Biodegradable Mulch Films Market Report Scope & Overview:

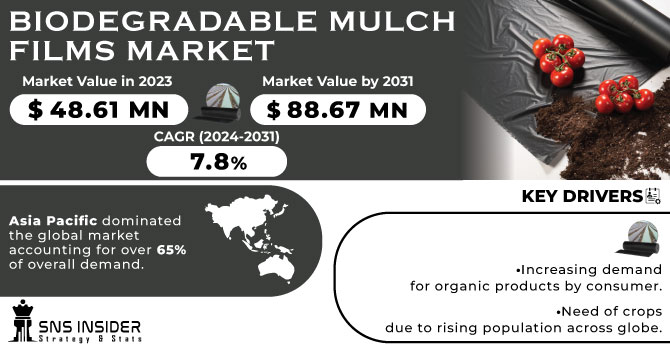

The Biodegradable Mulch Films Market size was USD 48.61 million in 2023 and is expected to Reach USD 88.67 million by 2031 and grow at a CAGR of 7.8% over the forecast period of 2024-2031.

Due to the increase in the global population, there is a growing demand for food crops and a need for them. The major challenge to the global agriculture sector is reducing agricultural and arable land in developed countries. By increasing crop yields and thus helping to address major issues such as water scarcity, soil pollution or climate change, these biodegradable films have offered a modest solution to this rapidly evolving problem. Global population growth is expected to continue at a rapid pace during the forecast period again giving boost to the market, due to increase in agricultural production.

Get More Information on Biodegradable Mulch Films Market - Request Sample Report

There has been an enormous population growth in many large countries around the world. Primary sources, in particular foodstuffs, have been put under strain by this scenario. Moreover, as a result of the population growth, there was also an increase in consumer consumption of food. There is a significant increase in population forecast for almost all of the world's largest countries. That trend is expected to exert pressure on the production of food and therefore farmers will be required to make use of efficient agricultural techniques.

This trend will have a positive impact on the market as these films offer excellent crop protection, higher yields and enhanced production cycles. Efforts have been made to plant the best quality food crops which produce a superior yield in order to take advantage of increasing demand due to increased consumption per capita. The application of agricultural mulching films increases yield by accelerating the germination cycles, preventing direct contact with soil and keeping fertilisers and nutrients closer to the crop. Consequently, the demand for biodegradable mulch films is to be increased over the forecast period.

MARKET DYNAMICS

KEY DRIVERS:

-

Increasing demand for organic products by consumer

Demand for organic crops is driven by the consumer's growing preference for organic and environmentally friendly products. In addition to boosting the prospects for growth on this market, biodegradable mulch films may also be applied in organic farming practices.

-

Need of crops due to rising population across globe

RESTRAIN:

-

Biodegradable Mulch Films may not be compatible with all type of crops

Different types of mulching films may be needed depending on the type of crops and their growth conditions. It can be difficult to ensure that biodegradable films meet the requirements of a variety of crops and farming practices.

OPPORTUNITY:

-

Providing Customized Solutions

New markets and niche opportunities can be created by the development of biodegradable mulching films based on special crops, growing conditions or local requirements.

-

As part of a broader commitment to sustainability, biodegradable mulch films can be marketed.

CHALLENGES:

-

Making Biodegradable mulch films Cost-Effective can be challenging

The production of biodegradable mulch films can be significantly more costly compared with traditional plastic Mulch Films. Farmers, especially in price sensitive markets, may be influenced by the costs factor when making their decisions to accept these films.

IMPACT OF RUSSIAN UKRAINE WAR

The war has dramatically increased the prices of oil and gas, which are key inputs in the production of biodegradable mulch. Oil prices have increased by more than 30% since the beginning of the war and gas prices have increased by more than 50%. This has resulted in reduced demand for biodegradable mulch films as businesses and consumers look to cut costs.

The war has also disrupted the biodegradable coating supply chain, as many raw materials and components come from Russia and Ukraine. Russia is a major producer of polyethylene, which is the main component of biodegradable mulch films. Ukraine is a major producer of corn, which is used to make biodegradable mulch. Disruptions to these supply chains have made it difficult for manufacturers to obtain the materials they need to produce biodegradable coatings.

IMPACT OF ONGOING RECESSION

The economic downturn is expected to lead to lower demand for biodegradable mulch films as businesses and consumers look to cut costs. The expected economic downturn will also disrupt the biodegradable coating supply chain, as many raw materials and components come from economically struggling countries.

Due to these factors, the global biodegradable coating film market is expected to decrease by 3% by 2023.

Some farmers are delaying or canceling their planting plans, reducing the need for biodegradable mulch. Some companies are turning to cheaper, non-biodegradable coatings, which also reduces the need for biodegradable mulch films. Suppliers are experiencing delays in the delivery of raw materials, which disrupts their production schedules.

Also, manufacturers are raising prices, making biodegradable mulch expensive for businesses and consumers.

KEY MARKET SEGMENTS

By Plastic Type

-

Thermoplastic Starch

-

Aliphatic Aromatic Copolyesters

-

Controlled Degradation Masterbatches

By Composition

-

Starch

-

Starch Blended with Polylactic Acid

-

Starch Blended with Polyhydroxyalkanoate

-

Others

By Crop Type

-

Fruits & Vegetables

-

Flowers & Plants

-

Grains & Oilseeds

REGIONAL ANALYSIS

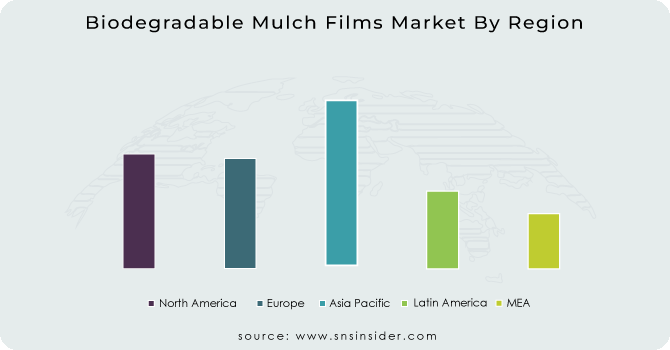

Asia Pacific dominated the global market, accounting for over 65% of overall demand. China became the world's largest consumer of biofilms, owing to an increase in industrialisation and urbanisation that lead to increased standard of living and demand for food products. The market's growth is supported by growing demand for food in the country.

With the rising trend of adopting eco-friendly products, Europe is expected to experience moderate growth over the next few years. Such mulching films do not entail waste disposal and are an environmentally sustainable alternative, which has been widely accepted in the region.

A considerable share was also taken up by North America. Market growth is expected to be positively influenced by favourable government legislation on eco- friendly products, in particular in North America. The product penetration is likely to rise over the projected period, driven by consumer concerns about plastic mulch residues in soil. While eliminating the need for removal and disposal as well as reducing environmental impact, biodegradable films may provide a benefit to plastic mulch. The growth of the market is expected to be driven by an increase in population, as well as increased regulatory support from different European Union countries and a growing concern for the environment related to artificial substitutes.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Biodegradable Mulch Films market are Biobag International AS, Novamont, British Polythene Industries PLC, BASF SE, AB Rani Plast OY, RKW SE, Kingfa Sci & Tech Co Ltd, Al-Pack Enterprises Ltd, AEP Industries Inc, Armando Alvarez and other players.

British Polythene Industries PLC-Company Financial Analysis

RECENT DEVELOPMENT

-

Australian Research Organization CSIRO, in cooperation with farmers, has developed sprayable bioplastic membranes that could help to increase yields while also saving water, nutrients and agrochemicals.

-

BASF announced the introduction of its new biodegradable Mulch Film ecovio M2351 in June 2023. A mixture of polybutylenedipate terephthalate and other biodegradable polymers is used to produce the film. It is intended to produce a more sustainable substitute for traditional plastic mulching films by breaking into the soil in 12 months.

| Report Attributes | Details |

| Market Size in 2023 | US$ 48.61 Mn |

| Market Size by 2031 | US$ 88.67 Mn |

| CAGR | CAGR of 7.8 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Plastic Type (Thermoplastic Starch, Aliphatic Aromatic Copolyesters, Controlled Degradation Masterbatches) • By Composition (Starch, Starch Blended with Polylactic Acid, Starch Blended with Polyhydroxyalkanoate, Others) • By Crop Type (Fruits & Vegetables, Flowers & Plants, Grains & Oilseeds) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Biobag International AS, Novamont, British Polythene Industries PLC, BASF SE, AB Rani Plast OY, RKW SE, Kingfa Sci & Tech Co Ltd, Al-Pack Enterprises Ltd, AEP Industries Inc, Armando Alvarez |

| Key Drivers | • Increasing demand for organic products by consumer • Need of crops due to rising population across globe |

| Market Challenges | • Making Biodegradable mulch films Cost-Effective can be challenging |