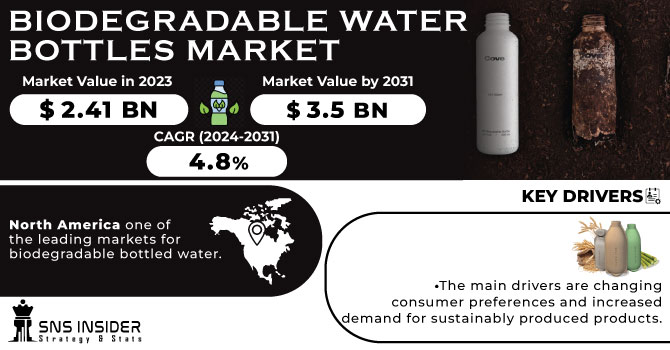

The Biodegradable Water Bottles Market size was USD 2.41 billion in 2023 and is expected to Reach USD 3.5 billion by 2031 and grow at a CAGR of 4.8% over the forecast period of 2024-2031.

The biodegradable water bottle market is growing significantly. Factors such as growing environmental concerns with plastic bottles, increasing government efforts to encourage people to use biodegradable water bottles, and reducing the use of single-use plastics are the major factors driving the growth of the market. I'm here. Additionally, as several countries have announced bans on the use of plastic, biodegradable water bottles can be a great alternative to plastic water bottles. Biodegradable water bottles are environmentally friendly as the bottle, label and cap can be composted.

Get More Information on Biodegradable Water Bottles Market - Request Sample Report

Biodegradable, plant-based water bottles reduce your carbon footprint. These can be broken down and easily burned as clean-burning fuels. Such bottles are ideal for entertainment complexes, corporate events, sporting events, etc. This greatly reduces plastic bottle waste. Moreover, increasing production of bioplastics such as PHA, PLA and starch mixtures is also driving the growth of the global market.

Moreover, increasing R&D activities by major players to produce biodegradable water bottles that are easily compostable and help reduce plastic waste will contribute to the growth of the global biodegradable water bottle market during the forecast period. It can offer great opportunities. However, in some countries, consumers prefer to use plastic bottles, which may hamper the growth of the global market.

Many governments around the world have implemented regulations and policies to encourage the use of biodegradable materials and reduce the use of single-use plastics. These guidelines created a favorable environment for the growth of these bottles. In addition, the market is also driven by increasing availability and affordability of biodegradable materials. Advances in technology and manufacturing methods have made biodegradable materials more accessible and affordable, making it easier for manufacturers to mass produce biodegradable bottles.

KEY DRIVERS:

The main drivers are changing consumer preferences and increased demand for sustainably produced products.

Consumers are active participants in the selection of products conforming to their environmental values and willing to pay a price premium for biodegradable alternatives.

Governments across the globe are implementing laws and policies aimed at reducing plastics pollution and promoting sustainable practices.

RESTRAIN:

Compared with traditional plastics, biodegradable materials and manufacturing processes often have a higher cost.

OPPORTUNITY:

There is a significant potential for growth in the emerging markets

Consumer awareness about environmental concerns is on the rise in emerging markets and efforts are being made to introduce sustainable practices. Untapped opportunities exist for the manufacture of bioplastic water bottles in emerging economies such as Asia, Latin America and Africa.

Opportunities for innovation of products are present as biodegradable materials, manufacturing processes and packaging designs continue to improve.

CHALLENGES:

A lack of awareness about the advantages and availability of biodegradable water bottles may continue to exist among consumers.

During the conflict water bottles market had a short-term effect on the market growth potential. War and its aftermath can affect consumer sentiment and purchasing behavior. In times of geopolitical tension, consumers sometimes prioritize basic needs and necessities over eco-friendly products. The focus shifts to more pressing concerns about safety and affordability, which could impact demand for biodegradable bottled water in the short term.

Packaging of America had a total revenue loss of 3.1% during 2022, this was majorly due to the conflict. There was also the supply of less organic raw materials which affected the nations. Russia exported paper, paperboard, Cellulose fibers worth $16.32 million in 2021, which was reduced to $8.56 in 2022. Sweden exported nearly about worth $15 million in raw materials to Russia which was reduced to $8 million in 2022.

In this way, conflict affected many nations’ imports and export which affected the market growth of the biodegradables water bottles market.

Sales growth is continuously declining during recession period. Sales growth of major companies declined by 7.1% in 2021, which declined to 6% in 2022 and in 2023 it is expected that it will decline to 4%.

This happened because during economic downturns, consumers may become more price-conscious and choose cheaper alternatives. Biodegradable water bottles are often more expensive than traditional plastic bottles and can struggle to maintain market share. Price-conscious consumers may be attracted to cheaper packaging options, which may affect demand for biodegradable bottled water.

There are chances for the growth of market because, during recessions, governments often implement fiscal stimulus measures to revive the economy. These measures can include policies promoting sustainability, environmental protection, and the use of eco-friendly products. If governments incentivize or support the adoption of biodegradable packaging solutions, it could provide a boost to the biodegradable water bottle market.

By Material

Paper

Sugarcane Pulp

Organic Material

Bamboo

PHA

PLA

Cellulose Based Plastic

Algae

Others

By Capacity

15-100 ml

100-500 ml

500-1000 ml

Others

By End User

Specialty Purpose

Institutional Use

Residential Use

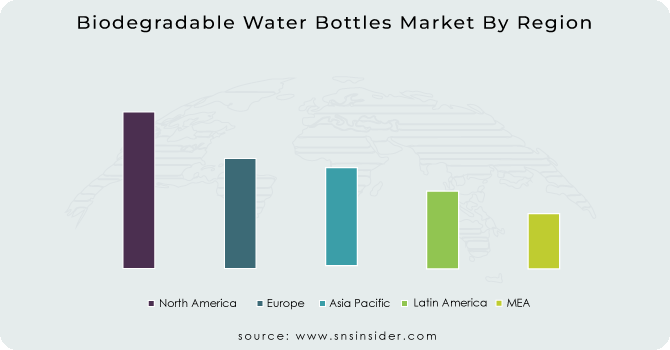

North America:

Growing environmental awareness and focus on sustainability have made North America one of the leading markets for biodegradable bottled water.

Consumer preferences and government initiatives have increased demand for biodegradable alternatives to traditional plastic bottles in the United States and Canada.

Major companies in the region have adopted biodegradable bottled water, resulting in a highly competitive market.

Europe:

Europe is at the forefront of sustainability efforts, including reducing plastic waste. As a result, the market for biodegradable water bottles has grown significantly. Countries such as Germany, the United Kingdom, and France are seeing increased demand for eco-friendly packaging solutions, driving the adoption of biodegradable water bottles.

Stringent regulations and initiatives to promote a circular economy have played an important role in shaping the European market.

Asia Pacific:

The Asia-Pacific region is experiencing significant growth in the biodegradable bottled water market, which is mainly driven by its large population, increasing urbanization, and increasing environmental awareness.

Countries such as China, Japan, and India have seen a shift towards sustainable packaging and increased demand for biodegradable water bottles.

Government initiatives, consumer education, and the emergence of eco-friendly brands are expected to continue to accelerate penetration in the region.

Latin America:

As consumers become more environmentally conscious, interest in biodegradable bottled water is also growing in Latin America.

Countries such as Brazil, Mexico and Colombia are seeing increased demand for sustainable packaging options such as biodegradable water bottles.

The market in the region is expected to grow as more companies introduce biodegradable alternatives to traditional plastic bottles.

Middle East and Africa:

The market for biodegradable water bottles in the Middle East and Africa is relatively small compared to other regions, but it is gradually gaining importance.

Growing environmental concerns and growing awareness of sustainability have increased the demand for biodegradable packaging solutions such as bottled water. Countries such as South Africa, the United Arab Emirates and Kenya are increasing their intake of biodegradable alternatives.

Get Customized Report as per your Business Requirement - Request For Customized Report

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some major key players in the Biodegradable Water Bottles market are Raepack Limited, Mitsubishi Plastics, Paper Water Bottle, Lyspackaging, TSL Plastics Ltd, Ecologic Brands Inc, Montana Private Reserve, Choose Water, Just Water, Biopac Co and other players.

In partnership with Erewhon, Cove, the California based material innovation firm, made its First Biodegradable Water bottle.

Agthia, an Abu Dhabi based food and beverage company, is launching a new bottle of water made from palm oil.

| Report Attributes | Details |

| Market Size in 2023 | US$ 2.41 Billion |

| Market Size by 2031 | US$ 3.5 Billion |

| CAGR | CAGR of 4.8% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Paper, Sugarcane Pulp, Organic Material, Bamboo, PHA, PLA, Cellulose Based Plastic, Algae, Biodegradable Plastic, Others) • By Capacity (15-100 ml, 100-500 ml, 500-1000 ml, Others) • By End User (Speciality Purpose, Institutional Use, Residential Use) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Raepack Limited, Mitsubishi Plastics, Paper Water Bottle, Lyspackaging, TSL Plastics Ltd, Ecologic Brands Inc, Montana Private Reserve, Choose Water, Just Water, Biopac Co |

| Key Drivers | • The main drivers are changing consumer preferences and increased demand for sustainably produced products. • Governments across the globe are implementing laws and policies aimed at reducing plastics pollution and promoting sustainable practices. |

| Market Restraints | • Compared with traditional plastics, biodegradable materials and manufacturing processes often have a higher cost. |

Ans: Biodegradable Water Bottles Market is expected to grow at a CAGR of 4.8%.

Ans: Biodegradable Water Bottles Market size is expected to Reach USD 3.5 billion by 2031.

Ans: Plastic is expected to lead the biodegradable water bottles market.

Ans: Higher cost of manufacturing the restrain for the market growth.

Ans: North American region is leading the market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine war

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

4.3 Supply Demand Gap Analysis

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Biodegradable Water Bottles Market Segmentation By Material

8.1 Paper

8.2 Sugarcane Pulp

8.3 Organic Material

8.4 Bamboo

8.5 PHA

8.6 PLA

8.7 Cellulose-Based Plastic

8.8 Algae

8.9 Biodegradable Plastic

8.10 Others

9. Biodegradable Water Bottles Market Segmentation By Capacity

9.1 15-100 ml

9.2 100-500 ml

9.3 500-1000 ml

9.4 Others

10. Biodegradable Water Bottles Market Segmentation By End User

10.1 Specialty Purpose

10.2 Institutional Use

10.3 Residential Use

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Biodegradable Water Bottles Market by Country

11.2.2North America Biodegradable Water Bottles Market by Material

11.2.3 North America Biodegradable Water Bottles Market by Capacity

11.2.4 North America Biodegradable Water Bottles Market by End User

11.2.5 USA

11.2.5.1 USA Biodegradable Water Bottles Market by Material

11.2.5.2 USA Biodegradable Water Bottles Market by Capacity

11.2.5.3 USA Biodegradable Water Bottles Market by End User

11.2.6 Canada

11.2.6.1 Canada Biodegradable Water Bottles Market by Material

11.2.6.2 Canada Biodegradable Water Bottles Market by Capacity

11.2.6.3 Canada Biodegradable Water Bottles Market by End User

11.2.7 Mexico

11.2.7.1 Mexico Biodegradable Water Bottles Market by Material

11.2.7.2 Mexico Biodegradable Water Bottles Market by Capacity

11.2.7.3 Mexico Biodegradable Water Bottles Market by End User

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Biodegradable Water Bottles Market by Country

11.3.1.2 Eastern Europe Biodegradable Water Bottles Market by Material

11.3.1.3 Eastern Europe Biodegradable Water Bottles Market by Capacity

11.3.1.4 Eastern Europe Biodegradable Water Bottles Market by End User

11.3.1.5 Poland

11.3.1.5.1 Poland Biodegradable Water Bottles Market by Material

11.3.1.5.2 Poland Biodegradable Water Bottles Market by Capacity

11.3.1.5.3 Poland Biodegradable Water Bottles Market by End User

11.3.1.6 Romania

11.3.1.6.1 Romania Biodegradable Water Bottles Market by Material

11.3.1.6.2 Romania Biodegradable Water Bottles Market by Capacity

11.3.1.6.4 Romania Biodegradable Water Bottles Market by End User

11.3.1.7 Turkey

11.3.1.7.1 Turkey Biodegradable Water Bottles Market by Material

11.3.1.7.2 Turkey Biodegradable Water Bottles Market by Capacity

11.3.1.7.3 Turkey Biodegradable Water Bottles Market by End User

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Biodegradable Water Bottles Market by Material

11.3.1.8.2 Rest of Eastern Europe Biodegradable Water Bottles Market by Capacity

11.3.1.8.3 Rest of Eastern Europe Biodegradable Water Bottles Market by End User

11.3.2 Western Europe

11.3.2.1 Western Europe Biodegradable Water Bottles Market by Country

11.3.2.2 Western Europe Biodegradable Water Bottles Market by Material

11.3.2.3 Western Europe Biodegradable Water Bottles Market by Capacity

11.3.2.4 Western Europe Biodegradable Water Bottles Market by End User

11.3.2.5 Germany

11.3.2.5.1 Germany Biodegradable Water Bottles Market by Material

11.3.2.5.2 Germany Biodegradable Water Bottles Market by Capacity

11.3.2.5.3 Germany Biodegradable Water Bottles Market by End User

11.3.2.6 France

11.3.2.6.1 France Biodegradable Water Bottles Market by Material

11.3.2.6.2 France Biodegradable Water Bottles Market by Capacity

11.3.2.6.3 France Biodegradable Water Bottles Market by End User

11.3.2.7 UK

11.3.2.7.1 UK Biodegradable Water Bottles Market by Material

11.3.2.7.2 UK Biodegradable Water Bottles Market by Capacity

11.3.2.7.3 UK Biodegradable Water Bottles Market by End User

11.3.2.8 Italy

11.3.2.8.1 Italy Biodegradable Water Bottles Market by Material

11.3.2.8.2 Italy Biodegradable Water Bottles Market by Capacity

11.3.2.8.3 Italy Biodegradable Water Bottles Market by End User

11.3.2.9 Spain

11.3.2.9.1 Spain Biodegradable Water Bottles Market by Material

11.3.2.9.2 Spain Biodegradable Water Bottles Market by Capacity

11.3.2.9.3 Spain Biodegradable Water Bottles Market by End User

11.3.2.10 Netherlands

11.3.2.10.1 Netherlands Biodegradable Water Bottles Market by Material

11.3.2.10.2 Netherlands Biodegradable Water Bottles Market by Capacity

11.3.2.10.3 Netherlands Biodegradable Water Bottles Market by End User

11.3.2.11 Switzerland

11.3.2.11.1 Switzerland Biodegradable Water Bottles Market by Material

11.3.2.11.2 Switzerland Biodegradable Water Bottles Market by Capacity

11.3.2.11.3 Switzerland Biodegradable Water Bottles Market by End User

11.3.2.1.12 Austria

11.3.2.12.1 Austria Biodegradable Water Bottles Market by Material

11.3.2.12.2 Austria Biodegradable Water Bottles Market by Capacity

11.3.2.12.3 Austria Biodegradable Water Bottles Market by End User

11.3.2.13 Rest of Western Europe

11.3.2.13.1 Rest of Western Europe Biodegradable Water Bottles Market by Material

11.3.2.13.2 Rest of Western Europe Biodegradable Water Bottles Market by Capacity

11.3.2.13.3 Rest of Western Europe Biodegradable Water Bottles Market by End User

11.4 Asia-Pacific

11.4.1 Asia-Pacific Biodegradable Water Bottles Market by country

11.4.2 Asia-Pacific Biodegradable Water Bottles Market by Material

11.4.3 Asia-Pacific Biodegradable Water Bottles Market by Capacity

11.4.4 Asia-Pacific Biodegradable Water Bottles Market by End User

11.4.5 China

11.4.5.1 China Biodegradable Water Bottles Market by Material

11.4.5.2 China Biodegradable Water Bottles Market by Capacity

11.4.5.3 China Biodegradable Water Bottles Market by End User

11.4.6 India

11.4.6.1 India Biodegradable Water Bottles Market by Material

11.4.6.2 India Biodegradable Water Bottles Market by Capacity

11.4.6.3 India Biodegradable Water Bottles Market by End User

11.4.7 Japan

11.4.7.1 Japan Biodegradable Water Bottles Market by Material

11.4.7.2 Japan Biodegradable Water Bottles Market by Capacity

11.4.7.3 Japan Biodegradable Water Bottles Market by End User

11.4.8 South Korea

11.4.8.1 South Korea Biodegradable Water Bottles Market by Material

11.4.8.2 South Korea Biodegradable Water Bottles Market by Capacity

11.4.8.3 South Korea Biodegradable Water Bottles Market by End User

11.4.9 Vietnam

11.4.9.1 Vietnam Biodegradable Water Bottles Market by Material

11.4.9.2 Vietnam Biodegradable Water Bottles Market by Capacity

11.4.9.3 Vietnam Biodegradable Water Bottles Market by End User

11.4.10 Singapore

11.4.10.1 Singapore Biodegradable Water Bottles Market by Material

11.4.10.2 Singapore Biodegradable Water Bottles Market by Capacity

11.4.10.3 Singapore Biodegradable Water Bottles Market by End User

11.4.11 Australia

11.4.11.1 Australia Biodegradable Water Bottles Market by Material

11.4.11.2 Australia Biodegradable Water Bottles Market by Capacity

11.4.11.3 Australia Biodegradable Water Bottles Market by End User

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Biodegradable Water Bottles Market by Material

11.4.12.2 Rest of Asia-Pacific Biodegradable Water Bottles Market by Capacity

11.4.12.3 Rest of Asia-Pacific Biodegradable Water Bottles Market by End User

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Biodegradable Water Bottles Market by Country

11.5.1.2 Middle East Biodegradable Water Bottles Market by Material

11.5.1.3 Middle East Biodegradable Water Bottles Market by Capacity

11.5.1.4 Middle East Biodegradable Water Bottles Market by End User

11.5.1.5 UAE

11.5.1.5.1 UAE Biodegradable Water Bottles Market by Material

11.5.1.5.2 UAE Biodegradable Water Bottles Market by Capacity

11.5.1.5.3 UAE Biodegradable Water Bottles Market by End User

11.5.1.6 Egypt

11.5.1.6.1 Egypt Biodegradable Water Bottles Market by Material

11.5.1.6.2 Egypt Biodegradable Water Bottles Market by Capacity

11.5.1.6.3 Egypt Biodegradable Water Bottles Market by End User

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Biodegradable Water Bottles Market by Material

11.5.1.7.2 Saudi Arabia Biodegradable Water Bottles Market by Capacity

11.5.1.7.3 Saudi Arabia Biodegradable Water Bottles Market by End User

11.5.1.8 Qatar

11.5.1.8.1 Qatar Biodegradable Water Bottles Market by Material

11.5.1.8.2 Qatar Biodegradable Water Bottles Market by Capacity

11.5.1.8.3 Qatar Biodegradable Water Bottles Market by End User

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Biodegradable Water Bottles Market by Material

11.5.1.9.2 Rest of Middle East Biodegradable Water Bottles Market by Capacity

11.5.1.9.3 Rest of Middle East Biodegradable Water Bottles Market by End User

11.5.2 Africa

11.5.2.1 Africa Biodegradable Water Bottles Market by Country

11.5.2.2 Africa Biodegradable Water Bottles Market by Material

11.5.2.3 Africa Biodegradable Water Bottles Market by Capacity

11.5.2.4 Africa Biodegradable Water Bottles Market by End User

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Biodegradable Water Bottles Market by Material

11.5.2.5.2 Nigeria Biodegradable Water Bottles Market by Capacity

11.5.2.5.3 Nigeria Biodegradable Water Bottles Market by End User

11.5.2.6 South Africa

11.5.2.6.1 South Africa Biodegradable Water Bottles Market by Material

11.5.2.6.2 South Africa Biodegradable Water Bottles Market by Capacity

11.5.2.6.3 South Africa Biodegradable Water Bottles Market by End User

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Biodegradable Water Bottles Market by Material

11.5.2.7.2 Rest of Africa Biodegradable Water Bottles Market by Capacity

11.5.2.7.3 Rest of Africa Biodegradable Water Bottles Market by End User

11.6 Latin America

11.6.1 Latin America Biodegradable Water Bottles Market by country

11.6.2 Latin America Biodegradable Water Bottles Market by Material

11.6.3 Latin America Biodegradable Water Bottles Market by Capacity

11.6.4 Latin America Biodegradable Water Bottles Market by End User

11.6.5 Brazil

11.6.5.1 Brazil America Biodegradable Water Bottles by Material

11.6.5.2 Brazil America Biodegradable Water Bottles by Capacity

11.6.5.3 Brazil America Biodegradable Water Bottles by End User

11.6.6 Argentina

11.6.6.1 Argentina America Biodegradable Water Bottles by Material

11.6.6.2 Argentina America Biodegradable Water Bottles by Capacity

11.6.6.3 Argentina America Biodegradable Water Bottles by End User

11.6.7 Colombia

11.6.7.1 Colombia America Biodegradable Water Bottles by Material

11.6.7.2 Colombia America Biodegradable Water Bottles by Capacity

11.6.7.3 Colombia America Biodegradable Water Bottles by End User

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Biodegradable Water Bottles by Material

11.6.8.2 Rest of Latin America Biodegradable Water Bottles by Capacity

11.6.8.3 Rest of Latin America Biodegradable Water Bottles by End User

12 Company profile

12.1 Raepack Limited

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Mitsubishi Plastics

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Paper Water Bottle

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Lyspackaging

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 TSL Plastics Ltd

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Ecologic Brands Inc

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Montana Private Reserve

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 Choose Water

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Product/Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 Just Water

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Biopac Co

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Product/Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Insulated Packaging Market Size was $16.2 billion in 2023 and is expected to reach USD 28.5 billion by 2031 and grow at a CAGR of 6.5% by 2024-2031.

The Graphic Film Market size was USD 32.67 billion in 2023 and is expected to Reach USD 49.16 billion by 2031 and grow at a CAGR of 5.24 % over the forecast period of 2024-2031.

The Tube Packaging Market size was valued at USD 11.53 billion in 2023 and is expected to Reach USD 19.81 billion by 2032 and grow at a CAGR of 6.20% over the forecast period of 2024-2032.

The Sustainable Pharmaceutical Packaging Market size was USD 82 billion in 2023 and is expected to Reach USD 299.95 billion by 2032 and grow at a CAGR of 15.5 % over the forecast period of 2024-2032.

The PET Packaging Market size was valued at USD 77.24 billion in 2023 and is expected to Reach USD 120.85 billion by 2032 and grow at a CAGR of 5.1% over the forecast period of 2024-2032.

The Trash Bags Market size was USD 12.95 billion in 2023 and is expected to Reach USD 26.10 billion by 2032 and grow at a CAGR of 8.1% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone