Biodegradable Plastic Additives Market Report Scope & Overview:

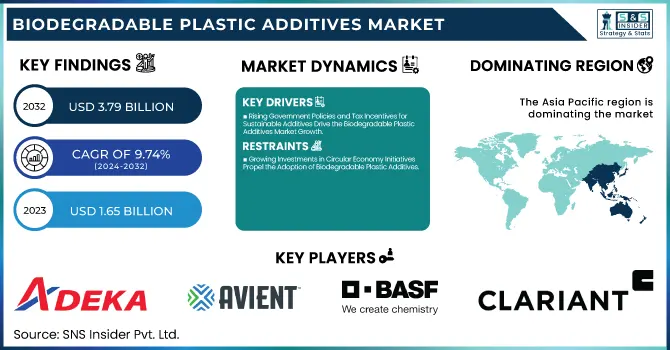

The Biodegradable Plastic Additives Market Size was valued at USD 1.65 Billion in 2023 and is expected to reach USD 3.79 Billion by 2032, growing at a CAGR of 9.74% over the forecast period of 2024-2032.

To Get more information on Biodegradable Plastic Additives Market - Request Free Sample Report

The Biodegradable Plastic Additives Market is evolving as industries seek sustainable alternatives to conventional plastics. Our report explores the raw material landscape, highlighting key feedstocks enhancing biodegradability. A price comparison by region and polymer type uncovers cost variations influencing market adoption. Governments are driving change through incentives and grants, accelerating the shift toward eco-friendly solutions. The sustainability and environmental impact of these additives are analyzed, showcasing their role in reducing plastic pollution. A comparison with conventional plastic additives provides insights into performance and cost-effectiveness. Additionally, waste management and recycling trends highlight their role in a circular economy. With rising demand for green solutions, our report offers a strategic outlook on innovations and market opportunities.

Biodegradable Plastic Additives Market Dynamics

Drivers

-

Rising Government Policies and Tax Incentives for Sustainable Additives Drive the Biodegradable Plastic Additives Market Growth

Governments worldwide are implementing strict environmental policies to curb plastic pollution, leading to increased adoption of biodegradable plastic additives. Regulations such as single-use plastic bans, extended producer responsibility (EPR) programs, and plastic taxation are pushing industries to invest in biodegradable solutions. Additionally, financial incentives such as tax credits, grants, and subsidies are encouraging companies to develop eco-friendly plastic additives, accelerating market growth. These regulatory measures are particularly impacting industries like packaging, automotive, and consumer goods, where the demand for sustainable alternatives is rising. The European Union’s Green Deal and China’s National Plastic Pollution Control Plan are examples of global initiatives favoring biodegradable solutions. Such policies not only enhance industry compliance with environmental goals but also boost research into advanced biodegradable plastic additives. As sustainability regulations become more stringent, companies are prioritizing the development and adoption of biodegradable additives, leading to significant market expansion and technological advancements in the sector.

Restraints

-

Growing Investments in Circular Economy Initiatives Propel the Adoption of Biodegradable Plastic Additives

The shift toward a circular economy is creating lucrative opportunities for the biodegradable plastic additives market, as industries focus on sustainability and waste reduction. Governments and multinational corporations are investing in closed-loop production systems that prioritize recyclability, biodegradability, and efficient resource utilization. Biodegradable plastic additives play a crucial role in these initiatives by ensuring that plastics decompose safely and reintegrate into the environment without causing long-term pollution. Several global brands are implementing sustainable packaging strategies, incorporating biodegradable additives to enhance plastic breakdown while maintaining performance. Additionally, initiatives such as extended producer responsibility (EPR) schemes and biodegradable waste management programs are driving the demand for eco-friendly plastic additives. As companies embrace circular economy models, the biodegradable plastic additives market is expected to expand significantly, supported by increasing regulatory support, consumer preference for sustainable products, and industry collaborations focused on minimizing plastic waste.

Opportunities

-

Growing Investments in Circular Economy Initiatives Propel the Adoption of Biodegradable Plastic Additives

The shift toward a circular economy is creating lucrative opportunities for the biodegradable plastic additives market, as industries focus on sustainability and waste reduction. Governments and multinational corporations are investing in closed-loop production systems that prioritize recyclability, biodegradability, and efficient resource utilization. Biodegradable plastic additives play a crucial role in these initiatives by ensuring that plastics decompose safely and reintegrate into the environment without causing long-term pollution. Several global brands are implementing sustainable packaging strategies, incorporating biodegradable additives to enhance plastic breakdown while maintaining performance. Additionally, initiatives such as extended producer responsibility (EPR) schemes and biodegradable waste management programs are driving the demand for eco-friendly plastic additives. As companies embrace circular economy models, the biodegradable plastic additives market is expected to expand significantly, supported by increasing regulatory support, consumer preference for sustainable products, and industry collaborations focused on minimizing plastic waste.

Challenge

-

Consumer Misconceptions and Lack of Awareness About Biodegradable Plastic Additives Impact Market Adoption

Despite growing interest in sustainable materials, consumer awareness and understanding of biodegradable plastic additives remain limited. Many consumers mistakenly believe that all biodegradable plastics break down instantly in any environment, leading to unrealistic expectations. Others are skeptical about their effectiveness compared to traditional plastics, slowing market acceptance. Additionally, inadequate product labeling and unclear disposal guidelines contribute to improper waste management, reducing the environmental benefits of biodegradable plastics. Consumers may unknowingly dispose of biodegradable plastics in regular waste streams, where they fail to degrade efficiently. Addressing these misconceptions requires extensive public education campaigns, transparent product labeling, and industry-wide efforts to clarify disposal guidelines. Increased awareness and consumer trust in biodegradable plastic additives are essential for driving adoption and ensuring their long-term impact on reducing plastic pollution.

Biodegradable Plastic Additives Market Segmental Analysis

By Polymer Type

Polylactic Acid (PLA) dominated the biodegradable plastic additives market in 2023, holding a 34.3% market share, due to its superior biodegradability, mechanical strength, and suitability for various applications. PLA is extensively used in packaging, textiles, agricultural films, and biomedical products, making it a preferred choice among manufacturers. The growing push for sustainable packaging, driven by government regulations such as the European Union’s Single-Use Plastics Directive and China’s plastic ban, has significantly increased PLA consumption. Organizations like the European Bioplastics Association and the Biodegradable Products Institute have recognized PLA’s potential, further promoting its adoption. Additionally, leading manufacturers such as NatureWorks and Total Corbion have expanded their PLA production facilities to meet the increasing global demand. The combination of regulatory support, expanding production capacities, and growing consumer awareness about sustainable materials has solidified PLA’s dominance in the biodegradable plastic additives market.

By Foam Type

Plasticizers dominated the biodegradable plastic additives market in 2023 and accounted for the largest market share of 29.5% market share, as they play a crucial role in enhancing the flexibility, durability, and processability of biodegradable plastics. Many biodegradable polymers, such as PLA, starch blends, and PBAT, require plasticizers to improve their mechanical performance and adaptability for various applications. The increasing demand for flexible and durable biodegradable plastics in industries like packaging, consumer goods, and automotive has fueled the adoption of bio-based plasticizers. Government initiatives, such as the European Chemicals Agency’s REACH regulations, have encouraged the shift toward sustainable plasticizers, reducing the use of phthalates and other harmful chemicals. Companies like BASF, Dow, and Evonik have been investing in the development of bio-based plasticizers to cater to the evolving sustainability trends. As the market continues to move toward eco-friendly and high-performance materials, the demand for biodegradable plasticizers is expected to remain strong, reinforcing their dominant position in the industry.

By Application

Modifiers application dominated and held a 26.7% market share in the biodegradable plastic additives market in 2023, driven by their essential role in enhancing the performance, strength, and biodegradation properties of biodegradable plastics. These additives help improve impact resistance, thermal stability, and overall material performance, making biodegradable plastics more viable for a wide range of applications, including packaging, consumer goods, and automotive components. The rising demand for high-performance biodegradable materials has encouraged innovation in modifier formulations. Organizations such as the U.S. Department of Agriculture and the European Bioplastics Association have emphasized the importance of biodegradable plastic modifiers in achieving sustainable material performance. Companies like Novamont, Mitsubishi Chemical, and Clariant have been actively developing advanced biodegradable plastic modifiers to cater to the growing demand. With increasing regulatory support for sustainable materials and the need for durable biodegradable plastics, the modifier segment continues to play a vital role in advancing biodegradable plastic applications, ensuring its dominance in the market.

By End-Use Industry

The packaging industry dominated the biodegradable plastic additives market in 2023, holding a 40.25% market share, as the demand for eco-friendly packaging solutions surged globally. Stringent regulations on plastic waste reduction, such as the EU’s Single-Use Plastics Directive, India’s plastic ban, and the U.S. Plastics Pact, have driven industries to adopt biodegradable alternatives. Leading corporations, including Nestlé, Unilever, and Coca-Cola, have pledged to incorporate biodegradable packaging in their product lines, further fueling market growth. Organizations such as the Sustainable Packaging Coalition and the Ellen MacArthur Foundation have been advocating for a global transition to sustainable packaging solutions. With the rapid expansion of e-commerce, growing concerns over plastic pollution, and increasing consumer awareness about sustainability, the demand for biodegradable packaging continues to rise. As companies seek compliance with environmental regulations and look for innovative biodegradable packaging solutions, this segment is expected to maintain its leading position in the biodegradable plastic additives market.

Biodegradable Plastic Additives Market Regional Outlook

Asia Pacific dominated the biodegradable plastic additives market in 2023, holding a 41.8% market share, driven by rapid industrialization, stringent government regulations, and increasing consumer awareness regarding sustainable materials. Countries such as China, Japan, and India have been at the forefront of biodegradable plastic adoption due to their strong manufacturing sectors and rising environmental concerns. China, the largest contributor, has implemented a nationwide ban on non-biodegradable plastic bags and single-use plastics, significantly boosting the demand for biodegradable alternatives. The National Development and Reform Commission (NDRC) and the Ministry of Ecology and Environment have enforced policies promoting biodegradable plastic production, leading to major investments by companies like Kingfa Sci & Tech and Tianan Biologic. Japan, known for its technological advancements, has been developing high-performance biodegradable additives with government support through initiatives like the Plastic Resource Circulation Strategy. India has also played a crucial role, implementing extended producer responsibility (EPR) policies and supporting bio-based plastic research through organizations such as the Central Institute of Plastics Engineering & Technology (CIPET). With growing regulatory pressure and increasing investments in biodegradable plastic production, Asia Pacific continues to dominate the market, providing strong growth opportunities for both local and international players.

North America emerged as the fastest-growing region in the biodegradable plastic additives market, with a significant growth rate during the forecast period, driven by increasing regulatory policies, corporate sustainability initiatives, and rising consumer preference for eco-friendly products. The United States leads the region, with state-level bans on single-use plastics, such as California’s Plastic Pollution Prevention and Packaging Producer Responsibility Act, significantly boosting biodegradable plastic adoption. The U.S. Environmental Protection Agency (EPA) and the Biodegradable Products Institute (BPI) have been actively supporting research and certification of biodegradable materials, encouraging industry growth. Canada has also introduced strict policies under its Zero Plastic Waste strategy, aiming to eliminate non-biodegradable plastics by 2030. The demand for biodegradable plastic additives in North America has surged across industries such as packaging, agriculture, and consumer goods, with key players like NatureWorks, Danimer Scientific, and BASF expanding their production facilities. The region’s robust investment in sustainable innovation, along with strong government backing, positions North America as the fastest-growing market for biodegradable plastic additives.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

ADEKA Corporation (ADEKA Polymer Additives, ADEKA BIOBASE, ADEKA NOL)

-

Add-X Biotech (AddiFlex, Add-X Biodegradable)

-

Avient Corporation (OnColor Bio, Cesa Biodegradable Additives, Cesa Light Stabilizers)

-

BASF (ecoflex, Irganox, Irgastab)

-

BioSphere (BioSphere Biodegradable Plastic Additive, BioSphere Biodegradable Technology)

-

Bio-Tec Environmental (EcoPure, Bio-Tec Additives)

-

Blend Colours (BioAdd, Biodegradable Masterbatches, Bio Colours)

-

Clariant AG (Licocare RBW, Licocene, Exolit)

-

Colloids (Biocolloid, Biodegradable Masterbatch, Biocolloid Green)

-

Corbion N.V. (Puralact, PURALACT B3, PURALACT F)

-

Croda International PLC (Atmer Anti-Fog, Incroslip)

-

DIC Corporation (BIOCLEAN, HYDRAN, Sunfort)

-

Emery Oleochemicals (LOXIOL G, EMEROX, EDENOL)

-

Evonik Industries AG (VISIOMER Terra, TEGO, VESTOSINT)

-

Greenchemicals S.r.l. (GC GreenAdd, GC UV, GC Therm)

-

LANXESS (Stabaxol, Preventol, Plastilit)

-

Solvay (Alve-One, Omnix, Rhodoline)

-

Symphony Environment (d2w, d2p)

-

Willow Ridge Plastics (Reverte, Biodegradable Additive)

Recent Developments

-

May 2024: FUCHS launched ECOCOOL GLOBAL 1000, a cutting and grinding fluid for aerospace, improving tool life by 150% and cutting speeds by 16%. It also introduced FLUIDS LIVE for real-time lubricant monitoring.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.65 Billion |

| Market Size by 2032 | USD 3.79 Billion |

| CAGR | CAGR of 9.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Polymer Type (Polyhydroxyalkanoates (PHA), Polylactic Acid (PLA), Polybutylene Succinate (PBS), Polybutylene Adipate Terephthalate (PBAT), Starch Blends, Others) •By Foam Type (Plasticizers, Stabilizers, Flame Retardants, Antistatic Agents, Others) •By Application (Modifiers, Extenders, Stabilizers, Processing Aids, Others) •By End-Use Industry (Consumer Goods, Packaging, Healthcare, Textiles, Automotive, Agriculture, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF, Clariant AG, Croda International PLC, Evonik Industries AG, DIC Corporation, ADEKA Corporation, Corbion N.V., BioSphere, Bio-Tec Environmental, Willow Ridge Plastics and other key players |