Biodefense Market Size Analysis:

The Biodefense Market was valued at USD 16.03 billion in 2023 and is expected to reach USD 25.06 billion by 2032, growing at a CAGR of 5.11% over the forecast period of 2024-2032. This report emphasizes threat occurrence and readiness levels, propelled by the growing risk of biological threats, emerging infectious diseases, and geopolitical tensions that affect national security policy. The research considers funding and investment patterns in different regions as governments and private organizations enhance financial support for biodefense research, vaccine production, and quick-response technologies. Moreover, it looks into increasing demands for biodefense devices and medical countermeasures, like detection devices, protective equipment, and antiviral medication, with geographical differentials according to perceived threats and healthcare facilities. The report further evaluates trends in emergency response and stockpiling, with emphasis on the strategic stockpiling of vaccines, therapeutics, and diagnostic resources to provide speed of response at the time of biological crises.

To Get more information on Biodefense Market - Request Free Sample Report

The U.S. Biodefense Market was valued at USD 9.69 billion in 2023 and is expected to reach USD 14.36 billion by 2032, growing at a CAGR of 4.49% over the forecast period of 2024-2032. In the US, the market for biodefense is growing with greater federal spending on pandemic preparedness, growing concerns of bioterrorism, and the incorporation of new biotechnologies to augment national biodefense capacity.

Global Biodefense Market Dynamics

Drivers

-

The biodefense market is primarily driven by increasing government funding and heightened concerns over bioterrorism and infectious disease outbreaks.

Governments across the globe have substantially raised biodefense budgets to improve readiness. For example, the U.S. Department of Health and Human Services spent USD 8.5 billion in 2023 on biodefense initiatives, including vaccine and diagnostic stockpiling. The increasing threat of biological warfare and naturally occurring pandemics, like the COVID-19 pandemic, has highlighted the importance of a robust biodefense infrastructure. Moreover, innovations in biotechnology, such as genetic engineering and rapid diagnostics, have driven demand for new-age countermeasures. Next-generation vaccines, biosensors, and AI-based surveillance systems have also driven market expansion. In addition, public-private partnerships between research institutions, government agencies, and private players have resulted in new biodefense solutions. For instance, alliances such as BARDA's partnership with Moderna for mRNA vaccines reflect increased investment in biodefense innovations.

Restraints

-

The biodefense market faces constraints, primarily due to regulatory challenges, high development costs, and limited commercial viability.

The regulatory process for biodefense products is rigorous, involving a lot of testing and government approval, slowing down product launch. For instance, the FDA's regulatory process for anthrax vaccines is time-consuming, slowing market entry. Furthermore, the heavy R&D and stockpiling costs impose financial burdens on governments and private companies. Creating vaccines and therapeutics for low-frequency biological threats is expensive, costing more than USD 1 billion, without the potential for near-term commercial rewards. In addition, constrained public knowledge and political fluctuations affect budgetary distribution. Certain governments divert resources from biodefense toward pressing healthcare requirements, influencing long-term investments. The absence of institutionalized market demand from the private sector also deters innovation. In contrast to drugs against prevalent diseases, biodefense products are largely government-purchased, diminishing the incentive for private companies to invest in mass production and marketing.

Opportunities

-

The biodefense market presents significant opportunities through technological advancements, AI-driven surveillance, and expanding biosecurity measures.

The advent of AI and big data analytics in biodefense has dramatically transformed early warning systems, such as faster response times. For instance, AI-driven platforms like BlueDot effectively detected the COVID-19 epidemic before official announcements, illustrating the promise of predictive analytics in monitoring biothreats. The expanding need for the next generation of vaccines and antibody-based medicines also presents opportunities for biotech companies to diversify their product offerings. The advent of synthetic biology has made vaccine development quick, as is evident with mRNA technology's contribution to pandemic preparedness. In addition, the role of private industry in biodefense is on the rise, with major pharma players such as Pfizer and AstraZeneca making investments in biosecurity technologies. The other area is international cooperation, with entities such as WHO and CEPI funding global biodefense programs. The increasing emphasis on dual-use technologies, including biothreat detection systems that also track emerging infectious diseases, is likely to generate new streams of revenue for market participants. Governments across the globe are also considering public-private partnerships to facilitate long-term investment in biodefense infrastructure.

Challenges

-

The biodefense market faces key challenges, including the risk of bioterrorism evolution, supply chain disruptions, and geopolitical instability.

New and emerging threats, including genetically modified pathogens, make constant updating of countermeasures necessary. The threat of the misuse of CRISPR and synthetic biology to develop drug-resistant biological weapons heightens security threats. Supply chain vulnerabilities also affect the production availability of key biodefense products. Global dependencies on particular regions for vaccine raw materials, as experienced during the COVID-19 pandemic, resulted in shortages and delays. Maintaining a stable supply chain for critical biodefense stockpiles continues to be a pressing challenge. Furthermore, geopolitical tensions can interfere with biodefense funding and research partnerships. Changes in global relations impact cross-border efforts, as evidenced by tensions that impact global vaccine distribution. Another key challenge is the absence of standard global biodefense regulations, which creates disparities in readiness levels. Nations have varying biothreat detection and response standards, making global coordination challenging. Finally, public distrust of biodefense countermeasures, in the forms of vaccine reluctance and disinformation, constitutes an impediment in effectively implementing countermeasures during a crisis.

Biodefense Market Segmentation Analysis

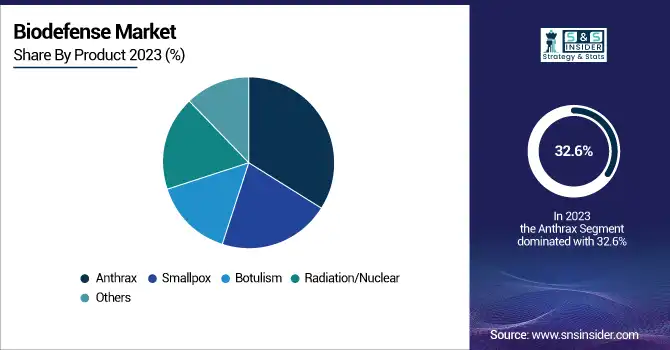

By Product

The anthrax segment had the highest market share of 32.6% in 2023 due to widespread government stockpiling programs and continued biodefense readiness initiatives. Anthrax is considered a high-priority biothreat because it can be weaponized and has high fatality potential if inhaled. Governments globally, especially in the U.S. and Europe, have invested significantly in anthrax vaccines and therapeutics to counter potential biological attacks. Also, ongoing research and financing for future-generation anthrax countermeasures have further helped the segment dominate.

Other Products, including countermeasures for new biothreats, were the highest-growing during the period. Growing worry over new and engineered biological threats has driven demand for a diverse range of biodefense solutions that go beyond conventional threats such as anthrax and smallpox. Increased investments in research into antiviral agents, bacterial toxins, and new detection technologies have driven growth in this segment. In addition, the move towards a broader biodefense program that covers a broad spectrum of possible threats has fueled substantial market growth.

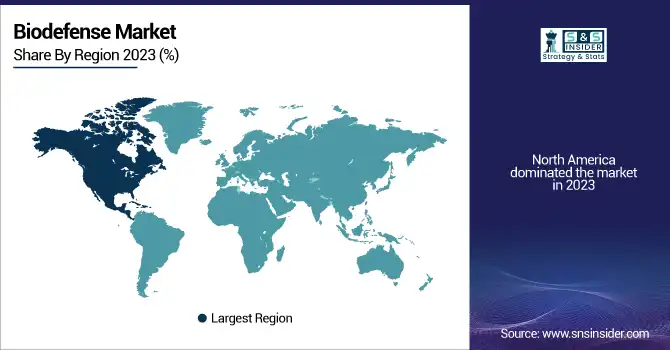

Regional Insights

North America dominated the biodefense industry, mainly based on robust government initiatives, big defense budgets, and sophisticated research infrastructure. The United States heads the market with organizations such as the Biomedical Advanced Research and Development Authority (BARDA) and the Department of Defense (DoD) which spend billions in biodefense initiatives. In 2023, the U.S. invested more than USD 8.5 billion in biodefense readiness, such as stockpiling vaccines, rapid diagnostic tools, and early-warning surveillance systems. Canada also makes a substantial contribution, with rising investments in biosafety and public health security.

Europe is also a prime market, with Germany, the UK, and France taking the lead in investments in biodefense infrastructure. The European Centre for Disease Prevention and Control (ECDC) has been enhancing biosecurity efforts, especially post-COVID-19, fueling the demand for biodefense solutions. Nevertheless, Asia-Pacific is the fastest-growing region, fueled by growing concern over biothreats and infectious disease outbreaks. China, India, and Japan are expanding their biodefense expenditures, with China initiating a USD 3.2 billion countrywide biosecurity program in 2023. Furthermore, rising government interest in pandemic preparedness and prevention against bioterrorism is driving the widespread embracement of biodefense technology throughout the region. The Middle East and Latin America are expansion markets, and investments in the detection and response strategies for biothreats are on the increase.

Get Customized Report as per Your Business Requirement - Enquiry Now

Biodefense Market Key Players

-

XOMA Corporation – Raxibacumab (Anthrax Monoclonal Antibody)

-

Altimmune Inc. – NasoShield (Intranasal Anthrax Vaccine)

-

Emergent BioSolutions Inc. – BioThrax (Anthrax Vaccine), Raxibacumab, ACAM2000 (Smallpox Vaccine), VIGIV (Vaccinia Immune Globulin)

-

Dynavax Technologies Corporation – CpG 1018 (Adjuvant for Biodefense Vaccines)

-

SIGA Technologies – TPOXX (Tecovirimat for Smallpox)

-

Elusys Therapeutics Inc. – Anthim (Obiltoxaximab for Anthrax)

-

Ichor Medical Systems – TriGrid (DNA Vaccine Delivery System for Biodefense)

-

DynPort Vaccine Company – Anthrax, Smallpox, and Botulism Medical Countermeasures

-

Cleveland Biolabs – Entolimod (Radiation/Nuclear Countermeasure)

-

Bavarian Nordic – Jynneos (Smallpox & Monkeypox Vaccine), MVA-BN Anthrax

-

Ology Bioservices – Biodefense Vaccines and Therapeutics Development

-

Alnylam Pharmaceuticals Inc. – RNAi Therapeutics for Biodefense Applications

Recent Developments in the Biodefense Market

-

In Sep 2024, Acurx Pharmaceuticals, Inc., a late-stage biopharmaceutical company, announced that selected ACX-375 analogues have shown in vitro activity against Anthrax (B. anthracis), including ciprofloxacin-resistant strains. This development strengthens its potential as a novel antibiotic for bioterrorism-related threats.

-

In April 2024, Aditxt, Inc. signed a definitive agreement to acquire Appili Therapeutics Inc., a biopharmaceutical company specializing in infectious disease treatments and biodefense countermeasures. The acquisition includes FDA-approved LIKMEZ, the ATI-1701 tularemia vaccine funded by a USD 14 million DoD grant, and the ATI-1801 topical formulation, strengthening Aditxt’s biodefense portfolio.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 16.03 billion |

| Market Size by 2032 | USD 25.06 billion |

| CAGR | CAGR of 5.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Anthrax, Smallpox, Botulism, Radiation/Nuclear, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | XOMA Corporation, Altimmune Inc., Emergent BioSolutions Inc., Dynavax Technologies Corporation, SIGA Technologies, Elusys Therapeutics Inc., Ichor Medical Systems, DynPort Vaccine Company, Cleveland Biolabs, Bavarian Nordic, Ology Bioservices, Alnylam Pharmaceuticals Inc. |