 Germany Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.7.2 France Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7.3 France Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.8.2 UK Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.9.2 Italy Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.10.2 Spain Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.13.2 Austria Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Biological Safety Testing Products and Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.4 Asia Pacific Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.6.2 China Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6.3 China Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.7.2 India Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7.3 India Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.8.2 Japan Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8.3 Japan Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.9.2 South Korea Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.10.2 Vietnam Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.11.2 Singapore Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.12.2 Australia Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12.3 Australia Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Biological Safety Testing Products and Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.4 Middle East Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.6.2 UAE Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Biological Safety Testing Products and Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.4 Africa Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 Africa Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Biological Safety Testing Products and Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.4 Latin America Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Latin America Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.6.2 Brazil Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.7.2 Argentina Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.8.2 Colombia Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Biological Safety Testing Products and Services Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Biological Safety Testing Products and Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Biological Safety Testing Products and Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

11. Company Profiles

11.1 Charles River Laboratories

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Product / Services Offered

11.1.4 SWOT Analysis

11.2 BSL Bioservice

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Product / Services Offered

11.2.4 SWOT Analysis

11.3 Merck KGaA (MilliporeSigma)

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Product / Services Offered

11.3.4 SWOT Analysis

11.4 Samsung Biologics

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Product / Services Offered

11.4.4 SWOT Analysis

11.5 Sartorius AG

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Product / Services Offered

11.5.4 SWOT Analysis

11.6 Eurofins Scientific

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Product / Services Offered

11.6.4 SWOT Analysis

11.7 SGS Société Générale de Surveillance SA

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Product / Services Offered

11.7.4 SWOT Analysis

11.8 Thermo Fisher Scientific Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Product / Services Offered

11.8.4 SWOT Analysis

11.9 BIOMÉRIEUX

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Product / Services Offered

11.9.4 SWOT Analysis

11.10 Lonza

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Product / Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Product

Reagents & Kits

Services

Instruments

By Application

Vaccines & Therapeutics

Vaccines

Monoclonal Antibodies

Recombinant Protein

Blood & Blood-based Products

Gene Therapy

Tissue & Tissue-based Products

Stem Cell

By Test Type

Endotoxin Tests

Sterility Tests

Cell Line Authentication & Characterization Tests

Bioburden Tests

Adventitious Agent Detection Tests

Residual Host Contamination Detection Tests

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

Specialty Medical Chairs Market was valued at USD 4.6 billion in 2023 and is expected to reach USD 8.47 billion by 2032, growing at a CAGR of 7.04% over the forecast period of 2024-2032.

The Neonatal Respiratory Care Devices Market size was valued at USD 1.82 billion In 2023 & is estimated to reach USD 3.10 billion by 2032 and increase at a compound annual growth rate of 6.1% between 2024 and 2032.

The Cardiac Monitoring Devices Market size is projected to grow from USD 29.15 billion in 2023 to USD 48.58 billion by 2032, at a Compound Annual Growth Rate (CAGR) of 5.84% during the forecast period 2024-2032.

The Basal Cell Carcinoma Treatment Market size was estimated at USD 5.56 billion in 2023 and is projected to reach USD 8.96 billion by 2032, at a CAGR of 5.48%.

The HLA Typing Market size was estimated at USD 1.59 billion in 2023 and is expected to reach USD 2.84 billion by 2032 at a CAGR of 6.6% during the forecast period of 2024-2032.

The Medical Equipment Rental Market was valued at USD 58.57 Billion in 2023 and is expected to reach USD 97.69 billion by 2032 and grow at a CAGR of 5.85%.

Hi! Click one of our member below to chat on Phone