Biodegradable films Market Report Scope & Overview:

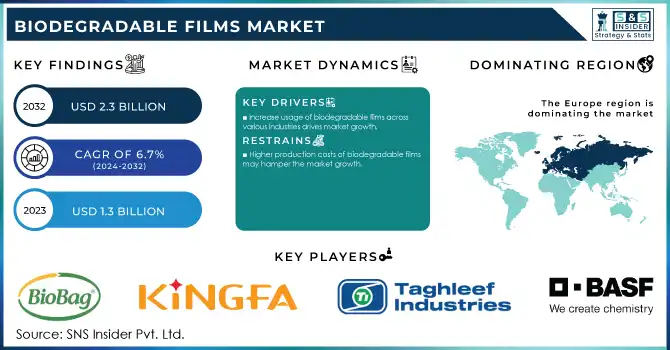

The Biodegradable Films Market size was USD 1.3 billion in 2023 and is expected to reach USD 2.3 billion by 2032 and grow at a CAGR of 6.7% over the forecast period of 2024-2032.

Get more information on Biodegradable Films Market - Request Sample Report

The biodegradable films market is driven primarily by the growth in the food packaging industry. With people turning to easy food options like ready-to-eat meals and portable snacks, the need for innovative and sustainable packaging solutions has been propelled. The increasing adoption of biologically degradable films in the food industry is due to their capacity to maintain the same level of product freshness, viable barrier properties, and lower environmental burden combined with traditional plastic packaging. In addition, the need for sustainable packaging that can break down fully has been a driver of these innovations in food manufacturing, with manufacturers pushing towards using biodegradable options, in in-line with regulatory and consumer demand for greener alternatives. This trend is also driven by the proliferation of online food delivery and meal kit services, which need flexible yet sustainable packaging options. Moreover, companies are collaborating with biodegradable film manufacturers to provide customized solutions, keeping in check both functional and environmental needs, increasing demand for the biodegradable film market in the upcoming years.

Additionally, the global production of bioplastics was 2.11 million tonnes in 2019, with expectations to rise to 2.43 million tonnes by the end of 2024. The food packaging sector is a major consumer of biodegradable films, accounting for a significant portion of this demand.

Technological advancements in biopolymers are one of the key factors that drive the growth of the biodegradable film market. The development of biodegradable plastics has advanced through innovations in biopolymers (such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based blends). Now these materials have better barrier properties, moisture resistance, and mechanical strength, and are suitable for a wide range of applications such as food packaging, agriculture, and medical products. The latest developments in high-performance biopolymer formulations, however, have lowered the production costs down to the levels needed for these materials to compete with oil-based plastics. Researchers and producers are also shifting their focus towards the production of biopolymers from agricultural residues and non-food biomass and waste materials, thus improving the sustainability of the polymers and decreasing dependence on fossil resources.

Government initiatives have played a crucial role in this expansion. For instance, the U.S. National Science Foundation (NSF), in partnership with industry leaders such as BASF, Dow, IBM, PepsiCo Inc., and Procter & Gamble Co., launched a USD 9.5 million research funding opportunity aimed at accelerating the discovery and manufacture of sustainable polymers.

Biodegradable Films Market Dynamics

Drivers

-

Increase usage of biodegradable films across various industries drives market growth.

A major factor fueling the growth of the market is the growing adoption of biodegradable films in diverse applications as an alternative material to conventional plastic film. Biodegradable films are emerging in applications from food packaging and agriculture to pharmaceuticals as they are eco-friendly and have functional properties. For instance, in the food packaging sector where plastic waste is a significant concern, biodegradable films address this issue by possessing the pre-requisite barrier properties required to maintain freshness and prolong shelf life. Likewise, biodegradable films can serve as mulch and cover for greenhouse crops in agriculture and have a lower environmental impact than traditional plastic. Rising consumer preference for eco-friendly goods and governmental regulations regarding reducing plastic waste will continue to proliferate demand for biodegradable movies as industries are under increasing pressure to adopt sustainable methods. Advances in biopolymer technology have also broadened the commodity spectrum of films, improving the cost-competitiveness and versatility of biodegradable films. As a higher percentage of industries continue to change to more environmentally sustainable options, the industry of biodegradable films continues expanding, with for wider adoption rate throughout the two, growing, and developing industry segments.

In 2023, NatureWorks a leading producer of Ingeo biopolymer (PLA), announced a major investment in expanding its biopolymer production facility in Thailand. The USD 300 million expansion project, announced in 2023, is expected to significantly increase the supply of Ingeo, which is widely used in the production of biodegradable films, particularly for packaging applications.

Restraint

-

Higher production costs of biodegradable films may hamper the market growth.

The biodegradable films are much more expensive to produce compared to conventional polymer products, which represents a major obstacle to market growth. Biodegradable films are made from renewable resources like starch, PLA (polylactic acid), or PHA (polyhydroxyalkanoates) which can be more costly than fossil-derived polymers. This leads to higher production costs, due to the price of raw materials, the complexity of manufacturing processes, and the need for special equipment. Also, although biopolymer technologies have improved, economies of scale haven't fully happened yet and biodegradable films still command a price premium over fossil-based alternatives. For manufacturers, this means that units will cost more which is often transferred to consumers, making it more challenging to compete in cost-sensitive industries with biodegradable films. In areas where cost is a significant driver, these increased costs can hinder businesses from moving to biodegradable compounds and slow the overall proliferation of these green alternatives. In addition to these costs, insufficient infrastructure to allow for the disposal or composting of microplastic films would carry its own price tag. So, biodegradable films do provide some advantages to the environment but their higher production costs result in limited penetration to the market.

Opportunities

-

Growing awareness about the harmful effects of traditional plastics on ecosystems.

-

Rising demand for biodegradable packaging materials in emerging economies.

Biodegradable Films Market Segmentation Analysis

By Type

The starch blend type segment dominated the biodegradable films market and held the highest revenue share of more than 39.5% in 2023 attributed to its excellent biodegradability, cost-effectiveness, and versatility. Starch-based blends offer a balance between performance and environmental sustainability, making them preferred choices for various packaging applications. Additionally, advancements in starch blend formulations and processing techniques have further enhanced their market appeal, driving their widespread adoption and revenue contribution.

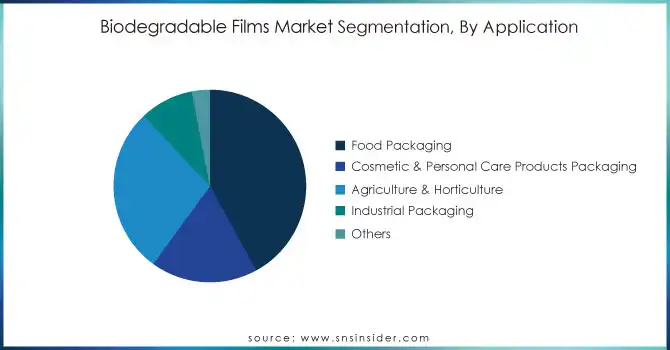

By Application

Food Packaging held the largest market share around 42% in 2023. food packaging owing to an increase in consumer preference for sustainable and eco-friendly packaging solutions. With the growing awareness of plastic pollution, both consumers and regulatory authorities are advocating the discontinuation of plastic packaging alternatively replaced by substitutes, especially in the food sector. In the last few years, biodegradable films, which provide similar functional properties to conventional plastic films that provide a moisture barrier, mechanical strength, and, freshness retention of food items along with environmentally friendly disposal, are becoming a more favorable option for food packaging over plastic films. Furthermore, to make the transition even more, as in most that include a ban on plastic and all the packaging used reflected, they would be working on an alternative to this being biodegradable.

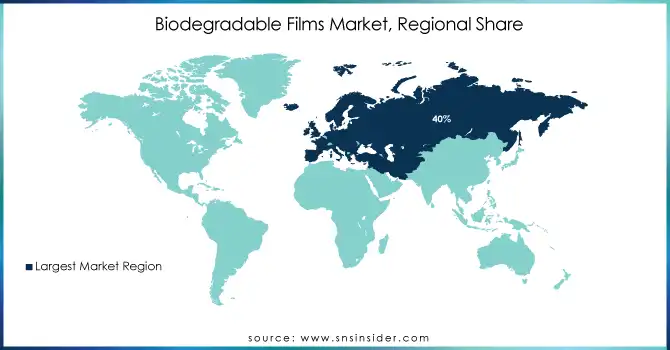

Biodegradable Films Market Regional Outlook

Europe held the largest market share around 40% in 2023. It dominated the biodegradable films market share owing to strict regulations for environment protection, rising consumer preference towards sustainable products, and high commitment from various industries towards sustainability. Some of the most stringent environmental policies, such as the European Green Deal in which the EU intends to be carbon-neutral by 2050,1 have been enacted in the European Union. By implementing these regulations, biodegradable films and other sustainable alternatives may be adopted to minimize plastic waste, propelling plans for a circular economy. Moreover, increasing awareness of environmental issues among European customers is a primary factor pushing the demand for sustainable packaging in food and retail sectors. Businesses in Europe are opting for biodegradable films more often, as their sustainability strategies evolve to fulfill not only regulatory requirements but consumer demand as well. It also enjoys an extensive recycling and composting infrastructure, fostering the use of biodegradable materials. Additionally, Europe is home to global bioplastics players which encourages innovative and invests in biodegradable film technologies. These factors combined, makes Europe the forerunner in the biodegradable films market because of the regulatory, market and technological forces.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

BASF SE (Ecovio, Soil biodegradation)

-

Taghleef Industries (Nativia, Biofilm)

-

Kingfa Sci. & Tech. Co., Ltd. (Eco-Friendly Biodegradable Films, Kingfa PLA Film)

-

BioBag Americas, Inc. (BioBag, BioBags for Food Storage)

-

Avery Dennison Corporation (Eco-friendly Label Films, Biodegradable Packaging Films)

-

Bi-Ax International Inc. (Biodegradable Film Rolls, Bioplastics)

-

Cortec Corporation (Eco-Corr Films, VpCI Biodegradable Films)

-

Clondalkin Group (Compostable Packaging Films, Flexible Packaging Solutions)

-

Paco Label (Biodegradable Label Films, Eco-Friendly Packaging Solutions)

-

Layfield Group (Biodegradable Mulch Film, Layfield BioFilms)

-

Polystar Plastics Ltd. (Biodegradable Films for Packaging, Eco-Plastic Films)

-

Futamura Chemical Co. Ltd. (NatureFlex, Compostable Films)

-

Walki Group Oy (Walki Biofilm, Walki Performance Films)

-

Plascon Group (Eco-Bags, Biodegradable Packaging Film)

-

Groupe Barbier (Barbioplast, Biodegradable Agricultural Films)

-

TRIOWORLD INDUSTRIER AB (TrioGreen Biodegradable Film, GreenPack Films)

-

Mondi Group (Mondi BioPackaging, Compostable Films)

-

Amcor (Amcor EcoFlex, Biodegradable Packaging Films)

-

U.S. Bioplastics (U.S. Bioplastic Bags, U.S. Compostable Films)

-

Sappi Lanier (Biofoils, Biodegradable Barrier Films)

Recent Development:

-

In 2023, BASF introduced Ecovio, a compostable material made from renewable resources, which has seen increased adoption in food packaging applications to reduce plastic waste.

-

In 2023, Taghleef Industries unveiled the Nativia range of biodegradable and compostable films. These films are primarily used in food packaging and have been developed to offer enhanced durability and environmental benefits, helping meet growing consumer demand for sustainable packaging solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.3 Billion |

| Market Size by 2032 | US$ 2.3 Billion |

| CAGR | CAGR of 6.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (PLA, PHA, Starch Blends, Biodegradable Polyesters, and Others) • By Application (Food Packaging, Cosmetic & Personal Care Products Packaging, Agriculture & Horticulture, Industrial Packaging, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Taghleef Industries, Kingfa Sci. & Tech. Co., Ltd., BioBag Americas, Inc., Avery Dennison Corporation, Bi-Ax International Inc., Cortec Corporation, Clondalkin Group, Paco Label |

| Key Drivers | • Increase usage of biodegradable films across various industries drives market growth. |

| Restraints | • Higher production costs of biodegradable films may hamper the market growth. |