Get More Information on Biological Safety Cabinet Market - Request Sample Report

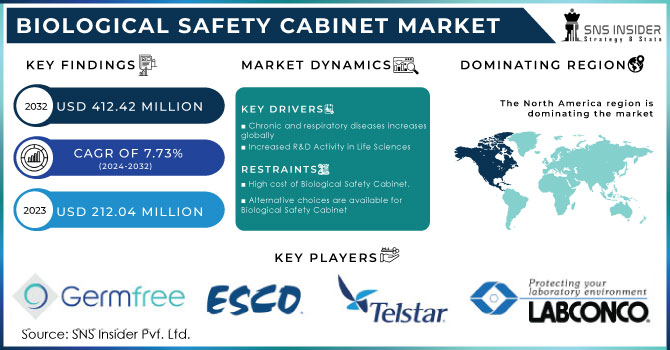

The Biological Safety Cabinet Market Size was valued at USD 224.85 Million in 2023 and is expected to reach USD 404.98 Million by 2032, growing at a CAGR of 6.76% over the forecast period of 2024-2032.

The Biological Safety Cabinets Market is expanding rapidly, driven by sustainability initiatives in manufacturing, as companies adopt eco-friendly practices to meet rising environmental concerns. Our report delves into the cost considerations that laboratories face when acquiring biological safety cabinets, highlighting the balance between performance, safety, and budget. It also examines the impact of global trends in laboratory automation, as automated systems enhance operational efficiency and increase demand for advanced safety solutions. Furthermore, our analysis covers the life cycle of biological safety cabinets, focusing on sustainability from production to disposal. These insights offer a comprehensive understanding of the factors influencing the market’s evolution, ensuring a complete view of current and future trends shaping the industry.

The US Biological Safety Cabinet Market Size was valued at USD 68.48 Million in 2023 with a market share of around 75% and growing at a significant CAGR over the forecast period of 2024-2032.

The Biological Safety Cabinets Market in the United States is growing due to increasing demand for safety in laboratories and research facilities, particularly in the pharmaceutical, biotechnological, and healthcare sectors. U.S. regulatory bodies like the Occupational Safety and Health Administration (OSHA) and the Centers for Disease Control and Prevention (CDC) are enforcing stringent safety standards, further driving adoption. The surge in research and vaccine development, particularly during the COVID-19 pandemic, has also boosted market growth. Companies like Thermo Fisher Scientific and Labconco Corporation are leading innovations in biological safety cabinet design, integrating advanced filtration systems and automation to meet these rising demands.

Drivers

Rapid Advancements in Automated Filtration and Environmental Control Technologies Accelerating the Adoption and Innovation of Biological Safety Cabinets Across Markets

Technological breakthroughs in automated filtration and environmental control are revolutionizing the design and functionality of biological safety cabinets, thus propelling market growth across various regions. Manufacturers are incorporating sophisticated sensors, real-time monitoring systems, and smart automation into safety cabinets, ensuring superior performance in controlling hazardous aerosols and pathogens. These innovations offer enhanced reliability, precision, and operational efficiency by reducing human error and providing consistent air quality management. As automation becomes increasingly integral to laboratory operations, the need for advanced safety equipment that can seamlessly integrate with digital monitoring systems has surged. In addition, the ability to remotely track performance data and execute predictive maintenance routines minimizes downtime and extends equipment life. Laboratories are witnessing a shift from conventional manual systems to intelligent cabinets that adapt to environmental changes automatically, thereby enhancing user safety and workflow efficiency. This technological leap is not confined to any one market; it is a global trend that drives manufacturers to invest in research and development, creating a ripple effect throughout the industry. The enhanced features and reliability provided by these advancements make biological safety cabinets an indispensable asset for modern laboratories, pushing the boundaries of what is possible in terms of safety, efficiency, and sustainability in hazardous material handling.

Restraints

High Capital Investment Requirements and Stringent Regulatory Compliance Hampering the Widespread Adoption of Biological Safety Cabinets in Emerging Regions Globally

Despite the critical role biological safety cabinets play in maintaining laboratory safety, high capital investment requirements and stringent regulatory compliance continue to restrain market expansion in emerging regions globally. Laboratories, especially in developing economies, face financial constraints that limit their ability to invest in advanced safety technologies. The upfront costs of acquiring state-of-the-art biological safety cabinets are often prohibitive for smaller institutions and research centers with limited budgets. Additionally, navigating the complex regulatory landscape requires significant investment in quality assurance, documentation, and certification processes. These challenges are compounded by the need to regularly upgrade equipment to keep pace with evolving safety standards, adding to the financial burden on institutions. In emerging regions, where infrastructure development and funding are still in progress, the gap between technological advancement and affordability widens, leading to slower market penetration. The rigorous compliance requirements, while essential for ensuring safety, can deter potential buyers due to the perceived complexity and cost of maintaining certification standards. Consequently, the combination of high investment costs and the pressure of adhering to multifaceted regulatory frameworks acts as a significant barrier, curtailing the rapid adoption of biological safety cabinets and limiting their market reach in areas that need them the most.

Opportunities

Expanding Integration of Cloud-Based Software and Remote Surveillance Systems Facilitating Proactive Decision Making in Biological Safety Cabinets Utilization Across Industries

The integration of cloud-based software solutions and remote surveillance systems is emerging as a significant opportunity in the biological safety cabinets market, transforming how these critical systems are monitored and managed across industries. Cloud-based platforms enable real-time data aggregation, remote diagnostics, and seamless communication between safety cabinets and central monitoring hubs. This integration facilitates proactive decision making by providing users with instant access to performance metrics, maintenance alerts, and system health reports regardless of location. By leveraging remote surveillance, laboratory managers can monitor the operational status of biological safety cabinets in multiple facilities concurrently, ensuring uniform adherence to safety standards and quick response times in the event of system irregularities. This technological advancement not only enhances operational efficiency but also contributes to cost savings by reducing the need for on-site technical support and manual inspections. In addition, the continuous flow of data into cloud repositories offers opportunities for advanced analytics, enabling manufacturers to identify usage trends, optimize system designs, and offer tailored service packages. Such digital integration empowers laboratories to adopt a more dynamic and responsive approach to safety management, thereby elevating the overall performance and reliability of biological safety cabinets. The transformative impact of cloud-based and remote surveillance technologies is setting a new benchmark in proactive maintenance and operational excellence across various sectors.

Challenge

Complex Compliance with Evolving International Standards and Multi-Layered Certification Processes Presenting Difficulties in Advancing Biological Safety Cabinets Technology Across Markets

The biological safety cabinets market faces a significant challenge in the form of complex compliance requirements, as evolving international standards and multi-layered certification processes create hurdles for advancing technology across markets. Manufacturers must navigate a labyrinth of regulatory requirements, which vary not only between regions but also across different applications and end-user scenarios. The constant evolution of safety and performance standards means that product designs must be frequently reviewed and updated, incurring additional costs and development time. Moreover, the multi-layered certification processes demand rigorous testing, extensive documentation, and regular audits, which can delay time-to-market and impede innovation. This regulatory complexity is particularly challenging for smaller manufacturers with limited resources, as the burden of compliance can be disproportionately high compared to larger, more established companies. The pressure to meet these stringent requirements often leads to cautious innovation strategies, where companies may opt for incremental improvements rather than breakthrough advancements in technology. Furthermore, the lack of harmonized global standards exacerbates the situation, as products must be tailored to meet diverse regional regulations. This fragmented regulatory environment not only slows the pace of technological progress but also limits the market reach of advanced biological safety cabinets. As a result, the industry faces persistent challenges in balancing the need for rapid innovation with the imperative of strict regulatory adherence, ultimately affecting the overall competitiveness and growth potential of the market.

By Product

Class II dominated the Biological Safety Cabinet Market holding a market share of 58.3% in 2023, and within this category the Class II Type A subsegment is particularly prevalent. This subsegment has garnered widespread adoption owing to its balanced capability of protecting both the user and the product while ensuring optimal airflow and contamination control. Regulatory bodies such as the Centers for Disease Control and Prevention and the Occupational Safety and Health Administration have underscored the critical role of Class II A2 biological safety cabinets in handling low to moderate risk pathogens. Leading manufacturers like Thermo Fisher Scientific and Labconco Corporation have continuously enhanced the design and performance of these cabinets, integrating advanced filtration and monitoring systems that meet stringent safety guidelines. Additionally, several industry associations have highlighted the superior containment efficiency of Class II A2 cabinets in recent news, bolstering confidence among laboratories globally. The convergence of regulatory support, technological innovation, and a growing emphasis on laboratory safety has collectively propelled the Class II segment to dominate the biological safety cabinets market.

By End-use

Pharmaceutical and Biopharmaceutical Companies dominated the Biological Safety Cabinet market with a share of 42.8% in 2023, driven by their rigorous requirements for contamination control and precision in research and manufacturing environments. The high demand from these companies stems from the need to adhere to strict regulatory standards set by the U.S. Food and Drug Administration and similar bodies worldwide, ensuring safe handling of hazardous biological materials. News from industry watchdogs and associations such as the International Society for Pharmaceutical Engineering highlights increased capital investments in next-generation safety cabinets. Prominent organizations in the pharmaceutical sector, including major U.S. and European research institutes, continuously advocate for advanced safety solutions to support drug discovery and clinical testing. The ongoing expansion in biopharmaceutical research, coupled with government incentives for upgrading laboratory safety infrastructure, reinforces the market leadership of this end-use segment. Such proactive measures have catalyzed technological advancements and investment, further solidifying the dominance of pharmaceutical and biopharmaceutical companies in the biological safety cabinets market.

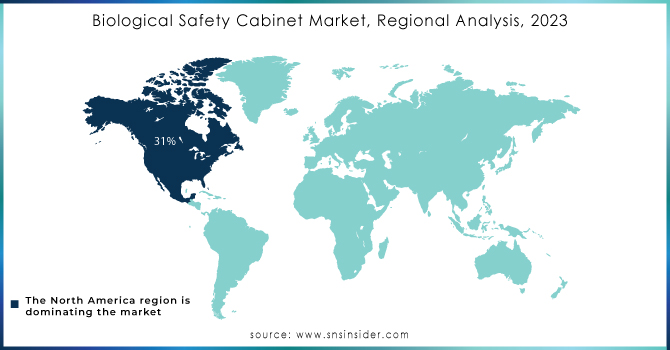

North America dominated the Biological Safety Cabinets Market in 2023 with a market share of 40.5%. This region’s leadership is driven by stringent regulatory frameworks, robust research infrastructure, and significant investments in laboratory safety. The United States, as the primary market, benefits from agencies like the Centers for Disease Control and Prevention and Occupational Safety and Health Administration enforcing rigorous standards, while Canada and Mexico contribute with progressive policies and growing research activities. The presence of leading manufacturers and innovative startups, along with active participation from organizations such as the American Biological Safety Association, has spurred market growth. Statistical data from government reports and industry analyses further underscore the region’s competitive edge, with continuous technological upgrades and strong demand across academic, pharmaceutical, and biotechnology sectors. This comprehensive ecosystem of regulatory support, innovation, and market demand firmly positions North America at the forefront of the global biological safety cabinets industry.

Moreover, Asia Pacific emerged as the fastest growing region in the Biological Safety Cabinets Market with a significant CAGR during the forecast period of 2024 to 2032. Rapid industrialization, increased healthcare spending, and the expansion of research and development activities are major growth drivers in this region. Countries such as China, India, and South Korea are witnessing substantial investments in modern laboratory infrastructure, driven by government initiatives to bolster biotechnological research and manufacturing capabilities. Regional organizations and news reports frequently highlight the surge in demand for advanced safety cabinets to meet international safety standards, prompting manufacturers to tailor their offerings accordingly. The integration of automated and digital monitoring technologies further boosts the operational efficiency of biological safety cabinets, making them highly attractive to emerging markets. Robust collaborations between academic institutions and industry players, along with supportive policy frameworks, are accelerating market adoption. The dynamic interplay of these factors, combined with a strong focus on quality and cost-effectiveness, is propelling Asia Pacific to become the epicenter of growth in the biological safety cabinets market.

Need any customization research on Biological Safety Cabinet Market - Enquiry Now

Air Science USA LLC (Purair BIO, Purair Class I)

Azbil Telstar (AZBIL TELSTAR, S.L.U.) (BioVanguard, Bio II Advance)

Berner International GmbH (Arctic, FlowSafe)

BIOBASE Group (BSC-1100IIA2-X, BSC-1500IIB2)

Cruma S.A. (PCR Workstation, BBS Class II)

Esco Micro Pte. Ltd. (Labculture Class II A2, Labculture Class III)

Faster S.R.L (SafeFAST Classic, SafeFAST Elite)

Germfree Laboratories, Inc. (Class III Glovebox, BioGO Mobile BSC)

Haier Biomedical (HR1200-IIA2, HR900-IIA2)

Jinan Biobase Biotech Co., Ltd. (BSC-1000IIA2, BSC-1600IIB2)

Kewaunee Scientific Corporation (Alpha Class II, Enterprise Series BSC)

Labconco Corporation (Logic+ Class II, Purifier Class I)

Lamsystems (Laminar-Safe, BSC-II “Laminar-Safe”)

LaboGene (Mars Pro, Mars Safe)

NuAire, Inc. (LabGard ES NU-540, LabGard NU-580)

Stericox India Private Limited (Class II A2 Biosafety Cabinet, Class I Biosafety Cabinet)

Telstar (Azbil Group) (Bio II Advance Plus, BioVanguard B)

The Baker Company, Inc. (SterilGARD e3, BioChemGARD)

Thermo Fisher Scientific Inc. (1300 Series A2, HeraSafe KS)

TopAir Systems Inc. (Class II A2 BSC, Ductless Fume Hood)

June 2023: Esco Lifesciences unveiled the Labculture G4, which marked a significant advancement in biosafety technology. The company introduced the innovative biological safety cabinet designed to enhance airflow management and improve overall laboratory safety, meeting rigorous global standards. The launch was celebrated across the industry, emphasizing the product’s cutting-edge features and future-ready design that promised to set new benchmarks in biosafety and operational efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 224.85 Million |

| Market Size by 2032 | USD 404.98 Million |

| CAGR | CAGR of 6.76% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Class I, Class II [Type A, Type B], Class III) •By End-Use (Pharmaceutical & Biopharmaceutical Companies, Diagnostics & Testing Laboratories, Academic & Research Organizations, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., Esco Micro Pte. Ltd., Labconco Corporation, The Baker Company, Inc., NuAire, Inc., Germfree Laboratories, Inc., Azbil Telstar (AZBIL TELSTAR, S.L.U.), Kewaunee Scientific Corporation, Air Science USA LLC, Berner International GmbH and other key players |

Ans: The Biological Safety Cabinet Market is expected to grow from USD 224.85 million in 2023 to USD 404.98 million by 2032, at a CAGR of 6.76% over the forecast period.

Ans: Sustainability initiatives and advancements in laboratory automation are driving the growth of the Biological Safety Cabinets Market as companies adopt eco-friendly and efficient practices.

Ans: Cloud-based software integration and remote surveillance systems are transforming the market by enabling proactive decision-making, real-time diagnostics, and enhanced operational efficiency across industries.

Ans: Class II biological safety cabinets dominated the market in 2023, with Class II Type A2 being particularly popular due to its balanced protection for both the user and the product.

Ans: The Asia Pacific region is expected to grow the fastest in the Biological Safety Cabinets Market, driven by industrialization, increased healthcare spending, and growing research activities in countries like China and India.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Sustainability Initiatives in Biological Safety Cabinets Manufacturing

5.2 Cost Considerations for Laboratories in Biological Safety Cabinets Acquisition

5.3 Global Trends in Laboratory Automation and Their Impact on Biological Safety Cabinets

5.4 Life Cycle Analysis and Sustainability of Biological Safety Cabinets

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Biological Safety Cabinet Market Segmentation, by Product

7.1 Chapter Overview

7.2 Class I

7.2.1 Class I Market Trends Analysis (2020-2032)

7.2.2 Class I Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Class II

7.3.1 Class II Market Trends Analysis (2020-2032)

7.3.2 Class II Market Size Estimates and Forecasts to 2032 (USD Million)

7.3.3 Product A

7.3.3.1 Product A Market Trends Analysis (2020-2032)

7.3.3.2 Product A Market Size Estimates and Forecasts to 2032 (USD Million)

7.3.4 Product B

7.3.4.1 Product B Market Trends Analysis (2020-2032)

7.3.4.2 Product B Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Class III

7.4.1 Class III Market Trends Analysis (2020-2032)

7.4.2 Class III Market Size Estimates and Forecasts to 2032 (USD Million)

8. Biological Safety Cabinet Market Segmentation, by End-Use

8.1 Chapter Overview

8.2 Pharmaceutical & Biopharmaceutical Companies

8.2.1 Pharmaceutical & Biopharmaceutical Companies Market Trends Analysis (2020-2032)

8.2.2 Pharmaceutical & Biopharmaceutical Companies Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Diagnostics & Testing Laboratories

8.3.1 Diagnostics & Testing Laboratories Market Trends Analysis (2020-2032)

8.3.2 Diagnostics & Testing Laboratories Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Academic & Research Organizations

8.4.1 Academic & Research Organizations Market Trends Analysis (2020-2032)

8.4.2 Academic & Research Organizations Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Biological Safety Cabinet Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.4 North America Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.5.2 USA Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.6.2 Canada Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.7.2 Mexico Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Biological Safety Cabinet Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.5.2 Poland Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.6.2 Romania Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.7.2 Hungary Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.8.2 Turkey Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Biological Safety Cabinet Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.4 Western Europe Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.5.2 Germany Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.6.2 France Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.7.2 UK Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.8.2 Italy Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.9.2 Spain Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.12.2 Austria Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Biological Safety Cabinet Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia Pacific Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.4 Asia Pacific Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.5.2 China Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.5.2 India Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.5.2 Japan Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.6.2 South Korea Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.2.7.2 Vietnam Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.8.2 Singapore Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.9.2 Australia Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.4.10.2 Rest of Asia Pacific Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Biological Safety Cabinet Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.4 Middle East Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.5.2 UAE Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.6.2 Egypt Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.8.2 Qatar Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Biological Safety Cabinet Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.2.4 Africa Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.2.5.2 South Africa Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.5.2.7.2 Rest of Africa Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Biological Safety Cabinet Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.4 Latin America Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.5.2 Brazil Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.6.2 Argentina Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.7.2 Colombia Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Biological Safety Cabinet Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Biological Safety Cabinet Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10. Company Profiles

10.1 Thermo Fisher Scientific Inc.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Esco Micro Pte. Ltd.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Labconco Corporation

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 The Baker Company, Inc.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 NuAire, Inc.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Germfree Laboratories, Inc.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Azbil Telstar (AZBIL TELSTAR, S.L.U.)

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Kewaunee Scientific Corporation

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Kewaunee Scientific Corporation

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Berner International GmbH

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

Class I

Class II

Type A

Type B

Class III

By End-Use

Pharmaceutical & Biopharmaceutical Companies

Diagnostics & Testing Laboratories

Academic & Research Organizations

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Non-Invasive Prenatal Testing (NIPT) Market is expected to reach USD 17.75 Bn by 2031 and was valued at USD 6.4 Bn in 2023, and grow at a CAGR of 13.6% over the forecast period of 2024-2031.

The Computerized Physician Order Entry Market size was valued at USD 1.84 billion in 2023 and is expected to grow to USD 3.27 billion by 2032 and grow at a CAGR of 6.63% over the forecast period of 2024-2032.

The Trauma Product Market size was valued at USD 6.10 billion in 2023 and is expected to reach USD 12.54 billion by 2032, growing at a CAGR of 8.36% from 2024-2032.

The Medical Gas Analyzers Market was valued at USD 264.48 Mn in 2023 and is expected to reach USD 371.7 Mn by 2032, growing at a CAGR of 3.86% from 2024 to 2032.

Toxicity Testing Outsourcing Market Size was valued at USD 3.76 Billion in 2023 and is expected to reach USD 8.28 Billion by 2032, growing at a CAGR of 9.2%.

The Thyroid Function Testing Market was valued at USD 1.68 billion in 2023 and is expected to reach USD 2.74 billion by 2032, growing at a CAGR of 5.58% from 2024-2032.

Hi! Click one of our member below to chat on Phone