Bio-Polyamide Market Report Scope & Overview:

Get More Information on Bio-Polyamide Market - Request Sample Report

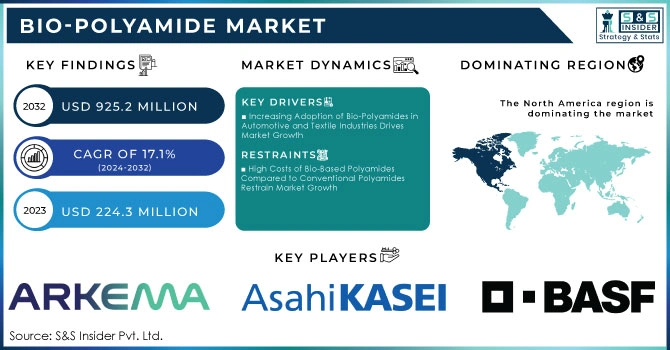

The Bio-Polyamide Market Size was valued at USD 224.3 million in 2023 and is expected to reach USD 925.2 million by 2032 and grow at a CAGR of 17.1% over the forecast period 2024-2032.

The Bio-polyamide market is experiencing significant growth due to increasing sustainability initiatives, a shift toward renewable materials, and the demand for eco-friendly alternatives in sectors like automotive, textiles, and packaging. Derived from renewable sources such as castor oil and sugar cane, bio-polyamides are gaining popularity for their lower environmental impact and excellent performance. Governments promote biobased products by setting stringent regulations to reduce carbon footprints, further accelerating bio-polyamide adoption across industries. This shift is also driven by the growing consumer demand for greener products and the industry's need to comply with environmental mandates while maintaining material strength and durability. In June 2024, Fulgar introduced a bio-based nylon made from castor oil, reflecting its dedication to sustainable innovation in the textile industry. This bio-nylon offers similar strength and elasticity as conventional polyamides while significantly reducing environmental impact. Fulgar’s launch highlights how companies in the textile sector are increasingly embracing bio-based alternatives to align with sustainability targets and meet the growing demand for eco-friendly fibers. This launch exemplifies the industry’s commitment to creating products that are both high-performance and environmentally responsible. Additionally, in July 2024, Monash University developed an innovative bio-nylon from sugar cane waste, marking a significant step forward in utilizing agricultural waste for high-value polymer production. This development reduces reliance on fossil fuel-based materials and opens new avenues for bio-polyamide production using sustainable feedstocks. Monash University’s breakthrough demonstrates the increasing collaboration between research institutions and industries to explore renewable alternatives and diversify the sources of bio-polyamide production, ultimately contributing to the growing adoption of bio-based polymers in a wide range of applications.

Moreover, Arkema, a key player in the bio-polyamide market, continues to lead sustainability efforts. In October 2024, Arkema reduced the carbon footprint of its bio-based polyamide 11 chain, reinforcing its commitment to green chemistry and eco-design. This advancement is part of Arkema's broader strategy to promote environmentally friendly production processes and cut greenhouse gas emissions. In February 2024, Arkema’s polyamide 11 received the prestigious Solar Impulse Efficient Solution label, showcasing the material’s potential to contribute to energy-efficient applications. The recognition of Arkema’s bio-based polyamides underscores the growing importance of sustainable solutions in industrial applications and reflects the increasing pressure on manufacturers to provide eco-friendly alternatives in the global marketplace.

The bio-polyamide market is poised for robust growth as companies like Fulgar, Monash University, and Arkema continue to develop innovative solutions that cater to the rising demand for renewable and sustainable materials. By focusing on reducing environmental impact and utilizing bio-based feedstocks, these developments are shaping a future where bio-polyamides play a crucial role in industries seeking to minimize their reliance on fossil fuels and lower their carbon emissions.

Bio-Polyamide Market Dynamics:

Drivers:

-

Increasing Adoption of Bio-Polyamides in Automotive and Textile Industries Drives Market Growth

The rising demand for bio-polyamides in the automotive and textile industries is a key factor driving market growth. Bio-polyamides, derived from renewable resources such as castor oil and sugar cane, are being increasingly adopted for their lightweight, high-performance properties, which are crucial for applications in automotive parts, including fuel systems, engine components, and under-the-hood parts. These materials help reduce the overall weight of vehicles, leading to improved fuel efficiency and lower carbon emissions. In the textile industry, bio-polyamides are gaining popularity due to their sustainability credentials, offering high strength and elasticity while reducing the dependency on petroleum-based alternatives. With automotive manufacturers under pressure to meet stringent emission regulations and textile companies seeking to offer eco-friendly fibers, the demand for bio-polyamides is expected to rise significantly in the coming years. Additionally, bio-polyamides contribute to the circular economy, aligning with broader sustainability goals across industries.

-

Government Regulations and Policies Favoring Biobased Products Promote Bio-Polyamide Market Expansion

Government regulations aimed at reducing carbon emissions and encouraging the use of renewable resources are driving the expansion of the bio-polyamide market. Numerous countries have implemented policies that incentivize the adoption of biobased materials to reduce dependence on fossil fuels and combat climate change. These regulations include tax breaks, subsidies, and grants for companies that invest in the production and use of biobased products. The European Union’s Green Deal, for instance, has set ambitious goals for carbon neutrality by 2050, spurring industries to transition toward more sustainable materials such as bio-polyamides. Similarly, countries in North America and Asia are pushing for greener alternatives in manufacturing processes to meet global environmental targets. As a result, the regulatory framework is playing a critical role in accelerating the demand for bio-polyamides across various sectors, including automotive, electronics, and textiles. The favorable policy environment ensures a steady rise in investments in bio-polyamide production and innovation.

Restraint:

-

High Costs of Bio-Based Polyamides Compared to Conventional Polyamides Restrain Market Growth

Despite the growing adoption of bio-polyamides, their high production costs compared to conventional, petroleum-based polyamides pose a significant restraint to market growth. The production of bio-polyamides involves complex processes, including the cultivation and extraction of bio-based feedstocks like castor oil or sugar cane, which adds to the overall cost. Additionally, the scaling of bio-based polymer production is still limited compared to petrochemical-based alternatives, further increasing the price of bio-polyamides. This cost disparity can make bio-polyamides less attractive, especially for price-sensitive industries like packaging and consumer goods, where cost efficiency remains a primary concern. While large corporations with sustainability agendas may be willing to invest in bio-based solutions, smaller companies may struggle to justify the higher costs, limiting the overall market penetration of bio-polyamides. Addressing the cost issue through process optimization and economies of scale is crucial for the broader adoption of bio-polyamides.

Opportunity:

-

Growing Investments in Research and Development to Enhance Bio-Polyamide Performance Offer New Market Opportunities

The growing investments in research and development to enhance the performance and application scope of bio-polyamides present significant market opportunities. As industries increasingly shift toward sustainable materials, there is a strong focus on improving the properties of bio-polyamides, such as strength, heat resistance, and durability, to make them suitable for a wider range of applications. For example, recent innovations in bio-polyamide production using sugar cane waste and other renewable feedstocks have opened up new possibilities for their use in high-performance applications like electronics, sports equipment, and aerospace components. Additionally, partnerships between academic institutions and companies are driving technological advancements, which could lead to cost reductions and improved production processes. As research continues to expand the application possibilities for bio-polyamides, industries such as construction, medical devices, and industrial machinery are expected to adopt these materials, creating lucrative opportunities for market players to expand their offerings and cater to the growing demand for sustainable materials.

Challenge:

-

Difficulty in Scaling Bio-Polyamide Production to Meet Growing Market Demand Remains a Key Challenge

One of the key challenges facing the bio-polyamide market is the difficulty in scaling production to meet the rapidly growing demand. Although bio-polyamides are gaining popularity due to their environmental benefits, the production process is still relatively complex and resource-intensive compared to conventional polyamides. Bio-polyamide manufacturing relies on bio-based feedstocks such as castor oil or sugar cane, which are subject to agricultural constraints, including limited availability, seasonal fluctuations, and the need for large-scale cultivation. These factors make it difficult for manufacturers to scale up production to meet the increasing demand from industries such as automotive, textiles, and electronics. Moreover, the current production capacity for bio-polyamides remains limited, and significant investments are required to build new facilities and optimize the supply chain. Overcoming these scalability issues is crucial for bio-polyamide manufacturers to keep up with market demand and ensure the widespread adoption of bio-based solutions across industries.

Bio-polyamide Market Segmentation Overview

By Type

In 2023, specialty polyamides dominated the Bio-polyamide market with a market share of around 45%. Among the specialty polyamides, PA-11 emerged as the leading sub-segment, accounting for approximately 25% of the overall bio-polyamide market. The preference for PA-11 stems from its excellent performance characteristics, including high thermal stability and chemical resistance, making it ideal for applications in various industries such as automotive and healthcare. For instance, PA-11 is commonly used in the production of fuel lines and other automotive components due to its robustness and ability to withstand harsh conditions. Furthermore, the growing adoption of bio-based materials in medical applications, such as sutures and adhesives, highlights the increasing significance of PA-11 in specialized sectors.

By Application

In 2023, the engineering plastics segment dominated the bio-polyamide market and accounted for a market share of approximately 60%. This significant share can be attributed to the growing demand for lightweight, high-performance materials in various industries, particularly automotive and electronics. Engineering plastics derived from bio-polyamides offer enhanced mechanical properties, thermal stability, and resistance to chemicals, making them ideal for critical applications like automotive components, electronic housings, and industrial machinery. For example, companies like BASF and DuPont have been increasingly investing in bio-based engineering plastics, leveraging their advantages in sustainability and performance to meet stringent regulatory requirements and consumer preferences for eco-friendly materials. As industries shift towards more sustainable practices, the engineering plastics segment is poised to continue its growth trajectory within the bio-polyamide market.

By End-use Industry

In 2023, the automotive sector dominated the Bio-polyamide market in terms of end-use industry, with a market share of around 42%. This dominance is attributed to the automotive industry's growing emphasis on sustainability and efficiency, as manufacturers increasingly seek to reduce vehicle weight and improve overall performance. Bio-polyamides are favored in this sector due to their favorable properties, such as strength, heat resistance, and durability. For instance, bio-polyamide materials are widely used in producing automotive parts such as battery casings, fuel lines, and other components that require high-performance standards. The continuous shift towards more environmentally friendly manufacturing processes within the automotive sector further supports the robust demand for bio-polyamides, ensuring its sustained growth in this end-use industry.

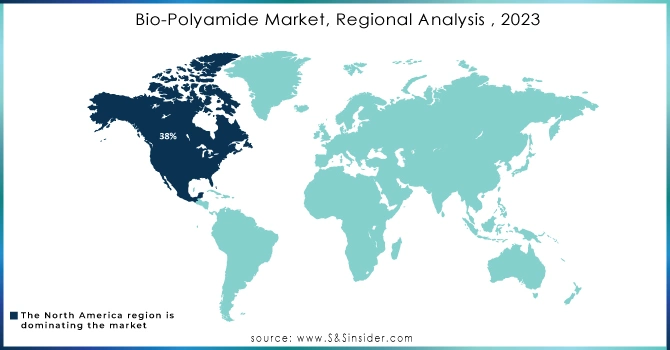

Bio-polyamide Market Regional Analysis

In 2023, North America dominated the Bio-polyamide market with a market share of around 38%. This leadership can be attributed to the region's strong emphasis on sustainability and innovation within key industries such as automotive, textiles, and electronics. The presence of major manufacturers and research institutions focused on developing bio-based alternatives has further propelled growth. For instance, companies like DuPont are investing in bio-polyamide technologies, which cater to the automotive sector's need for lightweight, high-performance materials. Additionally, stringent environmental regulations in the United States are driving manufacturers to seek sustainable solutions, thereby enhancing the demand for bio-polyamides. This combination of industry support, regulatory encouragement, and consumer demand for eco-friendly products has solidified North America's position as the leading region in the bio-polyamide market.

Moreover, the Asia-Pacific region emerged as the fastest-growing area in the Bio-polyamide market in 2023, with a CAGR of approximately 10%. This growth is largely driven by rapid industrialization, increasing automotive production, and a rising focus on sustainability in countries like China and India. The region's significant investments in infrastructure and the automotive sector, coupled with government initiatives to promote biobased materials, have created a conducive environment for bio-polyamide adoption. For example, leading automotive manufacturers in the Asia-Pacific region are incorporating bio-polyamides into their vehicles to meet stringent emissions regulations and cater to the growing consumer demand for sustainable products. As awareness of environmental issues continues to rise, the region is expected to witness further expansion in the bio-polyamide market, making it a crucial player in the global landscape.

Need Any Customization Research On Bio-polyamide Market - Inquiry Now

Key Players

-

Arkema S.A. (Rilsan PA11, Rilsamid PA12)

-

Asahi Kasei Corporation (Leona PA66, Tenac PA12)

-

BASF SE (Ultramid PA6, Ultramid Ccycled PA66)

-

Cathay Biotech Inc. (Terryl PA56, Terryl PA510)

-

Domo Chemicals (Technyl PA6, Technyl Star PA66)

-

DuPont de Nemours, Inc. (Zytel PA66, Hytrel PA12)

-

EMS-Chemie Holding AG (Grilamid PA12, Grilon PA6)

-

Evonik Industries AG (Vestamid PA12, Vestamid Terra PA610)

-

Grupa Azoty S.A. (Tarnamid PA6, Tarnamid PA66)

-

Honeywell International Inc. (Aegis PA6, Capron PA66)

-

Invista (Torzen PA66, Cordura PA6)

-

LANXESS AG (Durethan PA6, Durethan ECO PA66)

-

Li Peng Enterprise Co., Ltd. (Zig Sheng PA6, Zig Sheng PA66)

-

Mitsubishi Chemical Corporation (Durabio PA6, Diamiron PA66)

-

Radici Group (Radilon PA6, Radilon A PA66)

-

Royal DSM N.V. (EcoPaXX PA410, Arnitel PA12)

-

Sabic (Ultramid PA6, Ultem PA12)

-

Solvay S.A. (Bio Amni PA610, Technyl eXten PA610)

-

Toray Industries, Inc. (Amilan PA66, Toraycon PA6)

-

Ube Industries, Ltd. (UBESTA PA12, UBESTA XPA PA6)

Raw Material Suppliers

-

BASF

-

DSM

-

Arkema

End-Users / Industry Applications

-

Ford (automotive)

-

Adidas (textiles)

-

Intel (electronics)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 224.3 Million |

| Market Size by 2032 | US$ 925.2 Million |

| CAGR | CAGR of 17.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (PA-6, PA-66, Specialty Polyamides [PA-10, PA-11, PA-12]) •By Application (Fiber, Engineering Plastics) •By End-Use Industry (Automotive, Electrical & Electronics, Packaging, Textiles, Industrial Machinery, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Arkema S.A., Evonik Industries AG, BASF SE, Royal DSM N.V., Radici Group, EMS-Chemie Holding AG, Ube Industries, Ltd., Toray Industries, Inc., Asahi Kasei Corporation, LANXESS AG and other key players |

| Key Drivers | • Increasing Adoption of Bio-Polyamides in Automotive and Textile Industries Drives Market Growth • Government Regulations and Policies Favoring Biobased Products Promote Bio-Polyamide Market Expansion |

| RESTRAINTS | • High Costs of Bio-Based Polyamides Compared to Conventional Polyamides Restrain Market Growth |